Summary:

- Block is looking to leverage its Cash App into becoming a leading online bank with a financial “ecosystem.”

- Q1 results showed continued growth and improvement but nothing game-changing.

- The transformation that Block wants will be a gradual one, and there are other businesses that seem to be ahead.

- For those reasons, SQ stock’s current valuation, however big or small one’s growth assumptions, seems a bit rich to me.

Joe Raedle

I initially covered Block (NYSE:SQ) at the start of April. At the time, I was cautious about the valuation and its potential for good returns in the long run. This wasn’t just a question of its current financial capacity but also the story to how it should grow that. According to its founder-CEO, Jack Dorsey, the key is to develop an ecosystem in their company (hence changing the name from Square to Block). Citing reasonable doubt, I noted:

Customers care about what happens with their money. Cash App was built on millennials splitting the bill for dinner or chipping in for gas. A bank has a lot more going on, and I’m not convinced that Block appreciates what kind of step this is and how tight the competitive squeeze will be.

Ecosystems certainly don’t work like that.

Since my initial publication, the share price is down almost 28%, about $60 now. Q1 results have also since been released, so there’s a bit more to consider. I, however, maintain the long view that Block’s growth story is a tad ambitious and unlikely to be demonstrated in a near-term quarter’s results. For this reason, I continue to rate it a Hold.

Block Q1 Earnings Results

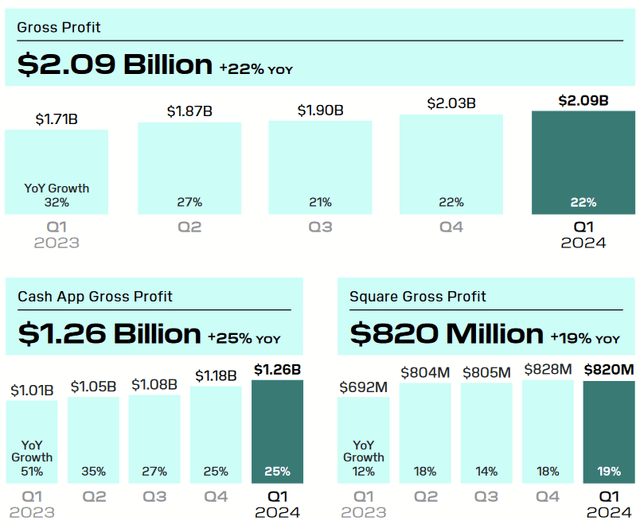

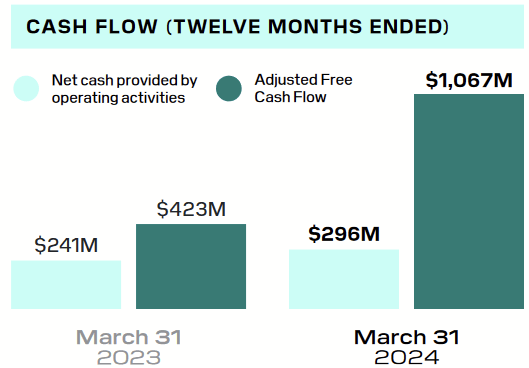

The first quarter showed continued growth for Block. In my last article, I referenced Block’s Adjusted Free Cash Flow figure, which I believe to be a reasonable representation of their cash-generative ability. Both AFCF and operating cash flows were up compared to Q1 2023.

Q1 2024 Shareholder Letter

They also reported that about $252M of that went toward share repurchases, with 3.6M shares bought back.

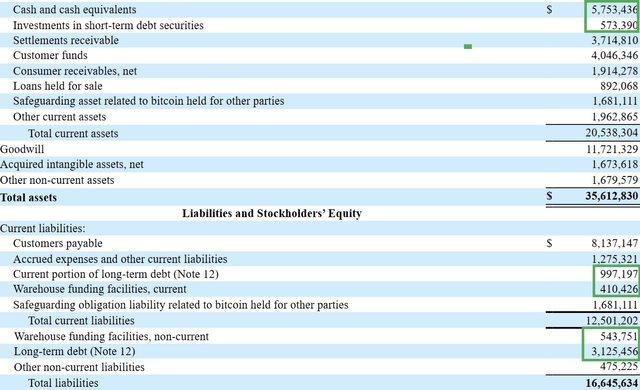

Their balance sheet was also quite healthy, with cash and short-term investments exceeding total debt, resolving to about net cash of about $2.03 per share.

While the company has consistently shown quarter-over-quarter growth in gross profit, this has mainly been led by growth of their Cash App segment, but Square still showed year-over-year growth. Cash App is key, as Block hopes to leverage their strength in this segment so that they can enter the banking space. This was discussed in my last article, the heels of Q4, and in their Q1 2024 Shareholder Letter, they noted:

We believe our financial services offerings are uniquely connected and differentiated from traditional banks.

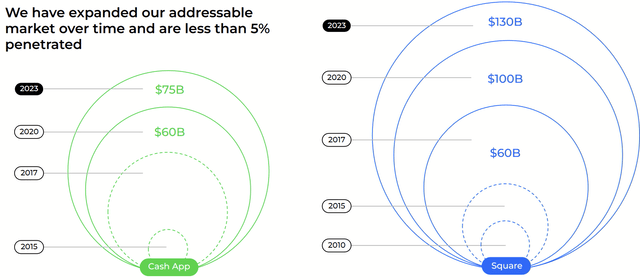

By growing their services and pairing the buyer-side aspect of Cash App with the seller-side aspect of Square, this is the basis for which Block believes it can shift into a banking role, and I agree that having both sides like this provides an intuitively reasonable basis for such.

They’ve also been working to go beyond the bill splitting and gas money, making Cash App available for direct deposit, a “buy now, pay later” feature based on their acquisition of Afterpay, and making the purchase of stocks and Bitcoin (BTC-USD) possible on the app as well. These are, of course, the pieces that they hope will create the “ecosystem” that I mentioned last time.

Examining the Challenges Ahead

In later May, Dorsey had another broadcasted conference call at the JPMorgan Global Technology, Media and Communications Conference. He spoke very candidly about the future of Block and why it takes time before their vision could be realized (and thus why next quarter is unlikely to have major or game-changing milestones crossed).

For example, Dorsey explained that the natural advantages of these businesses were overlooked for a long time:

So how does Square impact to the positive Cash App and vice versa? And over the past five years we kind of just lost that strength and that vision. And we spent the past six months just looking critically at everything and redoing everything and making sure that we are bringing the company together into one ecosystem into one team, so that we can realize this power, and we can actually create experiences that our competitors can’t have.

The current effort is therefore somewhat new for them and admittedly late. That doesn’t mean they can’t deliver, but it speaks to why this won’t happen overnight. One of my own critiques in my last article was the factor of trust that important in choosing a bank versus just having a digital wallet or a payment service. Dorsey himself agreed:

And if we want to go to this next level which Cash App does of becoming the primary banking relationship for all families and households under 150,000 in the United States. That is a different level of trust, that’s a different level of engagement…

He later added:

We have to be more reliable. We have to be more transparent. We have to be much more dependable if they have to call us for whatever reason. Like the customer service aspect of our business needs to feel like a product that again makes people say, wow, I don’t think it does today.

Of course, trust isn’t the only issue with banking. There are also regulatory hurdles. One does not simply become a bank, and players who already operate in such a space have an advantage. Last time, I noted how Zelle, the payment service backed by the big banks, enjoys much higher payment volume than both Square and Venmo (PYPL), even though it came later. The advantage of already being a bank and adding more services is huge.

Of course, there’s no need for me to dredge up the big banks again. Let’s talk about a company that’s already delivering on a similar vision to that of Block: SoFi (SOFI), which I also covered before. They already have a banking service, which paired very well with their student loan business and reduced their interest expense. The acquisition of Golden Pacific that gave SoFi a national bank charter occurred back in 2021, and it wasn’t until now that the benefits of that integration finally started materializing, and they continue to build an ecosystem of financial services as well.

Block also faces competition in the crypto space, believing Bitcoin is a way to facilitate friction-less transactions. As Dorsey put it:

I think Bitcoin often gets combined with the rest of cryptocurrency, and that is not what we are focused on at all. We are not even focused on Bitcoin as much as we are: “How do we build and help build an open protocol for money? How do we help build an open protocol for money movement?”

I think this is a good attitude, but I suspect they’ll also be placing second to the likes of Coinbase (COIN), which I’ve also covered. Namely, I’m speaking to their increasingly popular Stablecoin service, which is serving a similar need. For all that Block is trying to do with its ecosystem, I see other successful businesses that appear to be ahead of them in some regard.

SQ Stock Valuation

Having the best product is the key to growth, and growth is what justifies higher multiples on a business’s earnings (for our purposes, AFCF). Last time I declined to do a calculation because I don’t think we have enough history to get a reasonable baseline of AFCF. Yet, with FY 2023 results putting AFCF just over $500M and Q1’s trailing twelve months putting it just over $1 billion, the current market cap of $37B, whichever figure you use, is a big multiple on top of either.

SQ 5Y Price History (Seeking Alpha)

Whatever one’s growth assumptions or discount rates they want to use, one can tell this isn’t suggesting a bargain for Block, even if it’s down 28% since I covered it and seems cheap compared to the bull market of 2021. Not only is there not a compelling lead in these financial services, but there’s not a compelling price for even a modest future.

Conclusion

Throughout the talk I quoted, Dorsey mentioned that many of the changes that need to be made will take time. Block isn’t in trouble, as I’ve noted, its financial situation is great and has improved over recent years. Yet, today’s premium suggests a growth story of which I am more skeptical, particularly other businesses seem to be doing exactly what Block wants to do but seem to be a step or two ahead.

While Block wants to become more than just a digital wallet and payment service for merchants, other businesses already seem to have more of an ecosystem and potentially with a better product. For my part, I want to see Block actually execute against this competitive environment before I pay the kind of the multiple that is currently priced on the market. For that reason, I consider the stock to be Hold, and unless something truly amazing gets announced as Q2 approaches, I’m probably still maintain this conservative outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.