Summary:

- Square and Cash App continue to attract more users and to create new avenues for growth, even though consistent profitability is still far.

- However, in my opinion, Jack Dorsey has demonstrated many times poor resolve and focus on what is important. These are red flags that should not be ignored.

- Block has embraced crypto, has terribly overpaid for companies and has closed nonsensical acquisitions that can only be interpreted as personal projects by the CEO.

Joe Raedle

I have been a shareholder of Block, Inc. (NYSE:SQ), formerly known as Square for many years but I recently decided to sell my position. I want to be clear that there is actually a lot to like here and I believe both Square and Cash App are tremendous businesses, however over the years I ended up disliking the CEO Jack Dorsey. I lost trust in his ability to allocate capital rationally, and to focus on what is important for the benefit of the company. I am baffled by the TIDAL acquisition, disappointed by the price paid for Afterpay, and scared by the Bitcoin obsession. Too many red flags and no system in place to reign in the CEO given that thanks to supervoting shares he has absolute control of the company.

I decided to exit my position entirely as I just grew uncomfortable with the management. I would absolutely reconsider my decision in case of changes in CEO, however nothing indicates that things might change soon in that regard.

Despite my sell rating, I want to also cover why I think Square and Cash App have been great ideas and have evolved into very promising businesses. I will then cover more in detail what I consider red flags in the management and why I have lost trust in them.

Latest quarter closed a very good year for the business

When reviewing Square’s financials investors should really just focus on gross profits rather than Revenue. The company itself prepares their remarks focusing on gross profits, as that is the most useful metric to consider. That is very unusual and stems from an accounting decision of a couple of years ago that fundamentally altered the way Block records user’s Bitcoin transactions: the company initially recorded as revenue when customers were purchasing Bitcoin through Cash App, which created wild top-line swings quarter over quarter from the company for a segment that ultimately was (and still is) generating negligible gross profits. The effect of course was also to crush every margin metric reported by Block and the whole thing was just too bizarre. Therefore, to make things easier when reviewing Block it is better to focus on gross profits as if it was revenue, so as to avoid the effects on customers transactions in Bitcoin.

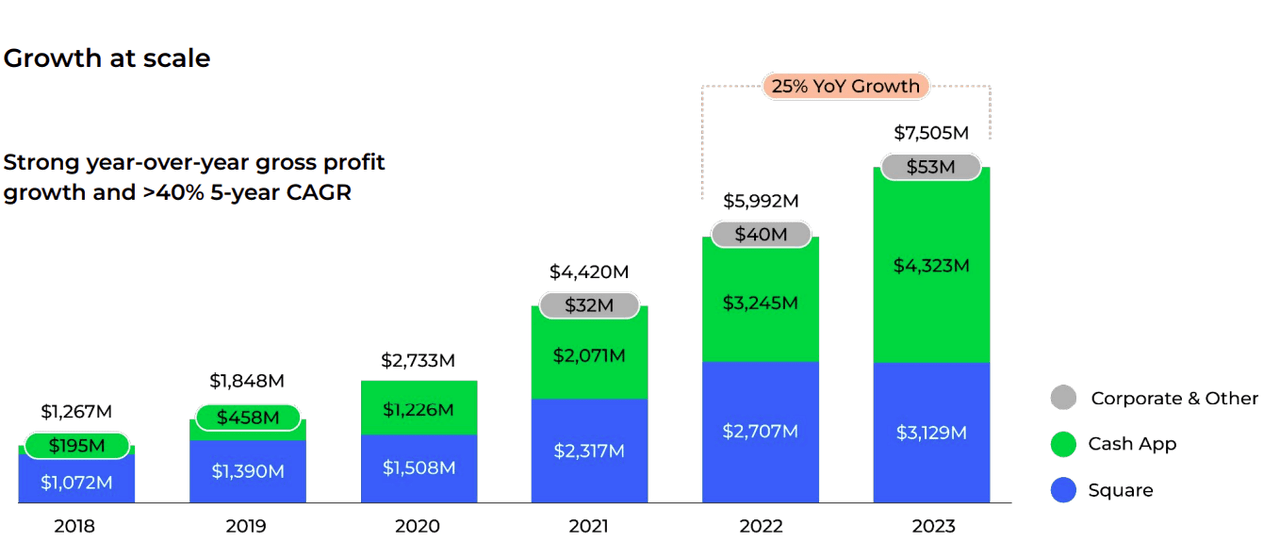

Both the Square and Cash App businesses are doing great, consistently growing and expanding into new verticals. In the latest quarter, Block as a whole grew gross profits 23% YoY to $2.03 billion. In particular, Square grew gross profits 18% to $828 million and Cash App grew 25% to $1.18 billion. The remaining part (about $22 million, 1% of total gross profits) is related to Bitcoin transactions, still a meaningless part of the business. For the full year, Block recorded growth of gross profits of 25% to $7.50 billion.

Gross Profit growth (Block 4Q 2023 Investor Presentation)

Despite the growth however, the company still recorded a very negative operating loss of $131 million, basically flat from the same quarter last year (loss of $135 million). Although still negative, for the full year the improvement has been more noticeable as in FY2022 Block recorded an operating loss of $625 million which shrank in FY2023 to a loss of $279 million. I find it disappointing that a company so mature as Block is still so far from consistent profitability, however it appears that management is more and more focused on growing more sustainably in the future.

The company indeed adopted a rather unorthodox strategy of imposing a strict, company-wide cap of employees of 12,000. Doesn’t matter the role, doesn’t matter the vertical, Block as a company cannot cross that number. I don’t find the move particularly appealing personally, I think it shows how the management themselves don’t believe that the company they built is able to responsibly and rationally manage the hiring process. Don’t get me wrong, the goal of cost reduction will be achieved, however the means to reach this goal don’t fully resonate with me as they show lack of self-control.

In the latest shareholder letter the company has confirmed that currently employees are already below the cap, which will translate into improved efficiency with the hope of affecting growth the least as possible. The cap will ultimately be lifted when management believes that the company literally cannot grow anymore without adding more headcount.

Square targets bigger businesses

The Square vertical is the most mature of the two businesses, and yet it still shows new growth avenues and potential improvements. The company has highlighted a conscious effort to deviate from the historical customer base of small business and to target the so-called “mid-market” companies, those with a turnaround between $1 million and $100 million. This segment of the market is not only massive, but it would naturally improve Square’s customer base resilience as bigger companies are much less likely to go out of business compared with small or micro companies. In essence, just by moving up the ladder of customer size, Square should see benefits in their customer’s retention and a reduction of churn.

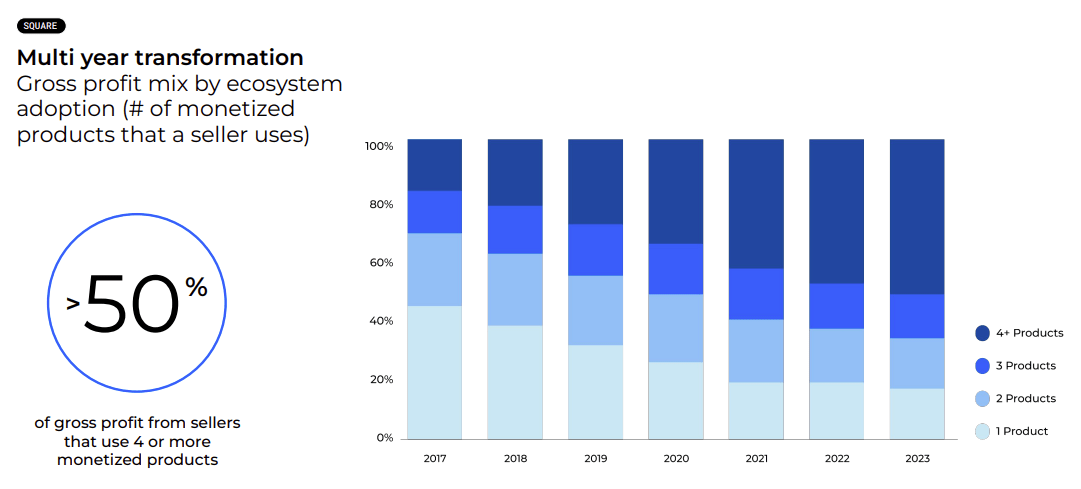

An additional bonus of retaining more customers over the years is that Square has demonstrated their ability to upsell more and more products to the same sellers. This is where the power of the ecosystem comes from, as over time the company is able to grow the gross profits they generate from the same seller that has been onboarded years back. The percentage of gross profits generated by sellers that adopted at least 4 products grew consistently over the years and today sits above 50%.

More and more sellers adopt multiple Square products (Block 4Q 2023 Investor Presentation)

For now, the mid-market opportunity seems largely unpenetrated as Block estimates that they only signed up about 0.5% of the potential businesses as their customers. Should they succeed in attracting bigger customers to their ecosystem, that should translate nicely into improved margins via upselling to multiple services.

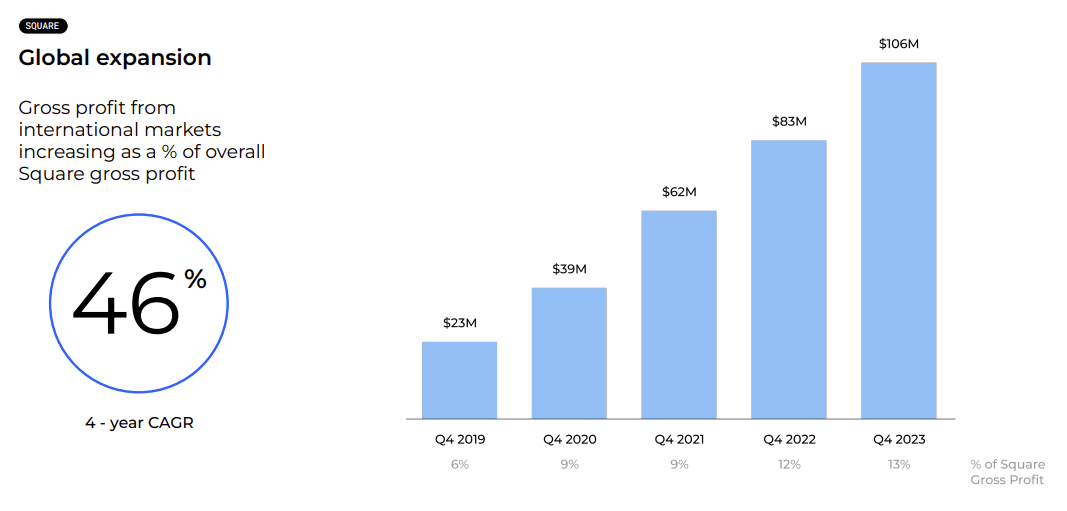

A lot of potential for further growth in Square comes from international expansion as well. For a long time Square was predominantly a US story, but during the past few years the company started to seriously ramp up their presence in other markets as well. In the fourth quarter of 5 years ago the company recorded $39 million in gross profit from international markets, which represented 9% of total gross profits. Not only has international gross profits grown in absolute terms (to $106 million in 4Q 2023), but also as a share of Square’s total gross profits, from 9% to 13%.

Block 4Q 2023 Investor Presentation

Overall, a lot to like as this is a stable business growing nicely with a clear path to growth and to improve customer’s retention as well.

Cash App wants to be a bank

Block’s achievements so far with the Square business have been impressive, but the company’s biggest success in my opinion has been the monetization of Cash App. For a long time Cash App has been a big question mark for analysts: nice to have millions of customers doing peer-to-peer transfers, but how to monetize this huge customer base?

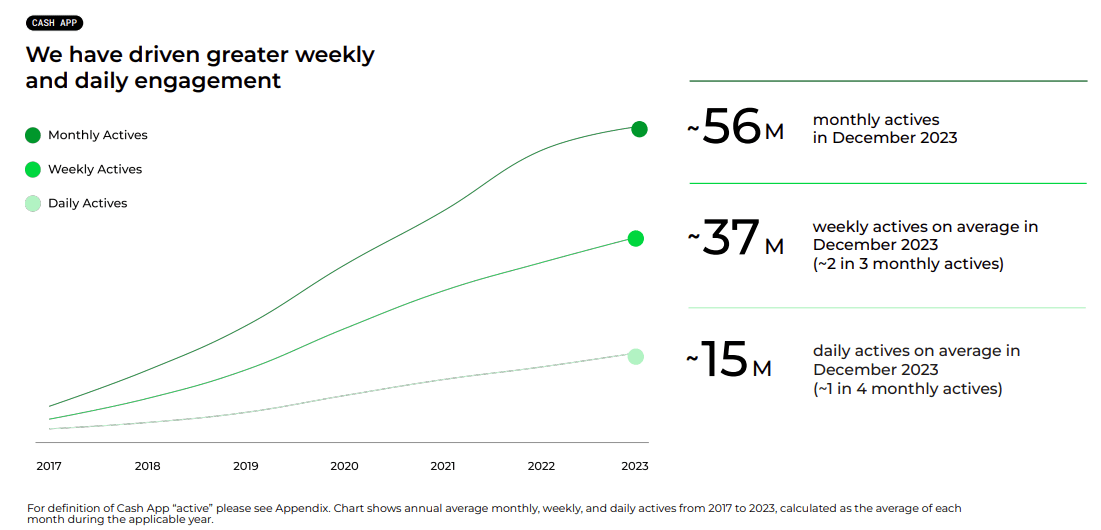

Users love Cash App and use it more and more. The company has consistently recorded an increase in daily, weekly and monthly actives (that is, accounts that perform at least one transaction or financial operation in the respective time period). The company has highlighted that in December 2023 on average 15 million accounts used Cash App every day.

Constant growth of Cash App users over the years (Block 4Q 2023 Investor Presentation)

The demographics of the user base are very exciting. The app is predominantly used by Gen Z and millennials, with just 6% of the customers being baby boomers. This might hurt the company in the short term as baby boomers generally are wealthier and spend more, however if you lock into your financial ecosystem a young customer today, there’s a good chance they might stick with you for the decades to come.

One caveat here is that in my opinion the times in which an individual would bank with the same institution for their entire life is well gone by now, thanks exactly to companies like Block. The success of Cash App stems from their ease of use, and we have seen the rise of neo-banks everywhere in the world attempting to displace the big retail banks. One effect of allowing customers to easily open new bank accounts in just 5 minutes by using their phone, is that tomorrow they might do the same with another new, flashy and cool upcomer and ditch you for the next big thing. That will be to some degree the rule of the game in banking for the future in my opinion.

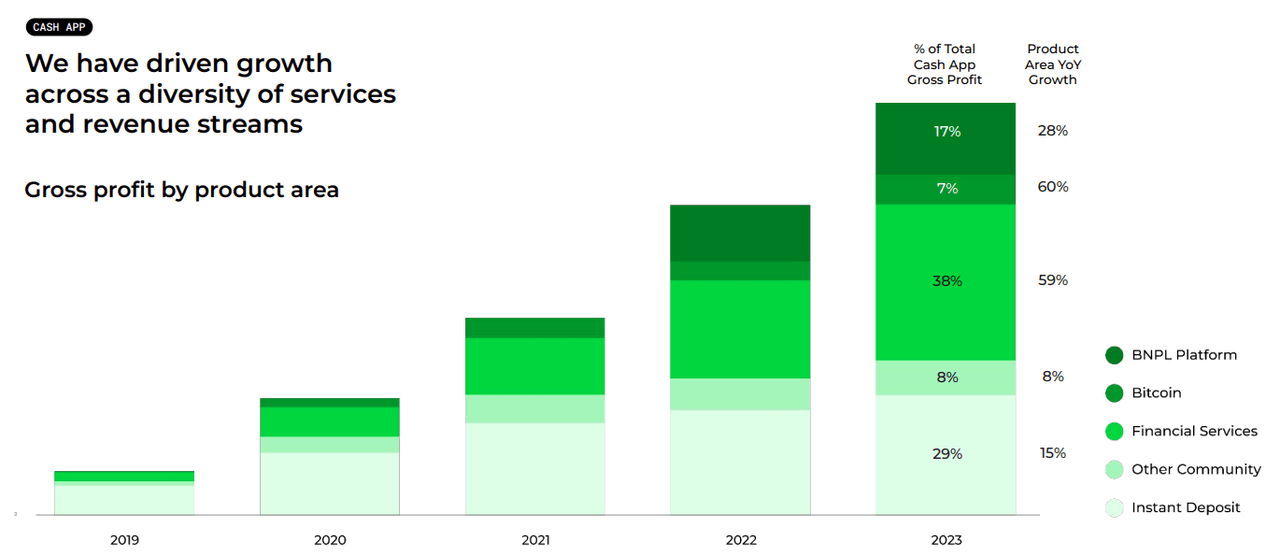

Block has attempted to transform Cash App into a bank, or something resembling it as much as possible without actually having a banking charter. The move makes a lot of sense and is akin to what Revolut has done in Europe. Where initially Cash App was only allowing to easily transfer money, it now offers a full suite of financial services such as debit cards, reward programs, stock and bitcoin purchasing and more. While basic functions remain free, Cash App earns money on more advanced services that an increasing number of users are starting to rely upon consistently.

New services accelerate gross profit growth (Block 4Q 2023 Investor Presentation)

I love the business model and I think Block has done phenomenally in executing their strategy. Growth is slowing down, but that is the name of the game when absolute numbers start to get bigger. Block closed the previous fiscal year (2022) with YoY growth in Cash App gross profits of +57%, while this year (FY2023) the growth was 33%. Management has guided for 15% total gross profit growth in FY2024 of 15% which indicates further deceleration, however it is unclear how this growth will be split between Square and Cash App.

One metric to follow is the growth of Cash Card users. Management has noted how Cash Card users could drive 5 times as much gross profit than non-Cash Card users, therefore growth in this field is paramount for the bull thesis.

I don’t trust Jack Dorsey

As much as I respect Jack Dorsey’s achievements in creating and building both Square and Cash App into the businesses they are today, I must say that the number one risk that I see in this company is Jack Dorsey himself.

I have a hard time with this company. I love Square and Cash App, but so many times the management (and Jack Dorsey in particular) has shown clear red flags in their resolve and focus on what is important. This is paramount to consider when over 50% of voting power is held by the two co-founders Jack Dorsey and Jim McKelvey thanks to a dual class shares system: there is almost no accountability in this scenario, which is one of the main reasons why we have seen so many weird mistakes in the past.

I saw time and time again the company wasting time and energy into acquisitions or side projects that have no clear connection with the business. The recent acquisition of the music streaming service TIDAL for $300 million is in my opinion an egregious example of terrible capital allocation. It feels as a whim by the CEO, an expensive networking move to be friends with Jay-Z at the expense of the company and its shareholders. In the fourth quarter 2023 the company had even to record a goodwill impairment of $132 million related to the TIDAL acquisition. There is no transparency about TIDAL’s performance because frankly, it does not matter and it is clear how the company has absolutely no chance to compete with Spotify or Apple Music. Terrible waste of money.

Afterpay has been another incredible disappointment of rational capital allocation. Block announced the acquisition of the buy-now-pay-later (BNPL) provider Afterpay in August 2021 at the top of the market bubble for $29 billion, an astonishingly high amount for a company that at the time was growing fast but recorded just about $384 million in revenue for the year in 2020. This means that Block acquired the company at a trailing Price to Sales ratio of about 75 which is simply insane. As a matter of fact, since the deal was an all-stock deal the closing price ended up being about $14 billion as both Block and Afterpay stocks crashed after the market bubble popped, nevertheless this is yet another clear sign of terrible decision making. For context, in the latest quarter Block generated about $242 million in gross profits from BNPL, still hugely disappointing considering the purchasing price back in 2021.

Another red flag in management’s resolve is the obsession with Bitcoin. Call me crypto gloomer, but I can only consider Jack Dorsey’s obsession with Bitcoin a huge risk. I don’t like when a CEO changes the name of the company to embrace a fad, I think it is immature. It might have been in response to Mark Zuckerberg’s decision to embrace the metaverse and rename Facebook into Meta, however both examples are terrible signs of management in my opinion. Block has even about $500 million of Bitcoin on the balance sheet which adds unnecessary risk for such a volatile asset class and once more I don’t think shows a serious use of cash. It might work out (it most definitely did for the past few months now that Bitcoin is around all-time highs), but it still remains a bet. Personally, I don’t like betting.

Key Takeaways

Block is cutting costs and that will improve their profitability already from the next year. However, it is still early and there are no clear signs that the company will achieve consistent, growing profitability. It may very well be, but the thing is for now the company has been operating basically at break-even for many, many years. As I highlighted above, I don’t have a high degree of confidence in the management here and thus I will trust more the numbers and less the promises.

Block is relying on stock-based compensation to pay employees and thus all the GAAP profitability numbers are in the red. On a Free Cash Flow basis, the company has been on and off profitable but again, generally I would define it as breakeven. Dilution here is quite high, as in the last 5 years total shares outstanding grew on average 8.5% per year, inflated by the all-stock purchase of Afterpay. This further adds risks as dilution is affecting the stock price movement negatively. Estimates for FCF next year are quite positive as the forward Price to Free Cash Flow at current valuation is 26x as per Seeking Alpha. Not cheap, but it depends on the growth rate. Management is guiding for gross profits of $8.65 billion in FY2024 (up about 15%), which translates into FWD Price to Gross Profits of 6x. Not cheap, not terribly expensive either.

This is a hard one. I honestly believe that one of the hardest things to do as investors is judging management, as we do not have a clear view on how they think and behave behind closed doors. For this reason, when we actually have clear reasons to doubt, we should listen very carefully. I decided to follow my guts on Block and actually exit my position lately as I don’t see myself trusting this management anytime soon.

I would not be surprised if the company continues to grow and reach consistent profitability, for the benefit of shareholders. I would not be surprised either if Jack Dorsey went shopping for some other personal projects with companies’ money, or overpay for something in an attempt to chase the next big thing. Anything could happen here, which is not my favourite risk-reward profile. As such, I’m out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.