Summary:

- Block remains a compelling investment despite a federal probe into its cryptocurrency transactions.

- The company reported strong financial results, with gross profits exceeding guidance and adjusted operating income handily beating guidance.

- Management raised their full-year outlook and reiterated their commitment to profitability, but investors should monitor their blockchain ambitions and use of customer deposits.

Phillip Faraone/Getty Images Entertainment

Block (NYSE:SQ) remains a compelling investment even if it appears to be mired in controversial waters. Heading into its latest earnings report, the stock dipped amidst reports of a federal probe into its cryptocurrency transactions. Management dismissed these reports on their call, but spent a considerable amount of time discussing their cryptocurrency ambitions in the shareholder letter. That may be an issue given that I suspect many investors are not invested in the name due to its blockchain growth potential. The stock remains cheap especially relative to tech peers. Management remains committed to profitable growth, and investors arguably should overlook the blockchain investments given that commitment. I reiterate my buy rating for the stock and believe patient investors will eventually be rewarded with a profitable re-rating.

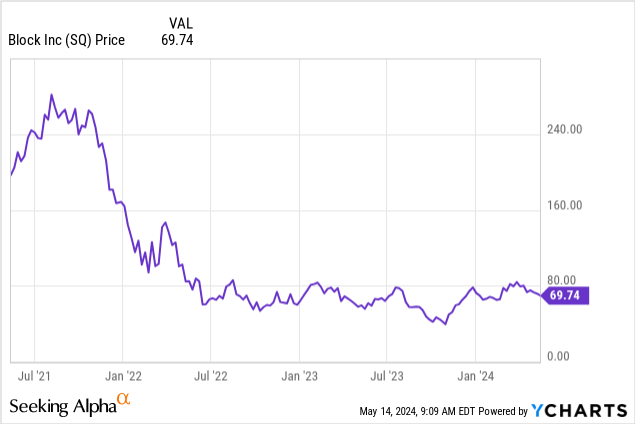

SQ Stock Price

I last covered SQ in February where I called the stock a top pick for 2024 on account of the profitability transition. The stock initially bounced strongly but has since given up those gains.

The market appears to either doubt the growth story or the quality of the underlying earnings. This uncertainty potentially represents a buying opportunity.

SQ Stock Key Metrics

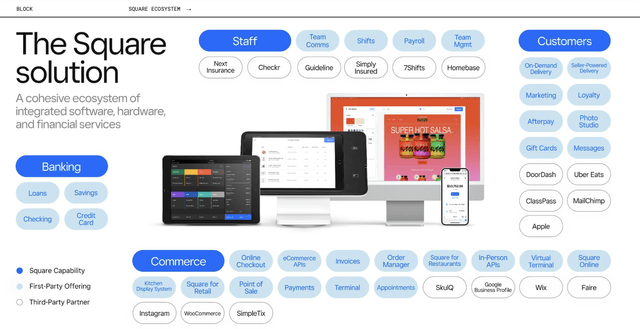

SQ is most well known for its point of sale devices but it is really a comprehensive fintech company as evidenced by its Cash App and buy now pay later offerings.

2024 Q1 Investor Presentation

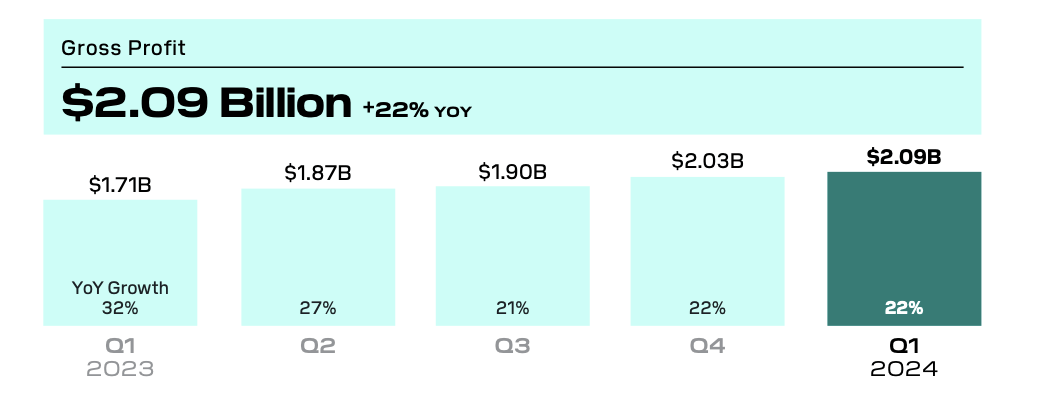

Gross profits grew 22% YoY to $2.09 billion, surpassing management guidance for between $2 billion and $2.02 billion.

2024 Q1 Shareholder Letter

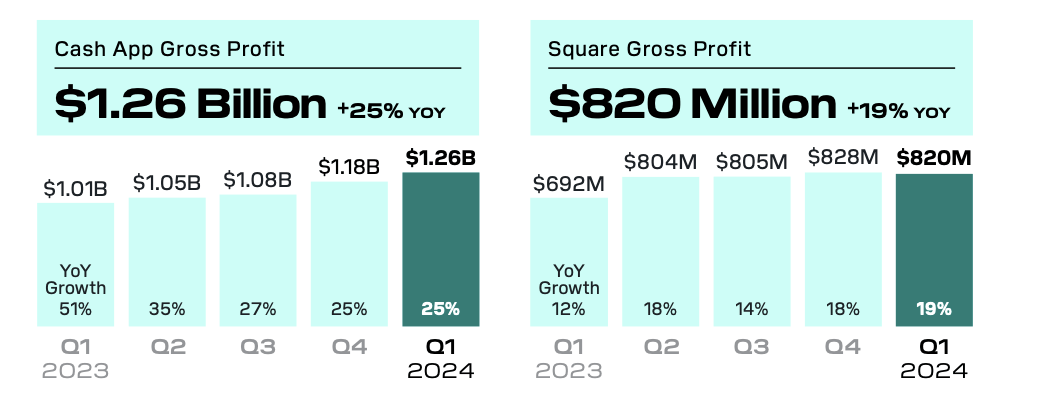

As usual, the growth was primarily from the Cash App, though I should note that Square’s gross profit growth accelerated sequentially to 19%. It appears that, like many tech peers, SQ is finally benefitting from some improvement in the macro environment (or at the very least, lapping easier comparables).

2024 Q1 Shareholder Letter

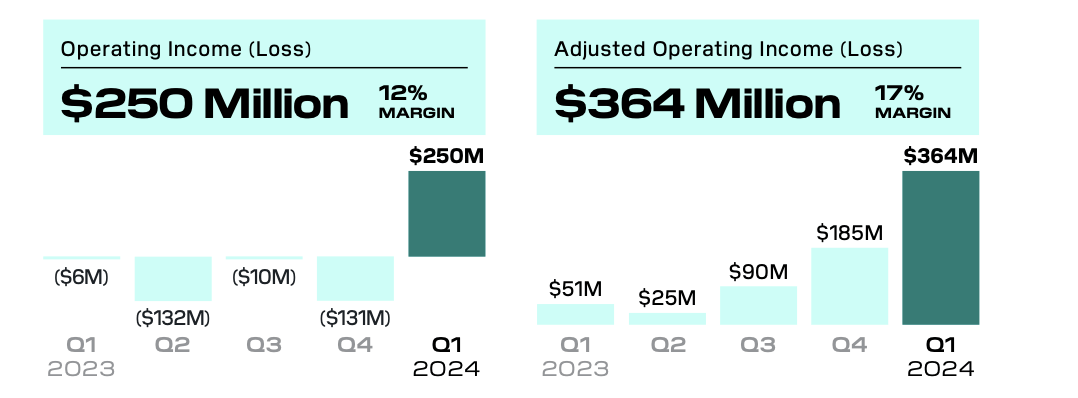

The company paired that strong top-line growth with a huge beat on the profit front, with adjusted operating income coming in at $364 million, crushing guidance for between $225 million and $245 million. I note that the company was solidly profitable on a GAAP basis as well (adjusted operating income does not add back equity-based compensation as many other tech peers do).

2024 Q1 Shareholder Letter

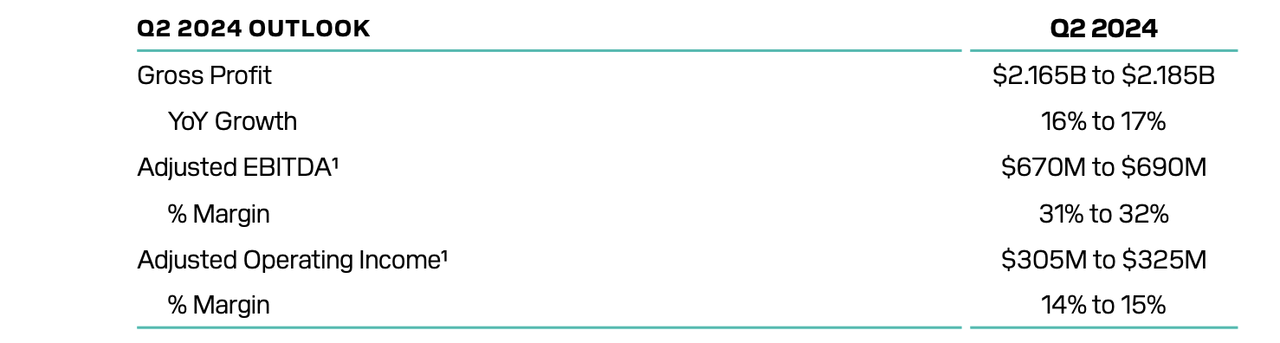

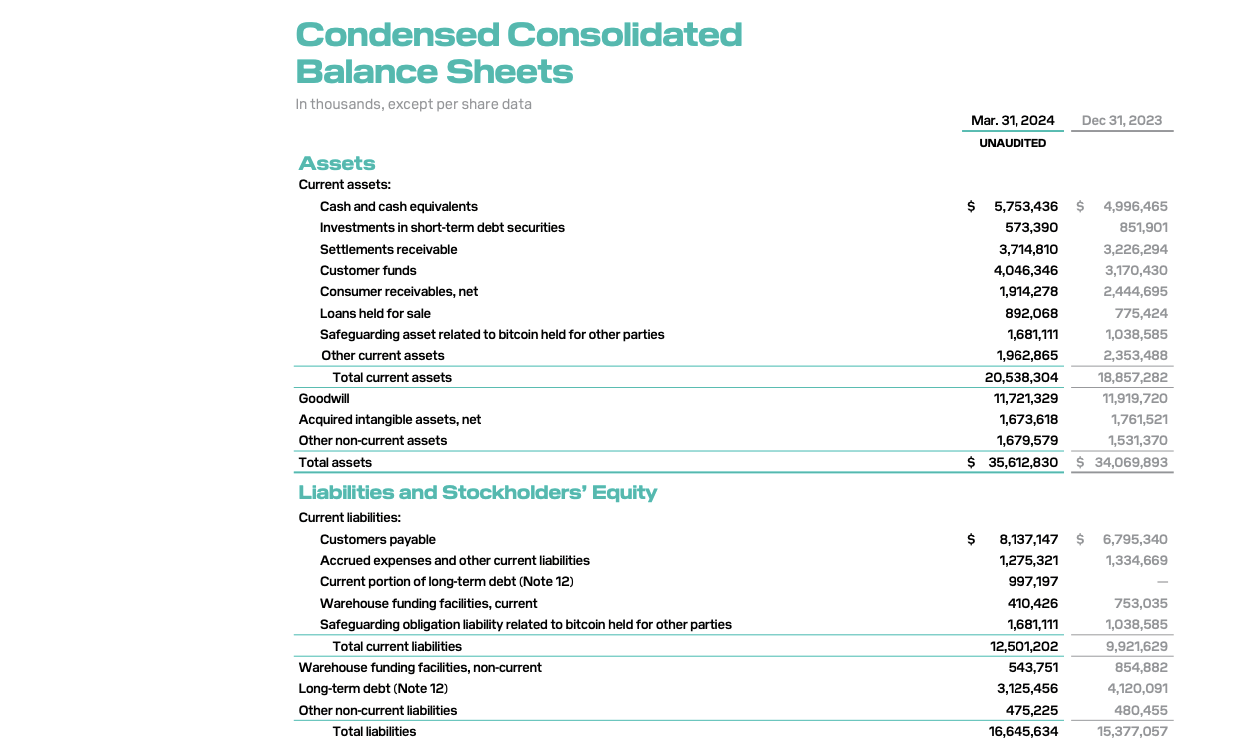

The company ended the quarter with $7.2 billion of cash versus $4.1 billion of debt, as well as $506 million worth of bitcoin investments. Looking ahead, management has guided for up to 17% YoY gross profit growth in the second quarter with even more aggressive gains on profitability.

2024 Q1 Shareholder Letter

Management raised their full-year outlook, now expecting up to 17% gross profit growth.

2024 Q1 Shareholder Letter

The company repurchased 3.6 million shares for $252 million – so far this looks like the perfect package, with management showing a great commitment to profitability alongside aggressive double-digit top-line growth, all while returning cash to shareholders through share repurchases. But, as usual, it isn’t so simple. In the company’s shareholder letter, management prominently discussed their long term ambitions for blockchain. Management noted that they are introducing a new mining chip, mining system, as well as intentions to invest 10% of gross profit from bitcoin into buying bitcoin. Management noted that they “believe the world needs an open protocol for money, one that’s not owned or controlled by any single entity,” a common argument discussed from bitcoin bulls (and perhaps viewed with scorn from the skeptics, including yours truly). Even though the company’s name in “Block” clearly indicates management’s focus, I think many investors are drawn more to the core businesses, and may be concerned that management eventually reverses course on the pursuit for profitable growth in favor of a bitcoin future. That certainly looks like a reasonable explanation for why the stock continues to trade at cheap valuations with a more modest recovery from 2022 lows than many peers.

On the conference call, management quickly addressed the reports that federal prosecutors were probing crypto transactions from the company. Management refuted it quite directly, stating that it does not appear to be new information (but instead related to existing and publicly known inquiries) and emphasizing their company commitment to compliance and transparency. Given that the stock is recovered much of its losses stemming from the initial reports, it looks like Wall Street is comfortable with this response. Management noted that several “key growth initiatives and strategies,” including those in Afterpay and the Cash App are expected to have more of a 2025 than 2024 impact. That commentary is welcome given that investors may be wondering if the strong 2024 top-line growth numbers can be sustained thereafter.

Is SQ Stock A Buy, Sell, or Hold?

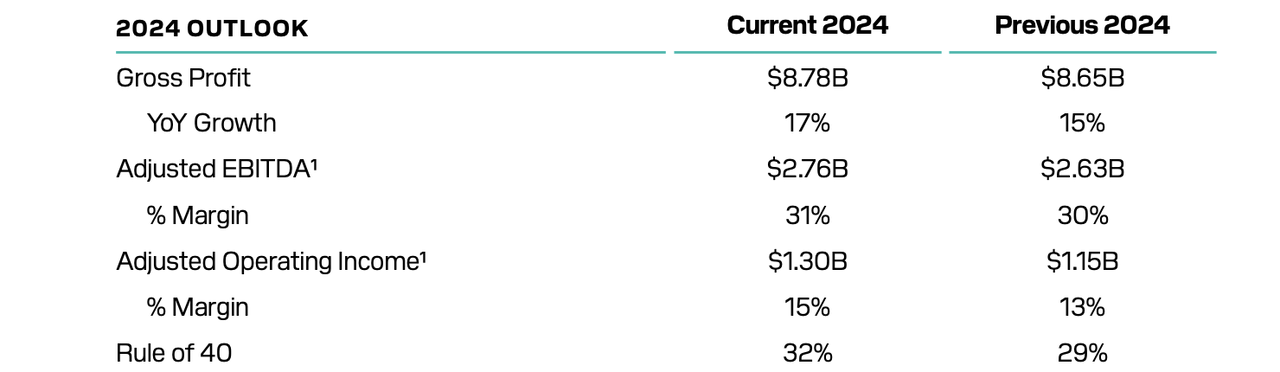

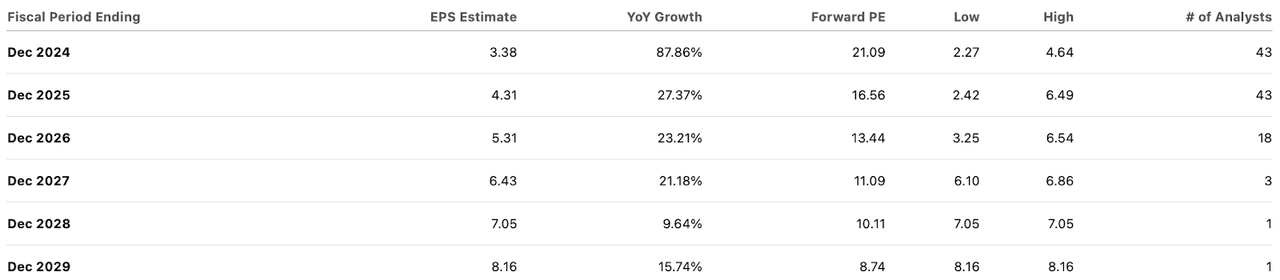

But perhaps investors are not asking the right questions, as SQ stock is not trading at the typically aggressive valuations that fast-growers trade at nowadays. The stock recently changed hands just around 21x this year’s earning estimates.

Seeking Alpha

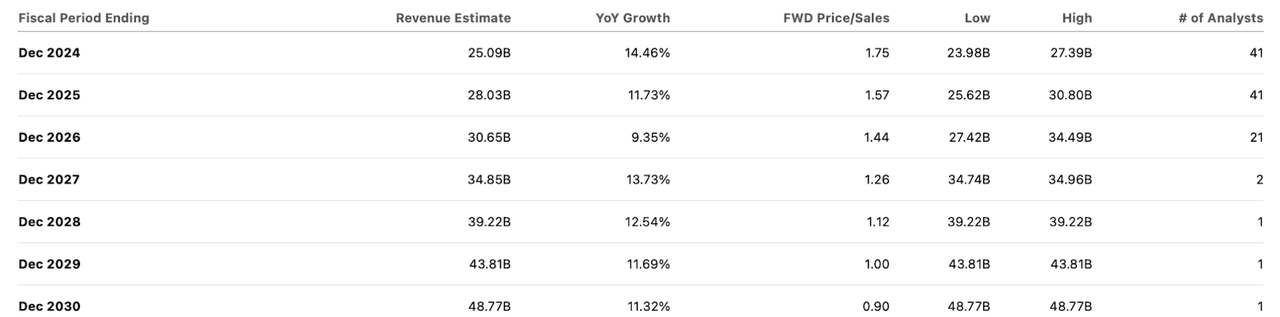

Consensus estimates call for the company to sustain double-digit top-line growth for many years to come.

Seeking Alpha

Bears might try to argue that the stock should be valued more like banks, which typically trade at low earnings multiples. I’d argue to the contrary – while the company does have some services associated with traditional banking such as customer deposits and loans, these make up a very modest portion of the balance sheet. Loans held for sale, in spite of rising rapidly, totaled just $892 million as of the latest quarter. Traditional bank risk mainly centers around the possibility of a “bank run,” in which customers pull their deposits and the bank is forced to sell its loans at fire sale prices in order to fund these deposits. SQ, on the other hand, has not yet aggressively invested customer deposits in loan investments, sidestepping such risk, and I again note that the company separately has $3 billion in corporate net cash.

2024 Q1 Shareholder Letter

I prefer to value the stock on gross profits due to the low margin profile of bitcoin revenues. The stock currently trades at 5.3x gross profits. Management has previously guided for “mid-twenties” adjusted operating margin by 2026. That margin is based off of gross profits. I can see the company generating margins of 50% or higher over the long term given that their OpEx structure eventually does not need to scale alongside growth in payment volumes. That said, the stock looks cheap even using a 25% margin assumption. I can see the stock being worth at least 20x earnings, justified by the double-digit top-line growth rate and net cash balance sheet. That equates to a 7.5x gross profit multiple, or stock price of around $100 per share.

Block Stock Risks

What are the key risks? Bears have long pointed to the potential that the Cash App is being used for criminal activities. With Cash App being the main growth driver of the business, the stock may underperform if the company is forced to pay any regulatory fines, or if growth slows down at the Cash App (perhaps due to the end of the supposed criminal activities). As I alluded to earlier, it is possible that management begins to invest aggressively in blockchain ambitions. In addition to pressuring margin expansion initiatives, it is unclear if a blockchain focus may earn an acceptable multiple from the market. On a similar note, the company might begin investing more of customer deposits into loan investments. While this might help boost both top and bottom-line growth, this would also increase the traditional bank risk for the company and may limit multiple expansion potential. I note that the company recently priced $2 billion of senior notes which carry an interest rate of 6.5%. It is unclear what this cash may be used for, and it is hard to explain the urgency given the high cost of capital.

Block Stock Conclusion

SQ is not a perfect package, as the double-digit top-line profitable growth is offset by management execution risk. Even so, the valuation looks quite attractive given the strong profitability, double-digit top-line growth, and net cash balance sheet. Investors need to monitor management’s ongoing commitment to profitable growth, and keep a close eye on both bitcoin investments as well as deployment of customer deposits. I view the risk-reward as being attractive and reiterate my buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!