Summary:

- The Boeing Company’s new CEO faces challenges with program overhangs, but 737 MAX production has increased, especially for deliveries to China.

- Despite tensions, China relies on Boeing for air travel, with deliveries to China crucial for Boeing’s balance sheet and long-term competitiveness.

- Deliveries to China are important for Boeing’s balance sheet, reducing inventory and liabilities while increasing cash flow, and showing small improvements in Boeing’s path.

Boarding1Now/iStock Editorial via Getty Images

With The Boeing Company’s (NYSE:BA) new CEO taking the lead of the troubled company, things are not going to change overnight, nor do I expect them to. Several program overhangs remain and need time to be dealt with, and the lesson Boeing has learned the past 5 to 6 years is that rushing things eventually comes at a price.

That, however, does not mean that there is absolutely no progress. Boeing 737 MAX production has increased over the past months and if all goes well, there will be another increase in production later this year. One area where Boeing is making progress is the reduction of its pre-built airplane inventory of Boeing 737 MAX 8 jets that were produced before this year. The delivery flow of airplanes destined for China plays a key role, as I demonstrate in this report.

Boeing: China Is A Key Market

Amidst Boeing’s single aisle troubles and the tensions between China and the US, there are two recurring elements in some comments from investors. The first one is that maybe Boeing should just give up on the single aisle market, and the second one is that Boeing should just give up on deliveries to China altogether. Neither of those comments capture the reality that it takes at least two manufacturers to service demand. Three out of every four projected airplane deliveries in the coming 20 years are single aisle airplanes, while China accounts for one in every five narrow body deliveries. So, simply giving up on China or the single aisle market altogether is just an unrealistic thought, even with the challenges that Boeing faces.

China Needs Boeing

While tensions between the US and China are high, which at times affects Boeing, the reality is that China has carefully crafted its tariffs on airplanes to exclude airplanes that are important to the Chinese travel market. Furthermore, we see that while at times deliveries are halted, which I believe at times is a function of rising tensions, but we also see that China is trying to get enough airplanes in to handle their peak travel seasons. So, China definitely relies on Boeing to efficiently service air travel.

In the years that David Calhoun was the CEO of The Boeing Company, I did not see him doing many good things. However, by publicly stating together with CFO Brian West that some jets that were built for China and could not be delivered would be remarketed, they put pressure on the Chinese regulator to allow the MAX back in the air. Reactivation of the Boeing 737 MAX fleet began in 2023 and was completed by the end of the same year. The reactivation of the nearly 100 airplanes that were already delivered to Chinese deliveries was a prerequisite for new airplane deliveries to commence.

A Look At The Boeing 737 MAX Trends In China

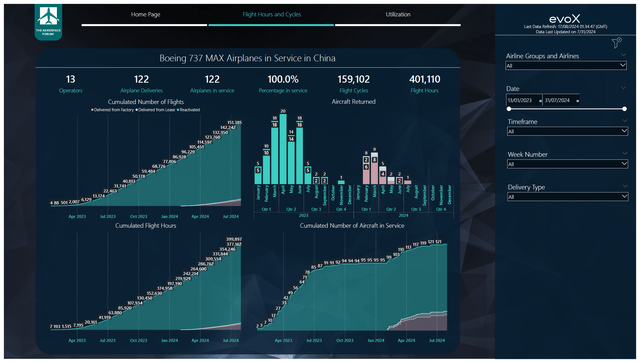

Initially, there were around 140 already built jets that should have been delivered to China. Boeing ended up remarketing 55 jets, labeling 85 jets destined for China by the end of 2023. By June 2024, the number of jets destined for China had been reduced to 65, which seems to be matching our tracked deliveries. By July, another nine airplanes had been delivered but had not entered service. Some of these jets had already been delivered on contract, but not handed over physically.

Assuming that Boeing does not remove airplanes from its inventory tally until physically delivered, we would see the number of airplanes for China in inventory down to 56 units by July. Assuming that around 10 airplanes are delivered monthly thereafter, it indeed seems to be that Boeing will have fully delivered its fleet of airplanes destined for China by the end of this year.

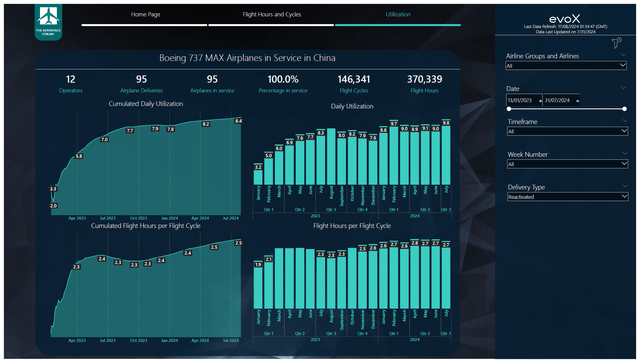

Looking at the flight hours in China, we see that the fleet of airplanes that entered service was 122 airplanes by the end of July. This marked a nearly 30% increase in the MAX fleet size in China, with another eight airplanes that have been delivered but only entered service in August. This would indicate that by the end of August we could see the fleet growth being 37% as a minimum. Those airplanes have accumulated over 400,000 flight hours on over 159,000 flights. The deliveries from Boeing this year account for 6.4% of the total flight hours and 16.1% of the hours since Boeing resumed deliveries.

If we look at the utilization of the reactivated fleet, we see that since January 2024 the utilization has been significantly higher, and that is driven by the full-year effect of reactivation. The growth of capacity this year was driven by the annualized effect of the reactivation. What this also means is that for further growth, there is little to gain in terms of daily utilization increases of the jets. New airplane deliveries are required, and the conclusion that one can draw is that to grow its travel market, China needs Boeing airplanes. Even more so when we keep in mind that the Chinese COMAC C919 is still not being produced in game-changing quantities, and Airbus will produce fewer aircraft this year than initially anticipated.

Why Are The Deliveries To China Are Important To The Boeing Balance Sheet?

The reduction of the inventory of planes is significant, as it allows Boeing to reduce its $74.5 billion commercial airplane programs inventory. This is partially offset by inventory increases on the Boeing 777X program. Additionally, as airplanes are delivered, the portion of prepayments that the customer made for the airplanes is also removed. So, a delivery means a reduction in inventories, advances, and progress payments on the liabilities side and might also increase the cash position as a final delivery payment comes in. So, some of these levers to improve the balance sheet are not apparent immediately and take time to materialize, but they are most definitely there. It also shows the importance of having a smooth production and delivery flow.

Conclusion: Boeing’s Path Will Be Long, But We See Small Improvements

I believe that when analyzing certain matters such as the complexities at Boeing, you should firmly root your analysis or view in market intelligence or data and that is what we did. It, undoubtedly, shows the need for Boeing airplanes in the Chinese travel market and puts on display rather well that pulling out of China or the single aisle market is unrealistic at best.

I believe that China, despite the U.S.-Sino tensions, will be an important market to Boeing for years to come even if the market share is lower. Every sale made to China is a sale not going to Airbus or COMAC and helps Boeing repair its balance sheet and gives it the ability to develop more competitive airplanes in the future. Leaving that uncontested gives the competition pricing power while potentially leaving Boeing less competitive in the market. I believe that while the challenges for Boeing are still there and will only unwind slowly, there still is a compelling long-term investment case as Boeing’s product remains in demand even in China.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.