Summary:

- Boeing receives FAA approval for Boeing 777X flight testing, a significant milestone in the certification process.

- Approval could lead to more orders for the Boeing 777X, helping Boeing recover from financial losses on the program.

- The Boeing 777X program has faced delays and financial challenges, but progress with FAA approval is a positive step for Boeing.

Jon Tetzlaff/iStock Editorial via Getty Images

Boeing (NYSE:BA) is working its way through a deep crisis that spans from leadership to production to certification to financials. All these elements, in some way or form, are interconnected, so seeing progress in one of the elements might positively affect other parts of the business. Some positive changes we have seen so far are the agreement to acquire Spirit AeroSystems (SPR) which should result in cleaner fuselages entering the assembly lines. Another element that hopefully will be good for Boeing is the leadership change, as CEO David Calhoun is set to step down later this year. These are small and slow steps that Boeing is going through, but the implications are big for the company.

Another step that is a positive for Boeing is that it has obtained FAA approval to embark on the next step of the flight testing campaign for the Boeing 777X. In this report, I discuss its significance which stretches beyond the Boeing 777X program.

FAA Approval For Boeing 777X Flight Testing Is Significant

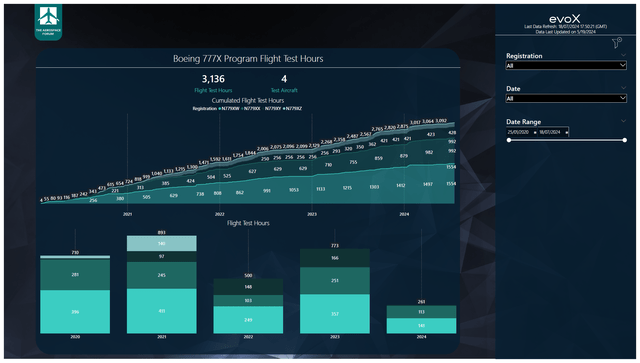

The Aerospace Forum

On the 13th of July, Boeing received its Type Inspection Authorization for the Boeing 777X. It’s a vital part in the flight-testing campaign that eventually will pave the way for Boeing to start delivering the Boeing 777X to customers. Boeing has already completed thousands of flight test hours prior to the TIA. So, what’s so special about the TIA?

In the development process of an airplane, the airplane has to be developed including a test article and that test article is subsequently put through a flight test campaign to verify and validate the design. Subsequently, the airplane needs to be certified for manufacturing before it can be delivered. So, there are many steps in the process and the TIA is in some way nothing more than a milestone from which point onwards FAA pilots can participate in the flight test campaign.

So, it’s an important milestone in the certification process. However, perhaps also not unimportant and maybe even more important is that it can also be seen as a sign of confidence from the FAA in the Boeing 777X and the manufacturer. Boeing has been seeking receipt of TIA for years by now and the FAA has not granted that TIA until now because it deemed the Boeing 777X design to lack maturity and there was no clear flight testing plan. The deeper issue was the Boeing 737 MAX crisis that eroded the regulator’s trust in Boeing and its processes. With the TIA being awarded Boeing has made a tiny step in recovering trust with stakeholders.

The Boeing Company

For Boeing that’s good news, and they could really use it as well. The Boeing 777X was launched in November 2013, which is almost 11 years ago. At the time, the service entry was slated for 2020 with optimistic targets even set at late 2019. So, the introduction of the Boeing 777X is years late. The TIA paves the way for the Boeing 777X to be certified in the next 12 to 18 months. So, we’re looking at a mid 2025 to late 2025 certification for the Boeing 777X. There’s no space to rush this, and I believe nobody involved will also push to rush. The Boeing 777-300ER was certified in roughly one year.

Boeing currently expects the first delivery in 2025, and if we look at the timeline that could indeed happen, but if the flight test program takes 18 months we will see a 2026 service entry, and we see customers such as Emirates and Lufthansa already bracing for a 2026 service entry.

Boeing Could Win Additional Orders With This Milestone

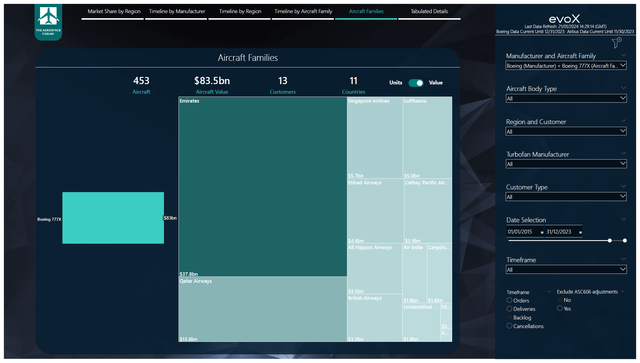

The Aerospace Forum

The biggest customers for the Boeing 777X are by far the Middle Eastern operators led by Emirates which has orders for 205 airplanes and Qatar Airways with 74 orders. Another Middle Eastern carrier, Etihad Airways, has nearly $5 billion worth of orders for the Boeing 777X but Emirates and Qatar Airways really stand out.

The Boeing Company

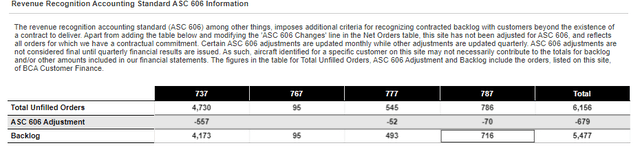

Looking at the backlog, we see that there are 786 Boeing 777X in backlog of which around 450 airplanes are Boeing 777X airplanes. So, the 777X program is important to the Boeing 777 combined program. Years ago, Boeing reviewed its order book and collected some Boeing 777X orders in the ASC 606 adjustments tally, as there was a purchase agreement but additional criteria were not met and the continued delays in certification and deliveries also led to these orders being doubtful. Some of those orders eventually were put back in the backlog as additional criteria were met, and it’s possible that with the TIA milestone we will see Boeing being more confident in discussing deliveries with customers which could result in more airplanes being added back to the backlog.

With the TIA milestone, Boeing could potentially talk more confidently regarding deliveries which could help in sales campaigns. Airlines tend to not be huge fans of ordering airplanes before they hit the market and the only reason some do is for the prestige and the discounts. The Boeing 777X has become the prime example of why many airlines do not like to buy what Delta Air Lines (DAL) calls “paper planes,” planes that exist only on paper or are not yet certified. For the upcoming Farnborough International Airshow that starts on July 22, it will be interesting to see whether Boeing will be collecting any orders for the Boeing 777X jet. There’s a potential order for 20 to 30 Boeing 777X airplanes from Korean Airlines and Turkish Airlines is also interested in the jet. Perhaps the TIA will help Boeing secure these sales during the airshow.

How Much Does A Boeing 777X Cost?

The list price of a Boeing 777-9 is $442.2 million, but estimates from AeroAnalysis put the actual value after customary discounts closer to $184 million. So, the Boeing 777X is expensive equipment, and getting orders drives sales significantly. To put it into context, a single Boeing 777X sale equals around 3-4 single aisle sales in terms of revenues.

Boeing Could Use Some Order Success For The Boeing 777X

The Boeing Company

Boeing could use some good progress on the timeline, but also in terms of sales. In 2020, Boeing announced a reach forward loss of $6.5 billion on the Boeing 777X program, and due to the temporary production halt, it incurred an additional $7.5 billion in costs excluding the research and development costs which could be around $6 billion. So, Boeing has a $13.5 billion financial hole that it needs to dig the Boeing 777X out of. Currently, the program is at near breakeven margins, and so turning a profit on the program at this stage is an illusion. If the company would generate a profit of 1%, it would need to sell more than 7,000 units, which would mean that the Boeing 777X would need to capture around 80% of the market. Even if we exclude development costs, at a 1% margin Boeing would need to sell nearly 4,100 airplanes.

So, capturing orders is important and not just to get to those 4,100 or 7,000 sales. More importantly, if Boeing is able to increase production rates on the program, it can better amortize costs and increase the margins. The Boeing 777-300ER is believed to have solid margins, and if the Boeing 777X could ever get to near half of those margins, the program could actually have a better – but still remote – shot at covering costs.

Conclusion: FAA TIA Milestone Is A Step In The Right Direction For Boeing

Boeing has been awaiting the TIA for the Boeing 777X. So, obtaining that milestone in the flight test campaign is important to march through the certification process and give customers a clearer timeline on deliveries and that could also help Boeing gather new orders, which is most definitely needed to cover at least some of the losses that the Boeing 777X has caused. By now, there’s around $13.5 billion and possibly a 13-year window from launch to delivery. So, what should have been a quicker and less expensive development became a drama for Boeing. I wouldn’t say that Boeing cut any corners on the Boeing 777X program. The program is tailored to the wishes of the biggest Boeing 777 operators, but the consequences of this development are definitely on Boeing’s plate.

For Boeing stock, I’m maintaining my buy rating as I believe that the company is getting on the right track step by step and eventually that will provide fundamentally supported upside for the stock again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.