Summary:

- Boeing faces significant self-inflicted challenges, with disrupted airplane production impacting deliveries, necessitating close tracking of monthly figures.

- September saw a modest increase in deliveries, but overall, there’s a notable year-over-year decline in both orders and deliveries.

- Despite long-term potential, Boeing’s near-term struggles with production stability and cash flow due to prolonged strikes lead to a hold rating.

- Leadership needs to improve decision-making and employee relations to unlock future value for shareholders, employees, and customers.

Jon Tetzlaff

Boeing (NYSE:BA) is currently being slapped from all sides and all I can say is that much, if not everything, is self-inflicted. This report will not be about the preliminary results that Boeing published last week. That’s something that will require a separate report, as there are a lot of things to unpack. Instead, in this report, I will be discussing the monthly airplane orders and deliveries. With airplane production disrupted with far-reaching implications for Boeing and the supply chain, it’s important to continue tracking the monthly figures.

Boeing Adds Airplane Orders For 737 MAX And Freighter

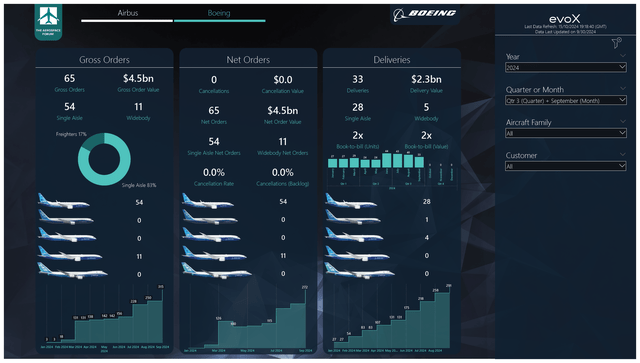

In September, airplane orders increased sequentially from 22 orders to 65 airplane orders. There were two orders from unidentified customers, namely an order for 54 Boeing 737 MAX airplanes and an order for 11 Boeing 777F airplanes, with a combined value of $4.5 billion.

During the month, the following changes were made to the order book:

- China Southern Airlines was identified as the customer for one Boeing 737 MAX.

- China Eastern Airlines was identified as the customer for one Boeing 737 MAX.

- Shenzhen Airlines was identified as the customer for two Boeing 737 MAX airplanes.

- ICBC Leasing was identified as the customer for one Boeing 737 MAX.

- Air New Zealand converted an order for three Boeing 787-10s to orders for three Boeing 787-9s.

When looking at the order inflow in September, there’s not really a lot to be excited about. What I think, however, is important to point is that Chinese customers being identified shows that the delivery flow to China is intact and that contrasts with the views many pessimistic investors had that China would not be ordering or taking delivery of airplanes from Boeing anymore. Generally, what holds is that the demand for Boeing airplanes has still been strong. The bigger problem has been that Boeing has not been able to meet the delivery schedules at all.

In the same month last year, Boeing booked 224 gross orders and 10 cancellations, bringing its net orders to 214 aircraft valued at $17.7 billion. So, we do see that order inflow was significantly lower year-over-year, while the mix was also less favorable.

Year-to-date, Boeing has gathered 315 gross orders and 43 cancellations, bringing the net orders to 272 valued at $22.3 billion. In the same period last year, the company logged 848 gross orders and 124 cancellations, bringing the net order tally to 724 orders valued at $61.8 billion. So, we see a significant decline in airplane orders, and given the lower production that Boeing has on the Boeing 737 MAX program, leading to uncertain delivery schedules, it’s not odd to see a sharp decline in order activity. It might sound odd, but my concerns are not at all centered on the order book or order inflow.

During the month, the ASC 606 adjustments tally, which records orders for which a purchase agreement exists, but additional criteria are not met, increased by 66 units. A doubtful order for 65 Boeing 737 airplanes and one Boeing 787 was added to the adjustment tally. Overall, the tally of orders for which a purchase agreement exists, but additional conditions are not met, increased from 675 to 741, meaning that almost 12% of the order book is currently doubtful. However, once the additional requirements are met, we could also see the tally reduce. So, while ASC 606 adjustments may be a prelude to a cancellation, that’s not necessarily the case. Especially over the past year, we saw the tally reduce at times without the order being cancelled, meaning that the additional set of requirements to count the order to the backlog was met.

Boeing Airplane Deliveries Are In Crisis Mode

In September, Boeing delivered a total of 33 airplanes, consisting of 28 single aisle airplanes and five wide body airplanes valued at $2.3 billion:

- Boeing delivered 28 Boeing 737 airplanes, consisting of 27 Boeing 737 MAX airplanes and one P-8A Poseidon deliveries.

- Boeing delivered one Boeing 767-300F.

- Boeing delivered four Boeing 787s, all of which were -10 models.

What holds for Boeing is that it was already producing below the targeted rates on the Boeing 737 MAX and Boeing 787 programs, and the strike obviously has not made things better. In fact, the current deliveries do not even show a delivery flow as we would see it during a strike, as Boeing delivered around 20 airplanes to customers before the strike began. It was a bit of a race against the clock, with Boeing pushing 13 airplanes to customers in the five days before the strike commenced. October numbers are without any doubt going to be worse, as Boeing delivered only two airplanes in the first two weeks of the month.

In September last year, Boeing delivered 27 airplanes valued at $2.6 billion. So, deliveries are higher year-on-year, but the delivery value fell from $2.6 billion to $2.3 billion, signaling a less favorable delivery mix. To date, Boeing has delivered 291 airplanes with a value of $21.1 billion compared to 371 deliveries valued at $27.3 billion a year ago, indicating a decline of 22% in units and 23% in terms of value, pointing to a better delivery mix.

The book to bill ratio for September was 2x in terms of units and 2x in terms of value, while for the nine months of the year it’s 1.1x and 1.2x, reflecting Boeing not producing in line with its production plans.

Hold Boeing For The Long Term

Those who have been reading my Boeing coverage know that in the near term I believe that Boeing has been a hold or even a sell, but for the long term the stock could rebound as demand for commercial airplanes has a favorable profile. That’s why I have maintained a buy rating. However, I’m now switching from a long-term view to a near-term view with a hold rating as we see that the prolonged duration of the strike has significant impact on Boeing’s cash flow, but more importantly, its production stability. I believe that most progress that Boeing had booked in sustainably increasing production volumes coupled with increased manufacturing quality has now been lost while the company continues to burn cash and an equity raise to service the debt and the cash flow burn seems to be inevitable to me. As a result, I do believe a better buying opportunity – even for the long term – will present itself once Boeing reaches an agreement with the unions and raises cash to service maturing debt in the years to come. So, I’m not changing my view, but the focus is shifting more toward how Boeing will address issues in the near term and on that end the company has yet to deliver and also does not have a great track record given the way it has handled near-term issues over the past five years.

Conclusion: Boeing Is At Risk To Throw Away Progress And Prospects

It almost goes without mentioning that the order numbers at this point are close to meaningless. Orders obviously do fuel the backlog, but currently the focus is on the deliveries and Boeing is evidently not doing great on that end and will also not be doing great in October. Perhaps, once a labor agreement is reached, things get better for Boeing, but currently the company feels like a rudderless ship. The decision to cut jobs is also not one that, I believe, is going to help Boeing, leaving the issues of the past behind. So, we really do need to see leadership doing better and so far, with not resetting the relations with employees and cutting jobs, I don’t think the company has done well, and I also have to say that Ortberg’s first months as the CEO of Boeing have left me unimpressed. Do I think that Boeing’s star can rise in the future? Most definitely. However, the company needs to make the right decisions to unlock tomorrow’s value for employees, shareholders and customers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.