Summary:

- Boeing’s capital raise of $23.8 billion is crucial to address near-term cash needs and long-term debt maturities, ensuring financial stability through 2030.

- Despite recent setbacks, BA aims to improve its net debt position from $47.25 billion in 2024 to a net cash position by 2030.

- Free cash flow is expected to turn positive by 2026, with significant improvements in leverage and debt reduction projected by the end of the decade.

- The capital raise also positions the Company to invest in new airplane development, crucial for maintaining competitiveness into the 2050s.

Jon Tetzlaff

Boeing (NYSE:BA) is working on a multi-year recovery trajectory. Before a strike crippled Boeing’s assembly facilities, the jet maker had started to make significant progress on improving oversight on assembly and stability that should allow the company to raise production without exceeding factory control limits. However, with the strike, that momentum has faded, and the company has faced a significant cash outflow while debt maturities are closing in. In 2025 and 2026, the company will see $12.5 billion in debt mature, while the company’s cash flow will not be able to cover maturing debt.

This necessitated a capital raise and, as I discussed in a prior report, I would like to see that capital raise being executed as soon as possible, and preferably before Boeing would reach a new labor agreement with unions. Not necessarily because that could put Boeing in a stronger position to negotiate with unions, but because any bump in the stock price would not fade—or at least be less likely to fade—once a capital raise takes place. The capital raise, in my view, was essential to clean up Boeing’s balance sheet, next to clearing out inventory and improving overall manufacturing quality. With the capital raise being completed, I will discuss what this means for Boeing’s debt profile in the years ahead, as well as its leverage.

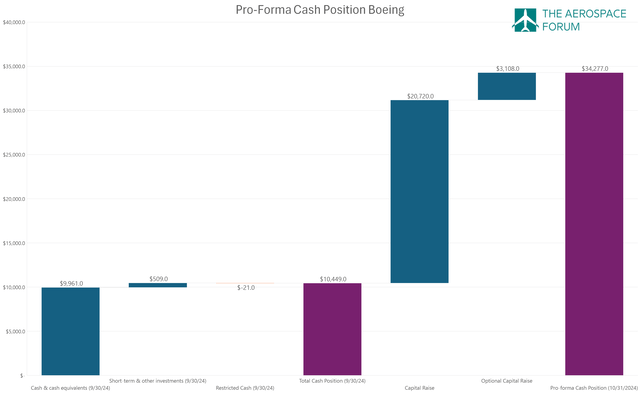

The methodology I will use starts with the cash and cash equivalents, including short-term investments, reported in Q3. From there, we will add the proceeds from the capital raise, which provides us with the starting balance of the cash pile. Against that cash pile, I will add the cash flows and subtract the debt maturities and dividends. This allows us to see until what extent the debt profile has been derisked and how the net debt and leverage are evolving.

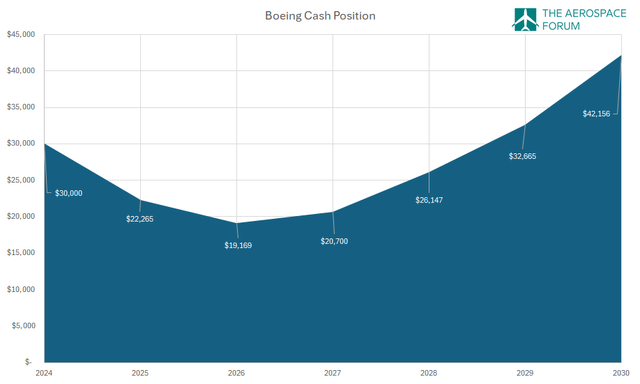

Boeing’s Cash Pile Grows To $34 Billion

By the end of September, Boeing had $9.96 billion in cash and cash equivalents, while short-term investments were $509 million. This included $21 million in restricted cash, which I have excluded from the calculations for cash and investments. This brings the total cash to $10.45 billion excluding the capital raise.

From there, we add the proceeds from the capital raise. Boeing issued 112.5 million shares of common stock at $143 resulting in gross proceeds of $16.1 billion. Additionally, the company issued $5 billion in preferred share capital for gross proceeds of $21.1 billion. Net proceeds were $20.72 billion. The company can issue an additional 16.875 million shares of common stock and $750 million worth of preferred capital, which would bring the gross proceeds of the options to $3.16 billion, with net proceeds estimated at $3.1 billion. This would bring the net proceeds from the capital raise to $23.8 billion.

We can put everything together and with the stock options fully exercised, this would bring the pro forma cash position for Boeing to $34.28 billion. This excludes any proceeds from the sale of businesses that Boeing could mark as non-core and attempt to sell. The reason for not including any proceeds is because we do not know which businesses Boeing will be selling, when and what the proceeds will be.

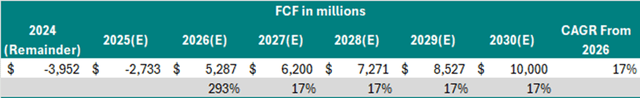

Free Cash Flow Inflection Point Modeled For 2026

Back in 2022, Boeing was bullish on the future, expecting that its free cash flow would be positive in 2022 and by 2025–2026 the free cash flow was expected to hit $10 billion. Those projections are, of course, no longer valid, but we are looking at the number of years it would take to go from free cash flow burn to free cash flow generation. For the remainder of the year, analysts expect another $4 billion in cash to be burned. In H1 2025, there will still be a cash burn, but free cash flow is expected to be positive in the second half of the year with a $2.7 billion cash burn. I have modeled a four-year shift to Boeing reaching the targets outlined in 2022 and that would put the CAGR of free cash flow from 2026 through 2030 at 17% and a total free cash flow generation of $30.6 billion.

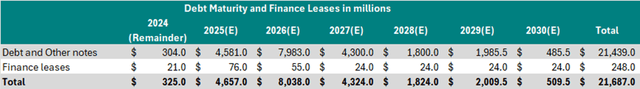

Boeing Has More Than $21 Billion In Debt Maturing Through 2030

Boeing has $21.7 billion debt and finance lease payments due through 2023. This includes the debt increase in May 2024. Stacked against the free cash flow generation, we see that Boeing would generate roughly $9 billion more in free cash flow than it has maturing debt and finance lease payments. However, the company aims to maintain $10 billion in cash. If we look at the total cash position in September 2024, the company already close to that $10 billion level, which made raising capital through a combination of debt and issuing shares a necessity. Furthermore, Boeing had nearly $13 billion in debt maturing through 2026, but its free cash flow generation would still indicate a $1.4 billion burn. So, due to the problems the company faced in 2024, the cash flow generation shifted to the right while the debt maturities remained in place, leading to Boeing not being able to cover its debt maturities from free cash flow. And the company already had no space in its cash position to pay down debt if a $10 billion cushion has to be maintained.

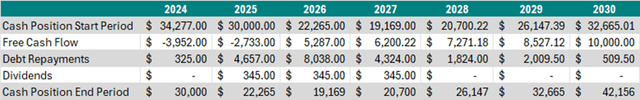

How Will Boeing Debt And Cash Evolve?

Boeing has three major components of cash inflows and outflows, those are the free cash flow, the debt repayments and the dividends on preferred stock. From the table above, we can also see why the capital raise was as big as it is. Just looking at 2025, we see a closing balance of $22.27 billion. Technically, it means the entire closing balance came from the capital raise. Boeing had no option other than to raise cash because it would otherwise have no cash at all by the end of 2025.

The $20 billion in undrawn credit facilities would also not provide a solution, since it would need to be repaid and $20 billion represents two years’ worth of free cash flow by 2023. $4 billion would mature in 2029, $3 billion would mature in 2028 and another $3 billion would mature in 2025. So, the $3 billion from 20245 would do little to nothing to cover debt. Boeing has another $10 billion credit agreement that was finalized in October 2024, but that is a 364-day agreement. That means that out of $20 billion in revolving credit facilities, only $7 billion could be utilized to repay debt without adding additional cash outflows in excess of free cash flow. It also partially explains why, initially, there were talks about a $15 billion capital raise. If we added the $7 billion in revolving credit facilities, we would get to $22 billion, which is rather close to the total net proceeds of the offering. The size of the current offering provides Boeing with an additional $9 billion cushion in 2026. If we subtract the $9 billion from the total offering, we get to $14.8 billion, which is close to the initial rumored size of the capital raise. So, Boeing essentially raised more to provide itself with some additional padding.

The graph above shows rather well that the critical years for Boeing are 2024 through 2026 as the free cash flow is not exceeding debt maturities, but beyond that things should improve significantly.

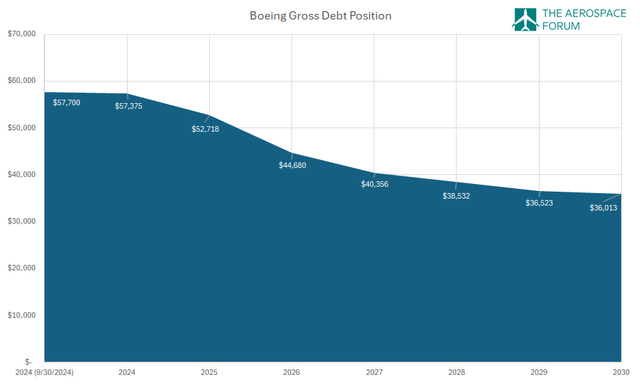

We can do the same thing for the gross debt development and that shows that Boeing is now positioned to reduce gross debt from $57.7 billion to $36 billion by 2030 without hitting a critical liquidity level or having to dip in its revolving credit facilities to pay long-term portions of debt maturing.

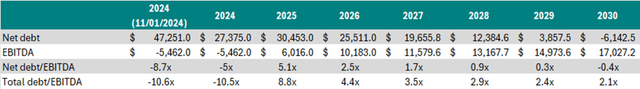

Boeing Leverage To Improve Significantly With Net Cash Position In 2030

With the projected gross cash and debt balance through 2030, we can also estimate the net debt balance. In 2025, we expect an uptick in net debt due to negative free cash flow. Starting 2026, the net debt balance will start to decrease and by 2030, the company should be in a net cash position. So, Boeing is set to improve its net debt position from $47.25 billion by Q3 2024 to a net cash position of $6.1 billion by 2030. Generally, I am looking for companies to have a net debt-to-EBITDA of 2.5x or better, and Boeing should be able to reach that by the end of 2026. On total debt to EBITDA, the peer group has a 2.28x leverage, and Boeing is set to get to those levels by 2030. So, we are seeing how a lot of things are coming together by 2030.

Boeing Has To Look At A Future Airplane Development

Boeing’s cash position will start rising from 2027 onwards if things go as projected and while exiting 2030 with $42 billion in cash is good, I don’t consider it a luxury but a necessity. The company could elect to repay more debt ahead of schedule, but Boeing also has to work on its commercial airplane portfolio. I expect that a new airplane development will cost around $25 billion at least. Boeing is unlikely to pay that from its cash position, but it technically could do so by 2030. A decade ago, it was envisioned that by Boeing would have a new airplane ready by 2030. I am not expecting an airplane to be ready by 2030 for the simple reason that a five to seven year timeline to develop the airplane would mean that Boeing should already have launched that airplane development or on an accelerated development timeline start developing next year. However, with the balance sheet not being quite healthy yet next year and Boeing having delayed the service entry of the Boeing 777-8F until 2028 I don’t think that it makes sense to launch a new development before that point.

However, what we do see is that in the 2029–2030 timeframe Boeing would be able to launch a new airplane that could be entering service around 2035 and that also provides an important angle on the capital raise. Not only was the capital raise needed to get through 2025, but it was also needed to position Boeing to have a new airplane enter service around ten years after that.

Conclusion: Capital Raise Has Importance For Near-Term Cash Requirements And Long-Term Balance Sheet Recovery And Airplane Development

Picking everything apart, going from the cash position to the capital raise and leverage development, it becomes clear why Boeing raised as much cash as it did. The size of the capital raise was such that Boeing simply would get through 2025 and have an additional cushion in the years ahead. That is not a luxury position for the plane maker as the jet maker still has to shed excess debt by 2030 and at some point, it has to invest in a new airplane development program. The size of the capital increase allows Boeing to recover its leverage to acceptable levels by 2030 measured by total debt to EBITDA and in 2026 by net debt-to-EBITDA. From there, the company can either look to further reduce the debt or work on developing a competitive airplane line up that should be able to compete for 15–30 years.

So, with that, I can conclude that the capital raise is not only a short-term derisk but also a step to allow Boeing to become a force to be reckoned with into the 2050s. We see a lot of investors having a very narrow focus from quarter-to-quarter or year-to-year, but it should be kept in mind that the aerospace industry is very much long-term oriented and the capital raise fits in both horizons. For Boeing, it is key to show for the first time in six years that it can actually deliver on its targets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.