Summary:

- Boeing’s tentative union agreement includes a 35% wage increase over four years, potentially ending a five-week strike and reducing cash burn.

- Boeing secured a $10 billion credit line, providing financial padding despite its near-junk credit rating and significant upcoming debt maturities.

- Boeing faces $5 billion in cost overruns, primarily from delays in the 777X program and other defense and space projects, weakening its competitive position.

- Despite financial challenges, Boeing is not on a bankruptcy trajectory, with plans to raise $25 billion through stock issuance to improve liquidity and attract long-term investors.

Jon Tetzlaff

It seems that Boeing (NYSE:BA) hasn’t had a week without a lot of news for the past five years, and news is actually flowing faster than we can provide analysis. In that regard, October has been no exception, with a mix of good and bad news. In this report, I will be discussing both the good and the bad items, as they can either have a direct impact on Boeing shareholders or the competitive position of the US jet maker.

Boeing Reaches Tentative Agreement With Union

The Boeing Company

Starting with the good news, Boeing has reached a tentative agreement with one of its key unions. The agreement includes a 35% increase in wages over a four-year period instead of the 25% increase from an earlier offer, and lower than the 40% increase that the union was looking for. Furthermore, the ratification bonus has been increased from $3,000 to $7,000 with a better 401(k) match. Union members will vote on the new offer on Wednesday, potentially ending a five-week strike at Boeing that crippled its production and led to a multi-billion dollar cash burn.

Boeing Secures $10 Billion Credit Line

On Oct. 14, Boeing announced that it entered into a $10 billion supplemental credit agreement, and while we rather not see Boeing potentially raising debt even further, I do consider it a positive sign that lending parties are still willing to lend money to Boeing as its credit rating is close to junk status. At the end of the second quarter, Boeing had $12.6 billion in cash and cash equivalents and $57.9 billion in debt, while preliminary figures showed cash and cash equivalents of $10.5 billion by the end of the third quarter. By the end of 2023, Boeing had $5.1 billion in short-term debt of which $0.6 billion is due in the remainder of 2024, $4.58 billion in debt due in 2025 and $8 billion in 2026. The credit facility will give Boeing some padding to address the cash burn expected this year and prepare itself to service the debt maturities in the upcoming years, as its free cash flow should increase.

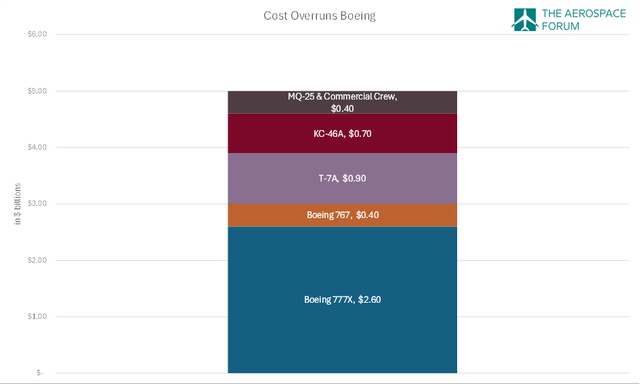

Boeing Announces $5 Billion In Cost Overruns

The Aerospace Forum

Boeing announced preliminary revenues of $17.8 billion and a GAAP loss of $9.97 per share, along with $1.3 billion in operating cash burn for the third quarter. Boeing also packed a flurry of pre-tax charges in its announcement of preliminary results. In total, Boeing announced $5 billion in charges. The biggest charge of $2.6 was on the Boeing 777X program where production stop due to the strike and the problems in the flight test campaign triggered a delay to service entry for the Boeing 777-9, which is now expected to enter service in 2026 while the Boeing 777-8F will not enter service until 2028. On the Boeing 767 and KC-46A programs, there were $1.1 billion in combined charges. $0.4 billion relates to the Boeing 767 freighter production due to the work stoppage and $0.7 billion relates to the KC-46A driven by the combination of the work stoppage and the decision to stop production of the Boeing 767-300F in 2027. On other defense and space programs, Boeing incurred $0.9 billion in losses on the T-7A trainer jet and $0.4 billion on the Commercial Crew program and the MQ-25 tanker drone. In a previous report, I flagged the newest defense programs of Boeing, namely the KC-46A, MQ-25 and T-7 as non-performing programs and the new round of cost growth also painfully demonstrates that along with the new cost growth on the Commercial Crew Program which has a troubled history on cost, schedule and reliability.

Boeing’s Competitive Position Is Under Even Higher Pressure

The Boeing Company

With the delays on the Boeing 777X program, we see that Boeing’s wide body offering remains weak. The Boeing 777X is not a huge seller, but absent of a replacement option for larger wide body airplanes, Boeing is in a weak spot on its wide body passenger product portfolio and that comes on top of its weak position in the single aisle market.

Furthermore, the decision to delay the service entry for the Boeing 777-8F and half production of the Boeing 767-300F also puts pressure on the freighter airplane portfolio. This was once a segment where Boeing would have the only capable dedicated freighter line up, and that is now also fading. In some way, it’s surprising that Boeing will halt Boeing 767F production since the FAA reauthorization bill passed earlier this year essentially would have allowed Boeing to produce less fuel-efficient aircraft such as the Boeing 767 freighter for another five years after the Jan. 1, 2028, deadline. Does this mean that there’s a permanent gap in the freighter line up? Not necessarily. I believe that this is a first step toward Boeing launching a freighter variant of the Boeing 787.

Boeing Eyes A $25 Billion Raise

The final piece of “bad” news is that Boeing is eyeing to raise $25 billion through either debt or stock, or a combination of both. It’s also the reason why I currently have a hold rating for the near term rather than a buy rating, even though for the long term I do believe that the stock can still offer significant value. Boeing currently has a market cap of $95 billion, so raising $25 billion in stock would dilute shareholders by more than 25%. Somewhat counterintuitive, I do believe that raising cash through issuing stock is the best way forward as adding debt would further pressure Boeing’s credit rating and put pressure on the US jet maker as it would add another $25 billion in debt that would need to be repaid. Given that Boeing spent tens of billions of dollars in share repurchases, I do believe that issuing stock now is the best way forward and the plane maker could opt to repurchase shares at a later date. To me, the combination of issuing shares and buying them back later is preferred over adding new debt that could cripple the company’s need for new, innovative products.

I also believe that issuing stock would attract the right types of investors, namely investors who are not so much focused on quarter-to-quarter reports but are more aligned with the long-term nature of the business looking for long-term value creation. I rather have the company issue the $25 billion in stock today rather than tomorrow to eliminate that overhang at once.

No Bankruptcy For Boeing

The Boeing Company

Tim Clark of Emirates suggested that Boeing is on a trajectory to bankruptcy. And while things are definitely not looking pretty for the US jet maker, I don’t believe that a Chapter 11 bankruptcy is the most logical step for the plane maker at this point. Boeing does face negative free cash flow and debt maturities, but with its liquidity position, it should be able to service debt maturities for 2024 through 2026 and by that time the company should be in a better financial position to further pay down debt or refinance debt at a lower interest rate as interest rates are now dropping. Furthermore, if free cash flow remains negative, Boeing still has the lever to issue shares, and it’s also shedding non-core businesses to reduce losses and increase its liquidity.

Conclusion: Boeing Kitchen Sinks The Quarter

Kelly Ortberg took the lead at Boeing earlier this year and his first months have not been the ones that investors were hoping for. Looking at the fact that the company has agreed on a 35% increase in pay rather than a 40% increase that was demanded, I would almost say that Ortberg should have agreed on the 40% increase in pay as it would provide a valuable reset on relations with employees.

Apart from that, it seems that his first six months are not so much focused on turning things around at Boeing but more so on facing the realities of the business and kitchen sink the quarter with $5 billion in pre-tax charges, securing additional funding lines in the form of debt, credit facilities and stock issuance. Perhaps that’s the reality check that Boeing and its shareholders really needed. For the time being, I’m maintaining a hold rating and consider flipping the rating to a buy again once Boeing has issued stock or debt. So, Boeing is a near-term hold, but for the long term, I maintain a buy rating and any weakness in the stock price can be used to buy shares, granted that you, as a shareholder, believe that Boeing will execute a sustainable turnaround.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.