Summary:

- Boeing should consider acquiring Spirit AeroSystems due to quality control issues and the need to improve manufacturing processes.

- The potential acquisition could reshape the global supply chain and the OEM mindset, bringing more work and part production back to Boeing.

- Onboarding Spirit AeroSystems CEO Patrick Shanahan could bring much-needed engineering expertise and problem-solving skills to Boeing’s leadership.

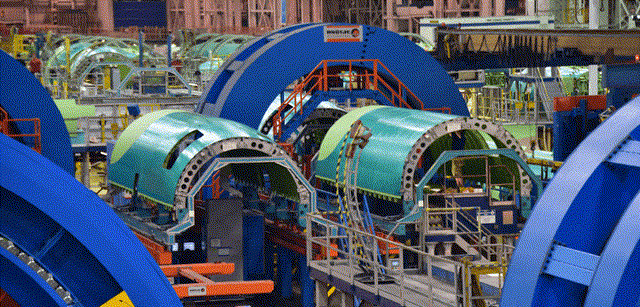

Wirestock

The Boeing Company (NYSE:BA) and Spirit AeroSystems Holdings, Inc. (NYSE:SPR) confirmed talks to combine their businesses earlier this month. In June last year, I laid out in a report why I believe that Boeing should not be acquiring Spirit AeroSystems. In this report, I will explain why a combination makes more sense now.

Why I Was Against A Takeover Of Spirit AeroSystems By Boeing

Initially, I was against Spirit AeroSystems being acquired by Boeing. The first reason was that as a shareholder it would be unlikely that Spirit AeroSystems would be valued according to its potential and that potential is big. Just among the Boeing 737 MAX and Airbus A320neo programs, there’s potential for doubling output while the Airbus A220 can be seen as a growth platform for Spirit AeroSystems. None of that would, however, be likely to be feathered into the acquisition price due to the uncertain ramp-up profile for production. More so, since Boeing is unlikely to be willing to pay a premium on Spirit AeroSystems for the upside that Airbus airplane programs offer.

Another reason why I was against the combination is that Boeing has spent years transferring risk to the supply chain via its Partnering for Success program. The program was intended to improve efficiency, and quality and control the spiraling costs of airplane development. However, in many cases, it was being used as a tool for Boeing to reduce supply chain costs by around 15%, extend payment terms, and secure commitment from suppliers to meet future production rates. It could hardly be called a partnership. Buying back Spirit AeroSystems would essentially mean that Boeing would be buying back the risk it has transferred to its supplier for years.

Those are the main reasons why I was not in favor of Boeing buying back Spirit AeroSystems.

Boeing Should Buy Spirit AeroSystems As A Last Resort

Since my previous report where I made the case that Boeing should not be buying Spirit AeroSystems, things have gone south for both parties. The incident with the Alaska Airlines Boeing 737 MAX 9 marked a new low for Boeing and Spirit AeroSystems. It became clear that Spirit AeroSystems had potentially delivered a fuselage to Boeing with defective rivets, according to a detailed reconstruction from The Air Current. While that itself did not cause the blowout as the defective rivets were not the same as the missing bolts in the door plug that should have been installed to keep the door plug in place, the continued quality defects at Spirit AeroSystems do show that the company can improve on manufacturing quality and quality control. It also showed how the assembly sequence is being complicated by so-called traveled work. Traveled work is basically passing work that still has to be performed or rectified onto the next point of the chain or the next station. In my view, the result is that there’s a lot of out-of-sequence work increasing the chances of mistakes as work is added on top of the standard work that a station is normally supposed to do.

Given that traveled work complicates the standard routines and procedures, I believe the possible outcome is that oversight might be lost. That’s also why Boeing is aiming to reduce traveled work according to a note from Stan Deal, CEO of Boeing Commercial Airplanes, and a report from Reuters.

Boeing is now considering making Spirit AeroSystems part of Boeing again and I can understand why. The arguments for not buying Spirit that I presented earlier are no longer valid or not as relevant. The quality management at Spirit AeroSystems and Boeing is so bad that more thorough action might be required to better control quality, meaning that acquiring Spirit AeroSystems is in the picture again. The FAA has barred Boeing from raising production on the Boeing 737 MAX program and gave the US jet maker 90 days to fix systematic deficiencies in quality control while it had also determined that Boeing’s push to improve quality had not been sufficient. While the FAA did not link any consequences to the lack of improvement, I believe the message is quite clear:

- Boeing has not done enough to improve quality.

- This might be the last chance that the Boeing 737 MAX will get.

The stakes already were high. They most certainly have increased even more after the findings from the FAA. The FAA audit found that Boeing failed 33 out of 89 audits while Spirit AeroSystems failed seven out of 13 tests. I believe that a major contributor to such poor performance is the outflow of manufacturing know-how during the pandemic. The current workforce seemingly is too inexperienced to even grasp the importance of following procedures, and using the right tools and lubricants while prescribed procedures that should ensure applying the right manufacturing methods and utilizing the right tools are too complicated. The lack of experience in my view is a major contributor, but I also feel like the lack of focus on safety contributes to this, and a strong safety culture is cultivated from the top down and not from the bottom up. Boeing and Spirit AeroSystems are now fully aware that their steps to assure quality have not been enough by a wide margin and that the Boeing 737 MAX is living one of its last chances. This likely adds to the realization that Boeing needs to control quality more firmly and one way to do so is by removing intra-company complexities by making Spirit AeroSystems part of Boeing and taking steps to prevent Spirit AeroSystems from shipping fuselages that potentially do not meet quality standards.

The fact that Boeing would essentially be buying back the risk it transferred is subordinate to the need to increase quality control within Boeing and down the chain. Without the Boeing 737 MAX, Spirit AeroSystems would not be able to be a viable business and Boeing would lose its bread and butter as well. The potential losses of a production stop of the Boeing 737 MAX are way bigger than Boeing buying back the risk it transferred, and in some way, Boeing is learning here that long-term risk transfer is not a healthy business practice for the production of high-quality products. As a combined entity, Boeing and Spirit AeroSystems have the chance to simplify processes and procedures and bolster quality control.

In case Boeing buys Spirit AeroSystems, it also would reshape the global supply chain and the OEM mindset. Over the past two decades, outsourcing to suppliers has become more and more prominent and OEMs such as Boeing and Airbus mostly focused on putting everything together. If Boeing brings Spirit under its wings, it also means that more of the work and part production is brought back, work that Boeing has not performed for a long time. Perhaps bringing actual production processes back to the OEM also improves the safety standards at OEMs as well as the realization that this is not just simply putting an airplane together like a LEGO set but a production and assembly process that should result in a high-quality product that airlines and customers trust to fly.

For Airbus, a sale of Spirit AeroSystems also could be transformative as the activities that are tied to Airbus airplanes could be sold to the European jet maker. So, what’s clear is that an acquisition of Spirit AeroSystems would reshape the supply chain that we know today.

Perhaps one of the best things that could happen to Boeing is onboarding the Spirit AeroSystems CEO. Those who have been following my work on Boeing know that I believe that Dave Calhoun is not the right man to lead Boeing to greener pastures. In my view, he’s reactive rather than proactive and uses failures at Boeing to demonstrate his promptness in decision-making. However, in the four years Calhoun has been CEO, I have yet to see a pivot to a safety-driven approach toward all parts of Boeing’s business and a proactive approach toward building a robust quality system.

I also echoed this view in one of my previous reports covering Boeing:

In my opinion, if anything, the continued issues that Boeing has faced on its programs including the most recent MAX 9 issues put on display that the current leadership is simply incapable of cultivating a better culture at Boeing. I believe that in some way you can see the current issues faced with the Boeing 737 MAX 9 as the product of Calhoun’s leadership and I believe that the only reason why he’s still Boeing’s CEO is because the MAX 9 accident was non-fatal. However, in my view that does not mean that Calhoun should stay. Had the MAX 9 accident happened at cruise altitude, chances are high the outcome would have been very different.

I strongly believe that to lead a company such as Boeing ideally the CEO has an aerospace engineering background and at the very least has a background in engineering. Boeing’s current CEO has an accounting degree and I believe that also leads to too much of a focus on financials rather than engineering, design, and manufacturing excellence. Boeing is known to internally promote candidates to eventually become CEO. Currently, Ted Colbert (CEO of Boeing Defense, Space & Security) and Stephanie Pope (COO of Boeing) are seen as the primary candidates to become Boeing’s next CEO. The former has an engineering degree while the latter has a degree in accounting. I don’t believe that stakeholders, including shareholders, will be happy to see someone with an accounting background leading Boeing once again. With the absorption of Spirit AeroSystems, Boeing could be adding a third candidate to one day become Boeing’s next CEO: Patrick Shanahan, the current CEO of Spirit AeroSystems.

Shanahan knows Boeing inside out as he worked for the company between 1986 and 2017. He has a degree in mechanical engineering, which I believe makes him better equipped to lead Boeing. He’s also known as a problem solver leading the recovery of the Boeing 787 program and having been involved in all of Boeing’s commercial airplane programs. Shanahan was one of two candidates that were on the shortlist to become CEO of The Boeing Company. However, Dennis Muilenburg who was the other candidate following a promotion path toward the CEO position, was selected to become Boeing’s next CEO and Shanahan left Boeing. The only problem I see with viewing Shanahan as a candidate for the CEO position is his age. He’s currently 61-years-old. The Boeing board increased the mandatory retirement age for Calhoun to 70 years. If virtually, Shanahan took over as CEO today he would be able to lead Boeing’s recovery and perhaps see the company developing a new airplane before retiring. That’s how long the development cycles are in the aerospace industry. Whether Shanahan will be a candidate to become Boeing’s CEO is not known, but I do think he most definitely has the problem-solving skills, engineering integrity, and approach toward safety and discipline that’s needed to get Boeing back on track. At the very least, Shanahan could add a lot of know-how that currently seems to be missing at Boeing.

So the reason for not acquiring Spirit AeroSystems is the risk that has been transferred over the years by Boeing. There are, however, more reasons to acquire Spirit AeroSystems and the pressure to make significant changes also has increased:

- By combining Spirit AeroSystems and Boeing, some intra-company complexities can be eliminated and Boeing could improve quality control.

- The company will have more manufacturing knowledge in-house changing OEMs from almost “assembly-only” to assembly facilities with manufacturing knowledge and capability which could add a better realization of the importance of quality, integrity, and safety.

- Pat Shanahan, who previously worked at Boeing and is lauded for his work at the US jet maker, could add knowledge that current leadership seems to be lacking.

What Does A Possible Acquisition Of Spirit AeroSystems By Boeing (Or if There’s No Deal At All) Mean For Investors?

For Spirit AeroSystems shareholders, I believe that in case Boeing acquires the business it will not fully value the potential of the company for the simple reason that Spirit AeroSystems is risk-infused at this stage. Selling the Airbus activities, however, could provide some value but is unlikely enough to be extremely attractive as compared to the highs that Spirit AeroSystems stock has previously traded on. Without a deal, I also believe that Spirit AeroSystems will be able to recover significantly, but the associated risk will remain high.

For Boeing, with or without a deal, I believe that risk has infused to a level that a convincing Buy rating is hard to maintain. I still maintain my buy rating on the assumption that Boeing will see the urgency to get their quality system and approach toward high-quality manufacturing and certification in place. However, any future indication that this is not the case will likely result in a downgrade of the rating for Boeing stock.

In short, I believe that a deal will allow both parties to improve quality down the chain and improve oversight. Absent a deal, I continue to believe both businesses have what it takes to improve the quality to conforming standards but the associated risk will be higher.

Conclusion: A Boeing-Spirit Combination Is Making More Sense Now

Previously, I believed that Boeing should not buy Spirit AeroSystems due to the risk that Boeing had transferred to its supplier. However, that risk as well as the quality lapses at the supplier as well as Boeing have become so pressuring that taking control of the company regardless of the risk seems to be the right thing to do to right the ship. On top of that, I believe that it could provide the opportunity for Boeing to welcome Pat Shanahan back. Shanahan is someone who I believe is more equipped to right the ship at Boeing, or level the airplane if you will. The higher margin business that Spirit AeroSystems has for aftermarket sales as well as defense is nice to have as those business segments under normal circumstances have higher margins than Boeing. Boeing could learn how to generate those margins and virtually eliminate them as a cost adding to their own margins.

I believe that at this point in time, the right thing to do for Boeing is acquiring Spirit AeroSystems. Boeing has a final chance to get things right and acquiring Spirit should add to a simplified supply chain flow with better quality control. Furthermore, Spirit AeroSystems has been bleeding cash and I don’t believe that a company bleeding cash can optimally focus on improving its quality control mechanisms. It might not make financial sense, but at this point, that does not matter anymore. For Boeing and Spirit AeroSystems getting the quality control right is crucial.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, SPR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.