Summary:

- We had upgraded Boeing to a Hold rating in April.

- The stock had a nice bounce immediately after that but then got smashed lower.

- We analyze the recent news flow and tell you what you need to focus on.

Vladimir Zapletin/iStock via Getty Images

It would be fair to say that we have not been fans of The Boeing Company (NYSE:BA). We have been even less impressed with its stock price. That said, after, multiple sell ratings, we did upgrade the aircraft maker in April of this year.

Seeking Alpha

In our defense, we were expecting an oversold bounce, and we did actually get one right around our upgrade.

Seeking Alpha

We ended that note with these words.

Our take is that this is a great time for shorts to cover, and maybe some intrepid souls could take a short-term trade. But a buy point to make money over the longer term lies far lower.

With the stock down 11% and underperforming the S&P 500 (SPY) by another 25%, we take a look to see if we are reaching that point.

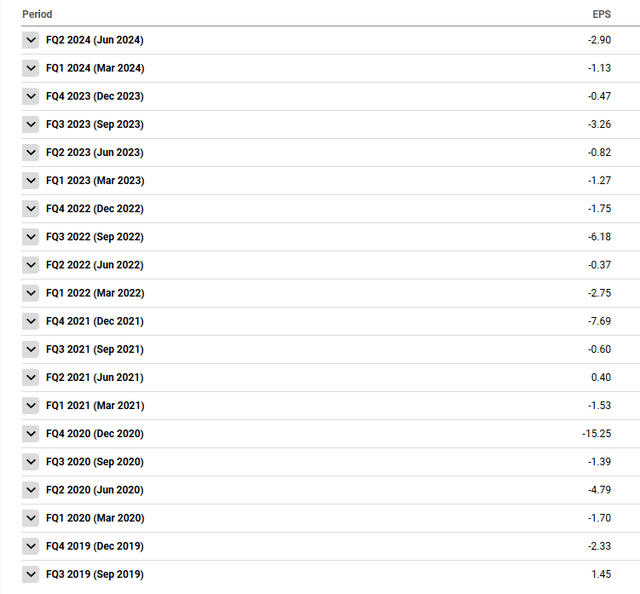

1) Earnings Per Share

Call us old-fashioned, but we think companies should actually make money. We are looking for actual GAAP earnings in our investments (except for REITs and some oddball companies where GAAP metrics don’t apply). BA has delivered a spectacular loss for about 5 years straight.

You have to applaud the consistency there, although Boeing did report one positive quarter in June 2021. But that history aside, we are looking for signs of consistent profits ahead before we buy. Perhaps the turnaround is here? Sadly, no. Boeing’s earnings estimates are crashing rapidly across the board. The only green numbers (increases) in the picture below come courtesy of the loss for 2024, getting far worse than what was expected.

We also want to point out that the analysts have been chronically wrong about this company. Back in 2021, when we wrote “Fooled By Randomness“, the expectations were that 2024 and 2025 would be cash gushers.

2) The Sales Multiple We Care About

Ok, on earnings, the story remains the same. Going from bad to worse on a consistent basis. The reason to own the stock has always been that, 5 years from now, Boeing will finally deliver. One reason we have gotten this story so right is that we have focused on another metric that is key. Enterprise value to sales/revenues ratio. This ratio is important as it assumes that margins will mean revert over time, so earnings in any one particular year, can be ignored. So when investors countered our bearish pieces with “they have a huge backlog”, our response was always to go back to this ratio. Whatever their backlog, it does not matter. Over time, this ratio will normalize. One other reason we preferred this over the more commonly used price to sales ratio is that the one we use, adjusts for the debt load. Price to sales ratio is in essence a market capitalization to sales ratio. There is no accounting for debt. That debt is a crucial part of the equation for Boeing. It wasn’t before COVID-19, but it certainly is today.

So where does this ratio stand today? At around 1.87. It does not matter whether you use this year’s numbers or the next one.

This ratio is so silly and so high that we continue to be amazed at analysts that have slapped buy ratings on this. Many have had bullish ratings on this even when the stock was near $260/share (EV to sales over 2.3X at the time). The entire history of BA prior to COVID-19 has shown that you fall on your derriere every time you pay more than 1.20X on this metric. But the intrepid bulls have gone dancing into twice that multiple because Boeing won some silly contract. So this ratio continues to signal extreme caution, and it will take years of repair and pay down of debt to get to a buy point.

3) Debt Ratings & The Recent Strike

This is an aspect we have gotten horribly wrong. We would have predicted that Boeing’s bonds would be deep into junk tiers by now. After all, we wrote this in 2020.

Seeking Alpha

We had actually given up on rating agencies waking up to this catastrophe, but almost 4 years later someone woke up and said, “hey, at this rate they will go under. Should we really call them investment grade?” Perhaps they did not want to top their call on subprime mortgages in 2008, so the slumbering rating agencies are finally coming around.

How did it come to this? S&P Global Ratings is weighing downgrading the credit score of Boeing, one of America’s most storied companies, to junk. The embattled planemaker continues to suffer from the fallout of a protracted labor strike. The walkout however is just the latest crisis for a company whose recent stretch of troubles go back at least six years, to two horrific crashes of its flawed 737 Max planes that killed 346 people. Since then, the hits have kept coming for Boeing. As for S&P, it estimates the company will incur a cash outflow of approximately $10 billion in 2024, due in part to costs associated with the strike.

Source: Bloomberg

Moody’s (MCO) said something similar in its update about a month back. Both focused on the strike, which is ironic, as we always thought the best thing Boeing could do was to stop making airplanes for a while. Whichever way this pans out, keep in mind that we are at one of the tightest credit spreads in history. When (not if) we hit a recession, expect Boeing’s interest costs to rise tremendously. This will happen even if the Fed cuts rates another 100 basis points. A lot of Boeing’s debt was placed in far happier times. See Exhibit A below.

So rates will rise on that debt load over time, and if you combine that with a 1-2 tier move into junk, you can expect some serious fireworks ahead.

Verdict

The stock is a bit oversold, so we are hesitant to short it here or put a Sell rating on it. We see the possibility of a bounce as the news flow improves. That said, Boeing is egregiously expensive. It missed its opportunity to issue tons of equity higher up. That was one of the worst management decisions, and that is saying a lot. We think, longer term, Boeing should trade in mid-double digits, and we would keep our eyes on the prize. That prize is a sub 1.0X EV to sales ratio.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

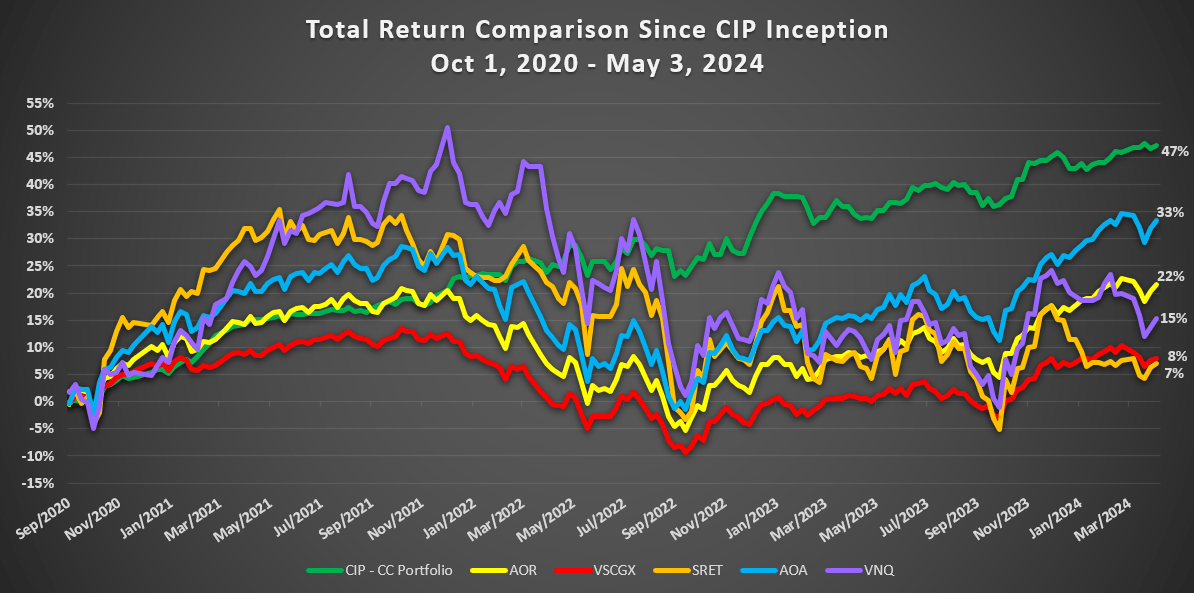

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with an 11-month money guarantee, for first time members.