Summary:

- Boeing’s significantly negative equity was likely brought closer to zero through the latest capital increase, which, on the other hand, diluted shareholders by 21%.

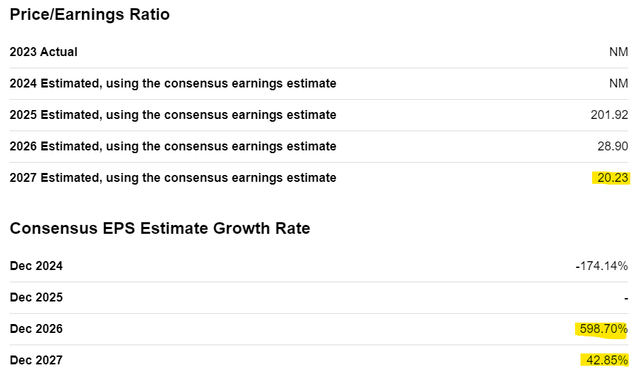

- A 2027 forward P/E multiple of 20 is still higher than that of the significantly more successful beneficiary Airbus at 15, or than highly profitable and growing Google at 15.

- Potential turnaround efforts, such as a promising new leadership, face monumental challenges in restoring quality and trust.

- Boeing’s strategic importance to the U.S. may ensure its survival, but this does not guarantee adequate shareholder returns in case more external financing might be required.

the_guitar_mann

Having been shocked by Boeing’s (NYSE:BA) series of partially fatal incidents and what I view as recklessly accepted mishaps over the past few years, the company never even came close to being a potential Buy candidate – just as it has been for many other investors. Even now, at the beginning of writing, at a price of $150 per share, the story still renders Boeing a Sell. The stock continues to drop as I write, now sitting at $139. But to avoid letting subjectivity take the lead, I will give the company an objective review and take a closer look at its valuation.

As often happens when some dust begins to settle and things appear to bottom out, proponents of Boeing’s turnaround story are making their case once again. After shedding light at valuation and some financials, I will discuss and summarize the recent qualitative arguments for and against Boeing and conclude with a commentary on why a potential company turnaround should not necessarily be mistaken for future shareholder returns.

Boeing’s Value Lies Entirely In The Future, If Any

While most methods of company valuation assess future earnings at present value, there is typically at least some existing equity on hand today – even if significantly lower than the market cap. On the other hand, companies like McDonald’s, for example, can carry negative equity but still justify their market cap through consistently reliable cash flows which are also expected to remain quite reliable in the future. Other companies, often young and high-growth, may also show little equity in relation to market cap and even operate at a loss, with their value derived from future profitability and anticipated strong growth.

So, what are we dealing with in Boeing? In my view, it is the worst of both worlds: $24 billion in negative equity prior to the recent capital raise, combined with erratic cash flows and, as recently evidenced, significant cash burn. And Boeing is certainly not a dynamic, high-growth startup either that would justify classifying Boeing under the earlier mentioned second category. Therefore, one must ask: what justifies a market cap of $103 billion today?

About Substance And Dilution

Let us revisit Boeing’s balance sheet closer: the recent capital raise of likely around $21 billion or more finally brings its negative equity closer to zero. What is a balance sheet improvement if only partially beneficial to shareholders, as future cash flows must now be shared among more shareholders, leading to dilution. There are currently about 750 million shares outstanding, which represents a 21% increase over the pre-raise count of roughly 620 million – hence, a dilution of about one-fifth. The most unfortunate aspect here: from 2014 to 2019, Boeing spent $42 billion to reduce its share count by a cumulative 200 million shares. Compare that to the current re-issuance of 130 million shares for probably more than $21 billion – a significant overall destruction of shareholder value.

The Turnaround Must Come

So, let us next move from the current situation to the midterm outlook. Boeing’s 2027 forward P/E stands at 20, which already assumes substantial earnings growth. A P/E of 20 appears high, given you must wait three risky years from now to land at it. Compare that to Airbus’ 2027 forward P/E of 15: a highly profitable competitor that has even benefited from Boeing’s challenges, yet it is valued lower. I will leave that without further comment. Even Alphabet – exceptionally profitable and growing – shows a 2027 forward P/E of 15, less than Boeing’s. In these comparisons, Boeing’s current market cap does not appear justified.

Seeking Alpha

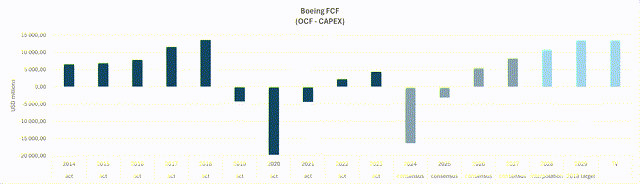

But is there anything at all to justify Boeing’s $103 billion market cap? Perhaps – if we assume Boeing can return to its peak free cash flow levels of $14 billion (seen in 2018) by 2029 and then sustain this as a baseline with 2% perpetual growth. Applying a 9% WACC and subtracting the net debt load, we arrive at roughly the current market cap. This implies that everything needs to go right over the next five years and beyond to support Boeing’s current valuation.

USD millions | Actuals: SA OCF – CAPEX | Consensus: dividendstocks.cash FCF projections (Author | Data: Seeking Alpha & dividendstocks.cash)

WACC was driven by the company’s above average Beta factor and offset by lower cost of debt, lately standing at a 6.44% (pre-tax shield) based on a 2040 bond yield to maturity.

Summarizing The Bigger Picture And Analysts’ Perspectives

Boeing’s effort to navigate its challenges, marked by management issues and poor decisions from the past, will be a monumental task to rectify. Significant declines in quality, reliability and reputation were rapidly self-inflicted, with Boeing repeatedly compounding the damage, involuntarily but recklessly pouring salt into the wound. The aftermath of what probably evolved from the McDonnell Douglas merger, which shifted the company’s focus from engineering excellence to financial maneuvering, has left Boeing at a clear competitive disadvantage from my perspective.

However, signs of a potential turnaround are emerging. The appointment of Kelly Ortberg, a CEO with an engineering background, is viewed as a step toward restoring the company’s former quality standards and engineering-driven culture, SA author Joseph L. Shaefer believes. The hope lies in a cultural shift where long-term thinking takes precedence over short-term financial goals.

Progress is also evident in the resolution of an eight-week strike, during which Boeing secured a labor agreement granting workers a 38% pay increase over 4 years among other, as well as in the planned acquisition of Spirit AeroSystems, a fuselage manufacturer. This acquisition has the potential to improve Boeing’s control over its supply chain, Envision Research expects. Meanwhile, competitor Airbus, with its robust financial position, has surged ahead. Boeing’s recovery will depend on Ortberg’s ability to stabilize operations, rebuild trust, and steer the company back to its core strengths.

The Fine Line Between “Turnaround” And “Shareholder Returns”

Although Boeing is likely to remain operational in the long term due to its strategic importance to the United States, this does not guarantee outcomes favorable to its shareholders. The recent capital increase has already resulted in dilution, highlighting exactly these kinds of challenges for investors. Measures such as direct financial injections, loans, or guarantees might come with conditions that erode shareholder value, including restrictions on dividends, share buybacks, or even the appointment of specific board members. If government support becomes necessary due to Boeing’s national importance, shareholder value is unlikely to be a top priority.

Moreover, Boeing might be compelled to sell strategic business units to improve short-term liquidity. Such sales, often made under pressure, could result in suboptimal pricing, reducing the company’s overall value and weakening its future earnings potential. SA Aerospace expert Dhierin Bechai recently highlighted the challenges associated with potential divestitures. The space business, in particular, could be considered a suitable target for a possible sale, as it is underperforming and facing intense competition. However, due to national security interests and its strategic role in the defense sector, finding suitable buyers and obtaining regulatory approvals would be no easy task.

At the same time, as Boeing struggles with internal challenges, it risks losing market share to Airbus – a loss that may prove difficult to recover. It should be noted, however, that competition among multiple providers is likely in the interest of airlines as well, particularly from a supplier diversification perspective.

In summary, while Boeing may survive and undergo restructuring, its shareholders face significant risks potentially making it a poor investment despite the company’s awaited recovery.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.