Summary:

- Block, Inc. shares have more than doubled since October 2023.

- SQ has a strong balance sheet and potential for growth in the fintech sector.

- However, the company’s profitability is a concern, with negative operating income and excessive stock-based compensation.

Joe Raedle

Since bottoming at the end of October 2023, Block, Inc. (NYSE:SQ) shares have more than doubled. Shares of SQ have appreciated by $45.73 or 117.71% from their lows as they have increased from $38.85 to $84.58 in roughly five months. One of my friends was trying to convince me to invest in SQ as he was very adamant it was undervalued in the $40s. He has been correct, and while I have missed out on the recent gains, I am not convinced about the investment.

Fintech continues to gain steam, and I believe a handful of companies in the sector, including SQ, will continue to innovate and transform the financial sector. SQ has built an incredible company and generated $21.92 billion in revenue for their 2023 fiscal year. However, while they provide in-demand services to the end-user, the underlying business isn’t that profitable. While SQ has a strong balance sheet and is projected to generate significantly more EPS in 2024, I have a hard time getting bullish on a company that has lost -382.9 million over the past decade while paying $4.28 billion in stock-based compensation over the past decade. Shares of SQ have plenty of momentum, and I wouldn’t be surprised if shares move back into the $100s if they can produce a strong Q1 and raise guidance for their 2024 fiscal year, but the profitability will need to increase before I can consider investing in SQ.

Seeking Alpha

The risk to my investment thesis is that SQ increases its margins, expands its revenue and shares continue higher

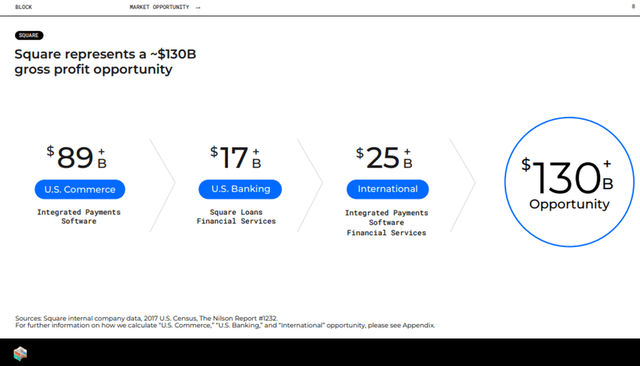

Since I am neutral about the company, the main risk of not entering into a position is opportunity cost and missing out on potential gains. SQ has built a growth company that is breaking barriers in traditional finance as the Cash App had 56 million monthly transacting activities across the United States and the U.K. in 2023, while its transacting activities brought more than $248 billion in inflows into Cash App. If SQ’s global expansion continues, there is an opportunity for more of the total addressable market to be captured and SQ to increase its gross profit opportunity, which they feel could exceed $130 billion.

Block, Inc.

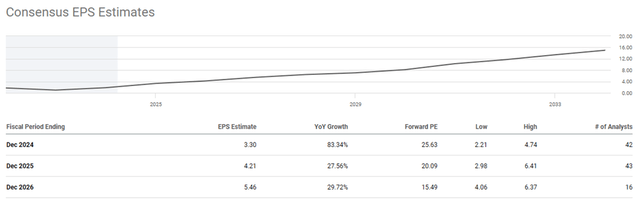

The analyst consensus estimates see SQ generating $3.30 per share of EPS in 2024, $4.21 per share in 2025, and $5.46 in 2026. I am only comfortable going out to 2026 because 16 analysts have given projections. SQ is trading at 25.63 times 2024 earnings and is expected to deliver 83.34% YoY EPS growth. Over the next 2 years, SQ is expected to grow its EPS by more than 25% on an annual basis and is trading at just 20.09 times 2025 earnings and 15.49 times 2026 earnings. From a forward basis, I will admit that shares of SQ look inexpensive, and if they deliver, shares could certainly continue to appreciate. The real question for me is will they deliver as they are operating a business that barely turns a profit.

Seeking Alpha

Why I think SQ is overvalued today and can’t bring myself to start a position

SQ has built up significant momentum, and shares can absolutely continue to grow, but at a $52.32 billion market cap, I feel that the company is overvalued. There are two things that I really like about SQ: its balance sheet and its ability to drive revenue from its products. The aspects that are deterrents for me are its margins, ability to turn a profit, and how its stock-based compensation significantly exceeds profitability. I am going to take you through how I am viewing SQ and why I think it’s a hold rather than a but at these levels.

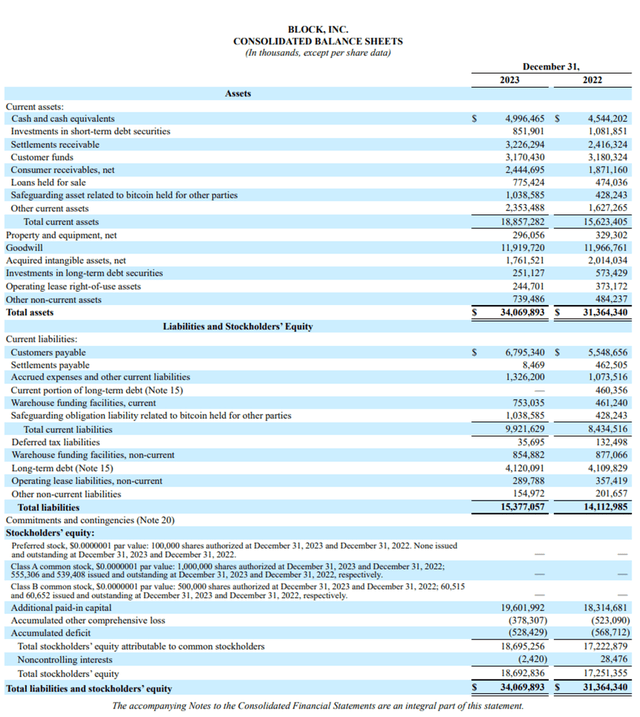

I always start with the balance sheet to understand a company’s foundation. SQ has a strong balance sheet with $7.72 billion in liquidity, which exceeds its long-term debt. SQ is sitting on $5 billion in cash on hand with an additional $770.38 million in short-term restricted cash, of which $291.4 million is allocated to a money market fund. SQ also had 8,038 Bitcoin (BTC) on its balance sheet under its short-term restricted cash, which at the time had a fair value of $339.9 million. Today, if they still hold the same amount of BTC, their short-term restricted cash value would be larger by $224.67 million as the price increase of BTC would make the 8,038 BTC valued at $564.57 billion based on the current value per BTC of $70,237.60. SQ has another $1.1 billion in short and long-term debt securities with $71.81 million in long-term restricted cash. Overall, the balance sheet is strong as there is only $4.12 billion in long-term debt, which could be eliminated tomorrow as SQ has more cash on hand than its debt obligations. There is also $18.69 billion in total stockholder equity on the balance sheet. From a foundational perspective, SQ is healthy, and its ability to grow the business in a fiscally responsible manner is impressive.

Block, Inc.

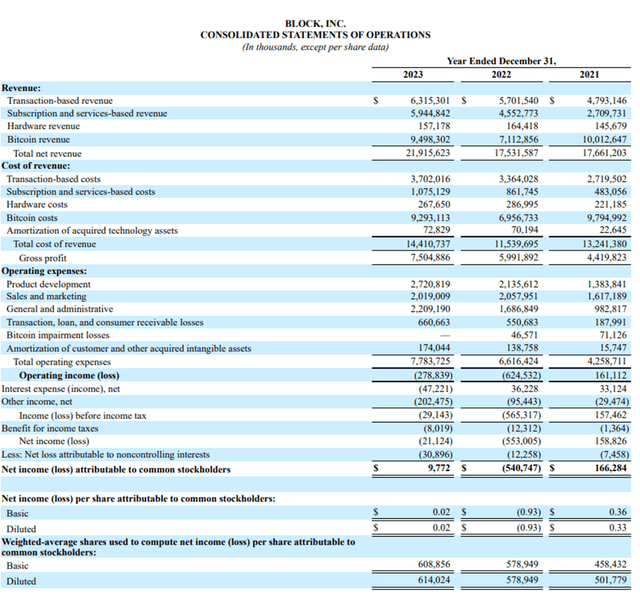

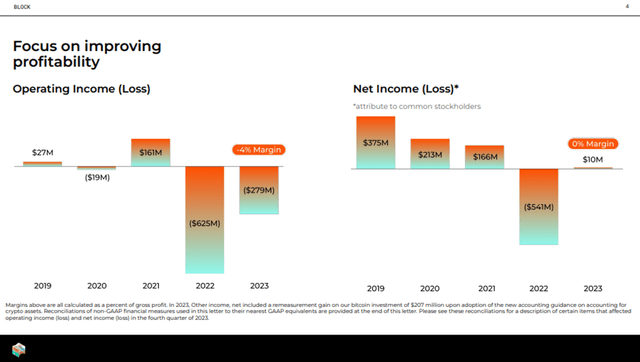

SQ’s operations are where the investment gets murky for me. SQ generated $21.92 billion in revenue for its 2023 fiscal year, which was an increase of 25.01% YoY, but they operated at a 34.2% gross profit. SQ’s cost of revenue was $14.41 billion, leaving $7.5 billion to cover its operating expenses. SQ’s product development, sales and marketing, and administrative costs all exceeded $2 billion on a line item basis. The total operating expenses to run the business amounted to $7.78 billion, which left SQ with negative operating income. SQ ended up generating $9.77 million in net income, which was $0.02 per share. The fact that SQ generated $21.92 billion in revenue and is operating at a 0.04% profit margin is a large reason why I am not starting a position in SQ.

Block, Inc.

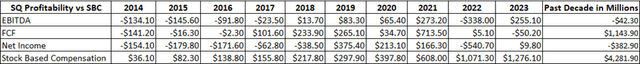

In addition to running a low-margin business, SQ has a history of paying out more in stock-based compensation (SBC) to its employees compared to the amount of profits it generates. Below I created a table that included its EBITDA, Free Cash Flow (FCF), net income, and SBC over the past decade. I am not against paying out SBC; I feel it’s a great compensation tool and incentivizes employees to work harder because they want their stake in their company to grow. What I am against is paying out an egregious amount of SBC, and I consider the amount of SBC that has been paid to SQ’s employees over the past decade to be egregious. In 2023, SQ paid out $1.28 billion in SBC and generated $9.8 million in net income. No matter what profitability line you look at, the discrepancy is massive. SQ generated $255.1 million in EBITDA and $50.2 million in FCF for the 2023 fiscal year, so there wasn’t a single measure of profitability that came close to the amount of SBC that was paid to employees.

Looking at SQ over the past decade, the amount of SBC that has been paid increased YoY while its profitability flowed in and out of negative territory. Over the past decade, SQ has generated -$42.3 million in EBITDA and -$382.9 million in net income. On an FCF basis, SQ has generated $1.14 billion in FCF over the past decade. On two out of the three profitability lines, SQ was in the red. Even if I look solely at the FCF of $1.14 billion over the past decade, SQ has paid out $4.28 billion in SBC since 2014. As a potential shareholder, I do not want to see this. This indicates to me that executive compensation and the way SBC is issued aren’t in line with SQ’s operational success. SQ generated a net profit of $9.8 million in 2023 and paid out $1.28 billion in SBC. This is not bullish, in my opinion.

Steven Fiorillo, Seeking Alpha

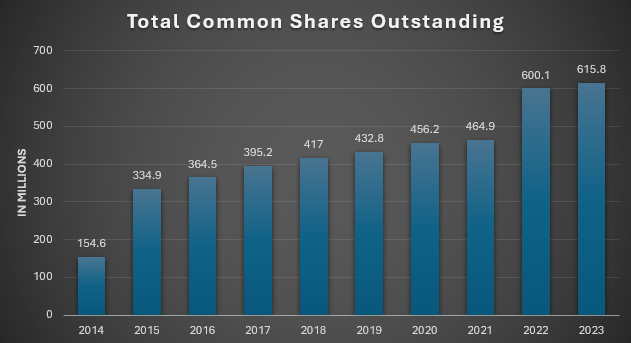

The other thing that worries me is that in the 10-K filing it specifically indicates that SQ has enough liquidity to meet their needs for the foreseeable future, including the $1.0 billion share repurchase program. Over the past decade, SQ has never reduced the amount of common shares, and while they have $5 billion in cash on hand, it makes me a bit nervous that they will utilize $1 billion of their liquidity to repurchase shares and instead of retiring them they will decide to pay them out as SBC.

Steven Fiorillo, Seeking Alpha

Conclusion

Right now, I am neutral on shares of SQ rather than bullish because of the underlying financials. SQ’s TAM and its growing revenue across transactions, subscriptions, services, and BTC is exciting. SQ has become a powerhouse in the Fintech space and could continue to expand its position throughout the sector. While their focus is on improving profitability, their only guiding for $2 – $2.02 billion in gross profit for Q1 2024 which would be a decline QoQ if they don’t exceed the high end. If SQ can rein in its expenses, especially its SBC, and improve its margins, I wouldn’t be surprised if shares exceeded $150 over the next year or two. Right now, I am skeptical that costs will be controlled, and I want to see significant margin and profitability expansion before starting a position at SQ. I want to become a shareholder because I feel SQ will continue to increase its dominance in Fintech, but I will remain on the sidelines until its profitability becomes more enticing.

Block, Inc.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.