Summary:

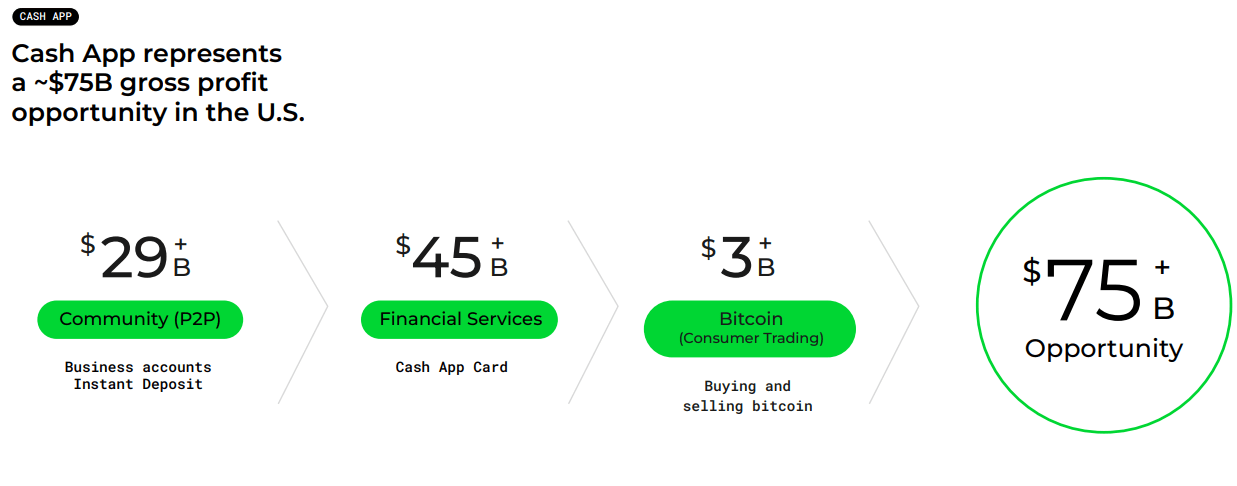

- Block has an estimated ~$75 billion gross profit opportunity in the U.S. market from P2P transactions, financial services, and Bitcoin trading.

- Cash App’s monetization includes $29 billion from P2P transactions, $45 billion from financial services, and $3 billion from Bitcoin.

- In Q2 2024, Cash App had 57 million monthly active users, with an average inflow per user of $1,243.

- Bitcoin trading contributed 63.3% of Cash App’s Q2 2024 revenue, highlighting exposure to cryptocurrency market volatility.

- Block’s withdrawal from the U.K. signals a U.S.-focused strategy, raising global scalability and growth concerns.

imaginima/iStock via Getty Images

Investment Thesis

Block’s (NYSE:SQ) Cash App ecosystem can capitalize on a ~$75 billion addressable market potential at an epicenter of P2P transactions, financial services, and Bitcoin trading in the US. Cash App is positioned for growth on the back of 57 million active users and increasing monetization. However, Block remains inextricably linked to Bitcoin (BTC-USD) revenue in Q2 2024 with 63.3%; therefore, revenue would be susceptible to market fluctuations. Its recent withdrawal from the UK raises questions about international scalability.

Despite these challenges, Cash App’s diverse revenue streams, large user base, and ongoing cost-cutting efforts position it for continued growth, supporting the buy rating.

Bullish Catalyst: Growth Of Cash App Ecosystem

Block’s Cash App ecosystem creates a strong growth fundamental, representing a strong bottom-line opportunity based on the US addressable market. Notably, this indicates an opportunity in the US market of ~$75 billion total, derived from three primary sources: at a P2P transaction level, financial services, and Bitcoin trading. It is estimated that the first part of Cash App’s gross profit opportunity is $29 billion, emanating from P2P transactions and business accounts. Block monetizes these with fees mainly for instant deposits, which grow with increased adoption. Financial services represent an even larger opportunity, at roughly $45 billion, accounting for the projected gross profit.

Technically, a Cash App card allows spending on a Cash App balance, like a debit card, bringing more inflows and monetizing avenues to Block. In addition, another $3 billion extra gross profit came in due to the fraction brought forth by Bitcoin trades. One of the most popular features of the Cash App is its ability to let its users transact and hold Bitcoin. This has gained immense popularity with the rising inclination towards cryptocurrencies. Far from it, Bitcoin trading has gone so far as to differentiate Cash App, further improving user engagement and making the top line of the app more diversified.

Block Investor Presentation 2Q24

Cash App had 57 million monthly active users in Q2 2024, with an average inflow per user of $1,243 and a monetization rate of 1.53%, which would put its gross profit at $1.079 billion for the quarter. These numbers indicate the platform’s strong capability to acquire and retain users by effectively monetizing their activity.

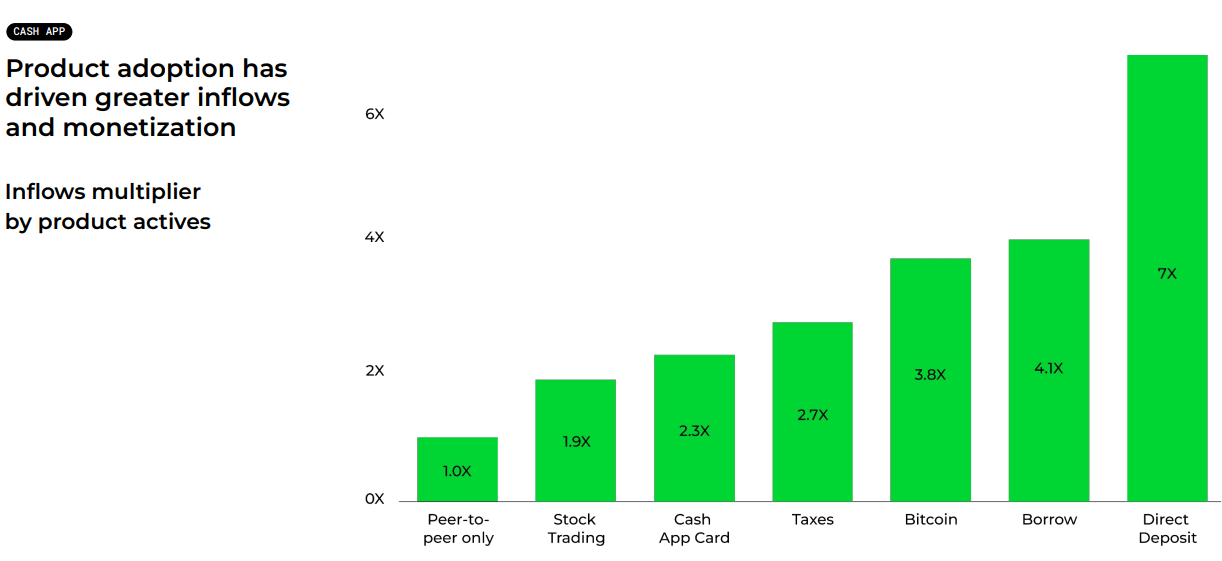

The monetization rate indicates that Cash App has moved from being purely transactional to high revenue with value-added services. The multiplier of by-product inflows or actives suggests the various products and how they contribute to inflows at Cash App. For pure P2P users, base level-1X Inflows significantly increase for users who adopt additional products. For example, there are 7X and 2.3X inflow multipliers for direct deposits and Cash App cards, respectively.

Block Investor Presentation 2Q24

Moreover, Block’s Cash App growth potential is pointed out by its capability to attract digital-native users. These are particularly Generation Z and Millennials, representing a considerable portion (~73%-75%) of Cash App’s user base. Specifically, Generation Z represents ~56 million individuals (aged 13-25) with a mean income of $39K. Generation Z has the highest monthly active user (“MAU”) engagement at 38%, accounting for 28% of total inflows. This is a critical element for growth, as younger consumers are often more inclined to adopt new digital services.

Furthermore, the largest demographic segment, at 72 million people, Millennials (aged 26-41), has a higher mean income of $85K. They reflect 35% of Cash App’s monthly activities and 42% of total inflows, indicating a high level of engagement and spending through the platform. The higher inflows among Millennials also suggest that this group is more likely to adopt Cash App’s financial services (like Cash App card or Bitcoin trading), further boosting profitability.

Moreover, Generation X (aged 42-57) and Baby Boomers (aged 58-76) have higher mean incomes ($113K and $79K). However, their engagement with Cash App is lower, with Generation X making up 19% of monthly actives and 22% of inflows, and Baby Boomers hold just 8% in both categories. While these demographics represent a smaller portion of Block’s user base, they still offer untapped potential. How? Cash App may progressively expand its product offerings to have more older-wealthier users.

Looking ahead, Block’s Cash App guidance for 2024 reflects continued growth. Cash App may derive strong gross profit growth in H2 2024, with growth in line with the second quarter’s 23%, as the company captures the benefit from improvements in structural costs in H2. As a result of operational edge, the normalized income is moving in line with gross profit, making Block stock undervalued relative to historical PE ratio levels.

High Level Of Bitcoin Revenue Dependency

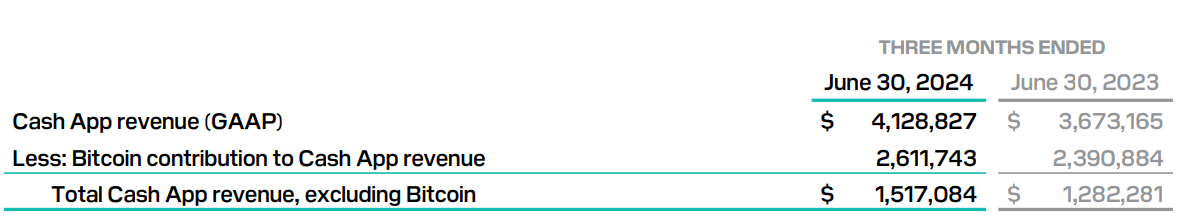

A fundamental issue for Block lies in its heavy reliance on Bitcoin revenue, which exposes it to volatile cryptocurrency markets. Although the company’s non-Bitcoin business has improved, the reliance on Bitcoin may significantly skew long-term growth. For instance, Cash App revenue, excluding Bitcoin, stood at $1.52 billion in Q2 2024, with an 18.3% annual increase. Meanwhile, Bitcoin revenue added $2.61 billion to the Cash App revenue line, making cryptocurrency-based revenue 63.3% of total Cash App revenue. This points to how Block’s growth hinges on Bitcoin sales through Cash App.

Gross profit from Bitcoin, which rose 52% in Q2 2024 versus Q2 2023, mostly reflects price action from late 2023 that increased the market price of Bitcoin given and granted. Investors might think 52% growth sounds exciting, but it masks an underlying issue. Bitcoin’s profitability highly depends on external factors beyond Block’s control, such as crypto market sentiment and pricing volatility. The company also held ~8,211 Bitcoins for investment on its books in Q2 2024, valued at $515 million.

While this might initially seem like a sound investment, Block had a remeasurement loss of $70 million on its Bitcoin holdings in Q2. This further highlights the risk inherent in relying on cryptocurrency, especially for GAAP numbers. This negative impact on net income may hurt the company’s bottom-line growth, as ongoing remeasurement losses based on Bitcoin’s volatility could further erode profits.

Block Investor Presentation 2Q24

Another downside that could impede Block’s Cash App growth is its decision to discontinue its operations in the UK as of September 2024. This marks a strategic retreat from international markets to focus on the US. Block’s decision is part of a broader plan to concentrate on growing its domestic market rather than pursuing global expansion.

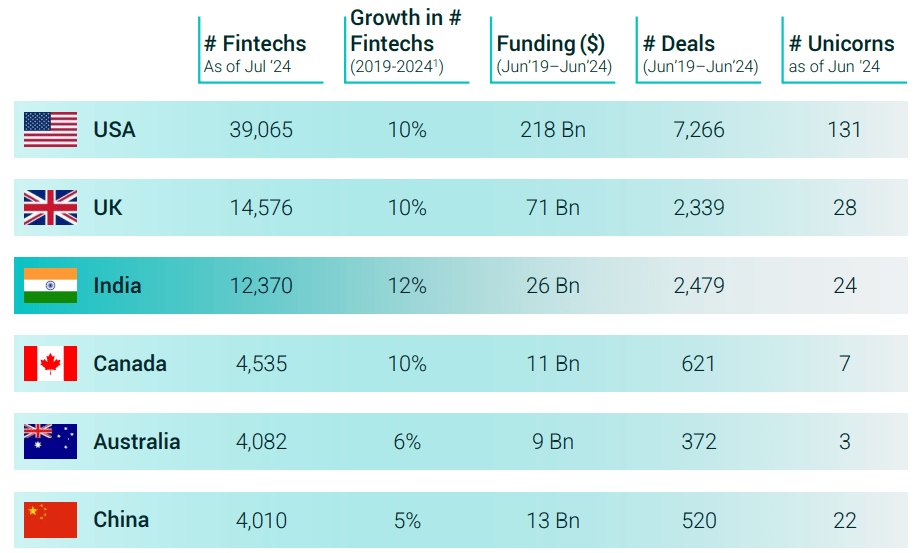

The intention to focus on US consumers earning up to $150K per year and positioning Cash App as a merchant banker marks a reliance on a relatively narrow customer base, conveying a contraction in geographic diversification. This is generally a sign of fundamental weakness for a fintech company. Exiting the UK signals problems in Cash App’s scalability and profitability outside the US, raising concerns about its potential for growth in other international markets. The UK withdrawal also points to the intense competition Block is facing in P2P payments from rivals like PayPal (PYPL), Venmo, and Zelle. By exiting this market, Block is ceding ground to competitors to hit its domestic market share, which may further limit Cash App’s ability to derive growth.

Overall, Jack Dorsey’s return as CEO in 2023 marked a shift towards cost-cutting moves and strategic refocusing. That signals Block is tightening its operations against macro and financial pressures. While the strategy may improve the bottom line in the short term, it also stifles the longer-term growth potential by limiting its international reach and reducing its ability to capitalize on fintech market opportunities. By concentrating on the US market, Block risks missing out on fintech growth in emerging markets, where digital payment adoption is gaining massive traction.

bcg.com

Takeaway

Cash App is well-positioned for future profitability with a growing user base of 57 million monthly active users and diverse revenue streams. However, the company faces challenges, such as heavy reliance on Bitcoin revenue and withdrawal from international markets, which may affect long-term growth. Overall, Cash App’s increasing monetization rates and engagement with younger demographics make it a promising driver of Block’s market expansion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.