Summary:

- SQ continues to demonstrate profitable growth trend and sticky consumer/ seller base, sustaining its premium valuations.

- Combined with the increased cross-selling, improved operating scale, and robust balance sheet, we believe the fintech may generate expanded bottom line performance ahead.

- FQ1’24 may also bring forth excellent numbers, with the management already launching intensified customer acquisition efforts in January 2024 as the US labor market and consumer spending remain robust.

- Having already rallied overly optimistically after the raised FY2024 guidance, SQ investors may want to wait for a similar rip-and-fall pattern to occur before adding for an improved margin of safety.

sofirinaja/iStock via Getty Images

We previously covered Block (NYSE:SQ) in September 2023, discussing its consistently improving metrics across its profit margins, user acquisition, and stock valuations, with the consensus already rewarding the raised forward guidance with expanded top and bottom line estimates through FY2025.

Combined with the well-diversified fintech offerings and improved cross-selling within its existing active users, we had maintained our Buy rating then.

In this article, we shall discuss why we are maintaining our Buy rating for the SQ stock, attributed to its promising monetization efforts and expanded profitability, despite the immense jump in its stock prices post FQ4’23 earnings call.

We also believe that FQ1’24 may bring forth excellent numbers, with the management already launching intensified customer acquisition efforts in January 2024 as the US labor market and consumer spending remain robust.

The SQ Investment Thesis Remains Attractive – After A Moderate Pullback

For now, SQ has delivered an exemplary FQ4’23 earnings call, with revenues of $5.77B (+2.8% QoQ/ +24% YoY), adj EBITDA of $562.16M (+17.7% QoQ/ +100.1% YoY), and adj EPS of $0.45 (-18.1% QoQ/ +104.5% YoY), and FY2023 numbers of $21.91B (+24.9% YoY), $1.79B (+80.8% YoY), and $1.80 (+80% YoY), respectively.

Much of the fintech’s tailwinds are attributed to the growing Total Payment Volume of $227.69B (+11.8% YoY), demonstrating the growing stickiness of the Square and Cash App platforms as the fintech also monetizes 56M of its Cash App monthly transacting actives (+1M QoQ/ +5M YoY).

The management’s intensified cross-selling approaches have delivered great results indeed, as SQ transitions more casual actives into primary card actives and bank actives, since these customers also bring in 2.3x and 7x more inflows, respectively.

This naturally explains why Cash App increasingly becomes the fintech’s bottom line driver at $1.18B (+9.2% QoQ/ +24.2% YoY) by the latest quarter.

On top of that, the fintech aims to extend its expand its existing Cash App base beyond households earning $100K to $150K annually, with the latter segment also representing nearly 80% of US consumers, triggering new growth opportunities.

If anything, we may see SQ’s growth start accelerating from henceforth, with the fintech already introducing a 4.50% in Annual Percentage Yield (APY) on Cash App savings balances for paycheck deposit monthly actives by January 2024.

This number well exceeds the US big banks such as JPM at 0.01% and BAC at 0.01%, while also being higher than the national average savings account interest rates of 0.59% as of February 24, 2024. The rich APY may drive customer acquisition indeed, further aided by the numerous banking feature launches ahead, such as wire transfers, check deposits, and bill payments.

SQ’s growing penetration amongst sellers is undeniable as well, with Square recording increased software/ banking solution gross profits at $678.96M (+19.2% YoY) and sellers of >$500K in annualized GPV increasingly comprising its base at 40% (+1 points YoY/ +3 from FY2021 levels) by the latest quarter.

At the same time, the management has well-balanced the robust top-line growth with decelerating operating expenses of $1.48B (+2.7% QoQ/ +6.4% YoY), naturally contributing to its excellent bottom line performance as discussed above.

Lastly, it is unsurprising then that SQ has raised their FY2024 guidance to adj EBITDA of at least $2.63B (+46.9% YoY), implying an increase of +9.5% from the previous guidance of $2.4B (+34% YoY), with an expanded adj EBITDA margins of 30.4% (+6.8 points YoY).

These developments imply that the fintech has finally achieved economy in operating scale, allowing its bottom line growth to accelerate despite the high growth stage, further aided by the robust net cash of $1.27B on balance sheet (inline QoQ/ +89.5% YoY) and only $1B of its debt maturing in 2025.

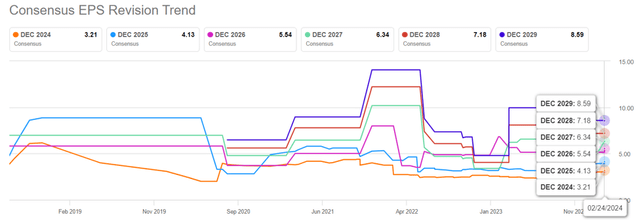

The Consensus Forward Estimates

Thanks to the consistently improving profitability, it is unsurprising that the consensus have further raised their forward estimates, with SQ expected to report an expanded bottom-line CAGR of +44.5% through FY2026.

This is compared to the previous estimates of +30.1% and historical growth of +37.2% between FY2017 and FY2023, further underscoring why the fintech deserves its premium profitable growth valuations.

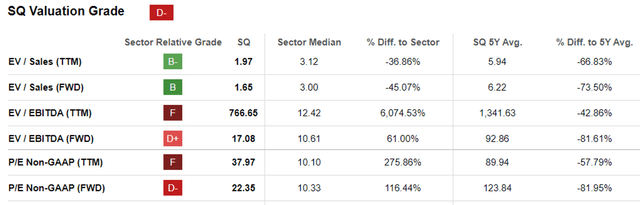

SQ Valuations

For now, SQ seems to trade at premium FWD EV/ EBITDA valuations of 17.08x and FWD P/E valuations of 22.35x, compared to the sector median of 10.61x/ 10.33x.

However, readers must note that these numbers are notably moderated from its 1Y mean of 23.40x/ 30.39x and 3Y pre-pandemic mean of 67.98x/ 90.76x, respectively.

It appears that the market is increasingly convinced about its prospects as well, as observed by the fintech’s ability to grow into its (previously) premium valuations.

So, Is SQ Stock A Buy, Sell, or Hold?

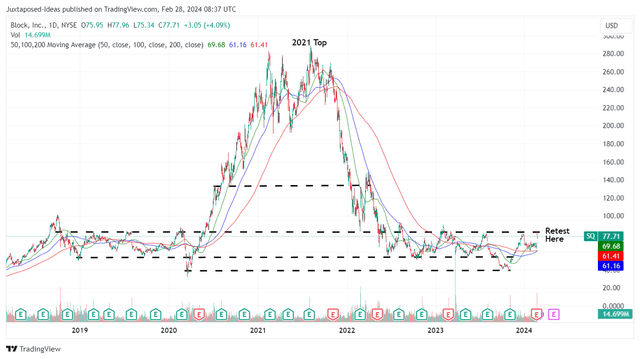

SQ 5Y Stock Price

For now, SQ has broken out of its 50/ 100/ 200 day moving averages post FQ4’23 earnings call, while retesting the previous resistance levels of $78s.

On the one hand, we believe that the recent jump has been overly optimistic, with the stock trading way above our fair value estimate of $40.20, based on the FWD P/E valuations of 22.35x and its FY2023 adj EPS of $1.80.

Based on the consensus FY2026 adj EPS estimates of $5.54, SQ has also pulled forward part of its upside potential to our long-term price target of $123.80.

Readers must note that the stock may follow its previous rip and fall pattern observed over the past few earnings calls as well, with it seemingly unable to retain much of its short-term gains.

Lastly, there may be moderate volatility ahead as the market enters extreme greed levels, thanks to the generative AI euphoria and the Magnificent Seven bubble.

On the other hand, we are still rating SQ as a Buy, attributed its improved monetization and growing profitability, further made attractive by the sticky consumer base.

At the same time, opportunistic investors may take advantage of the stock’s inherently cheaper FWD P/E valuations and the subsequent correction in its stock prices after much of the recent rally has been moderated.

Based on SQ’s historical trading pattern, we believe that investors may still add at between $62 and $70, with those levels offering an improved margin of safety.

Naturally, those that add here must also size their portfolios accordingly, since these inflated levels may prompt traders to take some of their gains here, naturally triggering moderate volatility in the near-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.