Summary:

- Block reported better than expected revenues for Q4, but the Fintech missed on earnings.

- The Cash App segment continues to drive growth, with gross profits increasing by 22% Y/Y in Q4.

- Block has a strong outlook for FY 2024, with a projected 47% jump in adjusted EBITDA and a 30% adjusted EBITDA margin.

- Shares have a 20X P/E which is reasonable considering the prospects for growth.

GOCMEN

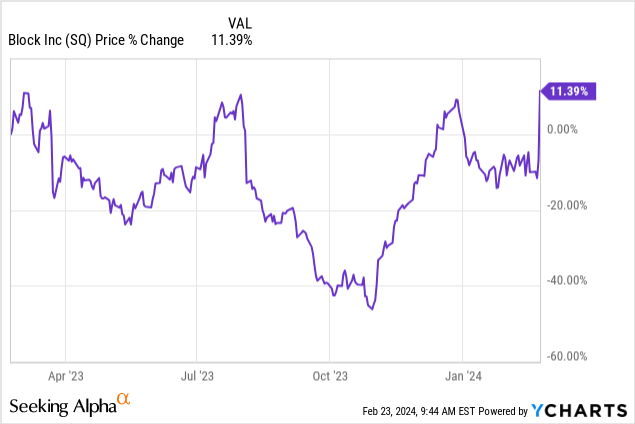

Block (NYSE:SQ) reported better than expected earnings for its fourth fiscal quarter on Thursday which were driven by continual growth momentum in the Cash App ecosystem and the Fintech submitted a strong guidance for FY 2024 adjusted EBITDA as well. The financial services and digital payments company generated a record amount of gross profits and adjusted EBITDA in the 2023 fiscal year, and with continual growth in its core businesses, I believe Block remains an attractive play in the Fintech space in 2024!

Previous rating

I previously rated Block a strong buy at $49 — Block: Nearing An Inflection Point — due to accelerating strength in its Cash App segment and I specifically mentioned the near term achievement of operating income profitability as a revaluation catalyst. In the fourth-quarter, and in FY 2023 more generally, Block executed well against its growth strategy in the Cash App segment and the Fintech is seeing solid adjusted EBITDA momentum. The outlook for FY 2024 is impressive and continues to justify a strong buy rating.

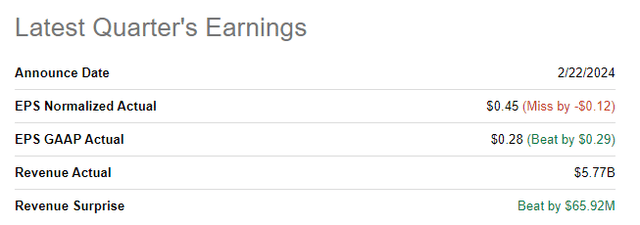

Block beat top line estimates, but missed on EPS

Block reported adjusted earnings of $0.45 per-share for the fourth-quarter, missing the prediction by $0.12 per-share. The top line beat expectations, however, coming in at $5.77B in Q4’23, reflecting an all-time quarterly record. Block’s realized revenue figure beat the consensus by a solid $66M.

Block’s Cash App is still crushing it, enhanced product mix leads to growth

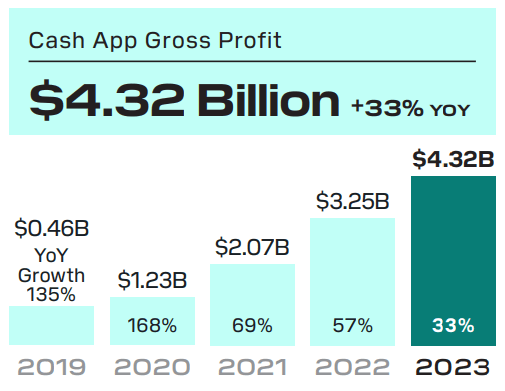

Block’s fourth-quarter gross profit increased 22% year over year to $2.03B, driven by momentum in the company’s largest business, Cash App. This segment has grown rapidly and consistently in the last two years due to a growing number of users as well as an effort on the part of management to increase its service offerings in the business which helped Cash App adoption.

In FY 2023, Block generated $7.5B in gross profits (+22% Y/Y). The Cash App segment, which is responsible for 58% of consolidated gross profits, generated $4.32B in gross profits, showing a growth rate of 33%. Cash App therefore grew at twice the rate as Block’s other core segment, Square, which posted a gross profit growth rate of “only” 16% year over year.

Block

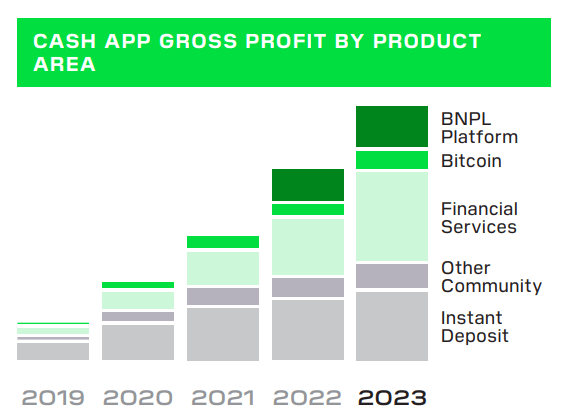

A key driver of Cash App growth is that the company has enhanced its product mix, adding new products such as financial services and BNPL (buy now, pay later) products that are seamlessly integrated into the app, making product adoption as easy as possible. The addition of BNPL products, especially, has been a success for Block: these products were only added two years ago and already account for 17% of the segment’s gross profits. BNPL products allow customer easy access to credit products that can be paid off in a small number of equal installments. The expansion of Block’s BNPL platform is a result of the Fintech’s $29B acquisition of Australian BNPL company Afterpay two years ago.

Block

Improving profitability profile

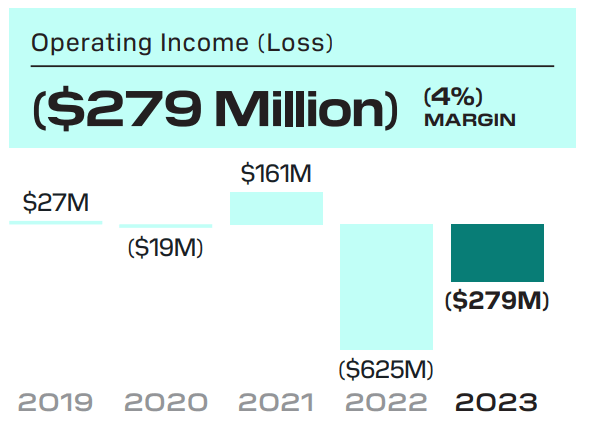

In my last work on the Fintech I said that Block’s achievement of operating income profitability could represent a milestone achievement as well as a revaluation catalyst for Block. In FY 2023, Block made considerable progress toward the goal of operating income profitability, but the company is not quite there yet. The FY 2023 operating loss was $279M, but losses narrowed by more than 50% Y/Y. At the current rate of improvement, Block could achieve operating income profitability in FY 2024.

Block

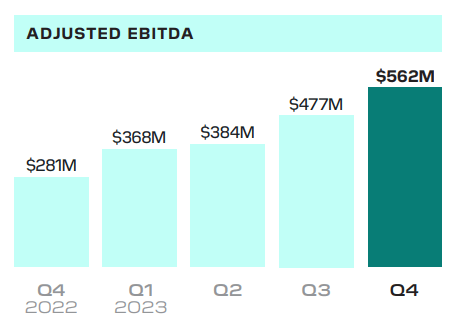

Block’s adjusted EBITDA also looked increasingly better as the year progressed: it hit $562M in the fourth-quarter of 2023, showing a 100% increase year over year, and the firm’s EBITDA has grown consistently every quarter in FY 2023. This growth, again, has been chiefly driven by growth in Block’s biggest business, Cash App.

Block

Strong outlook for FY 2024

Block guided for “at least $2.63B” in adjusted EBITDA for FY 2024, implying a 47% jump relative to FY 2023 and the forecast came in ahead of Block’s prior guidance of $2.40B. The new adjusted EBITDA guidance implies a 30% adjusted EBITDA margin and a 6 PP margin expansion Y/Y.

Block’s valuation relative to PayPal

PayPal (PYPL), a Fintech rival for Block, is a value stock due to the enormous amount of free cash flow the payments network throws off each quarter. PayPal’s free cash flow was the number 1 reason why I doubled down aggressively on the Fintech giant after the Q4 earnings sell-off.

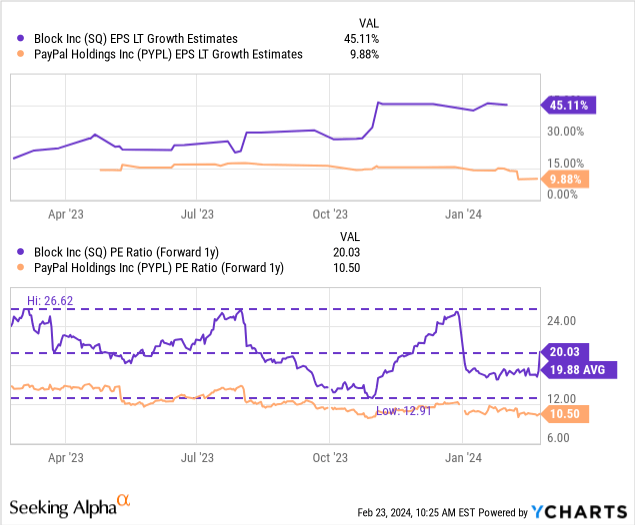

Block doesn’t have PayPal’s free cash flow, but the Fintech is projected to grow its EPS much faster… which is why Block is a growth, and not a value stock. Consequently, Block is currently valued at a higher price-to-earnings ratio of 20.0X compared to PayPal’s 10.5X P/E ratio, but Block’s earnings ratio is not excessive. I believe Block could be valued at a P/E ratio of 25X given that the Fintech achieves operating income profitability in FY 2024 and that its gross profits continue to grow in the double-digits.

A fair value P/E ratio of 25X implies a fair value of $100 (and 25% upside potential). This would be a dynamic value that could rise and fall related to changes in the Fintech’s gross profit growth rate and to progress in terms of moving towards consistent operating income profitability in FY 2024.

Risks with Block

The biggest risk factor, as I see it, relates to the company’s growth trajectory in the Cash App core business. The segment has solid momentum in terms of product adoption, but this momentum is likely the reason for Block’s higher earnings multiplier factor, especially with regard to other Fintech companies like PayPal… which is struggling keeping customers on the platform. What would change my mind, therefore, would be weakening Cash App usage and slowing gross profit growth (two metrics that I believe are worth monitoring in 2024 and beyond).

Final thoughts

Block submitted a much better than expected earnings sheet for the fourth-quarter which showed continual Cash App momentum and an improving product mix in Cash App, driven by BNPL. The outlook for FY 2024 adjusted EBITDA crushed it and explains the overwhelmingly positive market reaction to the Fintech’s earnings report. In FY 2024, Block could be headed for a significant milestone event… which would be the achievement of its first-ever full-year operating income profit in the company’s history. Shares trade at reasonable P/E ratio given the potential for growth and I believe Block could be a strong out-performance candidate in 2024!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.