Summary:

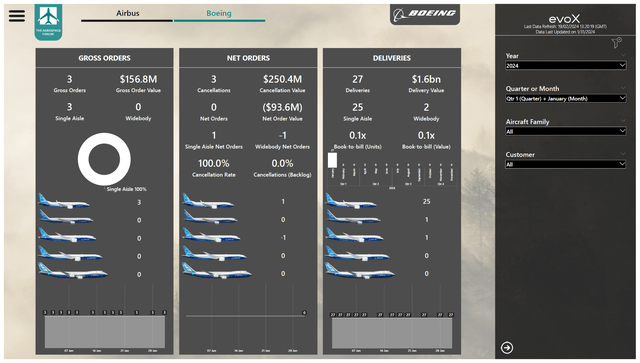

- Boeing booked orders for three airplanes in January, all for single aisle jets, reflecting a slow start to the year.

- The company also experienced cancellations and mutations to its order book, resulting in zero net orders for the month.

- Boeing delivered 27 airplanes in January, a decrease compared to the same month last year, primarily due to the Boeing 737 MAX program.

JULIEN DE ROSA/AFP via Getty Images

Boeing (NYSE:BA) had a strong year in terms of orders in 2023, booking orders for nearly 1,500 airplanes valued $125 billion. As we entered a new year, the annual order and delivery tally has been reset. Interesting will be to see whether jet makers can continue booking orders which can be seen as a measure of continue mid to longer-term demand for airplanes and how the delivery profile develops as this provides a measure of the ability of airplane manufacturers and suppliers to increase production to more closely match demand. In this report, I will be discussing the January 2024 airplane orders and deliveries for Boeing.

Boeing Orders Do Not Reflect Appetite for Airplanes

The Aerospace Forum

Boeing booked orders for three airplanes in January with a value of $156.8 million. The orders were exclusively for single aisle jets as an unidentified customer ordered three Boeing 737 MAX airplanes. Boeing certainly did not have an impressive start of the year and given the problems Boeing faces with the Boeing 737 MAX 9 after an in-flight accident earlier this year, the focus in January certainly was not on finalizing orders.

Boeing also processed several mutations to the order book:

- Air Europa cancelled an order for one Boeing 787-9.

- One or multiple unidentified customers cancelled orders for two Boeing 737 MAX airplanes.

- Akasa Air was identified as the customer for 150 Boeing 737 MAX airplanes.

- Kunming Airlines was identified as the customer for one Boeing 737 MAX.

- Air China was identified as the customer for one Boeing 737 MAX.

- Gol Linhas Aereas (OTCPK:GOLLQ) was identified as the customer for one Boeing 737 MAX.

- AerCap (AER) selected GE (GE) turbofans for eight Boeing 787-9s, five of which previously had Rolls-Royce (OTCPK:RYCEF) engines selected.

- Air Canada (OTCQX:ACDVF) was identified as the customer for one Boeing 787-9.

For Boeing, expectations were low for January following the accident with the Boeing 737 MAX 9 as incidents and accidents make it less appealing for customers to finalize orders. Furthermore, the FAA blocking production rate increases on the Boeing 737 MAX program has cast doubt on the delivery schedules in which case customers are looking for more clarity for their existing orders before committing to any new airplane purchases. Boeing did book orders for three airplanes valued $157 million, but after factoring in the three cancellations the jet maker was left with zero net orders for the month and a negative net order value of $93.6 million. In the same month last year, Boeing booked 55 orders at $5 billion and 16 net orders valued at $2.9 billion. In my view, January tends to be a slow month and the problems with the Boeing 737 MAX 9 did not add any appeal to finalize orders in January, leading to an even lower order inflow. In fact, the net orders for January were the lowest since 2021.

Boeing Airplane Deliveries Tumble

The Boeing Company

January is seasonally a slow month for many companies, including Boeing. In December, jet makers rush to get deliveries out of the door, leaving them with little to no inventory to deliver from, which often renders the start of the year weaker. That also means that the low number of deliveries in January should not be projected forward, and even if we have comparable delivery profiles from previous years, we cannot project deliveries out using relative shares of January deliveries in previous years. The reason is that over the past few years the supply chain health and pressures as well as production rates have fluctuated significantly which makes it almost impossible to project using relative shares of the January volumes.

In January 2024, Boeing delivered 27 airplanes valued $1.6 billion:

- Boeing delivered 25 Boeing 737 MAX airplanes.

- Boeing delivered one Boeing 767-2C, which functions as the base aircraft for production of the KC-46A tanker.

- Boeing delivered one Boeing 787-9.

- There were no deliveries for the Boeing 777 program.

During the same month last year, Boeing delivered a total of 38 airplanes valued at $2.3 billion. While there are many possible reasons for the lower delivery figures, I believe that the lower delivery volume can be attributed to the Boeing 737 MAX 9 accident which led to more oversight from the FAA on Boeing’s production lines and supply chain. Last year, Boeing delivered 35 Boeing 737 MAX airplanes and three Dreamliners. What we’re seeing is that the year-over-year decline is primarily caused by the Boeing 737 MAX program.

During the month, the book-to-bill ratio was 0.1 in terms of units as well as value reflecting a low order intake as well as a low delivery volume. ASC 606 adjustments, which adjusts for orders in the backlog for which not all requirements beyond the existence of a purchase agreement are met, remained flat during the month at 590. Under the current circumstances, Boeing is not able to count these orders towards the firm backlog which currently stands nearly 5,600 units (excluding the adjustments).

How Many Airplanes Did Competitor Airbus Deliver?

While Boeing delivered 27 airplanes, competitor Airbus delivered 30 airplanes in January. So, what we’re seeing is that there actually is not a big difference in the January delivery numbers. In fact, it’s likely that if deliveries would not have slowed down at Boeing’s side, we would have seen Boeing delivering more jets than Airbus to start the year. It remains to be seen whether Boeing can closely match Airbus’ delivery volumes amidst increased scrutiny on production in the remainder of the year. Where Boeing and Airbus diverged is in the year-on-year differences in delivery numbers. Boeing delivered less airplanes compared to last year while Airbus delivered more planes. This also provides an indication that the Boeing 737 MAX accident and the aftermath of that accident are a primary reason for the reduction in commercial airplane deliveries for Boeing.

Conclusion: Boeing Starts The Year On A Weak Note

For Boeing, the year had barely started and most of the hopes of expectations for this year already have vanished. I’m still expecting that in terms of deliveries, Boeing could be seeing a significant uptick compared to last year as I discussed in my Boeing Q4 2023 earnings analysis, but other than that I believe it is going to be a challenging year for Boeing with more risk than initially anticipated. In terms of orders, January was rather weak and one can wonder whether the increased uncertainty will have consequences for Boeing’s order inflow in 2024.

In terms of deliveries, we’re already seeing the consequences of quality stand downs as Boeing stopped production in Renton to discuss quality improvements and emphasize safety and quality. We also might be seeing the first impacts of more FAA boots on the factory floors of Boeing and suppliers. It’s premature to say that this will continue to be a source of delay to production and deliveries, but until the increased FAA oversight is not seamlessly integrated in the processes of Boeing and its supply chain there will be some delay. For now, I’m maintaining my buy rating with the sidenote that Boeing’s shares are not quite attractive for the near term, but the current prices might provide nice opportunities to add shares for 2025-2026 and beyond. That upside, however, hinges on how well Boeing can implement manufacturing quality improvements and improvements to the entire quality system to get permission from the FAA to increase production on the Boeing 737 MAX program again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, AER, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.