Summary:

- Block’s double beat FQ1’24 earnings call and raised FY2024 guidance have not been well appreciated, as observed by the stock’s underperformance thus far.

- At the same time, the management has intensified their bitcoin strategy, with it naturally impacting market sentiments with the cryptocurrency remaining volatile.

- The same moderation has also been observed in SQ and other fintech stock valuations, implying the market’s uncertainty on how to value these stocks due to the prolonged macroeconomic normalization.

- SQ is likely to trade sideways until the market is convinced about the fintech’s prospects along with bitcoin’s appreciation potential, both of which may be the catalyst to the stock’s eventual breakout.

- We will also highlight a few metrics to look out for in the upcoming FQ2’24 earnings call on August 01, 2024, with these underscoring SQ’s near-term prospects.

Khosrork/iStock via Getty Images

We previously covered Block (NYSE:SQ) in March 2024, discussing why we had maintained our Buy rating as the management expanded its monetization efforts and profit margins in FQ4’23, while offering a promising FY2024 guidance.

With FQ1’24 likely to bring forth excellent numbers, as the management launched intensified customer acquisition efforts and the US labor market/consumer spending remained robust, we believed that it continued to offer a compelling investment thesis after a moderate pullback to its trading ranges of between $62 and $70.

Since then, SQ has lost -13.4% of its value despite the double beat FQ1’24 earnings results and raised FY2024 guidance, with the stock’s FWD valuations also consistently moderated compared to their 1Y and pre-pandemic means.

It appears that the market is undecided how to value the fintech, as the management also intensified their investments in bitcoins from April 2024 onwards. With the stock yet show signs of breakout potential, our reiterated Buy rating is only intended for investors with higher risk tolerance and patient investing trajectory.

In the meantime, SQ is likely to trade sideways until the market is convinced about the fintech’s prospects along with bitcoins’ appreciation potential.

SQ’s Cash App Segment Continues To Outperform Expectations

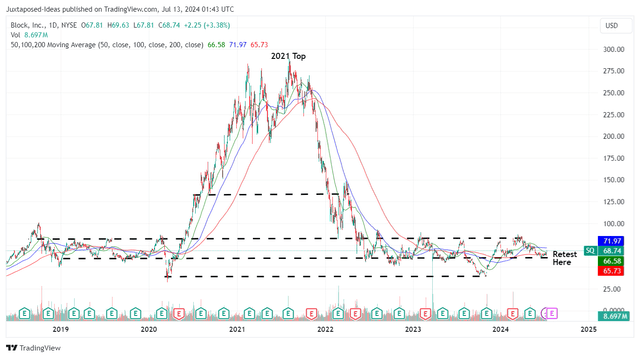

SQ 5Y Stock Price

For now, SQ has continued to trade sideways since May 2022, with the stock charting robust support at $61s and resistance levels of $83s. Even so, we are disappointed that the stock has failed to break out of this trading pattern despite the double beat FQ1’24 earnings call and raised FY2024 guidance.

Much of its top/ bottom line tailwinds are attributed to robust monetization observed in SQ’s Cash App segment, with revenues of $4.17B (+6.6% QoQ/ +27.5% YoY) and gross profit margins of 30.2% (+0.1 points QoQ/ +1.8 YoY).

With Cash App also increasingly adopted with 57M monthly transacting active users (+1M QoQ/ +4M YoY) along with higher inflows of $1,255 per user (+10.3% QoQ/ +10.4% YoY) and higher monetization rate of 1.48% (inline QoQ/ +0.07 points YoY), it is unsurprising that the segment has been the top/ bottom-line driver thus far.

Combined with the growing Cash App Card monthly active users of 24M (+1M QoQ/ +4M YoY), it is apparent that SQ’s intensified user acquisition and cross-selling monetization has worked as intended.

This is through the introduction of numerous banking products which builds upon its existing BNPL and digital wallet offerings, resulting in an extremely sticky fintech platform with minimal churn.

Even so, readers may want to note that SQ may face more competition despite the robust fintech prospects, as Apple (AAPL) exits from the BNPL scene while highlighting Affirm (AFRM) as one of the key partner banks/ lenders in the US moving forward.

As discussed in our AFRM article, we believe that AAPL users may be more likely to adopt its BNPL platform, with the partnership potentially influencing “customer decisions on which cards to spend on, or where to set up credit.”

As a result of the potential headwind, readers may want to pay attention to SQ’s upcoming FQ2’24 earnings call on August 01, 2024, while monitoring key metrics, such as the Cash App active users and monetization rate, since these are indicative of its retention rate.

The Bitcoin Love Story Continues

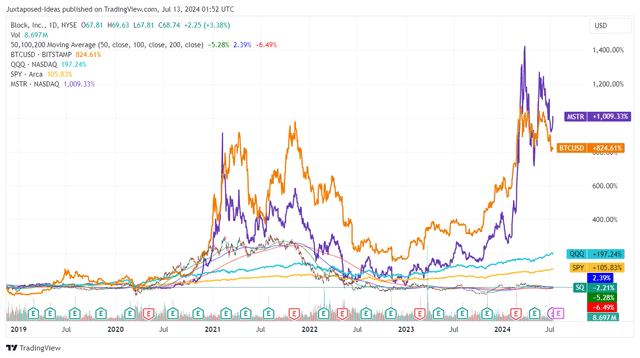

Bitcoin Prices Against MSTR & SQ

On the one hand, SQ’s interesting choice to make bitcoins more accessible has worked out as intended, with over 21M active Cash App users using the cryptocurrency while generating robust bitcoin revenues of $2.73B (+8.3% QoQ/ +26.3% YoY) and bitcoin gross profits of $80M in FQ1’24 (+21.2% QoQ/ +60% YoY).

With “only 0.7% of related expenses,” bitcoin has been a lucrative segment for the fintech indeed, with Cash App’s vertically integrated capabilities allowing users to “buy, hold, withdraw, or sell bitcoin” within one platform.

On the other hand, perhaps part of the pessimism embedded in its stock prices may be attributed to the SQ CEO’s conviction surrounding Bitcoins, the supposed king of alternative cryptocurrencies.

For now, we believe that SQ has yet to emerge as a Bitcoin proxy stock as how MicroStrategy (NASDAQ:MSTR) has over the past few years, with the former only holding 8,038 bitcoins (inline QoQ/ data not available) compared to the latter at 214,278 bitcoins as of March 2024 (+13.2% QoQ/ +53% YoY).

Even so, it is undeniable that both CEOs remain highly convinced, with SQ already committing to investing “10% of its monthly gross profit from bitcoin products into purchases of bitcoin itself” from April 2024 onwards.

With the belief of smaller incremental purchases to offset the “challenges of market timing,” readers may want to closely monitor SQ’s intermediate term execution.

This is especially since bitcoins have previously retested its all-time top of $70Ks, after recovering tremendously by over 4x from the November 2022 bottom of $15Ks and recently pulled back to $57Ks.

The inherently volatile Bitcoin spot prices may have also contributed to the pessimistic market sentiments surrounding the SQ stock, since it appears that some swing crypto traders have unlocked some gains at recent heights.

As a result of the speculative nature of bitcoins and the potential impact on its balance sheet, we can understand why the market remains undecided about SQ, as observed in the stock’s sideway trading since May 2022 despite the increasingly profitable fintech segment.

Moving forward, readers may want to pay attention to SQ’s Bitcoin revenues and bitcoin funding allocation in the upcoming earnings call, since the uncertain Fed pivot has put a massive damper on the recent Bitcoin price movement, worsened by the prolonged normalization in macroeconomy outlook.

So, Is SQ Stock A Buy, Sell, or Hold?

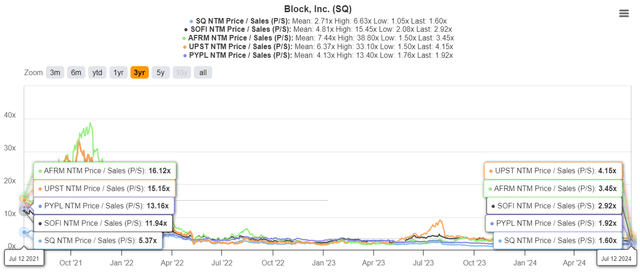

SQ Valuations

The same uncertainty has also been observed in the consistent moderation in SQ’s FWD EV/ EBITDA valuations to 13.86x and FWD P/E valuations to 19.22x.

This is compared to its 1Y mean of 18.33x/ 24.07x, 3Y pre-pandemic mean of 67.98x/ 91.24x, and the sector median of 10.10x/ 11.13x, respectively.

Volatile Stock Valuations

Readers must also note that the same volatility in stock valuations has been observed with multiple fintech stocks, namely SoFi (SOFI), Affirm (AFRM), Upstart (UPST), and PayPal (PYPL), with the correction seemingly yet to end.

These developments imply that fintech investors may want to temper their near-term expectations, with the uncertain macroeconomic outlook and the prolonged Fed pivot likely to remain a breakout headwind.

While we continue to stand by our previous fair value estimates of $40.20 and the 2Y price target of $123.80, with the SQ stock currently well supported at the YTD bottom of $60s, readers may want to observe its movement for a little longer and only add if the exercise reduces or matches their dollar cost averages.

Even then, we believe that SQ is likely to trade sideways in the intermediate term, until the market is convinced about the fintech’s prospects along with bitcoins’ appreciation potential, both of which may be the catalyst to the stock’s eventual breakout.

Until that happens, it goes without saying that our Buy rating is only suitable for investors with higher risk tolerance and long-term investing trajectory.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.