Summary:

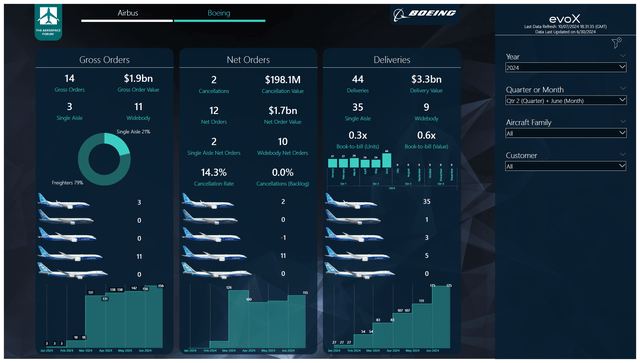

- Boeing’s June orders included 14 airplanes, primarily focused on freighters, with a net order value of $1.7 billion.

- Boeing delivered 44 airplanes in June, including 35 single aisle and 9 wide body planes, valued at $3.3 billion.

- Despite challenges, Boeing is making progress in improving quality, increasing deliveries, and repairing its reputation through smoother inflow of aerostructures.

Emil Sandberg/iStock Editorial via Getty Images

Boeing (NYSE:BA) has been in the news for all the wrong reasons this year and while the sentiment is negative, I believe the biggest positive changes are the upcoming departure of David Calhoun as CEO and the acquisition of Spirit AeroSystems that was announced earlier this month giving Boeing more oversight and ability to control quality. It is a long way for the company to be where it is supposed to be, but we are already seeing a smoother inflow of aerostructures in Boeing’s assembly system with less rework required. That should help the company improve quality, increase deliveries and repair its reputation.

In this report, I will be discussing the orders and deliveries that Boeing announced for the month of June. While there likely is some noise from quarter-end deliveries, we could also get a better indication of how things are progressing for the troubled plane maker.

Boeing Airplane Deliveries Improve

The Aerospace Forum

In June, airplane orders increased sequentially from four orders to 14 airplanes ordered. Orders consisted of 11 freighter airplanes and three single aisle orders valued at $1.9 billion:

- Alaska Airlines ordered one Boeing 737 MAX.

- BCA Customer Finance ordered two Boeing 777F airplanes.

- Turkish Airlines ordered four Boeing 777Fs.

- An unidentified customer ordered two Boeing 737 MAX airplanes.

- An unidentified customer ordered five Boeing 777F airplanes.

During the month the following changes were made to the order book:

- Aerolineas Argentinas cancelled an order for one Boeing 737 MAX.

- Air Europa cancelled an order for one Boeing 787-9.

- BOC Aviation was identified as the customer for one Boeing 737 MAX.

- TUI Travel was identified as the customer for one Boeing 737 MAX.

- 9 Air was identified as the customer for one Boeing 737 MAX.

- MSC was identified as the customer for one Boeing 777F.

- Orders for eight Boeing 787-9s were transferred from Boeing Capital Corporation to Boeing Commercial Airplanes Customer Finance.

In June, the order inflow was primarily focused on freighter airplanes. There were three orders for the Boeing 737 MAX, but Alaska Airlines (ALK) is likely to offset the airplane that was involved in the January accident and was returned to Boeing. Furthermore, I believe that the two Boeing 777F airplanes ordered by BCA Customer Finance are offsetting a doubtful order.

With 14 gross orders and two cancellations, the net order tally for the month was just 11 units with a net order value of $1.7 billion. In the same month last year, Boeing booked 304 gross orders and 16 cancellations, bringing its net orders to 288 aircraft valued at $22.5 billion. Important to keep in mind is that the year-on-year comparisons for June and July are not necessarily reflective of a change in appetite for airplanes. Alternating every year, the Paris Airshow is hosted in June while the Farnborough Airshow is hosted in July. This year, the Farnborough International Airshow will take place meaning that any order bump will occur in July rather than June.

Year-to-date, Boeing has gathered 156 gross orders and 41 cancellations, bringing the net orders to 115 valued at $11.6 billion. In the same period last year, the company logged 527 gross orders and 112 cancellations, bringing the net order tally to 415 valued at $34.5 billion. As mentioned, the timing of the airshow skews the comparison somewhat. The only thing we do know is that Boeing would need tens of billions of dollars worth of orders during the Farnborough Airshow just to keep the year-on-year order tallies slightly down to flat. With the problems on the production rate for the Boeing 737 MAX and Boeing 787, one can wonder whether that really will be happening.

In June, the ASC 606 adjustments tally, which records orders for which a purchase agreement exist but additional criteria are not met, increased by 116 units. Two Boeing 777F airplanes were added to the tally. I believe that Boeing placed a balancing order for these slots during the month to provide the customer with financing. The Boeing 737 tally increased by a net number of 114 and I believe that there was one Boeing 737 MAX order from Aerolineas Argentinas that was in the tally that got cancelled while another 115 were added to the tally. Overall, the tally of orders for which a purchase agreement exists but additional conditions are not met increased from 563 to 679 meaning that over 11% of the order book is currently doubtful. However, once the additional requirements are met, we could also see the tally reduce. So, while ASC 606 adjustments could be seen as a prelude to a cancellation that is not necessarily the case. Especially over the past year, we saw the tally reduce without the order being cancelled meaning that the additional set of requirements to count the order to the backlog was met.

The Boeing Company

In June, Boeing delivered a total of 44 airplanes consisting of 35 single aisle airplanes and nine wide body airplanes valued at $3.3 billion:

- Boeing delivered 35 Boeing 737 airplanes, consisting of 38 Boeing 737 MAX airplanes and one P-8A Poseidon.

- Boeing delivered one Boeing 767-2C, which is the base airplane for the KC-46A tanker.

- Boeing delivered five Boeing 777F airplanes.

- Boeing delivered three Boeing 787s, including two Boeing 787-9 airplanes and one Boeing 787-10.

Boeing is currently producing significantly below its targeted rate of 38 Boeing 737s per month. During the month, Boeing delivered 35 Boeing 737 MAX airplanes and that should not be seen as production rates snapping back to more acceptable rates. In the first three months of the year, Boeing had roughly 60 Boeing 737 MAX airplanes that were “work in progress” and it is very likely that part of that inventory has been burned off in the end-of-quarter delivery surge. On the Boeing 777 program, we saw deliveries increase and that could indicate that shortages of GE90 engines and components are easing. On the Boeing 787 program, the production rate has been brought down as well and the delivery volume was in line with the production rate. So, June deliveries were not impressive, but they were simply in line with what can reasonably be expected.

In the same period last year, Boeing delivered 60 airplanes valued at $4 billion. So, deliveries are down 27% in terms of units and 17.5% in terms of value, reflecting the higher share of wide body deliveries in the mix. To date, Boeing has delivered 175 airplanes with a value of $12.7 billion compared to 266 deliveries valued at $18.6 billion a year ago, indicating a decline of 34% in units and 32% in terms of value.

The book to bill ratio for June was 0.3x in terms of units and 0.6x in terms of value while for the first half of the year it is 0.9x and 1.2x mostly reflecting Boeing not producing in line with its production plans.

Measured by deliveries, we see a 52% decline and a 55% decline measured by dollar value. Year-to-date, Boeing has delivered 131 airplanes valued at $9.5 billion compared to 206 deliveries valued at $14.5 billion last year, indicating a 36% and 34% decline respectively. The book-to-bill ratio for the month was 0.2 in terms of units and 0.4 in terms of units while year-to-date, the ratios are 1.1x and 1.4x, driven by weak deliveries.

Conclusion: Tiny Steps For Boeing

In Boeing’s orders and deliveries, I don’t see anything that impresses me much. We saw order inflow increase sequentially driven by freighter sales, but sales for passenger airplanes has gained no traction and given the uncertainty regarding production rates and timing of production ramp ups also does not make it extremely attractive to finalize sales. If anything, the Farnborough Airshow hosted this month will provide a better indication for airplane demand.

On the delivery side, we see that sequential deliveries increased by 20 units, and I believe that we are seeing some easing on the Boeing 777 supply chain constraints and some Boeing 737 MAX airplanes that were being built in the first half of the year being released to customers now. There is no strong indication that the production rates are indeed recovering. The positive is that the inventory is being burned off and Boeing is seeing more clean fuselages entering the 737 assembly line, which should also allow for higher quality assembly and eventually higher production rates.

For Boeing it is now key, to get its production and quality management system as well as its leadership in order and aligned for quality manufacturing and engineering, which itself will likely generate sufficient cash to service debt.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.