Summary:

- Block, Inc. has continued on its path to sustainable profitability, validating its business model.

- It expects to reach its Rule of 40 metric in FY2026, providing more clarity over its business model.

- Block has made structural changes to its organization to improve its go-to-market strategies. However, it’s still too early to assess its success.

- However, SQ’s forward adjusted PEG ratio suggests the market has baked in significant pessimism, potentially benefiting high-conviction buyers.

- I explain why SQ’s improving profitability and attractive valuation indicate there are no real reasons to panic. Read on to find out why.

hapabapa

Block: Down, But Not Out Yet

Block, Inc. (NYSE:SQ) investors have endured significant market volatility in August 2024, as the fintech leader fell toward the $55 zone before its recent recovery. As a result, fintech investors are likely assessing whether SQ can position itself for more sustained progress in its underlying momentum, even as the economy potentially weakens further. Fintech leaders like PayPal (PYPL) have experienced a remarkable recovery in buying sentiments, suggesting the worst of their selling intensity is likely over.

In my previous bullish SQ article in June 2024, I reminded investors why a growth inflection in its recovery trajectory could be close. I underscored the company’s ability to improve its underlying profitability as it scales. Block’s Q2 earnings release corroborates my optimism, as it remains on track to achieving its Rule of 40 metric.

Block’s Getting Closer To Its Rule Of 40 Metric

Block full-year guidance (Block filings)

As seen above, Block revised its full-year outlook, telegraphing confidence in its profitability growth inflection. As SQ is priced for growth (“A+” growth grade), the company must demonstrate its ability to continue gaining operating leverage.

In SQ’s Q2 scorecard, I’m assured of its constructive momentum, given the 20% increase in its corporate gross profit. Its consumer-focused Cash App delivered a 23% increase in gross profit, while its merchant-focused Square posted a 15% increase in gross profit. Therefore, it underscores a robust broad-based growth profile across its critical profitability drivers, improving investor confidence in its bullish thesis.

Notwithstanding the increasing challenges afflicting consumer spending, Cash App has demonstrated remarkable resilience given the weakening labor market and high-interest rate headwinds. In addition, it recorded a 10% YoY growth in inflows per active, highlighting the appeal of its platform. Hence, it should mitigate concerns over its competitive challenges as the fintech space evolves.

In addition, constructive commentary from Affirm (AFRM) suggests the intense headwinds that battered the BNPL space could improve further, lowering the market’s worries about an overstretched consumer. Therefore, I assess that Block’s consumer ecosystem remains resilient, suggesting it should be able to navigate potentially more intense macroeconomic headwinds moving ahead. Cash App’s ability to drive a higher direct deposit momentum should validate its acquisition strategies, underpinning its ability to outperform its peers. The company’s move toward streamlining its organization toward a more functional setup is expected to improve its go-to-market motion. As a result, I assess that the company is not resting on its laurels, capitalizing on its recent momentum to potentially gain more share.

I believe the potential benefits from its organizational improvements aren’t isolated to only its consumer-focused Cash App. The changes aim to improve its overall sales strategies, leveraging closer collaboration and partnership initiatives across Square and Afterpay (BNPL). Hence, there are opportunities for the company to evolve its operational efficiencies while gaining traction on its revised GTM strategies. Given the nascent developments on its adjusted roadmap, I assess that the market likely requires more confidence from the company’s performance before a further valuation re-rating.

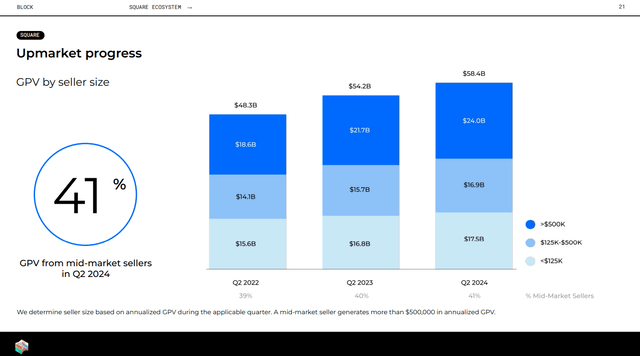

Block Is Moving Upmarket Confidently

Square upmarket progress (Block filings)

In addition, Block is making a concerted effort to improve its upmarket reach, assessed to be critical to its scaling efforts and reaching its targeted Rule of 40 metric. The company highlighted the progress in Q2, as mid-market sellers accounted for 41% of its GPV. While Block may have penetrated the SMB base more effectively previously, I assess that the changes in its GTM strategies could be aligned with the need to adjust its ability to penetrate the upmarket sellers more effectively. Therefore, there could be unanticipated execution risks inherent to its GTM shift, which investors must assess and account for accordingly.

Despite that, there are reasons to be cautiously optimistic about the company’s innovative capabilities as it looks to streamline and improve its merchant onboarding process. Accordingly, Block highlighted its move to a “much more flexible and reliable platform,” which should translate to improved order flow management and customer service response for restaurant merchants. It’s also looking to deepen partnerships in the food and beverage verticals, potentially enhancing its GPV growth profile. I assess these as constructive developments that should underpin investor confidence in its profitability growth inflection. Additionally, management anticipates achieving the Rule of 35 for FY2024, suggesting SQ is expected to get closer to its Rule of 40 goal in FY2026.

SQ Stock: Lack Of Buying Momentum Suggests Caution

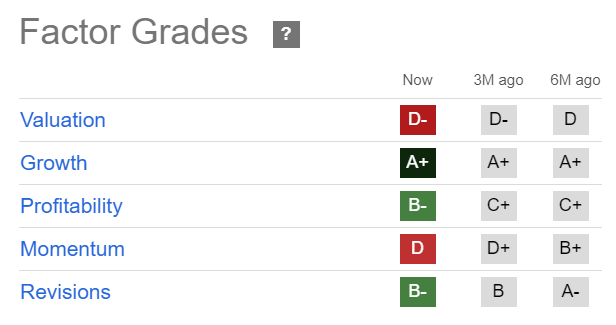

SQ Quant Grades (Seeking Alpha)

Therefore, I’m somewhat surprised by the lack of buying optimism on SQ over the past three months, as seen in the significant decline in momentum from “B+” to “D.” It suggests that the market has not been convinced by the developments underpinning SQ’s GTM revisions, potentially heightening its execution risks.

Given its embedded growth premium (“D-” valuation grade), I believe the market’s caution is necessary. Despite that, the improvement in its underlying profitability should undergird its valuation. Accordingly, SQ’s forward adjusted PEG ratio of 0.4 is substantially below its sector median of 1.24. Therefore, the stock is assessed to be markedly undervalued when adjusted for its growth profile.

Is SQ Stock A Buy, Sell, Or Hold?

Block’s Q2 performance has assured me that its ability to track closer to its FY2026 Rule of 40 metric is on track. In addition, its resilience amid heightened macroeconomic concerns has lent credence to its ability to improve its operating efficiencies further.

Notwithstanding my optimism, the lack of buying momentum despite an attractive growth-adjusted valuation suggests the market is concerned about the underlying changes to its GTM strategies. Therefore, the stock could be stuck in a consolidation over the next two to three quarters as the market assesses the improvements to its sales cycle and user acquisition profile.

Given SQ’s appealing forward PEG ratio, I assess that the stock’s improved fundamentals should assure investors that much of the recent pessimism has been priced in.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!