Summary:

- Founded in 1998, Blink Charging is one of the earlier respondents to the future of electric vehicles.

- While revenues look sleek, BLNK is mounting losses quarter after quarter.

- Blink Charging appoints Aric Ohana as president of Blink Mobility, aiming to drive more revenue as electric vehicles become more popular.

- The merger with Envoy Technologies expands Blink’s services to include on-demand electric vehicles.

- I remain neutral on Blink Charging. Despite record Q2 revenues, it continues to be an unprofitable business.

Editor’s note: Seeking Alpha is proud to welcome Kevin Chow as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

sefa ozel

Founded in 1998, Blink Charging (NASDAQ:BLNK) is one of the earlier respondents to the future of electric vehicles. While revenues look sleek, BLNK is mounting losses quarter after quarter. Blink Charging has had its ups and downs, and it remains a Hold.

Electric vehicle charging stations are requisites for EV owners to accommodate the convenience of re-charging when on the road. As the world heads toward a global warming crisis, it is necessary that these charging stations become more widely available at every corner or people will not go through with their first EV purchase. The country proposes that EVs be the only vehicles on the road by 2030. Blink is on its way to providing more charging stations and better services for the greater good of the environment. A comprehensive network of charging stations continues to ramp up for Blink while electric carsharing becomes one of the focal points in its purview. With a CAGR (compounded annual growth rate) of 23.1%, the EV market looks poised to excel. However, Blink funds almost all of its operations through equity and debt financing, and the company cannot ensure the completion of its initiatives.

Company Overview

Blink Charging believes that sustainability is a way of life. It aims to create a cleaner environment for future generations. In its efforts to accelerate EV adoption, it has become one of the world’s largest EV charging networks with acute reliability. Blink Charging offers multiple kinds of charging solutions ranging from “Level 2 chargers for residential use to fast DC charging stations for commercial and public locations.” The company has installed its EV chargers by partnering with major retailers, hotels, and parking facilities. To date, Blink Charging has saved 4,951,665 pounds of CO2 and 491,445 gallons of gasoline otherwise consumed by non-electric vehicles. It has accomplished these feats along with saving over 5,000 acres of U.S. forests per year.

Company Quality

Blink aims to drive sustained growth by being the only U.S. vertically integrated full-service provider. The charging stations are mainly manufactured at Bowie, a Blink facility in Maryland. The construction of its business model subsumes the fact that by providing EV charging stations to locations that want or need its service, Blink Charging Stations can be either “Hybrid Owned”, “Blink As A Service”, “Blink Owned”, or “Host Owned.” With this flexibility, the customer business has many buckets to pick from.

Along with its EV charging services are its carsharing subsidiaries BlueLA and Envoy; Blink can either charge the location for the charging services of the EV charging stations or provide EVs as a complimentary carsharing benefit as an amenity. Electric car sharing is a relatively primitive business model. With respect to Blink Charging’s subsidiary Blink Mobility which owns BlueLA and Envoy, it remains one of the biggest leaders in the space.

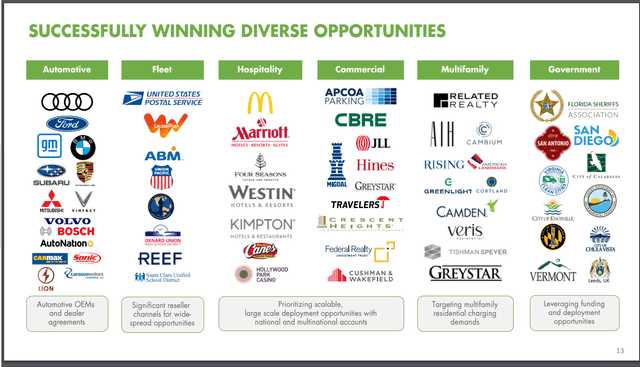

With its “Synergistic Revenue Streams”, the company is primed to “accelerate market penetration” and create “more durable customer relationships”. Blink Charging partners with a variety of customers, including automotive, fleet, hospitality, commercial, multifamily, and government. Blink excels primarily by supplying its chargers and carsharing services to its multitude of demanding customers.

Latest Quarter

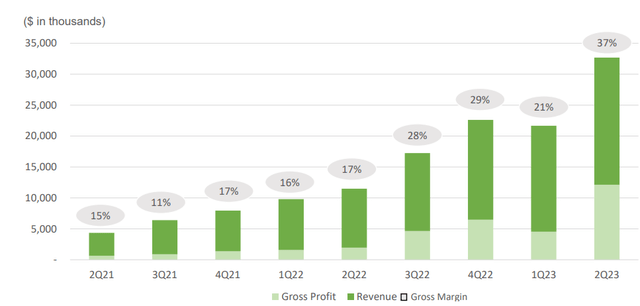

In its latest quarter, Blink reports EPS of -$0.44, a miss of $0.03, and revenues of $32.8m. Unfortunately, it continues to miss the mark on EPS. However, EPS estimates begin to trend up in the next quarter and onward, which may signal hope for investors.

BLNK came through with strong momentum in its business which led to an increase in its 2023 revenue target to $120 million – $110 million from $110 million to $100 million. Additionally, the company targets a positive adjusted EBITDA run rate by December 2024.

The company attributes its revenue growth to being largely organic. There was strong demand for its equipment and services in the U.S. and its owner/operator strategy in Europe made significant gains. Total revenues grew 186% ($21.4 million) in Q2 2022 to $32.8 million in Q2 2023. This is a record-beating number which signifies the increased demand in its charging stations, chargers, and carsharing services. Product Sales, which account for its commercial chargers, DC fast chargers, and residential chargers, increased by 179% from the same period a year ago. Service Revenues, which consist of charging service revenues, network fees, and carsharing service revenues, increased 211%.

I raise an eyebrow at the net loss in the quarter. At -$41.5 million or -$0.67 per share, this is nearly doubling the loss the company generated a year ago ($22.6 million or -$0.52 per share.) Part of the loss is explained as a “non-recurring bonus expense related to the performance milestone achieved by our CTO”. Compensation-related operating expenses for the three months ended June 30, 2023, compared to that in 2022 increased by over 250%. The company appears to be paying out a huge sum for the amount of revenue it is generating.

Valuation

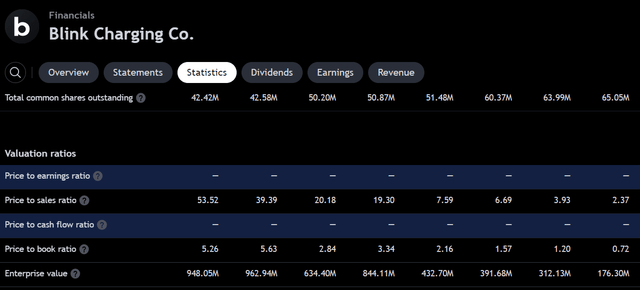

I will begin my valuation of the company by comparing BLNK with its top competitor in the industry, ChargePoint (CHPT). On a relative valuation, Blink outmatches CHPT in its book valuation in terms of P/B and also in its P/S ratio. With a Price-to-Book ratio of 0.72, I would consider that to be undervalued compared to ChargePoint’s P/B of 7.52. By paying merely $0.72 per $1 in the company’s assets, an investor is likely to have an advantage there.

Despite the comparison, neither company has performed well this year. This points to the idea that BLNK is not well received in spite of its undervalued P/B ratio.

As I cannot value the company based on its P/E due to unprofitability, I look to its P/S. Its Price-to-Sales is 2.37 and BLNK can be considered overvalued in this metric. While its P/S has been trending lower and lower over the quarters, it continues to be overvalued based on the fact that investors must pay $2.37 per $1 of sales that the company generates.

In comparison to CHPT with a higher P/S ratio of 3.66, BLNK can be considered the better buy. Investors might do well to beware of the implications of the P/S ratio without careful examination of the amount of debt of both companies. While companies with large amounts of debt can lower the P/S ratio because of a lower resultant market cap, it can make it look undervalued, but neither of the two companies has much debt. In Blink Charging, its debt-to-asset ratio is 0.03. With ChargePoint, its debt-to-asset ratio is 0.29. Lower debt-to-asset ratios like these display the point that these P/S ratios discussed are not bad at assuming their valuations. A par P/S ratio is somewhere between 1 and 2.

Taking it a step further, I consider the enterprise value-to-sales, which takes into account a company’s debt. I deduced the sales of the company to be 1.56 million from the P/S. From the above, the enterprise value is 176.3 million. Dividing the EV into the sales gives an EV/Sales of 113. Using the same formula, I judged the EV/Sales of CHPT at 1,342. The fact that the calculations for both are very high suggests that there is a solid premium attached to speculating on the high growth potential of both companies. The fact that BLNK scores lower than CHPT, but still extreme, I cannot consider BLNK as a good investment to open a position right now. However, I maintain a neutral viewpoint of Blink Charging due to the contradicting metrics in which the P/B concludes undervaluation while the P/S concludes overvaluation. You should hold.

Comparisons

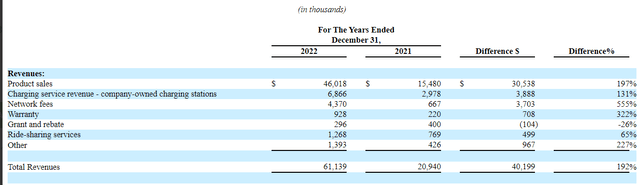

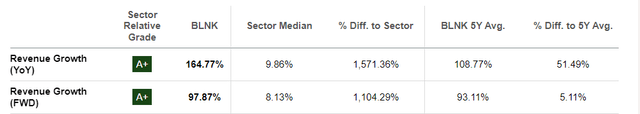

Total revenues from year-ended 2021 to year-ended 2022 tripled from $20.94 million to $61.13 million. Judging only from the growth in all of its revenue segments, one may be tempted to buy. Especially given its 164.77% YoY revenue growth in comparison to the sector median of just 9.86%.

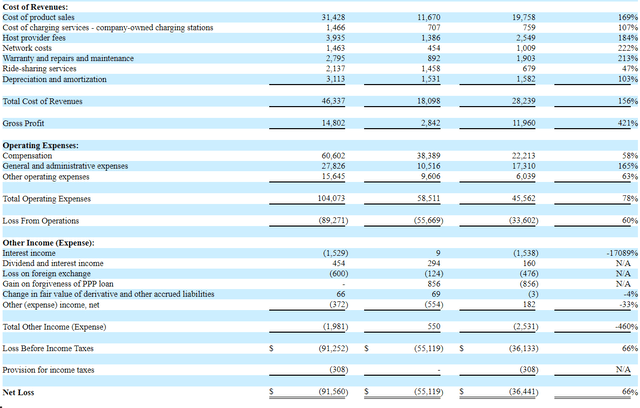

YoY Revenues (Blink Charging 10-K) BLNK Revenue Growth (SA) YoY Net Loss (Blink)

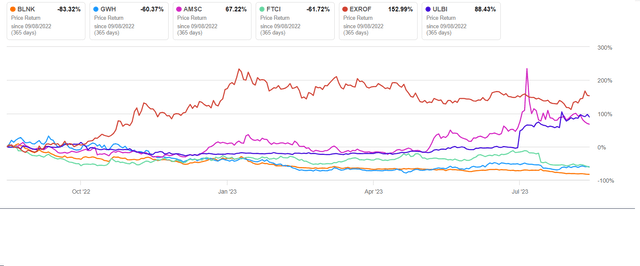

However, with a look at year-over-year comparisons, the company’s net loss increased 66% from -$55.12 million to -$91.6 million. While the company may be projecting aggressive growth, opening a new long position at this date in an unprofitable company is not viable, especially if you are a risk-averse investor. Shares have shed 83% YTD in less than a year, which signifies that investors are losing patience with the company’s prospects. In fact, BLNK is the biggest loser compared to its competitors according to Seeking Alpha.

BLNK Competitor Stock Prices (SA)

I would point to ChargePoint Holdings as a top competitor to Blink Charging. Even as it was formed ten years after Blink, CHPT is making more significant headway in the EV space. In the latest quarter, CHPT reported $150 million in revenues compared to BLNK’s $32.8 million. While Blink continues to mount increasing losses in operating expenses, CHPT reduced an estimated $30 million in operating expenses. In comparison to the plummeting share price in BLNK this year, CHPT has an alpha of 46% (-37% YTD). Both companies and the EV charging sector as a whole have had negative years so far compared to the broader market’s gains, which should be signs that there is much that needs to be accomplished for further growth.

EV Mobility As An Amenity

There may be a bright spot in Blink. Blink Charging recently appointed a new president, Aric Ohana, to its electric car-sharing service subsidiary, Blink Mobility. Ohana has the ability to drive more revenue for BLNK as electric vehicles become more ubiquitous to everyday people. Through the acquisitions of BlueLA and Envoy, Blink Mobility has an opportunity to be one of the leading EV companies as an innovator in car sharing. The company is at the forefront of creating a greener environment by providing unique services to users of electric cars.

Ohana acted as founder and CEO of Envoy for six years, leading its innovative mobility technology solutions. He was a real estate entrepreneur with 12 years of experience prior to that role. On Sept. 5, 2023, he was appointed as President to spearhead Blink Mobility and its subsidiaries. He is expected to grow electric car-sharing for the company with the purpose of growing EVs’ footprint in communities nationwide. The new electrification of car-sharing is a projected $13 billion dollar industry and Ohana will now be asked to bring Blink into the pie.

Let’s take a moment to bat an eyelash at where the company has gotten so far with its car-sharing platform, BlueLA. Since September 2020, BlueLA has been a subsidiary of Blink Charging. Across underserved communities in the City of Los Angeles, the platform provides affordable EV accessibility, especially to those people who are burdened by multiple sources of pollution. Overall revenues from its car-sharing service, BlueLA, increased from $168,000 to $769,000 in its first year. From 2021 to 2022, it then increased 65% from $769,000 to $1.268 million. With the growing demand for its services, Blink has become the largest 100% EV car-sharing company in California.

In 2022, its vehicle fleet grew by 70%, the average utilization rate came close to doubling, and total trips increased by 37% compared to 2021. These are the results of what can be attributed to the communities’ increasing interest in being eco-friendly. A lifestyle that decreases the rate of pollution cleans the environment in the long run. With Ohana as president, he is especially excited to showcase his ability to advance Blink Mobility’s presence in this space.

The merger with Envoy Technologies in late April 2023 brought on-demand electric vehicles to Blink as an amenity to apartments, hotels, and workplaces. Blink Mobility is well-positioned to be the future market leader in electric car-sharing. From Nissans to Teslas, Envoy has electric vehicles to fit any lifestyle. In Blink’s eyes, it is not enough that you can feel like an owner of a car without having to own it. It is their mission to electrify the mode of car-sharing while providing it as an amenity for average people.

As is the case with BlueLA, Envoy has built its services to accommodate low-income and disadvantaged communities. With this tactic, Blink allows people to rent their cars for short periods of time and only pay for their usage. Users of Blink Mobility can enjoy the benefits of no parking fees, no insurance, no maintenance, and no fuel costs. Membership rates start as low as $1 per month for income-qualified residents and $0.15 per minute plus tax for rental rates.

With $75 million in cash and cash equivalents, Blink Mobility could have some potential. Since Envoy’s beginnings in 2017, Envoy has deployed more than 300 EVs at over 150 multifamily properties and office properties. It has installed more than 150 EV charging stations in response to its popularity. Envoy has deployed electric vehicle brands such as Tesla (Model S, 3, X, Y), Rivian R1T, Porsche Taycan, Polestar 2, Audi e-tron, Chevy Bolt, and the Nissan Leaf. The car-sharing service is offered across the United States, including in New York, Florida, California, and Illinois to name a few. Blink Mobility has the green light from the Los Angeles City Council to expand its services by adding an additional 300 street-side EV charging stations across 60 new locations. The number of EVs in its fleet is expanding to 150. These expansions are expected to be completed by the end of 2023 and could make Blink a front-runner in the space.

Some Risks

A good investment thesis doesn’t come without some risks. The total count of chargers deployed by Blink Charging is decelerating in its growth rate. This suggests that the company may be running out of locations to install its charging stations. It also implies that either customer acquisition is becoming less of a priority as Blink begins to mature, or that customers are turning to competitors to supply stations. The non-profitability continues to be a concern that shouldn’t be overlooked. An unprofitable company at a stage like Blink Charging could suggest that it is still quite a ways off from its lofty goals of being a representative component of the future of all things EV.

Summary

Despite the initiatives that Blink Charging and its subsidiaries are undertaking, the company is challenged by increases in net losses. BLNK remains unprofitable due to its high cost of revenues and especially its operating expenses, in which most is suspected to being paid out heavy-handedly to executives. Although the company is projecting aggressive growth, its stock may not show up to class on time. Its competition is beating BLNK in terms of price return this year but the new appointment of Aric Ohana as president of Blink Mobility has potential to bring light to the company’s overall outlook. If you have shares, you could hold them until the company turns around, given a turning point in EPS estimates beginning next quarter. The record quarter reported last month shows that it is not out of consideration, just not a great buy opportunity there.

I conclude by reminding that this is not financial advice. Everything is my opinion based on facts I have gathered from reputable sources. Do not make any investment without conclusively doing your due diligence on fundamentals, technicals, and macro factors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.