Summary:

- Airbus leads Boeing by over $85 billion in the single aisle market, with significantly more orders and deliveries.

- Boeing has lost high-profile customers to Airbus, including KLM, Transavia, and Qantas.

- Boeing’s product evolution and revolution are falling behind, with delays in the Boeing 737 MAX 10 and the shelving of plans for a new mid-size jet.

Aeon Aviation Photography/iStock Editorial via Getty Images

As Boeing (NYSE:BA) is struggling to get its quality and manufacturing system in order while demand for commercial airplanes has increased significantly, it is clear that Airbus (OTCPK:EADSF) is the clear winner in the duopoly. That does not need much explanation. However, how big the benefit is for Airbus is often barely quantified nor do we see a lot of discussion among investors on how the crisis has kept Boeing’s innovation grounded while Airbus is making steps to increase its market share. In this report, I will be quantifying the differential between Boeing and Airbus on the single aisle market and discuss further implications of the lasting crisis for the US jet maker.

Airbus Leads Boeing By More Than $85 Billion

Those that have been long time readers of my Boeing and Airbus coverage know that in my view the engineering crisis at Boeing did not start with the Boeing 737 MAX crisis, but were visible in the years before as I explained in a report discussing the challenges faced on virtually all Boeing commercial airplane programs. Some even make a case of the crisis having started with the merger between McDonnel Douglas and Boeing in 1997 leaving Boeing as the sole US jet maker, but with “McDonnel Douglas” mindset leading the company.

The Aerospace Forum

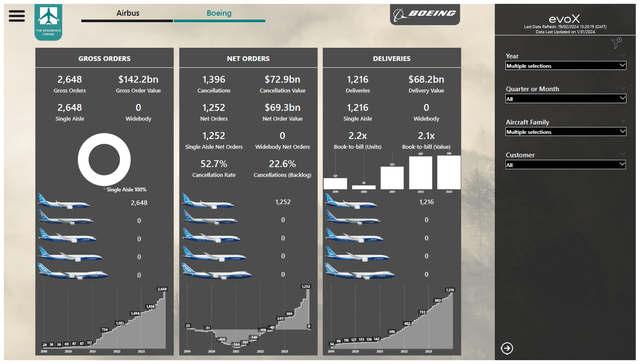

Focusing on the crisis impact in the single aisle airplane domain, the domain that accounts for over 75% of the total commercial airplane demand in the coming 20 years according to Boeing, we see that Boeing booked 2,648 orders since 2019 which is the year in which the second Boeing 737 MAX crash occurred and planes of the type were grounded. There is of course some impact from the pandemic, but Boeing net orders bottomed out in 2021 losing 564 orders since 2019 and are now up nearly 1,250 net orders. Measured against the gross order inflow the cancellation rate was significant at more than 50% and nearly one in every four orders in backlog was cancelled. Net order value stood at $69.3 billion with $68.2 billion worth of deliveries giving it a book-to-bill ratio above 1 partially reflecting the high demand for airplanes and on the other side the inability to efficiently service that demand due to global supply chain challenges as well as various production stops and delays. Net book-to-bill ratio was slightly above one also demonstrating why using a gross book-to-bill as opposed to a net book-to-bill can be somewhat deceiving.

The Aerospace Forum

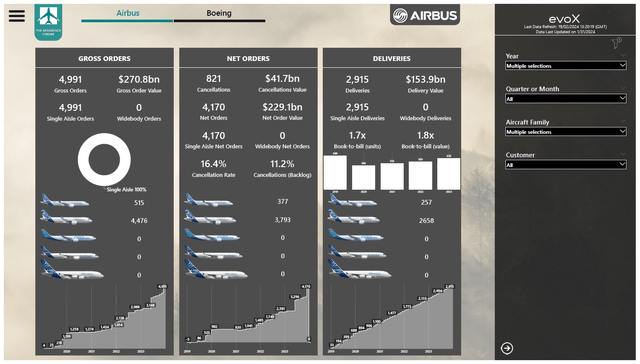

If we look at the single aisle numbers for Airbus combining the A220 and A320, we see that Airbus booked nearly 5,000 gross orders almost 80% more than Boeing while net orders and net order value were 3.3 times the number of orders Boeing received. The cancellation rates were 16.4% measured against the order inflow and 11.2% measured against the backlog while deliveries were 140% or $85.7 billion higher than Boeing. The net book-to-bill ratio 1.4x as compared to the roughly 1 for Boeing.

Airbus has been having an edge over Boeing in the years prior to the pandemic and the Boeing 737 MAX crisis collecting 45% of the orders according to our data analytics monitors. This suggests that Boeing has lost $188 billion in net orders due to the Boeing 737 MAX crisis. On narrow body production, both jet makers tend to follow each other quite closely with a slight edge for Airbus suggesting that Boeing underdelivered by nearly $165 billion.

In 2019, Boeing recognized $5.6 billion worth of charges related to the Boeing 737 MAX program. What is clear, however, is that the pains on order and delivery end are far worse than that.

More importantly, to show the positive impact the Boeing 737 MAX crisis had on Airbus we should consider the market shares for orders and deliveries. On the delivery end, where the business generates value, Airbus’ market share grew to 71% from a market share that used to be between 50 and 55 percent. The market share in orders jumped from 55% to 66%. So, Airbus won considerable business due to the Boeing 737 MAX crisis.

Boeing Has Lost Big Campaigns To Airbus

The significant change already shows that Boeing lost considerable business. If we look at which customers Boeing lost for its single aisle product, we see that the list contains quite some high profile names. Even though KLM and Transavia were Boeing-only operators with a long history of Boeing 737 activity in the fleet, Air France-KLM (OTCPK:AFRAF) chose to order up to 160 Airbus A320neo family airplanes. Qantas is another example of a Boeing 737 operator that selected Airbus instead of the Boeing 737 MAX. The Australian airline ordered 29 A220s and 28 Airbus A321XLR airplanes to replace its Boeing single aisle fleet which includes the Boeing 717 and 75 Boeing 737s with purchase rights for more airplanes.

United Airlines ordered 50 Airbus A321XLRs in December 2019 and followed up with an order for 70 A321neo airplanes in 2021. The continued problems on the Boeing 737 MAX program which are delaying the certification of the MAX 10 are pushing United Airlines to Airbus even more. Bloomberg reported that United Airlines is looking to lease up to 36 Airbus A321neo jets from lessors and if there were no constraints due to global supply chain challenges on production, I believe it would have been likely that United Airlines would have considered a large quantity of jets from the European jet maker.

It is not the case that Boeing did lose everything, it won customers for the MAX such as Delta Air Lines (DAL) and Allegiant Air (ALGT) but it is likely that the MAX crisis created an environment in which significant discounts could be obtained by the customers making such a deal attractive. The uptick in demand for airplanes supported a strong rebound of airplane prices from which both jet makers have benefited. However, the issues at Airbus did result in extra orders and the European jet maker is virtually sold out through the end of the decade on the A320neo program meaning that the orders it signs now are at very attractive prices for the jet maker. Boeing on the other hand had to discount to airplanes to make them attractive. So, the Boeing 737 MAX crisis resulted in significant pricing momentum for the Airbus A320neo.

Boeing Product Evolution And Revolution Is Falling Behind

After the problematic development of the Boeing 787 from cost as well as timeline perspective. Boeing grew adverse of moonshot developments and favored product evolution by means of equipping existing commercial airplane platforms with more efficient engines and wings. Such developments tend to be 10 to 15 percent more fuel efficient while completely new developments could be 20 to 30 percent more efficient. The fact of the matter is that Boeing’s evolution of products is stalling facing years long delays while completely new developments are off the table for the time being.

The Boeing 737 MAX 10 was launched at the Paris Airshow in 2017 and should contend with the Airbus A321neo entering service in 2020. While the MAX 10 was already a relatively late answer to the Airbus A321neo, the Boeing 737 MAX crisis is continuing to put pressure on the timeline and I expect the MAX 10 certification to be at least five years late. The MAX 7 certification will also be late, but the impact of that is far less given that the MAX 7 is not a very popular product among customers.

Boeing has been looking at launching a new mid-size jet for years but due to the complicated business case it had been hesitant to launch such a new product that would replace the Boeing 757 and some of the Boeing 767 market. In 2019, prior to the second fatal Boeing 737 MAX crash, the indications were that a launch decision would be made in 2020. Driven by a combination of the MAX crisis and the pandemic chances of a launch diminished. As Calhoun took over as CEO of Boeing in 2020, he ordered a rethink on the new mid-size jet effectively shelving the plan and in 2022 Calhoun’s words indicated that a new jet should not be expected this decade citing a lack in uptick in engine efficiency:

And I know you know where I come from, and I’ll try to be as clear as they can be. If you go back in history on new airplanes, they were never really started until the propulsion package brought somewhere around a 10%, 15%, 20% improvement over the last one. That’s not happening today. Now there are a lot of good ideas that are being tossed around on the subject of sustainability and new ways to power airplanes. That timeline is well out there, well out there, at least a decade from now, my view.

I have closely studied the prospects of the Boeing new-mid size jet as it had initially envisioned and I would say that the lack of advancement in propulsive efficiency is mostly driven by the fact that as the timeline for the jet has been sliding it would no longer make sense to compare it to some of the older airplanes while airplanes such as the A321XLR are available. Effectively this means that the development of the Boeing new-mid size jet has been delayed so much it comes too late to serve as a replacement to the Boeing 757, but too early to effectively compete with newer airplanes. Calculations from 2018, already showed that an early service entry would be difficult given the technological insertion points for propulsion systems but a service entry should have been possible in the second half of the decade. With the timeline sliding, a new Boeing jet would be simply too late to the market in my view to play a meaningful role.

The result is that due to the Boeing 737 MAX crisis, Boeing’s evolutionary products are late to the market. The Boeing 737 MAX 10 will likely be at least five years late to the market and the same holds for the Boeing 777X. Boeing’s revolutionary product, which should a clean-sheet design, could be at least a decade later than expected. All of that is to a major extent driven by the Boeing 737 MAX crisis. The Boeing 787, launched in April 2004, was Boeing’s last clean-sheet design and this means that Boeing has not launched an all-new jet in 20 years and it might even take 26 years before it will do so. That is a long time for a commercial airplane manufacturer to not launch a new product.

Meanwhile Airbus has been benefiting significantly launching an extra-long-range version of the A321XLR in June 2019. While plans for such a launch were there before the Boeing 737 MAX crisis fully unfolded, it is clear to me that while Boeing’s development trajectory has been largely static Airbus has been incrementally upgrading its product to become more and more dominant allowing the product efficiently capitalize on the trend of larger single aisle airplanes being utilized for operations to lower per-seat costs and connect cities for which wide body operations are not viable. The Airbus A321neo platform has a 70% market share in the A320neo family while it only 22% market share in the Airbus A320ceo family.

This demonstrates a demand spot that is largely uncontended by Boeing and where Airbus has been innovating for years.

Conclusion: Airbus Is Steps Ahead Of Boeing

I believe that ultimately Boeing and Airbus will both be doing well. For Boeing, that is on the condition that it makes the necessary changes to its systems and procedures. What is clear to me, however, is that Airbus benefiting from the crisis at its US counterpart in ways that will shape up the competitive field and product portfolio for years to come. The company has increased its market share in single aisle deliveries from 50-55 percent to over 70% whereas it kept strengthening the A321neo platform capabilities and increased its pricing power. Boeing has not been able to answer with either an evolutionary product in the form of the Boeing 737 MAX 10 or a revolutionary product design in the form of the new Boeing mid-size jet due to continued crisis situation. In some way, you could say that Boeing is at best five years and in the worst case at least a decade behind compared to Airbus and while Boeing is already seeing tens of billions of missed revenues compared to what the pre-crisis market shares would suggest. A continued stall on the innovative spirit of an engineering company could be even more costly.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.