Summary:

- Boeing is facing a crisis following the Boeing 737 MAX 9 accident, with production rates dwindling and FAA banning production increases.

- Boeing’s airplane orders and deliveries have significantly decreased, with net orders down year-on-year and deliveries declining by 52%.

- Boeing is under significant pressure, with analysts predicting a rise in net debt due to lack of deliveries and a need for a capable CEO with an engineering background.

Wirestock

The Boeing Company (NYSE:BA) is once again in crisis mode as the company is in the crosshairs of the Department of Justice following the accident with a Boeing 737 MAX 9 in January this year. While expectations were high for this year with a promising path towards a near-full recover on airplane production rates, hopes of that have now dwindled. Things are so bad at Boeing that the FAA has banned Boeing from raising production on the Boeing 737 MAX program and airline executive have been dissatisfied with the US plane maker, leading to Boeing CEO David Calhoun announcing his departure by year-end.

Boeing CEO Calhoun was also blasted by senators in a hearing with senators and all while this report is not the main topic, one thing to me was clear and that was that Calhoun is in no way equipped to lead Boeing and its stakeholders to greener pastures. Meanwhile, Boeing’s stock has lost nearly a third of its value year-to-date putting on display how a lack of safety culture and a cash oriented business approach can eventually backfire.

That things are not going well at Boeing is also evident from their airplane orders and deliveries, as I discuss in this report.

Boeing Airplane Orders And Deliveries Fall

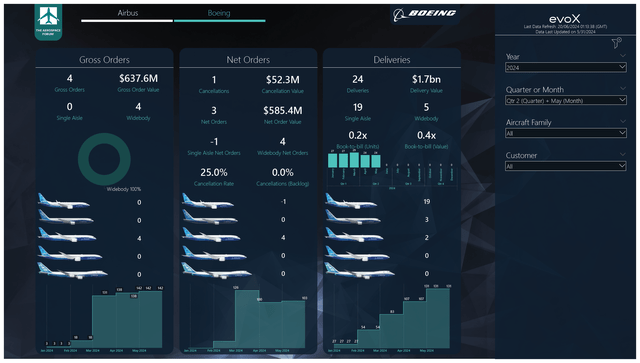

In May, Boeing logged four gross orders, all of which were for wide body airplanes with a value of $637.6 million with EVA Air being the sole customer with an order for four Boeing 787-10 airplanes. During the month, the plane maker saw Aerolineas Argentinas cancel an order for one Boeing 737 MAX while ICBC Leasing was identified as the customer for two Boeing 737 MAX airplanes.

With four gross orders and one cancellations, the net order tally for the month was just three units with a net order value of $585 million. In the same month last year, Boeing booked 69 gross orders and 11 cancellations, bringing its net orders to 58 aircraft valued at $3.2 billion. Year-to-date, Boeing has collected 142 gross orders and 39 cancellations, bringing the net orders to 103 valued $10 billion. In the same period last year, the company logged 223 gross orders and 96 cancellations, bringing the net order tally to 127 valued $12 billion.

So, what we don’t see is a significant uptick in cancellations as those are actually down year-on-year, but we see that the gross order inflow has been down considerably. To me, the crisis impact seems to be rather clear. With the Boeing 737 MAX and Boeing 787 programs being at production rates significantly below the targeted rates and little certainty for customers on when they can get a hold of the flight equipment that can cost anywhere between $50 million and $200 million per airplane, there is no strong reason to be ordering airplanes. On top of that, in the storm that Boeing finds itself in now, airlines might not all be inclined to order Boeing airplanes due to the current reputation of the plane maker. Some airlines eventually may look to see whether they can harvest some additional discounts for other from Boeing in these times, but many are remaining on the sideline. While things do seem to be bad for Boeing, we should also keep in mind that some months prior to big airshows, it is possible to see order inflow dry as order announcements are collected to be released during the airshow. This year, the Farnborough Airshow will take place in July 2024, and I would say that that event will really put the marker on how big the appetite for ordering airplanes from Boeing really is.

During the month, Boeing saw no changes in its ASC 606 adjustments tally, which records orders for which a purchase agreement exist but additional criteria are not met.

In May, Boeing delivered a total of 24 airplanes consisting of 19 single aisle airplanes and 5 wide body airplanes valued $1.7 billion:

- Boeing delivered 19 Boeing 737 MAX aircraft.

- Boeing delivered six Boeing 767 airplanes, including two base aircraft for the KC-46A tanker and one Boeing 767-300F for FedEx Express (FDX).

- Boeing delivered two Boeing 787-9 airplanes.

Currently, Boeing is producing at rates far below the rates that the master schedule dictates. On the Boeing 737 MAX program that is driven by the increase quality inspection and integrating stronger quality management system and on the Boeing 787 program it is mostly driven by bottlenecks in the supply chain while the Boeing 777 and Boeing 767 programs lean on freighter sales while the freight market is going through a recession and the Boeing 777X has yet to be certified.

In the same period last year, Boeing delivered 50 airplanes valued $3.8 billion. Measured by deliveries, we see a 52% decline and a 55% decline measured by dollar value. Year-to-date, Boeing has delivered 131 airplanes valued $9.5 billion compared to 206 deliveries valued $14.5 billion last year, indicating a 36% and 34% decline respectively. The book-to-bill ratio for the month was 0.2 in terms of units and 0.4 in terms of units while year-to-date, the ratios are 1.1x and 1.4x driven by weak deliveries.

Overall, we see deliveries stable at 24 units and there is no indication that Boeing will make up for the lower deliveries in the back half of the year. Currently, the expectation is still that Boeing will be delivering more airplanes in the balance of the year, but the year is shaping up to be another disappointing one for Boeing.

Conclusion: Boeing Is Under Significant Pressure

Looking at the orders and deliveries, we see that Boeing is under significant pressure. The orders may pick up during the Farnborough Airshow in July which I consider to be a marker for appetite for Boeing airplanes and I am also anticipating an increase in airplane deliveries in the balance of the year, but overall, it is just going to be a bad year for Boeing. The anticipated repair of the balance sheet as well as confidence in Boeing’s brand is not going to happen this year. For 2024, analysts had initially expected a net debt position of around $30 billion but since the accident with the Boeing 737 MAX 9 that estimate has risen towards $36 billion. The major factor is of course the lack of deliveries which enable a significant cash flow, but we should also point out that even the smaller cash inflows upon signing of airplane orders is weaker as Boeing is simply not able to efficiently finalize airplane purchase agreements at this point.

The best thing for Boeing right now is for a capable CEO to be selected and I believe that this person should be someone with an engineering background capable of bringing the right engineering mindset embedding safety, ethics and quality throughout every rank of the organization. I am maintaining my buy rating as I believe that Boeing will in the end get it right. In my opinion, David Calhoun was simply not the man fit for the job and it cost Boeing four years on its way to recovery, while it should also be pointed out that the pandemic-driven exodus in the aerospace industry has not helped Boeing building back in a qualitative way.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.