Summary:

- Boeing’s Q3 earnings and revenues missed expectations, with a $4 billion loss in Commercial Airplanes and continued cost overruns in Defense, Space and Security.

- Boeing’s 2024 outlook has worsened due to supply chain issues, production delays, the strike, and additional costs, necessitating a capital raise.

- Boeing Global Services showed strong earnings but missed estimates, indicating limited growth potential at current revenue and profit levels.

- I maintain a hold rating for Boeing, anticipating recovery momentum shifting to 2026, with a potential buying opportunity post-capital raise.

Jon Tetzlaff

Boeing (NYSE:BA) reported third-quarter earnings earlier this month, and it was not the quarter that Boeing investors were hoping for, much in the same way it’s not the year that investors were hoping for. Expectations for 2024 suggested this would’ve been a year with positive cash flow, but since the Boeing 737 MAX 9 accident, the prospects of a financial recovery have quickly fallen apart. To that, we can add supply chain issues that keep the Boeing 787 below the targeted rate, the Boeing 777X flight test campaign suspension, problems with the Starliner space module, the work stoppage, and additional costs related to the end of production of the Boeing 767 Freighter by 2027, in addition to continued cost growth on key defense and space programs.

In this report, I will be discussing earnings segment by segment and stack the performance, or better said lack thereof to my expectations for the quarter.

Note from author: In this report, the rationale for the imminent need of a capital raise was discussed. While this report was awaiting editorial review, the news broke that Boeing would indeed be raising capital. The report has been updated to include details on the capital raise.

Boeing Q3 Earnings And Revenues Miss Expectations Once Again

Boeing reported third-quarter revenues of $17.84 billion, which was $102.8 million lower than what analysts had expected. Core earnings per share were -$10.44, missing the consensus by $1.72.

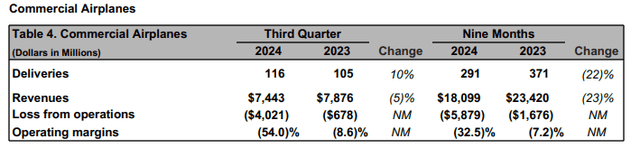

Boeing Commercial Airplanes Books $4 Billion Loss

Boeing’s third-quarter deliveries increased 10% year-on-year, which might be somewhat surprising given the fact that Boeing 737 MAX deliveries have failed to reach desired rates this year. The revenue reduction was of 5% was driven by fewer Boeing wide-body airplanes in the delivery mix. To assess whether revenues were in line with what the delivery volume would suggest, I entered the delivery data into my model, which put the revenue expectation for BCA at $7.413 billion. So, Boeing actually did slightly better than expected. On R&D, to reflect the Boeing 777X flight test campaign, I increased the BCA R&D expectation by a third, and abnormal production costs were assumed to be $80 million on the Boeing 787 program. Including the charge in the amount of $3 billion for the Boeing 777X program to account for the service entry now being delayed to 2026 and Boeing 767 freighter production ending in 2027, the estimated loss was $4.04 billion and that included the assumption that some positive pricing changes on the Boeing airplanes does not translate to the bottom line.

So, the loss from operations at Boeing Commercial Airplanes was more or less in line with what I had expected for the quarter after adding the charges to the mix. Slight positives are the fact that the Boeing 737 MAX inventory is down to 60 units and the Boeing 787 inventory is down to 30 units. However, whereas initially, the target was to have virtually all airplanes that were previously built delivered to customers by year-end that’s now slipping into 2025. So, overall, BCA revenues and profits were ugly but in line with the realities the company faces now.

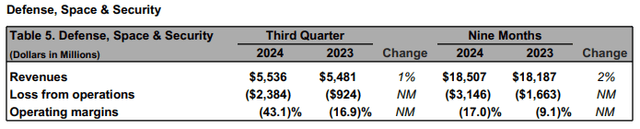

Boeing Defense, Space & Security Costs Overruns Continue

For BDS, I had modeled the revenues at $5.5 billion, more or less stable year-on-year. Boeing reported $5.536 billion in revenues, which was in line with expectations. The performance during the quarter was not great. Without charges, we have this business modeled at a 2% margin for the time being and that means that including the $2 billion in charges on the T-7A, KC-46A, Commercial Crew program, and MQ-25 tanker drone, we would have estimated the loss at $1.89 billion. The loss, however, was nearly $500 million higher. The additional losses were driven by the ramp-up of the F-15EX program and the wind-down of F-18 production.

Previously, Boeing had been able to say that its fixed-price programs are eating away the profits while the core portfolio is still doing well. Due to the losses on fighter jet programs, that was not the case in the third quarter.

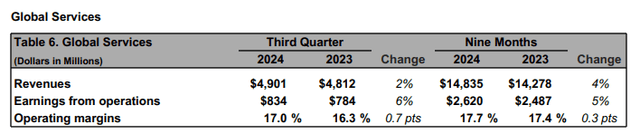

Boeing Global Services Earnings Are Strong But Missed Estimate

I have been modeling BGS as a $4.95 billion business with 18% margins, but just like in the previous quarter, the company reported lower revenues than anticipated and a lower margin driving an earnings miss of $57 million, driven by higher unfavorable catch-up adjustments of $22 million. For a long time, BGS has been able to grow revenues as well as margins, but I believe that the services segment is close to its limits at current revenue and profit performance.

Boeing Earnings Missed My Estimates

Boeing missed analysts estimates on revenues by $102.8 million. With the implementation of the commercial airplane delivery mix, $5.5 billion in sales for BDS, $4.95 billion for BGS, and unallocated items of $25 million my revenue estimate would be $17.838 billion indicating that Boeing exceed expectations by $2 million. However, we do note that BCA revenues were $30 million higher than expected, BDS revenues were $36 million higher than expected while BGS revenues were $49 million lower than expected, and unallocated revenues were $15 million worse than expected. I estimated core earnings per share to be $9.42 per share loss. Boeing reported a loss of $10.44. 85% of that gap is driven by missing estimates in the operating segments while the remainder was driven by higher net interest expenses and a lower tax benefit than anticipated.

Details On The Boeing Capital Raise

For the nine months ended, Boeing repaid $4.8 billion, but it borrowed another $10.1 billion, effectively raising its borrowings, and that excludes another $10 billion in credit agreements drafted in October. The company ended the third quarter with $10.5 billion in cash and cash equivalents and $57.7 billion in debt. Boeing intends to maintain a level of $10 billion in cash and cash equivalents next to its existing revolvers. As I discussed in a prior report, Boeing has been readying to raise $25 billion through debt or stock. If we subtract the credit agreement from the $25 billion, we would likely see a minimum $15 billion capital raise, which should happen sooner rather than later, given that the company faces debt maturities and its cash balance at the end of the third quarter was already reasonably close to what the company feels comfortable with.

Boeing ended up announcing the issuance of 90 million common shares as well as the issuance of depositary shares. Holders of such shares have an interest of 5% in preferred share capital. The $5 billion in preferred share capital is mandatory convertible in October 2027. At Friday’s closing price of around $155 per share, this would result in nearly $14 billion in common share capital being raised plus $5 billion in preferred share capital for a total of $19 billion. Additionally, the preferred share capital issuance can be increased by another $750 million and another 13.5 million in common stock can be issued, adding another $2.84 billion in possible capital increases for a total of $21.8 billion.

Conclusion: Things Got Even Uglier For Boeing

For Boeing, 2024 has gotten uglier every quarter, and the third quarter was no exception. The performance of BCA is under pressure due to the work stoppage while BDS is facing continued cost growth, and one can wonder how much growth BGS can still produce for the company. With two out of the three business segments not performing, the company is bleeding cash. As expected, Boeing ended up announcing a capital increase which, I believe, should help the company cover free cash flow burn through the first half of 2025 and address debt maturities.

With the capital raise announced, I do believe Boeing has taken a significant step in resetting the balance sheet and while I note that a lot of recovery momentum is shifting in 2026, I do believe that we can move back to a buy rating as analysts are expecting a significant improvement in cash burn next year and an inflection to cash flow positive performance in the year after. For long-term investors, the dilution could provide a compelling entry point. The terms of the preferred share capital are not clear, but even those could be interesting to shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.