Summary:

- Boeing’s 2024 estimates have significantly dropped due to 737 MAX issues, 787 supply chain challenges, and production strikes, impacting EBITDA and free cash flow projections.

- Despite near-term struggles, Boeing offers long-term upside, with potential 20% gains by 2027 if it successfully executes its turnaround strategy.

- The stock is a buy for patient, long-term investors, but risks include slower-than-expected recovery and mandatory preferred stock conversion impacting share price.

- Immediate value is limited; however, long-term prospects are attractive, contingent on Boeing repairing its balance sheet and stakeholder confidence.

Ryan Fletcher

In a previous report, I discussed the capital raise that Boeing executed earlier this year. I consider that an essential part of the company’s turnaround. What I have yet to do is connect this to a stock price target. With the issuance of preferred as well as common stock and the absorption of Spirit AeroSystems (SPR) planned for next year, this is not an easy task, but I will make an attempt in this report.

If there is one thing that I think that Boeing should have learned the past years, it is that the company should have applied one of Warren Buffett’s quotes:

Lose money for the firm, and I will be understanding; lose a shred of reputation for the firm, and I will be ruthless.

Applying that principle would likely have led to a faster departure of David Calhoun as CEO of The Boeing Company.

Boeing Estimates Unsurprisingly Have Come Down

The Aerospace Forum

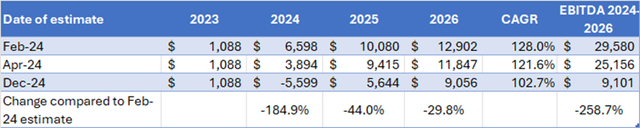

Given the problems that Boeing has faced on the Boeing 737 MAX program and the aerospace supply chain challenges on the Boeing 787 program, as well as the strike that crippled production in the fourth quarter, it does not come as a surprise that the estimates for 2024 have come down significantly. At the start of the year, analysts expected $6.6 billion in profits, which was already down $8.6 billion expected earlier, and the most recent estimates show that analysts now expect EBITDA to be negative $5.6 billion. For 2025, driven by a challenged production ramp up and delays on certification of the Boeing 777X, the estimates have come down 44% and 30% in 2026. It probably serves as a stark reminder that the prior CEO has not changed Boeing on core principles, where changes were much needed.

The CAGR might be considered somewhat less meaningful given the earnings dip in 2024, but it shows that the CAGR has come down, and overall profit generation is down from nearly $30 billion between 2024 and 2026 to $9.1 billion.

The Aerospace Forum

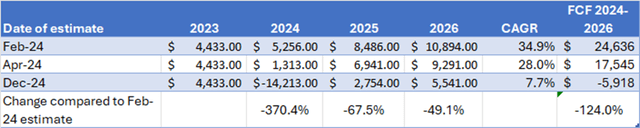

Looking at the free cash flow estimates, we see that free cash flow burn for 2024 has been revised down from $5.3 billion to negative $14.1 billion with significant cuts in the subsequent years as well with the CAGR dropping significantly as well and the total FCF generation has been revised down from $24.6 billion to -$5.9 billion.

So, both metrics that play a key role in the way I determine stock price targets have come down significantly.

Boeing Stock Offers Upside For The Extremely Patient Investor

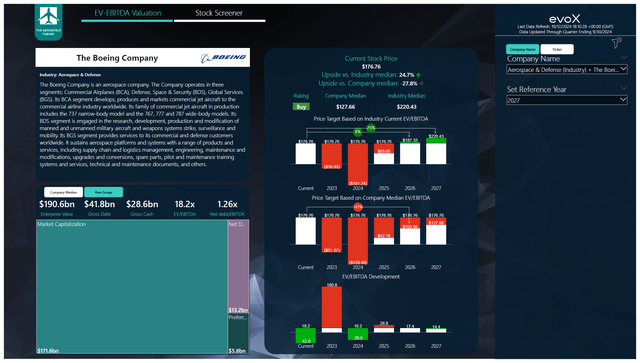

To determine multi-year price targets, The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions and update the stock price targets accordingly. In a separate blog, I have detailed our analysis methodology.

The Aerospace Forum

Boeing, without doubt, has one of the ugliest projections of any of the 170+ names I cover with price targets. The stock has no upside for 2025 and just 6% upside for 2026. However, Boeing’s turnaround is a long-term story that will carry on until at least 2030 I believe. So, I have modeled in 2027 as well using my own estimates since analyst estimates are not yet available and that shows that if Boeing gets its act together the upside starts increasing rather fast with 20% upside against the FY27 earnings and undoubtedly more in the years thereafter. This includes the expected dilution from the acquisition of Spirit AeroSystems in an all-shares deal as well as the mandatory conversion of the preferred stock in 2027, which I believe provides a $10 drag on the common share price.

So, Boeing is a buy for the long-term investors who do not expect dividends, or share repurchases in the years ahead. The major risk obviously remains that the recovery tracks slower than currently expected.

Conclusion: Little Value In The Near Term But Long Term Attractive With Risk

I believe if you look at Boeing, you currently have no strong incentive or no incentive at all to acquire shares if you look for fundamentally driven value for this year or next. That is just the reality. However, I do believe that like many aerospace and defense names the longer term should be considered and just from pulling one year extra into the targets we get to a $220 price target with a buy rating. It almost goes without mentioning that Boeing has to repair a lot on its balance sheet and, more importantly, the confidence with stakeholders. Any disruptions in booking tangible progress in setting up a sustainable production ramp will put pressure on Boeing’s finances and subsequently the price targets. So, I am marking the stock a buy, but I am also cognizant of the risks. I view the current turnaround as a buying opportunity for long-term focused investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.