Summary:

- Washington has a significant political interest in keeping Boeing afloat and competitive.

- Boeing is crucial for national security and technological competition with China.

- Given that Boeing could benefit from the duopoly market and potential political support, the company’s valuation is attractive.

nycshooter

Introduction

In my previous article, I had a buy rating on Boeing (NYSE:BA). At the time, I focused on the duopoly nature of the global commercial aviation industry following the 737 Max 9 or 737-9 grounding. I argued that because the global aviation market is dominated by Airbus and Boeing, making it a duopoly, it will be possible for Boeing to get back on its feet upon fixing its overdue quality problems and increasing production down the road. Certainly, the road to this recovery will not be easy with a likelihood of increased government scrutiny, regulation, lawsuits, and more. However, I do not see a realistic scenario where Boeing’s legacy ends. Thus, in this article, instead of focusing on the duopoly nature of the industry in which Boeing operates, I am going to focus on the political landscape that will likely act as a floor. Boeing is too important for the US government, especially as China is attempting to enter the commercial aviation market. Washington will not want Boeing to be unstable and lose competitiveness, and as the global superpower, Washington has the ability, resources, and interest to keep Boeing alive. Therefore, given the political motivation, I am continuing to rate Boeing a buy despite the likelihood of a bumpy road to recovery.

Importance of Boeing

Although it will be hard for Washington to come out publicly to support Boeing following the multitude of problems Boeing faced over the past couple of years with the 737 Max program, I think it is clear that Washington’s interest is in keeping Boeing competitive and alive as the company is critical to the US defense industry.

Boeing is a massive defense contractor. The company was the 5th largest defense contractor in 2023 and 3rd largest in 2022 with the defense revenue reaching about $30 billion in 2023. The scale is massive, hinting at the importance of the company.

Boeing supplies critical assets to the US Department of Defense, DoD, which cannot be replaced by its competitors. For example, Boeing makes high-profile products such as Air Force 1, Apache Helicopters, P-8 Poseidon, B-52 Bomber, Chinook Helicopters, and more. The products Boeing makes range from aircraft to missiles to products for the United States Space Force. As such, as Boeing’s stability and success are directly tied to the national security of the United States, I believe it is reasonable to argue that it is in Washington’s best interest to keep Boeing afloat and competitive.

Washington’s Interest

Beyond the national security perspective, Boeing is important in geopolitical competition with China. Since former President Trump took office and into the current Biden Administration, the US government, in my opinion, has actively been attempting to curb China’s growth making it clear that Washington’s interest is to maintain its hegemony.

One example of the US government intervening in the market to support the US company and its interest is shown in the semiconductor industry. US Commerce Secretary Gina Raimondo said, “The CHIPS Act [allocate] $39 billion for manufacturing incentives to encourage companies to build and expand” in the United States. This comes as Washington and Gina Raimondo see that the support is critical to “protect our national security, and preserve our global economic competitiveness.”

Clearly, in the case where Washington believed that the country’s economic interest and national security were of concern, Washington did not hesitate to intervene and aid the industry players. Further, it is also clear, in my opinion, that Washington does not want any competitors like China to compete or exceed the United States in technologically advanced sectors for the future and in the interest of the United States.

Unfortunately, if the US government does not actively support Boeing or stand on the sidelines in the case that Boeing goes through rough times, China could become more competitive in the commercial aviation sector, which is closely tied to the defense industry.

China’s home-grown commercial airplane manufacturer Comac is attempting to break into the industry with its new C919 narrow-body plane. While the industry consensus is that the new plane-maker likely does not have a major competitive advantage beyond pricing, over the next few years and decades, this landscape, in my opinion, could change with the continued Chinese governmental support as was the case with semiconductors, electric vehicles, and much other industry China now excels at.

Therefore, given that the commercial aviation industry and the defense industry are correlated and that it is in Washington’s interest to protect national security and preserve the economic competitiveness in the sensitive industry, it is in Washington’s best interest to get Boeing back on track and keep the company competitive.

How Can Geopolitical Importance Help

One may wonder, how can geopolitical importance help Boeing. For the sake of argument, even if we assume that my opinion on Boeing is true, there are no major announcements from Washington publicly saying that they will keep Boeing competitive. So, how can this situation help Boeing?

We have all already seen the government support happen numerous times over the past couple of years. During the pandemic, the US government spent trillions of dollars to keep vital companies tied to the interest of the US national security and economy afloat. And, during this time, the US government allotted $17 billion of loans to Boeing to provide the company with additional financing options beyond the public markets.

Intel (INTC) is another company that benefited from the US government’s broad interpretation of national security. In this article published in July 2022, I argued that it is in the US government’s best interest to make Intel competitive in the foundry industry. At the time, Intel was behind Samsung (OTCPK:SSNLF) and TSMC (TSM) while even losing market share to AMD (AMD). Fast-forward a couple of years and after billions and billions of dollars in aid from the US government including the $8.5 billion from the CHIPS Act and 11 billion dollars in favorable loans, Intel is on track to become competitive in the foundry industry to the point where the company is attempting to become the number 2 foundry player by the end of the decade. From a company that gave up on foundry and Moore’s law to once again a competitive foundry player, help from the US government was present in the name of national security.

Similarly, in the case that Boeing starts to struggle and creates a potential scenario where it could cause material harm to the national security, I do not think it is unrealistic to expect major support from the US government in terms of loans, aid, or grant citing manufacturing prowess and interest to the national security.

Bumpy Road to Recovery

I am arguing that in the case that Boeing goes through a rough time, meaning that the company is seeing financial instability, widening losses, and more challenging longevity and competitiveness of Boeing, it is likely that the United States government will intervene to keep Boeing competitive and healthy, and I believe this is a crucial factor when considering investing in Boeing. The company will inevitably go through rough times in the coming few quarters or even years as the company navigates increased regulatory scrutiny, potential lawsuits, regaining public trust, and more. But, in the worst case, with the importance of Boeing to the United States, I do not see a significant risk of the company experiencing bankruptcy or a declining competitive advantage scenario.

Quantitative Argument

Overall, from the fundamental standpoint, I am arguing that Boeing offers an attractive buy opportunity as the company could see political support from the US government if the company sees a financial struggle that would jeopardize the continued operation and future competitiveness. Further, an investment in Boeing also makes sense when looking at the company’s valuation.

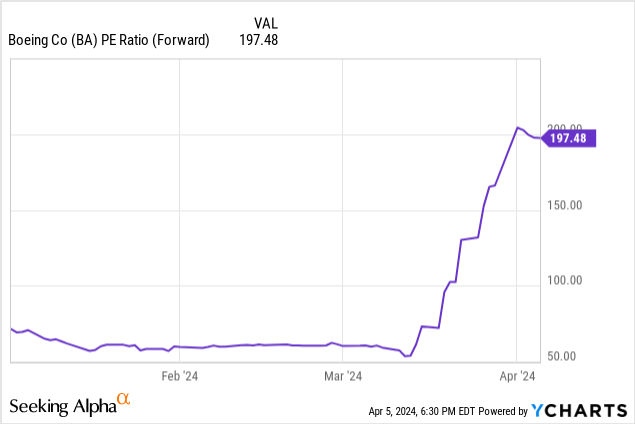

Boeing is not in a favorable condition today after a 787 Max 9 incident in January. As such, as the chart below shows, the company’s forward valuation multiple saw exponential growth due to Boeing’s future earnings expectation degrading. However, if it is the case that Boeing will be able to emerge from the current situation, then the company’s valuation is attractive.

After a diminished 2024, analysts are forecasting Boeing’s bottom line to grow by about 650% in 2025 and by another 44% in 2026 resulting in the company’s valuation multiple reaching 26.32 in 2025 and 18.28 in 2026 bringing the company’s valuation multiple to a reasonable level of around 20, which was the valuation multiple the company was trading at before the pandemic and the crash of 737 Max 8. Therefore, given the assumption that Boeing will be able to recover, I believe the company’s valuation today is attractive.

(The 737 Max 9 incident occurred just a few months ago, and Boeing has not provided official guidance on the company’s target delivery numbers. So, upon the management’s commentary on the topic, I will provide a more detailed opinion later in the comment section.)

Summary

Not for the best reasons, Boeing has been in the spotlight in recent months. The company could see increased regulatory oversight, lawsuits, a degrading relationship with the flying public, and more, yet I believe Boeing could be a buy at this level. The company enjoys a significant benefit as the commercial aviation market is a duopoly with an ability to leverage the US government for support as Boeing is critical to the political interest of Washington. Therefore, I believe Boeing’s recovery could be possible, making the company’s valuation attractive. Boeing is likely a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.