Summary:

- Boeing faces significant issues with the Starliner and Boeing 777X programs, impacting CEO Kelly Ortberg’s early tenure.

- Boeing’s 777X program is delayed due to thrust link failures, risking further certification and delivery delays.

- Boeing has incurred $15.9 billion in costs for the 777X, needing higher production rates to recoup expenses.

- Despite near-term risks, I maintain a buy rating for Boeing based on long-term turnaround expectations.

Kristian1108

The first weeks of Kelly Ortberg as the new CEO of Boeing (NYSE:BA) definitely are not easy ones, as the company is facing emerging issues on two high-profile programs. The first troubled program is the Starliner, which I discussed in an earlier report. The Starliner was launched before Ortberg became CEO, but its return has been problematic, and the decision has been made that the crew would be heading back to Earth on board of the SpaceX Crew Dragon Capsule, with Starliner returning to Earth autonomously. The second program that faced issues is the Boeing 777X, which will be the subject of this report.

What Happened To The Boeing 777X?

In July, things finally seemed to be heading somewhat in the right direction for Boeing as the 777X program received Type Inspection Authorization, which would allow FAA pilots to participate in the flight test campaign. However, after a flight on one of the test airplanes, cracks in the trust link structure were found, as reported by The Air Current. It is yet another setback for the program that earlier faced an uncommanded pitch event, and initially failed to reach the TIA milestone due to concerns on the design maturity. The airplane will be at least five years late on schedule and billions of dollars over budget.

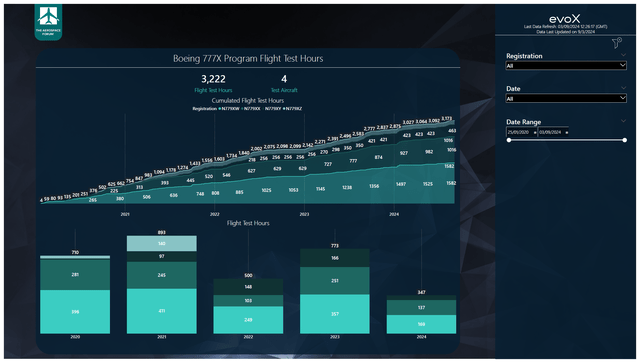

The Aerospace Forum

Flight data collection from The Aerospace Forum shows that the Boeing 777X flight test program cumulated more than 3,200 flight hours with 88 flight hours logged on three test aircraft before the flight test program was halted due to the broken thrust link.

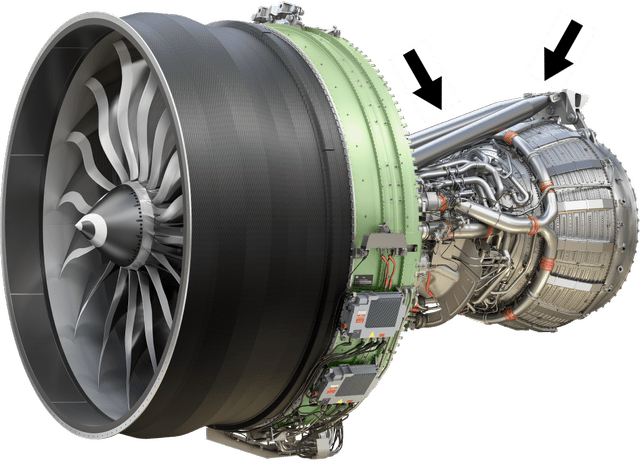

General Electric (arrows added by author)

The image above shows the thrust links. Each engine has two for redundancy, and they are installed to transfer thrust forces and torques to the aircraft structure. In essence, the thrust links provide a load path to transfer loads and torques into the structure rather than having other parts carry significant loads and stresses. While the issues with the thrust links are inconvenient at best, it’s better to find these kinds of issues during the flight test campaign and ground a test fleet instead of having to ground an in-service fleet.

Currently, it’s not known when the flight test campaign will resume. Boeing has inspected the test fleet and found that a thrust link on another airplane that has not flown in years was also affected by the thrust-link issue, according to Aviation Week. While a fix might be easy, the first step in the process is finding out why the thrust links failed. That could either be due to an issue in the design, a manufacturing issue or an installation issue. An issue with the design would force Boeing to redesign the part, which then needs to be verified and validated and might be the most time-consuming one. If the issue is related to manufacturing, there could be various causes of the failure as well. These causes include a wrong manufacturing method prescribed, a wrong manufacturing due to deviation from the outlined manufacturing procedures or imperfections in the material deviating from the material quality required for the parts. A material issue could also be batch-specific. So, there are a lot of variables. We do know that earlier this year, the FAA opened in investigation into the use of counterfeit titanium parts in Boeing and Airbus jets. If the part failed due to installation, Boeing has to make sure that the installation method is clear and the party that installs the thrust links needs to make sure that the links are installed using the outlined procedures.

So, there are many possible reasons for the thrust links failing, and until Boeing has determined the exact cause it’s unlikely we will see the Boeing 777X flight test campaign resume.

Why This Could Be A Problem For The Boeing 777X

Boeing

Boeing aims for a service entry in late 2025 and typically, it takes 12 to 18 months to go from Type Inspection Authorization to certification. For the Boeing 777X, that would put the certification date either in July 2025 or January 2026 with October 2025 as the mid-point. So, that fits with the late 2025 service-entry target. However, with the current ongoing delays and if those are not contained within the 12 to 18 months timeline, the certification will slip from July 2025 to August 2025 on the most upbeat certification path, and in the longest certification path it would slip from January 2026 to February 2026 with the midpoint slipping from October 2025 to November 2025. Given that the campaign has not resumed, there’s a significant schedule risk if the certification timeline would not allow for any issues such as the current issue that plagues the Boeing 777X.

Customers have repeatedly expressed frustration with the Boeing 777X delivery delays, and there’s a good reason for that. When the Boeing 777X was launched, early 2020 was targeted as the service-entry window. That’s now slipping toward 2026, which means that there has been a six-year delay. To date, Boeing has gathered 481 orders for the Boeing 777X, which would be worth around $90 billion at market value.

The new issues could put additional delays on turning that backlog into revenues and could even require thrust link replacements on the 20-plus jets that Boeing has already built for customers, which would add to additional costs next to additional costs incurred for a delayed certification path. Currently, Boeing has incurred $6.5 billion in forward losses on the program and $0.8 billion in abnormal production costs for a total of $7.3 billion plus another $6 billion at least for the development. That would bring total costs to $13.3 billion and there’s another $2.6 billion in deferred production costs, which are costs in excess of Boeing’s assumed margins. That would lift the total cost to $15.9 billion. If Boeing were to recoup these costs within the current accounting quantity of 500 jets, it would need margins of around 17%. That’s not an impossible task, but Boeing would likely need higher production rates than the current combined rate of four for the Boeing 777/777X program. Additional slides to the timeline will add to costs and could eventually trigger a reach-forward loss given that Boeing is currently already assuming a near breakeven margin for the Boeing 777X.

Conclusion: Increased Risk For Boeing On The Boeing 777X Program

While I’m maintaining my buy rating as I believe that Boeing will be able to lift its production rates on the Boeing 737 MAX, there are near-term risk factors and those include the Starliner program, the Boeing 777X program and a possible strike as contracts for 32,000 workers expire later this month. With that, it seems that Boeing’s problems created in the past on engineering, as well as workforce appreciation, is biting the company back. My buy rating for Boeing is based on the longer-term expectations that the company will be able to turnaround, but the near-term pressures are mounting. I believe that for the patient investor, weakness in the share prices could offer long-term entry points.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.