Summary:

- Block, Inc. faces intense competition and lacks clear leadership in the fintech sector, with limited synergy between its Cash App and Square segments.

- Recent strategic changes, including appointing Nick Molnar and new partnerships, show promise but require more evidence of success.

- With a fair value estimate of $64 per share, I remain cautious and await clearer strategic execution before re-rating Block higher.

Hispanolistic

Overview

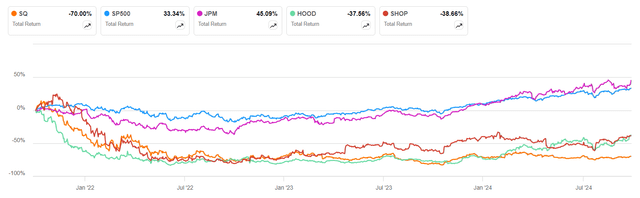

Investors haven’t especially valued the Fintech industry highly in the last three years. Companies like Robinhood (HOOD), representing B2C competition, Shopify (SHOP), B2B competition, and Block (NYSE:SQ) which unites both markets, have lagged behind the S&P 500 and banks like JPMorgan (JPM), as seen in Figure 1. Block doesn’t stand as a clear leader for investors. I myself know a lot of reasons to be on this side. Although I recognize that the company is doing some good things lately.

In the second quarter of 2024, the company’s gross profit increased by 20% compared to the previous year, reaching $2.23 billion. The company processed $61.94 billion in GPV, which is up 5% year over year. However, gross profit from these transactions was 1.15% of the total GPV, slightly down about one percentage point. Subscriptions and services have performed better, and that is important because those services imply a stronger relationship between the company and its customers. Its gross profit was roughly $1.5 billion, an increase of 27% year-over-year.

Block is a complicated business

Block is a collection of businesses that offer an array of complex services. It serves several industries and customer segments and is among the most complicated companies in the financial sector. Initially seen as a payment company, it now functions as a banking company through lending and deposit services. On its platform, you can buy or sell cryptocurrencies and more conventional securities, such as equities. Block operates in both business and consumer segments, offering tools for small businesses through Square and financial services for individuals via Cash App. While this approach helps Block diversify its revenue, it also creates problems managing such a complex organization with no recognized synergies.

Block’s acquisition of TIDAL, a music streaming platform, was seen as a strange move. I view it as a distraction from its core financial and payment services. Integrating TIDAL into Block’s ecosystem is hard due to disparate business approaches, adding complexity.

CashApp

Cash App is the most prominent segment. The app posted a 23% increase in gross profit in the second quarter, with a gross profit of $1.3 billion and more than half of the company’s total profits. One of the features driving this growth is Cash App Borrow, a loan product that saw originations rise to $2 billion—almost three times higher than the previous year. While Cash App is clearly Block’s key growth driver, the company faces increasing competition in fintech.

CashApp is one of the contenders in the BNPL (Buy Now, Pay Later) market and is doing well, but not well enough in my view. GMV was $7.75 billion, increasing 21% year over year. However, it falls short of 32% growth to $7.5 billion in GMV for Affirm.

To grasp the evolution of CashApp, we can compare it with Robinhood, which was created at the same time (April 2013). CashApp has been growing at a faster pace. CashApp has 24 million active users, up from 21 million a year ago. 43% are active monthly users when there were 39% a year ago. We can estimate that Robinhood activity could be smaller because it has, as of Q2 2024, 24.2 million funded customers and 24.8 million investment accounts with no active users available. Net revenue for CashApp was $4.1 billion as of 2Q2024 and $682 million in the same period for Robinhood.

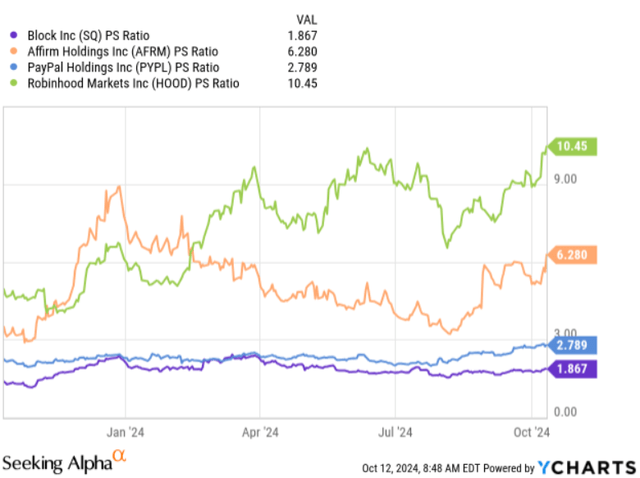

Despite these results, the market doesn’t value Block like Robinhood or even Affirm, expecting a greater growth potential from the latter companies (Figure 2).

Square

Square, Block’s original business serving sellers, hasn’t been so popular, but it still performed well. Square’s gross profit increased 15% to $923 million, driven by a steady 8% rise in Gross Payment Volume to $58.37 billion. While Square’s growth is behind CashApp’s, it remains a solid contributor thanks to its expanding portfolio of banking and software products. Its international GPV grew 19%, showing Square’s potential beyond U.S. borders.

Banking has been a particularly growing area. Notably, it is a shared service with CashApp. Gross profit in banking services has grown by 27% yearly, especially on loans. The company has facilitated 142,000 loans totaling $1.45 billion in originations, up 32% year over year.

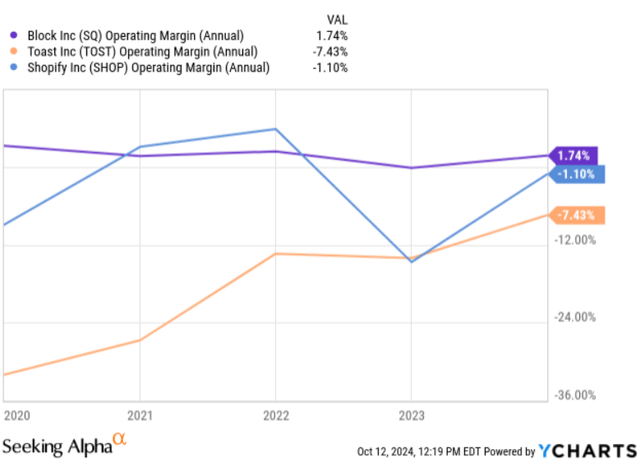

Shopify, one of its competitors, for instance, has a size similar to Square at $2 billion in revenue, which is equivalent to gross profit in Square but growing at a faster pace (21% vs 15%). The operating margin is slightly better at Square (Figure 3).

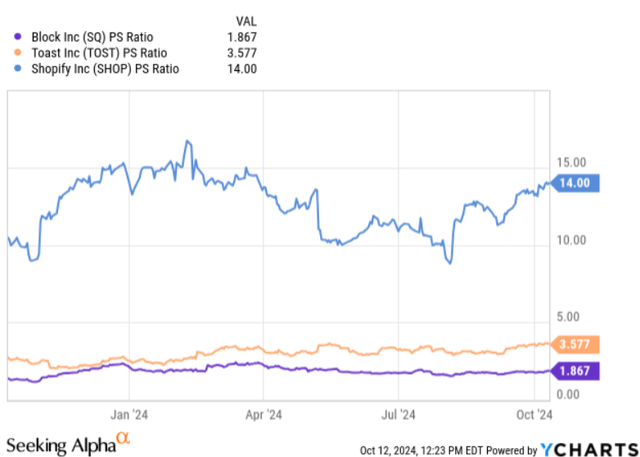

But, again, the market is assigning a higher multiple to Shopify (Figure 4). Apparently, there is room for an increase in the multiple for Block. For that, the company should build clear interactions between CashApp and Square to improve both operations; otherwise, it is better to segregate them. I think Block doesn’t show a clear value proposition for a diversified investor and doesn’t grab enough attention.

Changes in the right direction

In the last earnings call, management announced several changes. The first and most important is appointing Nick Molnar, CEO and co-founder of Afterpay, as responsible for the sales function across the company, including CashApp and Square. This change seeks to integrate both segments into a coordinated sales function. I am confident that he will find mutual benefit in both businesses.

New partnerships with US Foods, which will reach 40% of the restaurants in the US, and international bank agreements will speed up the company and go in the same direction as the integration of the sales function. This is a clear sign that competition is intensifying, and Block is sensitive to it.

Marketing rationalization with fewer verticals and campaigns and marketing integration with the sales function are steps further to gain speed. The company’s commitment to add more investment intensifies that.

Those changes go in the right direction, but I shouldn’t assume they will succeed until more data shows progress. So, I keep a cautious stance.

Valuation

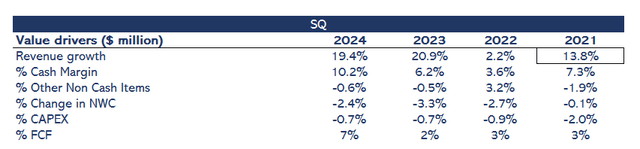

Figure 5 shows the company’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

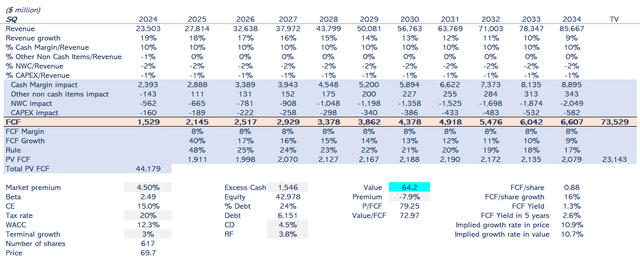

As I have outlined in previous sections, Block is a complicated business, and in my projections, I reflect this uncertainty with conservative assumptions. I estimate revenue will keep growing but at a slightly lower growth rate each year due to the increase in the baseline. I can’t foresee any clear evolution in cash margins, so I assume the same 10% margin over the whole period.

Cash flows will be discounted at a 12.3% WACC because the beta is 2.49. The risk-free rate is 3.8%. The company’s leverage is 24% of total capital, and the terminal growth rate is 3%.

As shown in Figure 6, my value estimate is $64 per share, an 8% downside from its current stock price. It has no significant downside margin, so I don’t consider it a sell situation. I prefer to be cautious and see more evidence of the company’s evolution, especially with the new changes.

Risks

Block operates in an intensely competitive market with companies offering similar services, such as Robinhood, PayPal, Stripe, and Shopify. This competition could press margins down or make customer acquisition more expensive.

Robinhood spends 36% on research and development, Affirm spends 22%, and Block 12%. Affirm spends 25% on sales and marketing, much higher than 8% in Block. Shopify spends 17% on research and development and 17% on sales and marketing. Those numbers reflect that competitors are investing more in product and marketing, and if this continues, Block will lose market share. Again, I am cautious because there is much uncertainty about who will be the leaders in those markets.

A recession could seriously impact Square because it serves small and medium-sized businesses (SMBs) very sensitive to macroeconomic headwinds. If consumer spending drops, these businesses will need fewer services like payment processing, and their credit quality for loans will deteriorate. Fewer transactions directly mean less revenue for Square. While a downturn isn’t certain, the hit to SMBs—and Square—could be significant if it does happen.

Conclusion

Block, Inc. presents, in my opinion, a complicated investment case. Its business ranges from payments to banking and cryptocurrency, serving consumers and small businesses. Cash App is growing fast, contributing more than half of Block’s gross profit, and Square’s steady performance goes in the right direction, but there’s limited synergy between these segments. This lack of cohesion and distractions like TIDAL leave me cautious about fully valuing the company’s potential.

My valuation reflects this complexity. With a fair value estimate of $64 per share and a minimal margin above its current stock price, I await more evidence about the management’s changes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.