Summary:

- Block plans to publish its Q3 results on the 7th of November after market hours, and we touch upon some of the important sub-plots of the earnings event.

- Valuations look cheap, particularly in light of management’s OPEX control and healthy EBITDA dynamics through the next year.

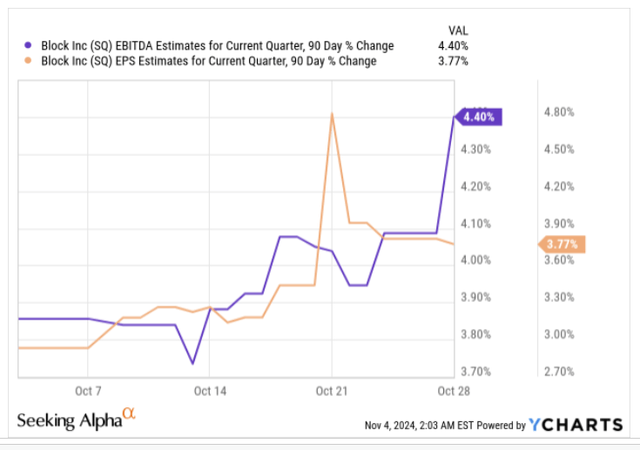

- SQ, which doesn’t have the greatest earnings track record, has little wiggle room to go wrong as estimates for Q3 have been lifted by 4% over the past 3 months.

- The transition towards the rule of 40 also results in better cash conversion, thus opening the prospect of increased buyback momentum, which could support the share.

- We like the set-up on the charts and think Block could benefit from some mean-reversion.

Eoneren

Introduction

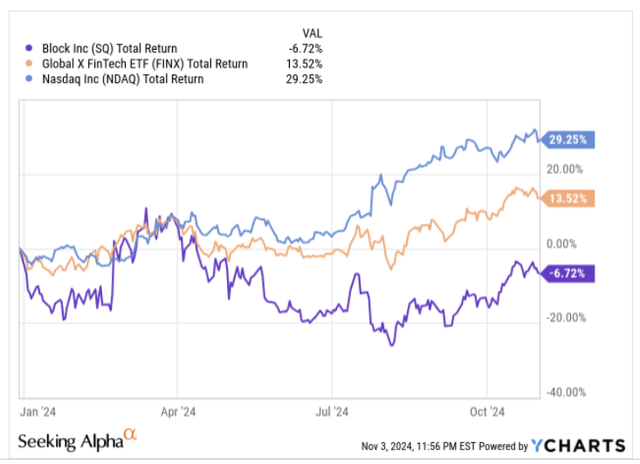

After a healthy 2023 with gains of over 23%, the stock of diversified fintech, Block, Inc. (NYSE:SQ), has proven to be a disappointment of sorts in 2024. On a YTD basis, SQ has wobbled, and is down by close to 7%, underperforming other fintechs (>13%), and the tech-heavy benchmark (>29%).

With around a couple of months to go, before the year draws to a close, SQ still has the time to ameliorate the degree of underperformance and end up with another year of positive returns. One event that could prove to be decisive in this regard is the upcoming Q3 results, due to be announced on the 7th of November, after market hours.

Q3 Earnings – Key Metrics

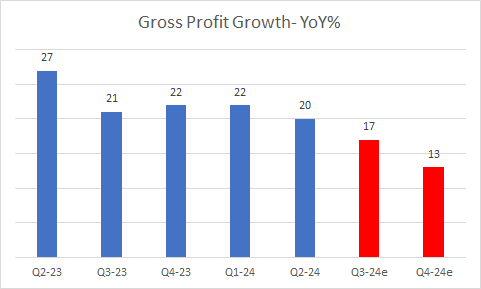

Even though investors like to focus on revenue trends during earnings season, in Block’s case, the onus will rather be on gross profit growth, which gives a better perspective on the health of the core transactional side of the overall business.

Note that after showing some stabilization between Q4 last year and Q1 this year (at the 22% levels), the group gross profit growth looks set to carry on with its declining trend in Q3. Admittedly, Q2 had to deal with tough comparable of 27% growth a year ago, but in Q3, the year-ago comparables will be a lot more palatable (21%), yet GP growth is expected to come off to levels of 17%, before dropping even further to 13-14% in Q4 (the implied Q4 number is based on management’s FY guide of 18% growth for the whole of FY24).

Having said that, don’t rule out the prospect of management lifting the December quarter GP growth, as transactional-based revenue for the ‘Square’ vertical usually gets a seasonal uplift on account of holiday trends. It’s worth noting that the forward-looking consumer confidence domestic numbers are currently hitting the highest cadence of monthly gains in 3.5 years, and this certainly bodes well for purchasing momentum in this quarter.

Shareholder letter

Even otherwise, we are rather enthused by management’s plan to bolster Square’s positioning through initiatives such as new centralized sales leadership, and a better self-serve onboarding experience for prospective sellers. SQ’s main target is to capture the mid-market and SMB cohorts, and we believe Q3 would have received a boost from their new onboarding platform (which came to fruition only in July 2024) designed to bring down the onboarding steps from 30 (and over 10 mins) to just 4. Block also plans to introduce a convenient single P-O-S app for its sellers before the close of FY24.

The Cash App side of the business has proven to be more resilient and has been the main driver of gross profit growth. For context, in Q2 it was up by an impressive 23% YoY, and whilst there may be some slight declines, we would still expect the Q3 and Q4 numbers to be trending closer to the 20% levels.

Within Cash App one of the more exciting products to keep an eye on is “Cash App Borrow” which is more like a convenient short-term working capital loan for retail clients (typically $100 and less than 1 month in duration). In Q2, Cash App Borrow saw a tremendous spike of 3x in total originations, highlighting the underlying popularity of this product and also serving as a useful fillip to the monetization rate. Within Cash App, one metric that didn’t fare particularly well was the growth in actives, which was up only by 5% YoY at 57m, but we would expect this to see an uplift in Q3 on account of the June launch of App Card Spending Insights which is designed to give the actives a more comprehensive perspective of their spending patterns, and help them make better financial decisions.

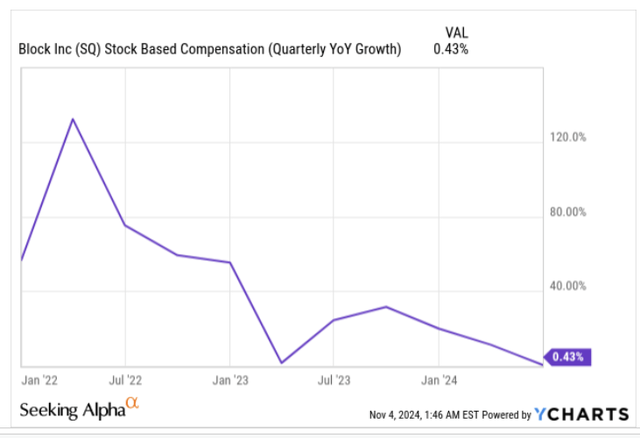

A word also on SQ’S SBC (Stock-based compensation) trends which also take on more prominence, given the weight it has on the company’s operating cash flow (roughly 63% of the H1-24 operating cash flow). In recent periods we’ve seen growth come in at a minimal pace of less than 1%, and we won’t be surprised to witness a YoY decline in Q3-24, given that last year’s SBC spend was quite high by historical standards.

What Does The Medium-Term Outlook And The Valuation Picture Look Like?

One of the other key reasons to turn more constructive on SQ is its ongoing efforts in cleaning up the expense base, which will help it engender better operating leverage over time and facilitate much healthier EBITDA growth. At the Goldman Sachs conference a couple of months back, the CFO has been on record stating that they’ve implemented a workforce cap of 12000 employees (meanwhile, reports last week suggest that the TIDAL workforce will be cut by one-fourth), even as efficiencies continue to be pursued in other areas such as real estate, software, cloud fees, etc.

For the uninitiated, SQ has a goal of hitting the rule of 40 (the aggregate of gross profit growth + adjusted EBIT margin) by 2026, but don’t be surprised to see it get there ahead of schedule. If we may refresh investors’ minds, during the Q2 event, SQ had already lifted its FY24 target from the previous levels of 32% (GP growth+ adjusted EBIT margin) to 35%. Having said that, H2 operating leverage may not necessarily be as strong as H1 given a likely ramp up in marketing spend across new channels.

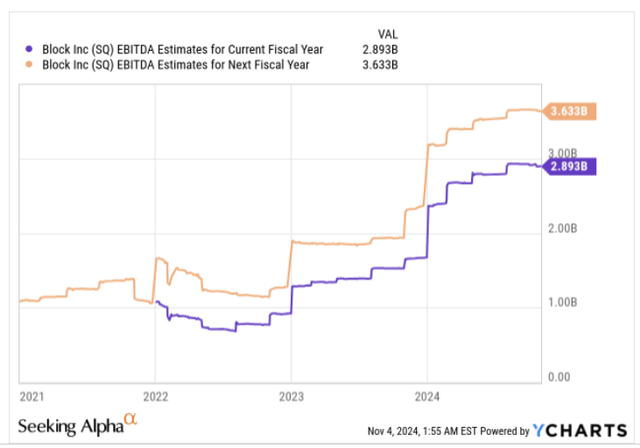

Nonetheless, if we take a broader perspective, and look at consensus estimates for this year and next year, and take last year’s adjusted EBITDA of $1792m as the base, it looks like we have a business poised to facilitate resilient EBITDA CAGR of 42% over the next two years.

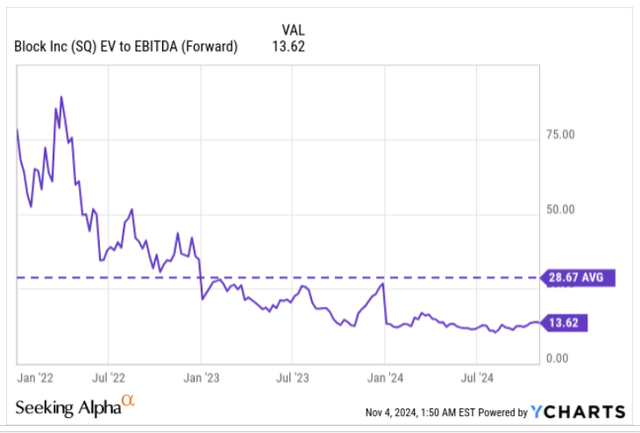

For that cadence of EBITDA growth, we think a forward EV/EBITDA multiple of less than 14x comes across as very attractive, more so as it translates to a +50% discount over the stock’s long-term average! In addition to these cheap valuations, investors should also note that the company is carrying over 8200 bitcoins on its balance sheet with a fair market value equating to roughly $0.5bn (as of H1).

Risks

With regard to the Q3 event, investors may want to note that expectations have been dialed up, leaving it little wiggle room to go wrong. To elaborate, note that both EBITDA and EPS estimates for this quarter have already been lifted by roughly 4% over the past 3 months. What also makes things slightly trickier is that Block doesn’t necessarily have the most pristine track record when it comes to meeting bottom line estimates. For context, over the last 3 years, around 25% of the time, Block has failed to meet quarterly EPS estimates.

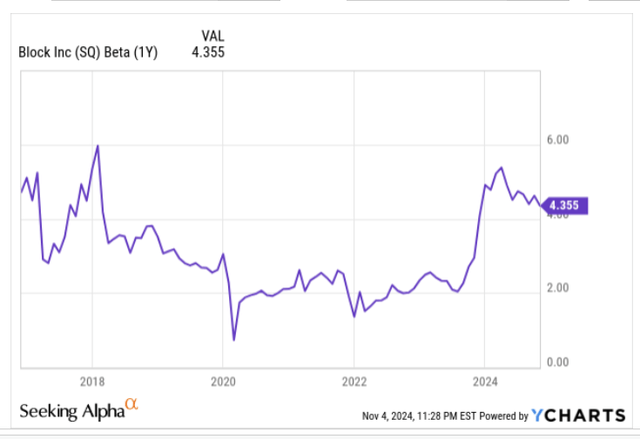

It’s also fair to say that the SQ stock isn’t meant for the faint-hearted, particularly on account of its heightened exposure to the crypto markets (as of H1-24, bitcoin-related revenue accounted for 44% of the total group revenue) which can be quite mercurial. We’d like to think that his facet has played an important part in SQ having an inordinately high beta of over 4x. With uncertainty around the Presidential elections, high beta stocks like SQ may not necessarily be the most opportune bet at this juncture.

Closing Thoughts – Is Block A Good Buy Now?

Besides the alluring EBITDA and valuation sub-plots, here are a few other reasons why we are more sanguine on the stock’s prospects.

Firstly, SQ’s monthly chart which captures the price movements over the last two and a half years suggest that it has been forming something similar to an ascending triangle pattern which is innately a breakout pattern characterised by a flat resistance and higher lows. Note that the price is yet to reach the potential breakout/resistance zone (the upper black line), so it gives prospective investors some elbow room to not get trapped right at the top (if the breakout fails to materialize).

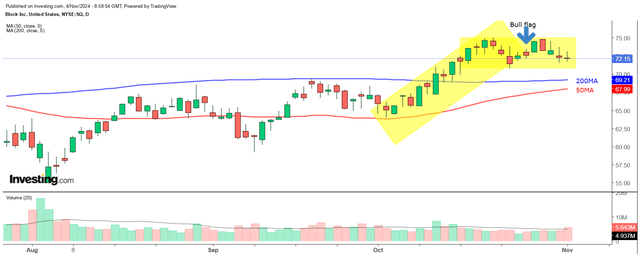

Then, if one drills down to the lower time frame daily chart, it appears that SQ has been forming a bull flag since the turn of October, with the second leg of the pullback currently underway. Meanwhile, it is also encouraging to note that the stock is trading above its 50 and 200 DMAs with a potential golden cross catalyst on the anvil.

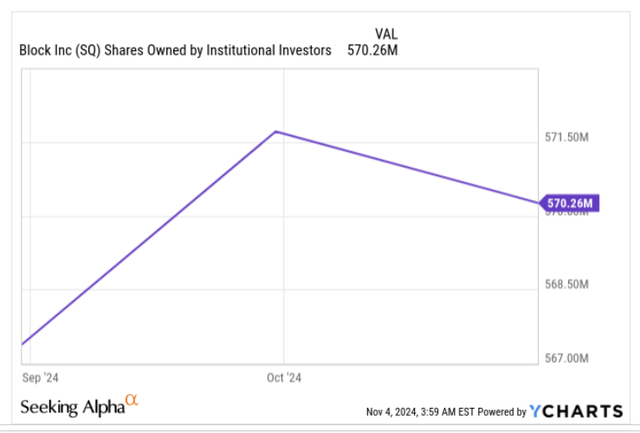

Investors may also be interested to note that the trend seen since the September lows has also been supported by the institutional segment (which reflects well on the quality of the trend).

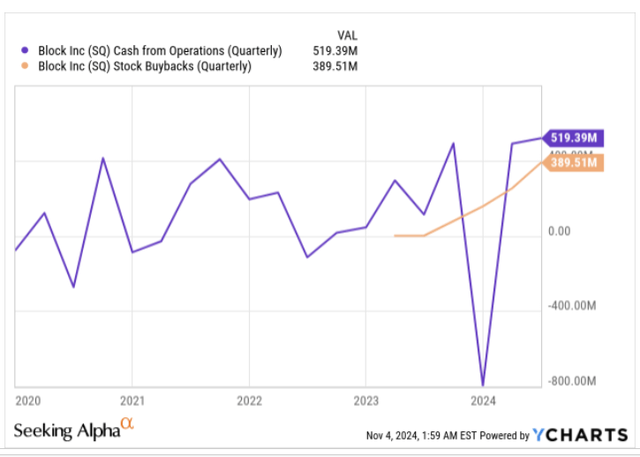

The stock will also likely get further support from a ramp-up in buyback momentum. As SQ gets closer to the Rule of 40 target, what you’ll also see is a much higher of cash conversion (Adjusted EBITDA to FCF conversion as of H1-24 had hit levels of 57%, up by a mammoth 1300 bps YoY) with operating cash flow (OCF) per quarter already at record highs of over $500m. Nonetheless, as OCF numbers orbit around a higher threshold, one can expect SQ’s buyback appetite to also keep pace. At the end of H1, SQ still had around $3.2bn worth of buyback ammunition due to be spent (representing 7% of the market-cap)

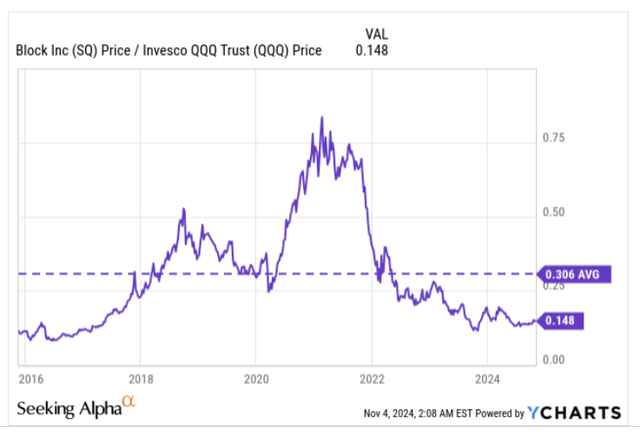

Meanwhile, if you’re big on the conception of mean-reversion in the markets like we are, then you’d like to know that the SQ stock represents one of the promising bets for those covering the Nasdaq. As things stand, the current relative strength of Block over the Nasdaq is roughly only half as much as its long-term average, offering some scope for normalization.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.