Summary:

- Block has executed well in its renewed strategy and focus on operational efficiency, sustaining growth and improving profitability in Q2.

- Square and Cash App remain high quality businesses with several growth verticals and large addressable markets.

- SQ’s centralized sales approach and focus on product development should help rekindle growth.

- Strengthening fundamentals, $3B in share repurchases and a historically cheap valuation are more support for SQ as a long-term attractive buy.

hapabapa

Investment Thesis

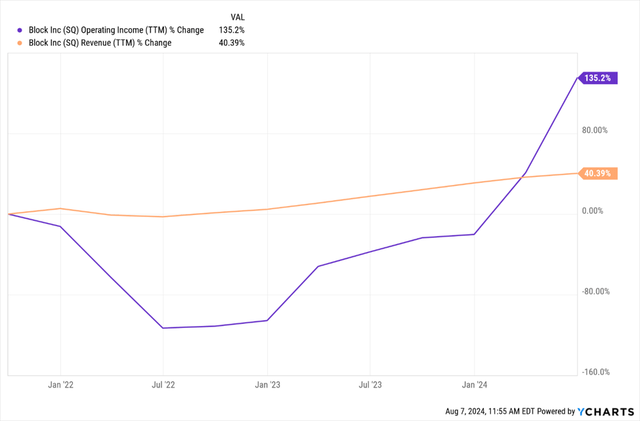

Block (NYSE:SQ) has taken meaningful strides this year in its transition from high-flying growth stock to steady compounder, yet the stock continues to flounder. The company has pared back operating expenses and narrowed the focus of its go-to-market strategy on the highest value activities within each business. A softer topline and mixed macro environment puts more pressure on the firm to increase profitability, which it has succeeded in the past few quarters. Block’s quality businesses and cheap stock price presents an attractive opportunity for investors.

Business Strategy & Outlook

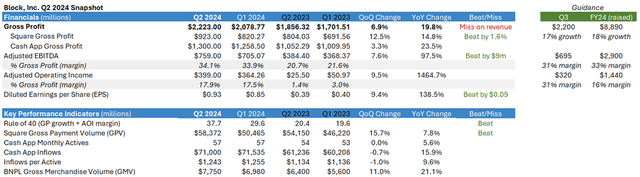

Block has reported three quarters since my previous article, each with a similar backdrop of improving profitability and refining its growth strategy. FY23 was all about operational efficiencies for the company including a cap on headcount, removing business ‘redundancy’, and setting performance targets based on shareholder value (Gross Profit Retention > 100%, Rule of 40 on Adjusted Operating Income by 2026). So far in FY24, management is on track with these targets and has shifted its aim to rekindling growth. Block grew overall gross profit (‘GP’) 20% in Q2, with Cash App and Square contributing 23% and 15% respectively. Here is a snapshot of SQ’s results:

Square

Square has been the laggard of Block’s businesses, averaging around 15% quarterly YoY growth vs Cash App’s 42% the last two years. Business inefficiencies, a weaker macro backdrop, and increasing competition have all contributed, but Square looks poised for a turnaround due to several key drivers.

Banking has been a strategic priority across Block’s businesses and was a significant driver of growth this quarter. Gross profit from banking products for Square grew 23% YoY, becoming the 2nd largest GP contributor for the business. Square banking products equip sellers with readily available funding to manage operations in addition to cash accounts. Square’s loan originations climbed 32% YoY in Q2, highlighting strong seller appeal. Banking strengthens customer lock-in and enables Square to both grow alongside its smaller sellers and further penetrate the mid-market space, defined as sellers doing more than $500k in annualized gross payment volume (‘GPV’). This segment expanded slightly to 41% of Square’s seller mix in Q2. Management estimates Square’s mid-market penetration at less than 1% of its addressable market, giving a nice runway for Square to execute on.

Alongside growth up-market, Square has focused on cutting its onboarding steps to enhance its go-to-market strategy, cutting the onboarding steps from 30 to 4. Square has demonstrated an ability to cross-sell within its product suite as greater than 50% of gross profit comes from sellers using 4+ products. Quicker customer acquisition only strengthens it. Lastly, Square for retail and restaurants climbed 21% YoY as the company expanded partnerships in the vertical with US Foods and other distributors. Square now has critical relationships with 40% of restaurants in the US. Partnerships outside the US also helped boost international gross profit growth of 34% in Q2.

Cash App

Cash App continued to be a bright spot for Block in Q2, with strong performance across the segment’s growth and KPIs. The only disappointing figure was growth in monthly transacting actives, which only rose 5%. Leadership attributed it to tapered back marketing spend which is expected to pick up in the back half of 2024. The emphasis for Cash App is clearly banking as it seeks to be the primary banking platform for users. Cash App financial services allow users to borrow, save and invest all through Cash App, driving inflows and allowing for greater monetization. Cash App’s commerce business, led by its buy-now-pay-later (‘BNPL’) segment saw success in Q2 as well. Inflows reached $71B, up 15% YoY, and Cash App’s monetization rate expanded 9 basis points, while BNPL gross merchandise value (‘GMV’) was up 21% to nearly $8B.

Outlook

Block’s opportunity remains compelling, especially with management’s more deliberate approach. CEO Dorsey named Nick Molnar, CEO and Co-Founder of Afterpay, as head of a centralized Sales function at Block. The strategy aligns with Block’s long-term vision of an ‘ecosystem of ecosystems’ where each business unit benefits the other, connecting sellers and consumers. Here’s what CEO Dorsey had to say on the shift in strategy:

I want us to be able to move much, much faster with newer technologies such as all of the AI models, all the open-source AI models that you’re seeing come to market, really level the playing field for us. And by seeing that technology through the lens of an engineering and design and product organized company versus trying to manage this across different business units, it means we can move much better and much faster. We do have multiple business units right now. They represent multiple brands, multiple customers. Obviously, as we’ve been talking about for some time, we believe our superpower is combining these. And I believe strongly that this model will allow us a lot more flexibility.

Leadership showed confidence Block’s long-term outlook by raising FY24 guidance for gross profit growth and operating margins while also initiating a $3B share repurchase program.

Economic Moat

Block’s underlying ecosystems in themselves carry some economic advantages. Square and Cash App are primarily software based, meaning they tend to be high margin and easily scalable (Square’s gross profit margin sits in the 40’s due to hardware costs, Cash App in the 80’s). Square’s business model comes with inherent switching costs especially as sellers adopt more products, allowing for gross profit retention and recurrence. This dynamic only strengthens as Square moves up-market. Cash App boasts clear network effects but was a riskier bet on monetization, yet the business surpassed Square in gross profit due to continuous growth in actives and inflows. Cash App’s lofty goal of becoming the primary banking partner of its users has already shown fruit as deposits, borrowing, and Cash App Card use have all grown. The App’s popularity and demographics are additional tailwinds on this initiative as it’s frequently the top-ranked finance app and 70% of its inflows come from Gen-Z and Millennials. Lastly, the potential synergies between each of its ecosystems, specifically within commerce and BNPL, would not only generate more growth but strengthen Block’s moat. But the strategy of linking Cash App users to Square sellers in still in the early innings. Block has the right tools to continue winning in its respective markets, and the stock’s increasingly attractive valuation provides a nice margin of safety.

Fundamentals & Valuation

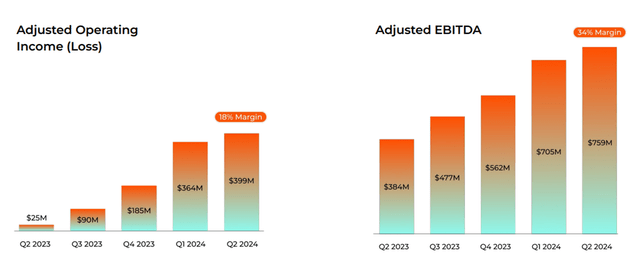

Despite some uncertainty around growth, Block has made nice headway in profitability, expanding both adjusted operating and EBITDA margins the last few quarters:

Management also bumped full year guidance for AOI margin to 16% and adjusted EBITDA margin to 33%. Operating expenses fell 4% led by cost cuts in Sales & Marketing and General & Admin, yet Product Development margin rose slightly displaying a commitment to future growth investment. A more deliberate approach to costs and investment has helped the company increase operating leverage and get more juice out of topline growth.

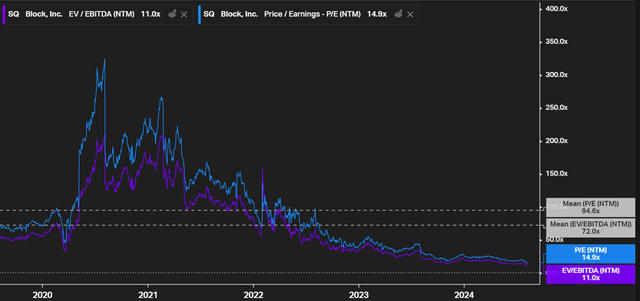

This improvement in profitability and still fairly robust growth make SQ’s current valuation all the more attractive. Relative to historical averages, SQ is trading near decade-low multiples:

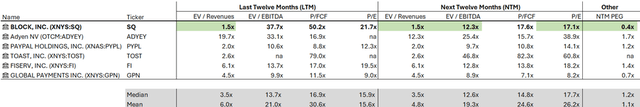

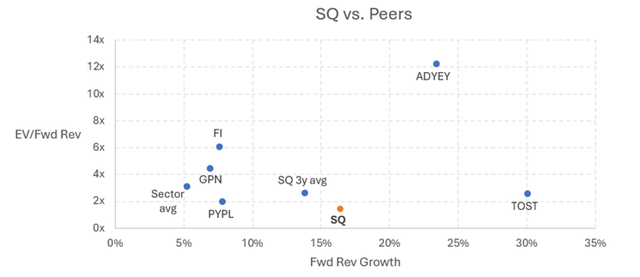

Compared to peer multiples, SQ trades below its peer group median on several measures. Additionally, a scatter plot comparing forward growth and forward EV/revenue shows Block is cheap given its revenue expectations.

Author, data from Seeking Alpha Author

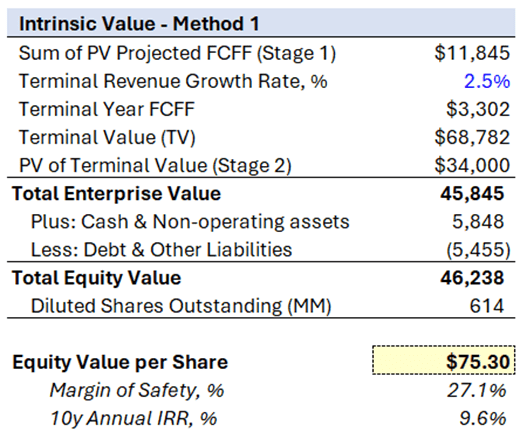

On a discounted cash flow basis, SQ also looks to have a nice margin of safety. I expect revenue growth to moderate over the next decade with Block averaging 11% annually, but the company has upside potential here in my view given its plentiful growth verticals and focus on product development. I estimate operating margin to continue expanding to 10% by 2033 as the company builds off a more efficient approach. I assume both fixed and working capital investment will stick near the following historical averages:

- Capex % of Revenue = 1.5%

- Depreciation % of Capex = 100%

- Change in Working Capital % of Revenue = 0.8%

Lastly, my terminal growth rate assumption is 2.5% and WACC is 9% (average beta: 1.25, risk-free rate: 4%, equity risk premium: 4.2%). The result is an estimated value per share of $75.30 and a margin of safety of just over 27%.

Author

Risks

There are a few external and internal risks investors should be aware of with Block. Externally, each of Block’s businesses are exposed to macro factors, specifically the US consumer. Weaker consumer spending’ which we’ve seen recently and slowing retail sales hurts sellers and the commerce segment of Block’s businesses. Block’s banking business is also impacted as borrowing tends to slow in a contracting environment. In addition, a greater reliance on banking exposes Block to greater regulation and competition as the industry is usually winner-takes-all, with large banks locking down a majority of up-market businesses. Still, Block has had success in the small to mid-market range. Square faces increasing competition with competitors like Toast (TOST) and Clover (FI). While still retaining decent market share, Clover does more in annualized GPV than Square and is growing revenue at nearly double the rate of Square. Still, GPV growth is similar across the two businesses. Cash App faces less direct competition, outside of Venmo (PYPL), and continues to be a market leader growing faster than Venmo.

Internally, SQ has seen dilution thanks to high stock-based compensation costs, with outstanding shares climbing each of the last few years. But management continues to increase share buybacks which should flip the script for shareholders, especially at the current historically low multiples. CEO Dorsey also holds major share voting power which adds key person risk to the mix. Block also has exposure to Bitcoin, BNPL, and customer loans which increase the company’s overall risk profile. Bitcoin is speculative by nature with upside and downside potential, and CEO Dorsey is committed to both investing in and building products around the technology. BNPL and loans expose Block to default risk, albeit the company’s risk management strategies have limited losses to about 3% of revenues as of Q2.

Conclusion

Despite a struggling share price, Block’s strategic focus and strengthening fundamentals are reason for long-term optimism. Square and Cash App are quality businesses well-positioned to execute against their individual markets. A historically and relatively cheap share price combined with a sizable margin of safety also support my view that SQ is a buy at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.