Summary:

- Block, Inc. may be reaching the end of growth in this economic cycle. CashApp may offer temporary support as the business environment deteriorates.

- CashApp and Afterpay may provide growth in the near-term as consumers opt for creative financing in the face of inflationary pressures.

- Management’s “Rule of” expectations for eFY24 result in lower than anticipated revenue growth.

Dilok Klaisataporn

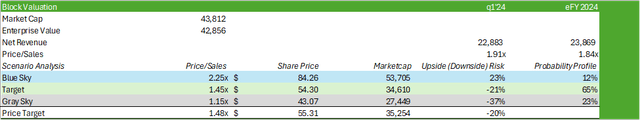

Block, Inc. (NYSE:SQ) may be reaching the tail end of growth during this economic cycle. Management is refocusing their go-to-market engagement with food & beverage services companies as the industry faces continued pressure on sales growth and higher input costs. I anticipate these headwinds will trickle into Block’s Square segment, while the disparity of CPI may pressure consumers into more creative financing features, such as Afterpay. Given the macro environment and the limited growth potential for eFY24, I am downgrading my recommendation for SQ shares to a SELL rating with a price target of $55.31/share at 1.48x eFY24 price/sales.

Be sure to read my previous coverage of Block here:

Block Runs The Risk Of Being A Bank

Block’s Earnings Will Be Energized By AI (Rating Upgrade).

Block Operations & Macroeconomics

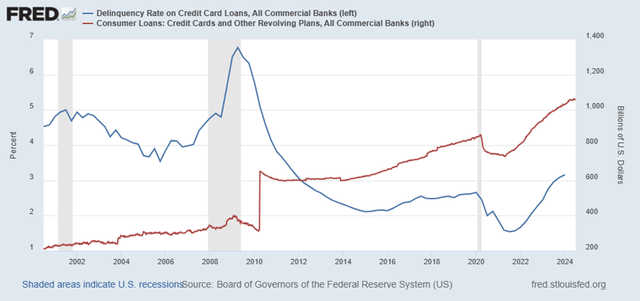

On the macro front, there are some concerning figures floating around as they pertain to the strength of the consumer. Total consumer debt continues to climb to new all-time-highs, as delinquencies have now surpassed pre-C19 levels.

Though this news falls into the dismal side of economic studies, I believe that this will play into Block’s consumer-facing business as consumers remain stretched on day-to-day costs of living. The recent June inflation print, or should I say deflation print, was promising; however, I do not anticipate it alleviates much of the pressure on the consumer. The deflationary reading was driven by a -10.1% decline in used cars and trucks and a -5.1% decline in airline fares. Gasoline also declined by -2.5%, which should relieve some pressure; however, gasoline prices remain at elevated levels for all intents and purposes. Daily expenses such as food at home and food away from home increased by 2.20% and 4.10% respectively. Electricity also increased 4.40%. In addition to this, PPI increased 20bps for June.

Though my field research is relatively limited, it appears to be confirmed by Baird’s data for fast-casual restaurants experiencing declining same-store sales in the range of -6%. In speaking with restaurant owners and management staff, it has become apparent to me that ticket volumes are considerably declining from the previous year. My presumption is that if larger chains are expected to suffer declining sales, small local eateries are likely experiencing similar declines. This may add certain headwinds to Block’s go-to-market strategy, especially with food & beverage services that presently utilize a competing digital POS and restaurant management system.

For the consumers, this will likely create tailwinds for Block as part of their Afterpay feature in their CashApp and headwinds for Block’s Square business. Though I do not believe this spending habit is sustainable for the long term, it should help uplift margins to a certain extent in the near-term. This is as consumers continue to have access to credit and instant access to funds to cover these costs.

What worries me about the uplift in Afterpay is the potential for it to work against Block. Though I cannot predict an upswing in delinquencies, I do believe that the increased use of buy now pay later, or BNPL, features is predicated on consumer credit being stretched thin. I believe this is what’s driving management to further push into autopay with CashApp as this may act as a hedge for ensuring payments are made.

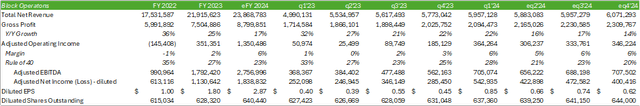

Block Financials

There is one sticking point that I cannot wrap my head around as part of management’s guidance. Management guided their form of “Rule of 40” to achieve Rule of 32 for eFY24; however, management guided a relatively low estimate for adjusted operating income for eq2’24 in the range of $305-325mm and guided further spending in sales & marketing for e2h24. In addition to this, management estimates a gross margin of 17% for eFY24. Though management does not guide revenue, consensus estimates revenue to come within the range of $23.9-27.3b. My estimate for eFY24 revenue comes in just shy of the range at $23.8b. Where I’m getting at is that with management’s expected adjusted operating income and gross margin growth, consensus is either overshooting on their revenue targets, or management is overshooting on their “Rule of” expectations. Management defines their “Rule of” as gross profit growth + adjusted operating margin.

One area of business Block is struggling with is their food & beverage footprint. One factor that continues to come to mind is their dominance with Starbucks (SBUX) years ago while new platforms, such as Toast (TOST) and Shift4 Payments (FOUR), formed and took a dominating lead. Though I do believe Block has the capabilities of developing a front- & back-office platform to compete with each of these platforms, I do not believe it will be an easy battle to win over business. From a personal perspective, I see many more Toast consoles at restaurants, bars, and breweries than Square. I don’t believe it will be a matter of ease of transition; but rather, reconfiguring IT systems to cater to the new infrastructure may crease an impediment. I anticipate that Block’s strategy will need to be more hands-on with newer businesses as they undergo the selection process, rather than approaching existing business with competing digital platforms.

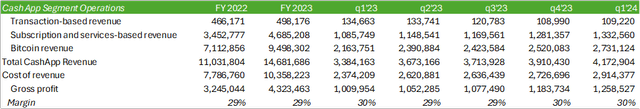

With a bleak macroeconomic outlook, I believe Block may experience some tectonic shift in their business. I anticipate Square to experience significantly slower growth as small businesses struggle with higher costs and fewer sales, while CashApp may create some uplift as consumers resort to creative financing as the dollar stretches thinner and thinner. For modelling purposes, I’m forecasting low-to-mid-single digit growth for Square and high-single digit growth for CashApp. In aggregate, this should create mid-single digit growth for the firm as a whole.

There is a bright spot for Block, as recently reported on Seeking Alpha. Block received their first order for its BTC (BTC:USD) mining chip from Core Scientific, as announced on July 10, 2024. This chip is a 3nm mining ASIC with a 15EH/s hashrate. I believe this chip came out a few years too late, as the halving event will likely create a more concentrated BTC mining environment. As discussed in my coverage of CleanSpark (CLSK), the firm is committed to reaching 50EH/s in eFY25 through organic growth and M&A.

Unless the firm’s supplier switches to Block’s ASIC, I do not believe Block will realize as broad of growth as anticipated with this specialty chip. Industry consolidation will make competition for hardware that much more competitive. I believe IT integration may also pose a challenge for the new ASIC, making sales to existing technology firms a challenge.

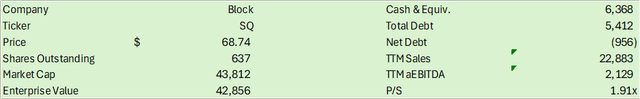

Valuation & Shareholder Value

I anticipate the headwinds posed by the macroeconomic environment will pressure growth in the coming periods and may result in significant share price decline. Given management’s “Rule of” forecast, I anticipate sales growth may come in short of consensus estimates to cater to their margin expectations. If this is the case, Block may be on the tail end of their growth story during this economic cycle. I rate SQ shares a SELL rating with a price target of $55.31/share, a -20% decline from the close on 7/13/24.

Valuation & Risks

Unpacking my scenario analysis and associated risks, each scenario is weighted based on the likelihood of the stock reaching its assigned multiple. The multiples provided are based on historical trading ranges. I believe a blue-sky event would involve various upside risks, such as continued growth in CashApp and stronger-than expected growth in Square. This may also include a low-to-normalized delinquency rate. The target scenario plays by my expectations in the body of this report. The gray-sky scenario would be lower-than-expected growth in Square and CashApp and involve a higher-than-expected delinquency rate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.