Summary:

- Blink Charging Co. has seen a rally in its stock after billionaire investor Ken Griffin bought shares, boosting interest in the company.

- The EV charging station business model is struggling due to low-margin product sales and high expense bases.

- While Blink has made improvements in its business model, it is still far from being profitable and faces major demand issues in the U.S. EV sector.

Serenethos

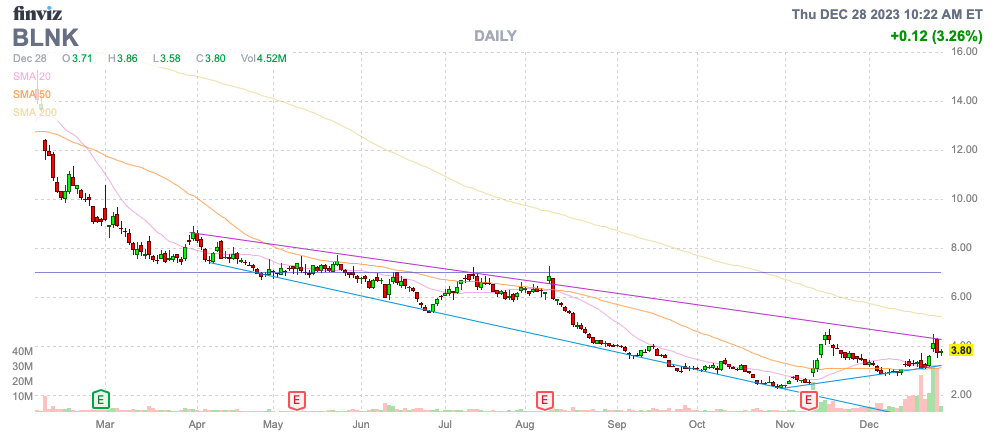

After a disastrous few years, Blink Charging Co. (NASDAQ:BLNK) started rallying in the last couple of months. The EV charging station company has seen the business model under pressure, but famed investor Ken Griffin bought shares, boosting the interest in the stock. My investment thesis is more Neutral on the stock, though Blink could rally in the short term with the positive trends in the business.

Source: Finviz

Tough Business Model

The EV charging station business models continue struggling due to focuses on trying to ramp up high margin services when EV owners and fleet operators utilize the charging station networks. The problem for Blink and other operators is that the vast majority of the revenues accrue from low-margin product sales, while expense bases soar.

In essence, the SG&A operating model is built on the gross revenues and not the much lower gross profits. Blink has seen a vast shift in this business model since Brendan Jones took over as CEO back in May

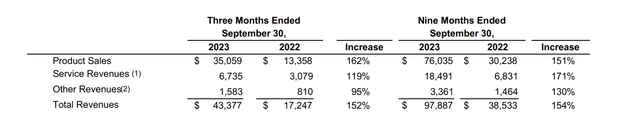

The EV charging station company recently reported Q3’23 revenues soared 152%, but the company continued to report large losses. The vast improvements in the business came due to a huge boost in equipment sales.

Source: Blink Charging Q3’23 earnings release

The key Service revenues were only $6.7 million in the quarter and have shown limited relative growth during 2023 after starting off at $4.8 million in the March quarter. Service revenues are up 119% in the quarter, but the base was so small in 2022.

Blink only has a 30% gross margin target, with a goal of just reaching adjusted EBITDA profits by December 2024. The Q3’23 adjusted EBITDA loss was $11.7 million, down from $17.6 million last year.

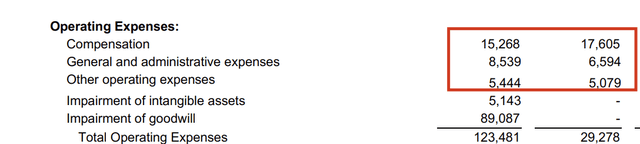

The shocking shift in the business model is that the new CEO was able to optimize costs to the point where Blink key Q3 operating expenses were in the $29 million range, flat YoY.

Source: Blade Charging Q3’23 earnings release

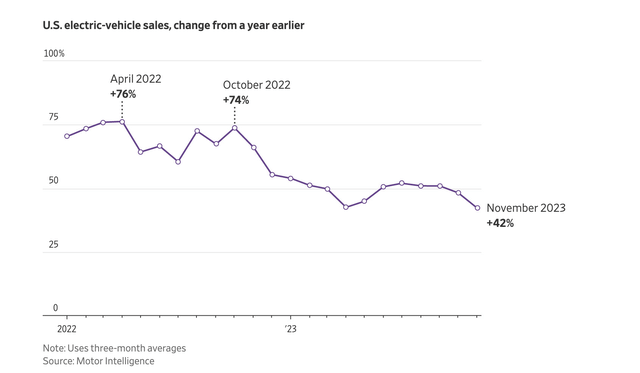

The problem here is that the U.S. EV market isn’t growing as expected outside of Tesla’s (TSLA) Supercharger network. EV monthly sales in the U.S. peaked months ago and is no longer showing any sequential growth, while the YoY metrics still show 42% growth in November.

Auto dealers are even facing over 60 days to sell an EV on their lots, while gas vehicles are just above 40 days. Blink could face a path to EBITDA profits far more complicated than thought when the company provided guidance after the Q3’23 earnings report.

Lurking Investor

Ken Griffin’s Citadel hedge fund has taken a small passive stake in Blink. According to an SEC filing, the hedge fund owns a combined 610K shares for a small 0.9% stake.

The move is interesting considering the tough business model and the limited cash balance of $66 million. Though, Blink Charging only has a market cap of $250 million.

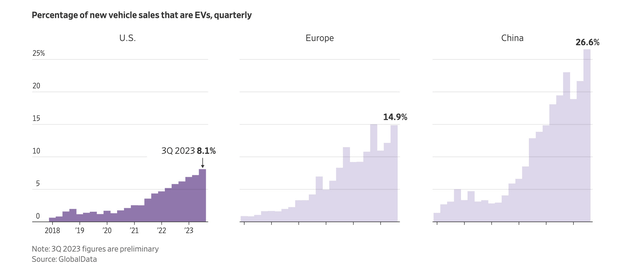

If the company has finally figured out the financials, the stock could factor into a long-term investment thesis due to the ultimate shift to EVs. The U.S. is only selling EVs at an 8.1% clip of new vehicles sales, compared to the rest of the world at double to triple the pace of the U.S.

The problem with all of the EV charging station business models is massive cash burn while awaiting for EV sales to turn material to drive utilization. A bleeding edge model doesn’t work very well for shareholders, getting massively diluted in the process.

Blink has a large ATM the company could utilize, so obtaining additional funds isn’t a major risk. The biggest issue is dilution from ongoing cash burn. Despite all of the improvements in the business model over the last year, gross margins in the 30% range don’t provide a quick boost to gross profits.

Takeaway

The key investor takeaway is that Blink Charging has made a shocking shift in the business model. The company has been able to more than double revenue while restraining costs. Unfortunately, the Blink Charging Co. business is still far away from being profitable and the U.S. EV sector faces major demand issues. The investment thesis is no longer Bearish, but the business dynamics still make being Bullish too difficult.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.