Summary:

- Apart from a poor 2Q24 performance, obstacles continue to plague Boeing; ongoing worker strikes are likely to affect its operations and liquidity.

- Despite these, recent developments such as the change in the CEO and the acquisition of SPR indicate that the company is proactively addressing safety and quality issues.

- Core drivers such as passenger traffic growth, industry’s capacity struggles, and a surge in defense spending will continue to support demand for Boeing’s products and services.

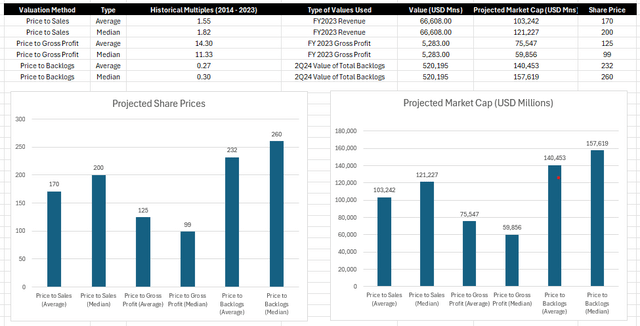

- Valuation analysis suggests that BA stock should trade between $99 and $260, representing an attractive risk-reward profile of 1.96x and a potential upside of 69.6%.

nycshooter

Introduction

Ever since the Covid-19 sell-off, share price of Boeing (NYSE:BA) has yet to recover from its pre-pandemic high. In fact, since 2020, the company has been consistently in the spotlight for the wrong reasons! Four years after the sell-off, BA is still about 54.9% below its pre-pandemic share price.

As a contrarian, I cannot help but question whether this represents an opportunity or a value trap. Based on my analysis, although it is likely that BA’s issues will continue to persist, the worst is over for the company. In addition, the company has taken proactive actions to address safety and quality issues. More importantly, the core demand drivers for the company remain strong. In this report, I will demonstrate why BA is poised for a turnaround and investors should start accumulating shares of this company.

Latest Developments

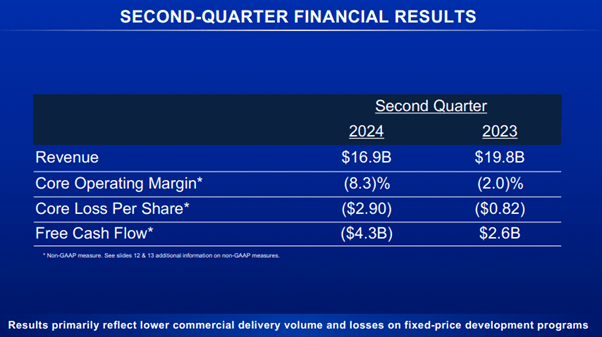

BA 2Q24 Financial Summary (Earnings Presentation)

Based on the company’s latest earnings report, BA has unsurprisingly disappointed investors again. During this period, the company has delivered 92 airplanes and generated revenues of $16.9 billion, representing a year-on-year decline of 14.6%. Overall EPS for the quarter was significantly worse than the same period last year, coming in at -$2.9 as compared to $0.82. BA has not provided any outlook or guidance in 2Q24. Additionally, on the 1st of July 2024, BA announced that the company will acquire Spirit AeroSystems (SPR) in an all-stock transaction at a total value of $8.3 billion with an equity valuation of $4.7 billion ($37.25 per share).

Obstacles Continue to Plaque Boeing’s Progress

For those who have not been following the company and the aviation industry closely, BA is no longer synonymous with safety and industry leadership. Ever since 2019, BA has been affected by an endless stream of negative events.

Between 2019 and 2020, the company halted production of 737 MAX aircraft after it has been grounded and BA acknowledged one of the aircraft’s feature (i.e. MCAS) had played a role in two fatal crashes, killing hundreds of people. In 28th August 2020, the FAA grounded BA’s 787 Dreamliners due to manufacturing issues, costing BA more than $20 billion and resulting in deliveries being halted by more than a year.

In 2023, BA found that a supplier (i.e. Spirit AeroSystems) had used a “non-standard manufacturing process” affecting a significant number of 737 MAX aircraft. On 5th January 2024, during a flight, BA’s 737 Max experienced a door plug blow out, leaving a huge hole during mid-flight! On 1st March 2024, the FAA continue to flag more safety issues for BA’s 737 MAX and 787 Dreamliner. Finally, recently, on 13th September 2024, more than 33k union members went on strike; in response, BA will furlough workers to preserve liquidity.

Boeing is Taking Multiple Steps to Resolve Their Difficulties

By now it is clear that BA is grappling with numerous problems on multiple fronts. However, it is important to note that, unlike the past four years where BA appeared to inadequately address their challenges, the company has embarked on multiple initiatives to resolve their current crisis and remain focus on safety.

Firstly, BA has finally replaced its Chief Executive Officer, Dave Calhoun. Ever since Dave Calhoun headed Boeing in 2020, BA had been plagued by negative events. Calhoun was hired to fix Boeing problems, but after four years, he not only departed with a 2023 compensation of $32.8 million but also left behind a legacy of problems. On 8th August 2024, Robert Kelly Ortberg had replaced Calhoun who managed to lead Rockwell Collins to become one of the major aviation suppliers. Although it remains to be seen whether Ortberg will successfully turnaround BA, at least Ortberg has led by example, enforcing the leadership team to take a pay cut (including himself) as the ongoing strikes continue.

Secondly, as a response to the recent door plug issue, BA’s submitted Safety & Quality Plan had indicated that the company is pursuing actions to prioritize safety and enhance overall quality. In addition to a host of safety related implementations such as simplifying of processes and procedures and strengthening supplier oversight and monitoring, the company has operationalized safety-focused KPIs to ensure that the company has real-time insights to be able to address quality and safety hazards in advance.

Finally, after the door plug debacle, BA’s plans to buy back SPR indicates that the company is taking proactive actions quickly to ensure safety and quality. The acquisition of SPR will allow BA to have tighter control and oversight to its manufacturing process. In a press release by SPR, Pat Shanahan, Chief Executive Officer, have stated, “Bringing Spirit and Boeing together will enable greater integration of both companies’ manufacturing and engineering capabilities, including safety and quality systems”.

Keys Revenue Drivers Remain Intact

Despite all the negativity that BA had faced over the past four years, there are multiple revenue drivers that continue to support the demand for the company’s products and services. Key drivers include: (1) aircraft capacity struggles, (2) passenger traffic growth, (3) healthy backlogs, and (4) surge in defense spending.

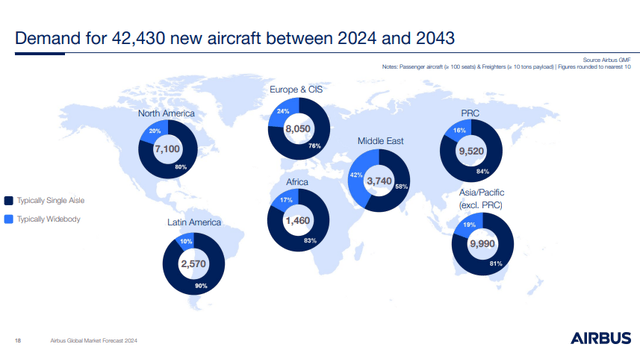

Aircraft Demand (2024 – 2043) (Airbus Global Market Forecast 2024)

The aviation industry continues to struggle for capacity due to supply constraints and heightened demand. According to Airbus’ (OTCPK:EADSF) latest global market forecast, demand for capacity is likely to persist and passenger traffic is expected to experience an 8.4% growth per year between 2024 and 2027; passenger traffic will continue to grow at a pace of 3.6% per annum from 2027 to 2043. Asia and Middle East are expected to contribute chiefly as the economies of these regions continue to mature. Additionally, the air cargo market is expected to surge from $245 billion in 2023 to $525 billion in 2043. Overall, airlines are expected to require an additional 42k new aircraft (i.e., 2.2k aircraft per year) between 2024 and 2043.

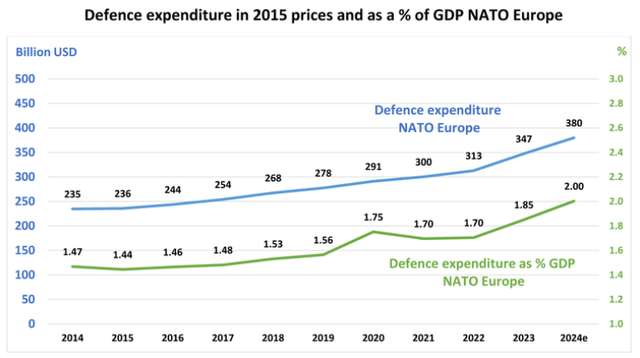

Apart from the aviation industry’s strength supporting BA, the surge in global defense spending will also be a robust and sustainable driver. As a reference, BA’s revenues from the Defense & Security segment contributed to 37.5% in 2Q24; 13.53% of total backlogs belong to the Defense & Security segment. As geopolitical tensions across the world deteriorate, global military spending has surged and is expected to continue growing in the near future.

Finally, despite BA’s ongoing issues and several halts in production, it is important to highlight that orders and total backlogs continue to grow, indicating a strong demand for the aircraft. In 2Q24, the total value of BA’s backlogs was $515 billion. Currently, $495 billion of these backlogs are contractual backlogs; in other words, these backlogs will eventually contribute to BA’s revenue.

Valuation: Share Price Appears Overly Beaten Down

Valuation Analysis (Author’s Illustration)

To investigate the current share price of BA, I conducted a valuation analysis, utilizing BA’s historical valuation multiples and FY2023 revenues, FY2023 gross profit, and 2Q24 value of total backlogs. These variables are being chosen because in recent years: (1) operating income and net income has been negative and (2) operating cashflows and free cashflows were highly irregular.

Based on the above chosen variables and the respective historical price-to-sales, price-to-gross-profit, and price-to-backlogs between 2014 and 2023, the results of the valuation analysis suggest that the current share price of BA should range between $99 to $260, representing a significant potential upside of 70% and a downside of 35.4%; the upside-to-downside ratio for this investment opportunity is 1.96x.

Deteriorating Liquidity Will Be A Major Risk

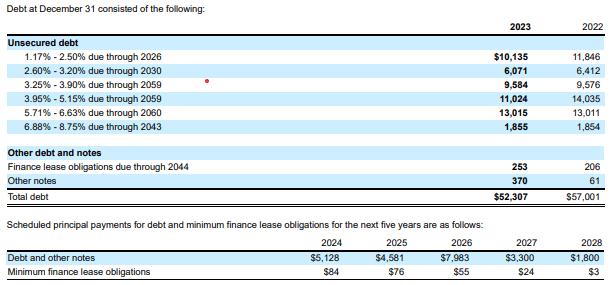

The company’s biggest risk is its liquidity position. In 2020, the company took up significant debt to shore up its balance sheet, increasing its long-term debt from $8.50 billion in 2019 to $60.98 billion in 2021; thus far, the company has managed to reduced its long-term debt to $46.62 billion. According to BA’s FY2024 10-K filing, the company is expected to pay down $5.1 billion (about 4.4 billion paid), $4.58 billion, and $7.98 billion of its existing debt in FY2024, FY2025, and FY2026 respectively.

Boeing’s Unsecured Debt (10-K Filings)

It is important to also highlight that the company’s ability to generate cashflow has been inconsistent. Operating cashflow for the first half of FY2024 was $7.28 billion. In addition, according to Moody’s, the ongoing worker strike’s prolonged duration and persistent manufacturing and production challenges pertaining to BA’s 737 and 787 aircraft will further weigh on BA’s liquidity; hence, the rating agency had placed all of BA’s rating on review for a downgrade.

Presently, BA has a total cash and short-term investments of only $7.5 billion. If liquidity draining events (e.g. worker’s strike or halt in aircraft production) persists or occur again, BA will likely wipe out its cash position and be forced to take up additional debt, making it more challenging to turnaround its current situation.

Closing Remarks

BA has been plagued by many issues since 2020. Unfortunately, many of these existing issues will take some time to solve. However, my analysis suggests that there exists an excessive pessimism on the company. I believe that the company is poised for a turnaround soon. It is important to highlight again that the company has been more proactive in taking actions to resolve these issues. The change in BA’s Chief Executive Officer and acquisition of SPR indicates that the company is attempting to change its safety and quality assurance culture. Moreover, at least for now, multiple quality demand drivers continue to exist, supporting the company’s topline.

Presently, BA’s share price has yet to recover from its pre-pandemic levels. The company is trading at 153.29 as compared to about 340 before the Covid-19 sell-off, representing a deterioration of 54.9%. My valuation analysis suggests that the share price of BA should range between $99 to $260, providing an opportunity with an attractive risk-reward ratio of 1.96x and a potential upside of 69.6%. With such an attractive risk-reward profile, I believe that the time “to be greedy when others are fearful” is now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.