Summary:

- Boeing stock has underperformed, dropping 25% relative to the S&P 500 over a 3-month period.

- Earnings estimates for Boeing have been consistently wrong, but current estimates for 2024 and 2025 are looking more realistic.

- We give you 3 reasons why we are upgrading and also tell you why the longer-term prognosis is not too good.

sharrocks/iStock Unreleased via Getty Images

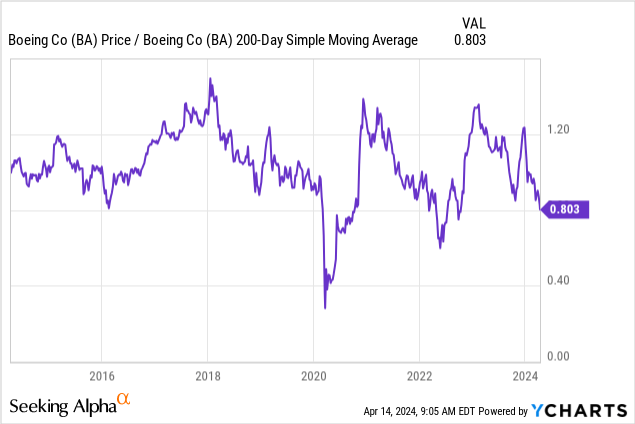

In our last update on The Boeing Company (NYSE:BA), we warned that the risks remained high for this high-flyer and gravity was likely to be a cruel mistress in the medium term.

So the risks are right in front of you and we think the stock could go to double digits in a recession fairly easily. We are frankly tired of being right on the thesis and wrong on the stock. Maybe the staunch bears throwing in the towel will open the floodgates. But for now, we are sticking with a “Strong Sell”. Buyer Beware.

Source: Defying Gravity Since 2021

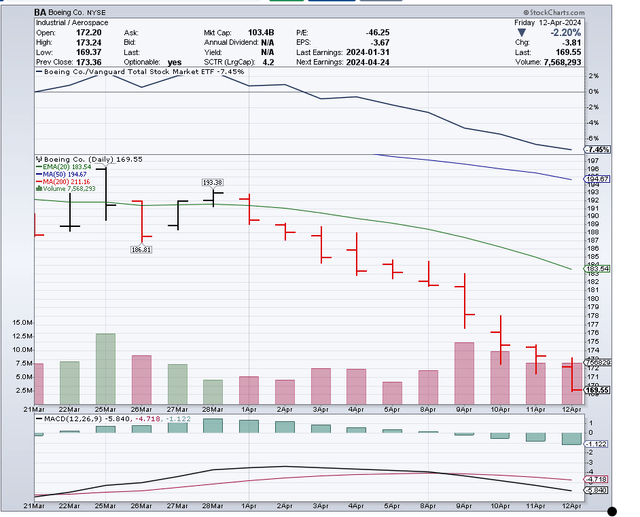

The stock has exceeded our expectations on the downside and left the bulls in a conundrum. The 25% underperformance relative to the S&P 500 (SPY) has been one of its worst drops over a 3-month timeframe.

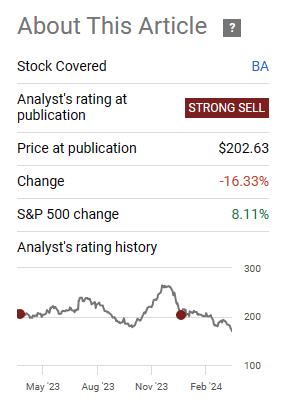

Seeking Alpha

We go over what has happened and why we are giving this a shorter term upgrade.

1) Earnings Realism Sets In, Once Again

In our last piece, we fleshed out just how wrong the bulls had been on this one. We are not referring to the price of the stock. That actually has held up relatively well since 2020. We are referring to the earnings estimates. We have seen bull after bull extol the virtues of owning this stock because deliveries will be magnificent and earnings will make you regret not owning. The opposite has happened and earnings have never delivered.

Now, let us look at the movement in these earnings estimates since our last update. For fiscal 2024, we went from about $4.00, all the way to $0.26. Fiscal 2025 has moved from about $8.00 to $6.41.

This is the Boeing cycle. Earnings disappoint and then all the bulls come together for some reason and say “it will be different next year”. The current earnings estimates are now actually looking quite realistic for both 2024 and 2025. So in that sense we see a little more opportunity for things to work out. Remember, it is not the performance. It is the performance relative to estimates. So Boeing’s estimates are likely a bit conservative, as far as 2025 is concerned. This should provide some support here.

2) Extremely Oversold, A Bounce Should Be Close

Stocks tend to move up over longer timeframes. Inflation, growth and money supply increases are all in favor of nominal prices moving higher over time. That means that bearish setups are to be treated differently than bullish ones. You can maintain bullish behavior on higher prices, but you have to tactically change bearish behavior when things get oversold. On that front, it is noteworthy that our protagonist has not had a single positive close in April.

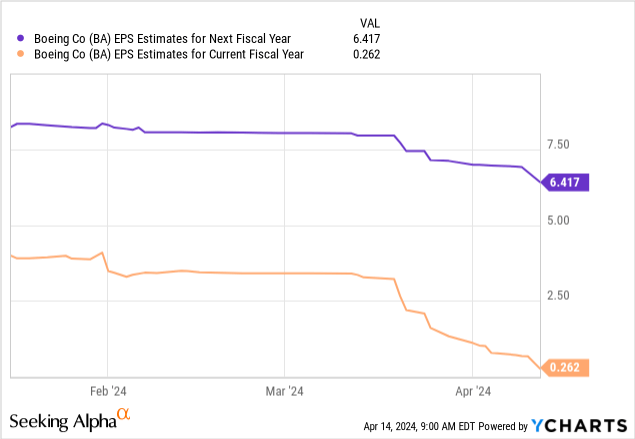

That is obviously fun to watch when you are bearish, but things tend to revert when you see 10 consecutive days of beating. On a medium term timeframe, we like to see the distance from the 200-day moving average. Boeing as cycled from being up over 20% above it to 20% below it, in about100 days.

This is deeply oversold and these levels tend to create significant bounces.

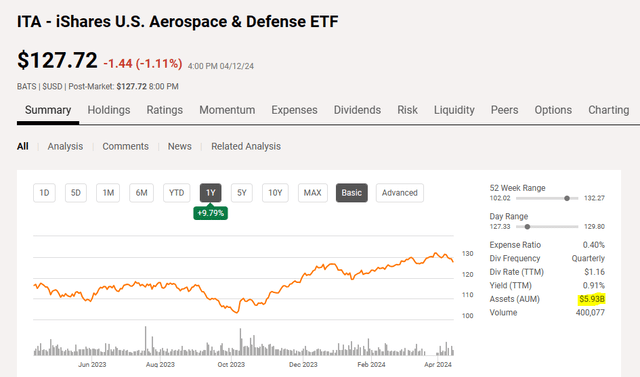

3) Defense ETF Flows Could Overwhelm The Bears

Of course, as we write this, there is a significant escalation of conflict in the Middle East. We will be opining on the geopolitics to the newly minted experts on X. But we can attest to the fact that these conflicts tend to move money flows at least for a short while. The largest ETF we follow here is the iShares Aerospace & Defense ETF (ITA). The fund has almost $6.0 billion in assets.

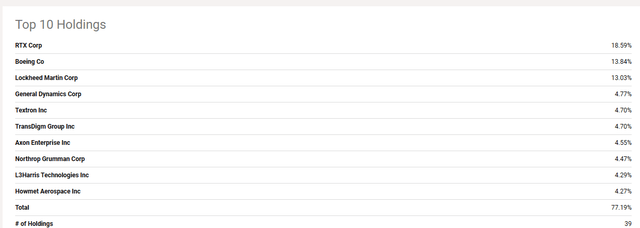

If you catch our drift, you know where we are going next. Yep. Boeing is a very large holding alongside RTX Corp. (RTX), Lockheed Martin Corp. (LMT) and General Dynamics (GD).

This is despite the defense segment forming a small part of the entire Boeing operation. Approximately $25 billion of the $77 billion in revenues came from defense. But Boeing will enjoy a full lift from marginal flows.

Verdict

We are upgrading this to a “Hold”, from a “Strong Sell”. We believe this will be a temporary lull in our negative ratings on this company. The last time we move to a “Hold” was under similar circumstances and the stock eventually rallied strongly from there.

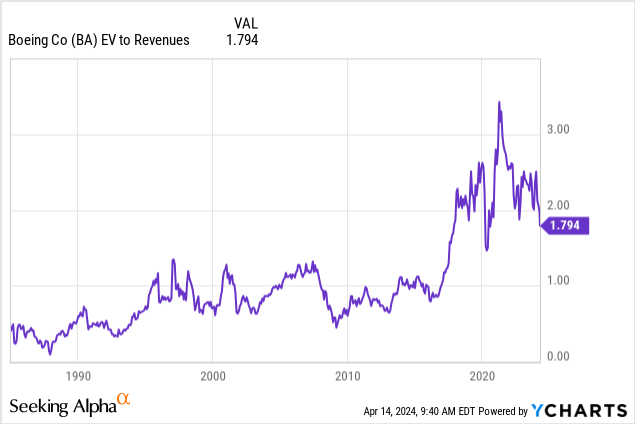

On a fundamental level, a compelling buy point remains extremely elusive for us. We keep coming back to this chart and it keeps us on the defensive. Boeing is extremely expensive on an Enterprise Value to Sales Basis.

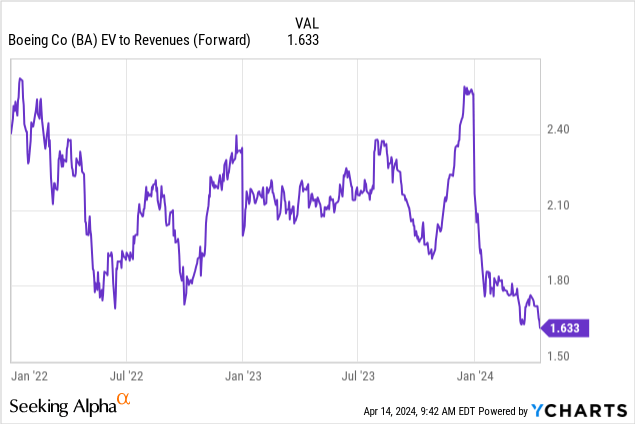

The stock spent its entire history until 2018 averaging 0.7X-0.8X and then did a liftoff. These are fairly absurd valuations, and we don’t think bulls will beat treasury bills even out 5-7 years from here. Even if you use next year’s numbers, things don’t improve materially.

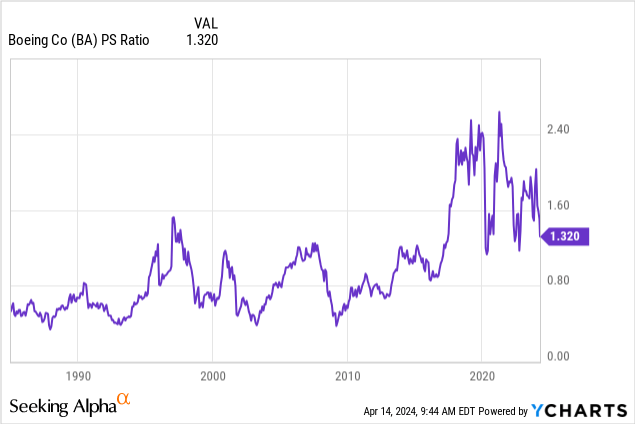

Some bulls are likely ignoring the debt that Boeing has taken on since COVID-19. But even if you ignore that and use price to sales (instead of EV to sales which takes into account debt), the numbers still look challenging for big returns.

Our take is that this is a great time for shorts to cover, and maybe some intrepid souls could take a short-term trade. But a buy point to make money over the longer-term lies far lower.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

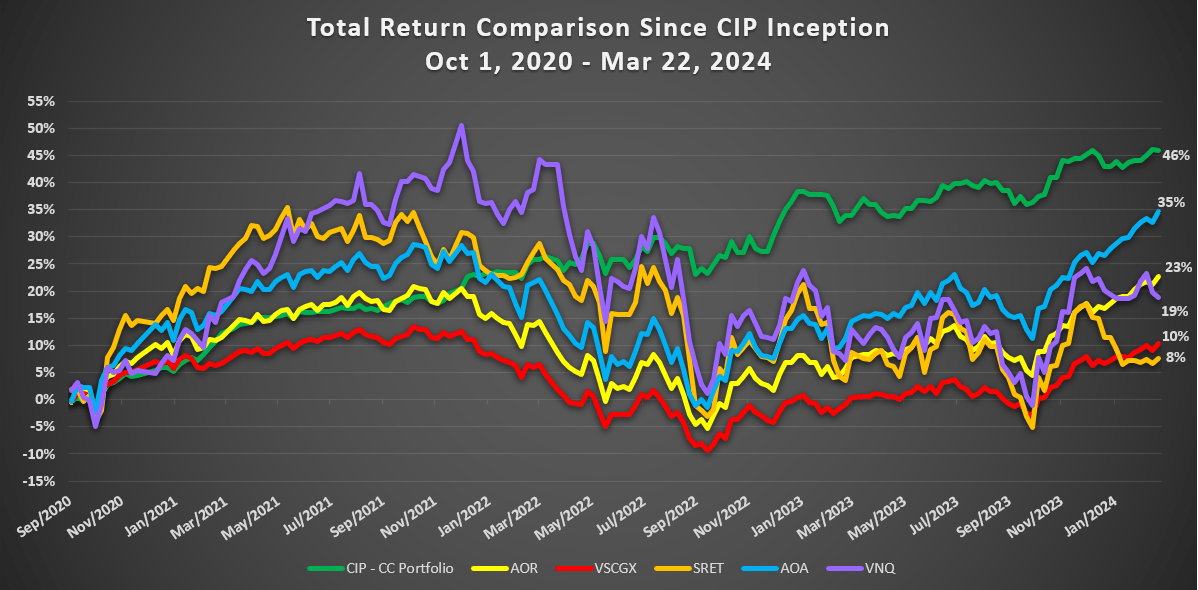

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.