Summary:

- Aerospace and defense stocks have performed well in the past year but have underperformed in the first half of 2024, dragged down by shares of Boeing.

- Boeing reported mixed quarterly results in April, with concerns over free cash flow and production challenges lingering ahead of July’s Q2 report.

- I see the stock in the range of its fair value and outline key price levels to monitor ahead of the upcoming earnings update.

sanfel

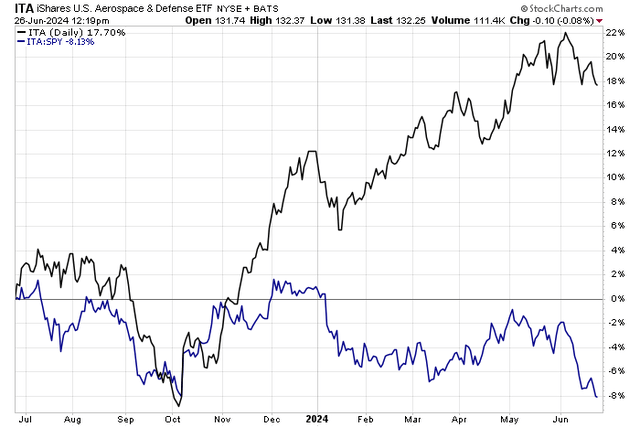

Aerospace and defense stocks have performed well on an absolute basis in the past year. The iShares U.S. Aerospace & Defense ETF (ITA) is higher by 18%, but there has been notable underperformance over the first half of 2024. While there are some macro challenges, including a strong dollar, there are also firm-specific bearish catalysts, particularly concerning one of the fund’s largest weights.

I have a hold rating on shares of Boeing (NYSE:BA) (NEOE:BA:CA). I see the stock as not far from fair value, but its chart remains troubled ahead of earnings next month.

Aerospace & Defense Stocks Losing Ground to the SPX

According to Bank of America Global Research, Boeing is the world’s leading aerospace company and the largest manufacturer of commercial jetliners and military aircraft combined. The different segments in the company are Commercial Airplanes, Boeing Defense, Space & Security (BDS), Boeing Global Services, and Boeing Capital Corporation, which provide financial solutions facilitating the sale and delivery of Boeing commercial and military aircraft, satellites, and launch vehicles.

Back in April, Boeing reported a mixed set of quarterly results. Q1 non-GAAP EPS verified at -$1.13, which was $0.30 better than what Wall Street analysts feared, but revenue of $16.6 billion, down 7.5% compared to year-ago levels, was a significant $620 million miss. Its backlog grew to $529 billion, which included more than 5,600 commercial aircraft, but operating cash flow was steeply negative, -$3.4 billion, amid lower commercial deliveries.

Shares fell 2.9% during the following session, giving back significant gains in the moments immediately after the numbers hit the tape. Its free cash flow burn rate was better than forecasts due to strong results from its Defense and Services units, but the elephant in the room was (and continues to be) its 787 production challenges. Making matters worse was a credit rating downgrade from Moody’s. Free cash flow remains a key concern for the company, particularly after the announcement of the acquisition of Spirit AeroSystems.

Key risks include product development challenges with so much focus on its safety issues and its 737MAX, among other new aircraft, could feature additional operational concerns and costs coming in above the firm’s expectations. Bigger picture, higher energy prices and a macro slowdown would likely hinder Boeing’s top line. Being a large multinational, adverse currency moves could reduce profits too. Ahead of earnings due out next month, the options market has priced in a 4.8% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the report, per data from Option Research & Technology Services.

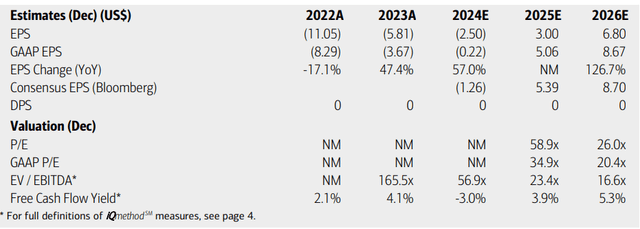

On earnings, analysts at BofA see operating EPS recovering this year, then rising sharply to more than $5 in 2025. By 2026, nearly $9 in non-GAAP per-share earnings is the forecast. The current Seeking Alpha consensus outlook calls for comparable EPS trends while revenue growth is forecast to increase markedly in the out year, from $79 billion in FY 2024 to $95 billion. Net sales could then rise to $106 billion by 2026. No dividends are expected to be paid on this blue-chip Industrials-sector stalwart, but the company could post decent free cash flow levels next year through 2026.

Boeing: Earnings, Valuation, Free Cash Flow Yield Forecasts

The valuation is tricky with Boeing today, given negative historical earnings. But if we assume $8.60 of operating EPS in 2026 and apply a sector median earnings multiple of 18.4, then shares should trade near $158, putting the stock slightly overvalued today. I will be interested to see how free cash flow trends evolve – if Boeing can produce increased FCF by 2026, then it could warrant a better multiple. What’s more, several quarters of profitability clarity could increase the chances of a dividend payout.

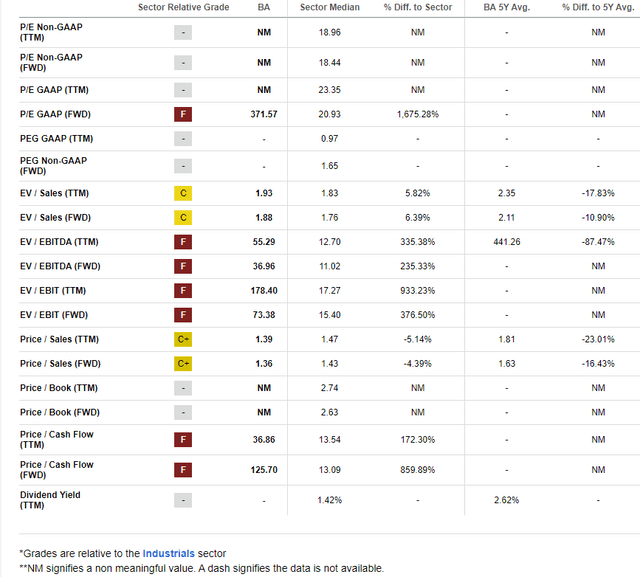

BA: Low Price-to-Sales Ratio, Uncertain EPS Future

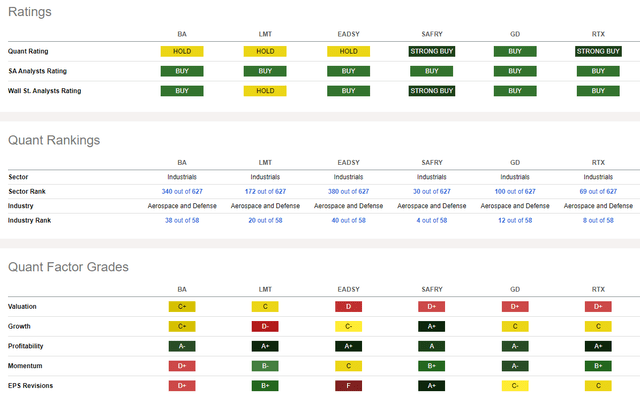

Compared to its peers, BA features a decent valuation grade though its growth trajectory is middle of the pack. But with profitability trends that are inflecting positive, much of the pessimism surrounding the company may be priced in. Still, share-price momentum is quite weak as the stock has been a massive laggard in recent years. What’s more, the company faces highly negative sentiment from the sellside community, evidenced by 22 EPS downgrades in the past 90 days compared with just a lone upgrade.

On a price-to-sales basis, though, BA trades at just 1.36x on the forward view, below its 5-year historical average of 1.63x, auguring for a higher fundamental share price.

Competitor Analysis

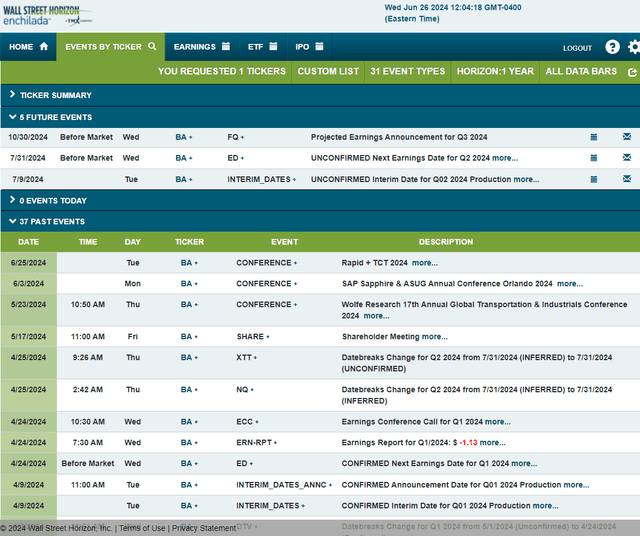

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2024 earnings date of Wednesday, July 31 BMO. Before that, Boeing reports interim production figures on Tuesday, July 8.

Corporate Event Risk Calendar

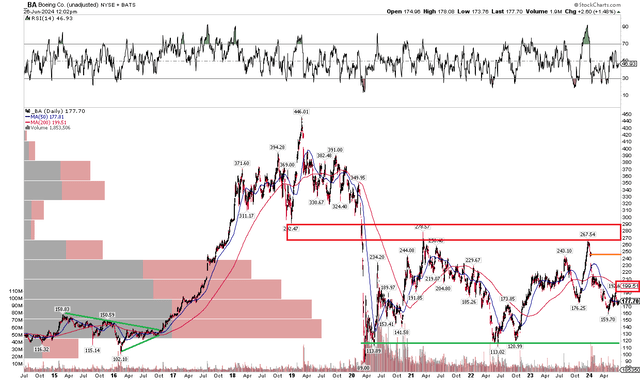

The Technical Take

With an uncertain future regarding free cash flow and net earnings, BA’s technical chart is likewise frustrating if you’re a bull. Notice in the graph below that shares remain below key long-term resistance in the $268 to $292 range. I see support near the $113 mark. That makes the current stock price in no man’s land, though there is a lingering price gap above $240 that could eventually get filled. With soft RSI momentum trends and a high amount of volume by price in the $110 to $240 range, however, I don’t envision BA challenging that gap any time soon.

Also take a look at the long-term 200-day moving average. It’s negatively sloped, suggesting that the bears control the primary trend. We could see a few buyers step up to the plate at the April low of 159.70.

Overall, with severe relative weakness in its industry, sector, and broad market, BA’s absolute momentum is weak.

Boeing: Within A Trading Range, 200dma Trending Lower

The Bottom Line

I have a hold rating on Boeing. I see shares as close to fair value when scanning valuation metrics, while the technical situation is poor amid an S&P 500 that is near all-time highs.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.