Summary:

- Boeing’s stock faces multiple headwinds, including labor strikes, CEO changes, credit profile deterioration, and six consecutive years of earnings losses.

- The company missed both revenue and EPS in 2Q FY2024; management indicated an inventory headwind and continued cash burn, expecting a higher usage of cash than previously anticipated.

- Higher leverage amidst persistent unprofitability increases insolvency risk, facing further credit downgrades.

- The company delivered 32 of 737 airplanes in August, falling short of its target of 38 per month.

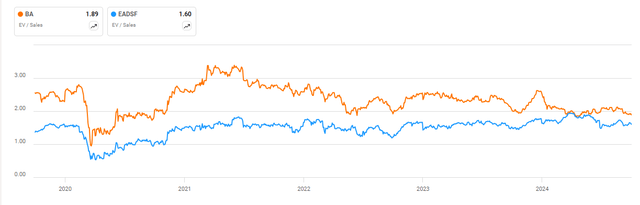

- Boeing’s EV/sales fwd is higher than Airbus’s, even as Airbus’s YTD deliveries have increased compared to the same previous period, in contrast to Boeing’s decline.

Wolterk

Investment Thesis

Boeing’s (NYSE:BA) stock has been under pressure as the company struggles turn around its growth. BA is facing several near-term headwinds, including a labor strike, the resignation of the former CEO due to the ongoing 737 Max crisis, credit downgrades, and, most importantly, six consecutive years of earnings losses since FY2019. These challenges limit the stock’s upside potential after a 50% price drop since early 2020. However, its EV/sales fwd is only 9% below its 5-year average, suggesting the stock’s risk-reward profile is not appealing. Moreover, the company’s high leverage ratio, combined with persistent unprofitability, increases its insolvency risk. While it’s possible the U.S. government could bail out Boeing to prevent bankruptcy during the potential recession, as it did during the 2020 pandemic, I believe the stock will remain a value trap in the near and mid-term. Therefore, I have initiated a sell rating on the stock to reflect these concerns.

Where is the Growth Inflection?

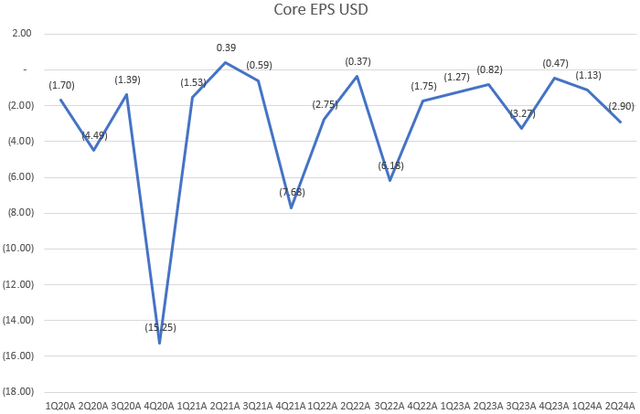

BA delivered another disappointing 2Q FY2024 earnings report, missing both revenue and core EPS estimates. As shown in the chart, the company has been losing money in nearly every quarter for the past four years. Although BA’s website only provides quarterly reports dating back to FY2020, Its FY2019 10-K indicated that the company also generated a net loss of $636 million during that fiscal year.

In 2Q FY2024, BA’s revenue declined by 14.6% YoY, largely driven by a 32% YoY drop in revenue from the lower deliveries of Boeing Commercial Airplanes (BCA) segment, particularly 737 MAXs. This represents a deterioration from the 7.5% YoY decline in 1Q FY2024. BA’s revenue growth has remained sluggish, with revenue TTM at $73.6 billion, which was 27% below its peak of $101.1 billion in FY2018.

Regarding the near-term outlook, management indicated during the 2Q FY2024 earnings call that BCA deliveries are expected to improve but cautioned that inventory will remain a near-term headwind as the company prioritizes supply chain stability. Despite management’s slightly positive tone regarding CY2025, I do not expect a strong growth turnaround in the next year. I believe this explains why investors remain patient and are staying on the sidelines for now.

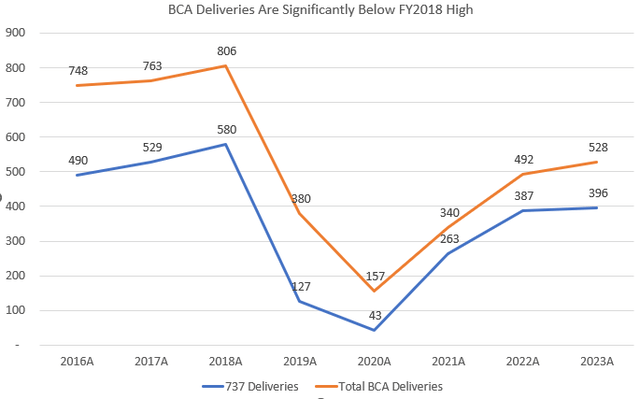

BCA Deliveries Are Under Pressure

The 737 models account for the majority of BA’s total deliveries, contributing 55% of total revenue in 2Q FY2024. As shown in the chart, although 737 deliveries have been improving, they remain below FY2018 levels. The company delivered 70 airplanes of 737 models in 2Q, which was below 103 delivered in the same period last year. The management expects roughly 38 per month going into 2H CY2024. According to a report, as of August, BA has delivered 258 airplanes YTD, compared to Airbus’s (OTCPK:EADSF) 447. In the same period last year, BA and Airbus delivered 344 and 433 airplanes, indicating Airbus has done a better job than BA. This puts BA 86 deliveries behind its YTD total from last year. The report also indicated that BA delivered 32 airplanes of 737s, falling short of its 38 per month target.

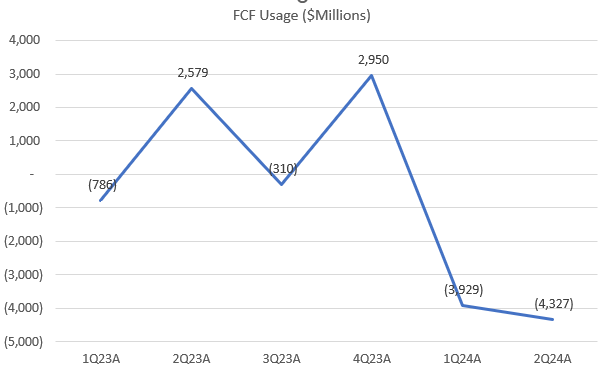

FCF Profile Continues Deteriorating

The company model

BA burned $4.3 billion in FCF during 2Q FY2024, an increase from $3.9 billion in 1Q FY2024, primarily due to lower commercial deliveries and working capital timing headwinds. The company acknowledged that its working capital challenges will persist, though it expects deliveries to improve in 3Q FY2024. During the earnings call, management indicated ongoing pressure on FCF in the near term, forecasting “a larger use of cash than previously expected.” They also stated that $10 billion is their “comfortable” cash balance, implying they would tap into revolving credit (which remains undrawn) if their cash balance fell below this threshold.

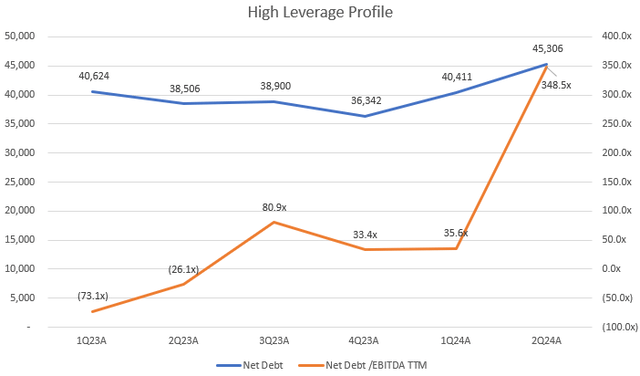

Credit Risk Is Trending Higher

In April 2024, BA’s credit rating was downgraded by S&P due to its 1Q FY2024 leverage profile, with concerns that the company would not generate sufficient FCF to cover upcoming debt maturities. Later, Moody’s also downgraded BA’s credit rating to just one level above junk status. A few months later, the company’s leverage profile significantly worsened in 2Q FY2024, as shown in the chart, with net debt (calculated as long and short-term debt minus cash, cash equivalents, and short-term investments) rising sharply to $45 billion, above its previous trajectory. This was driven by new debt issuance. At the same time, the company struggles to generate positive operating income have resulted in a very low EBITDA TTM number, leading to a net debt/EBITDA TTM ratio of 348.5x. Given that the average net debt/EBITDA ratio across most industries is typically below 5x, I believe that BA’s credit risk is likely to continue deteriorating, which will significantly impact its valuation multiples.

Continued Boeing Union Strike

The IAM labor negotiations are still ongoing, with no significant progress. While BA is attempting to strike a deal with the union, there’s a possibility that the negotiations could go south, leading to a prolonged labor strike, which is now in its third week involving nearly 33,000 machinists. This would further disrupt airplanes production and deliveries. The proposal includes pay raises and additional paid leave, which, if approved, will increase the company’s operating costs. Therefore, I believe BA’s turnaround story may take longer than previously anticipated.

Valuation

Despite the recent pullback, BA’s valuation multiples remain unattractive. Given its ongoing net losses, some valuation multiples such as P/E and EV/EBITDA TTM are not useful indicators. Since the company isn’t expected to reach profitability until at least CY2025, forward twelve-month multiples are also useless. Looking at its EV/sales TTM, BA is currently trading at 1.9x, which has been higher than Airbus’s multiple. Additionally, its EV/sales fwd is only 10% below its 5-year average. Considering its deteriorating credit profile, I remain cautious on the stock at this time.

Conclusion

In summary. BA faces significant growth headwinds that limit its stock’s upside potential, including multiple years of earnings losses, a deteriorating balance sheet, and persistent challenges in production and deliveries, particularly with the 737 MAXs. The company’s higher leverage ratio and negative FCF raise insolvency risks. In addition, the resignation of the former CEO and ongoing labor strikes further complicate its recovery amid the current economic slowdown. Although there are hopes for improvement in deliveries by CY2025, BA’s valuation is unattractive and more expensive than Airbus. With profitability not expected until beyond CY2025, I believe BA remains a value trap in the near to mid-term, justifying a sell rating until we see a clear growth inflection path.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.