Summary:

- The Boeing Company dip-buyers bought Boeing’s April 2024 lows despite market sentiments being pessimistic.

- Recent reports suggest Boeing’s second-half performance could improve further.

- The anticipated acquisition of Spirit AeroSystems Holdings should lower execution risks and not significantly dilute Boeing shareholdings.

- Boeing remains above its long-term uptrend, corroborating dip-buying sentiments.

- I argue why the crisis on Boeing is overblown, underscoring another fantastic dip-buying opportunity for patient investors.

sanfel

Boeing: Overblown Crisis Sentiments

The Boeing Company (NYSE:BA) investors are still suffering from the fallout of the crisis that engulfed the leading US aircraft manufacturer. As a result, BA is still struggling above its April 2024 lows after plunging from its previous highs in December 2023. However, I also gleaned buying sentiments have improved since BA bottomed in late April above the $160 level.

In addition, I have also assessed that selling intensity is expected to subside in the second half ahead of a more robust production ramp. The anticipated strategic acquisition of Spirit AeroSystems Holdings, Inc. (SPR) should lower execution risks moving ahead. In addition, the expected all-stock deal shouldn’t result in significant dilution for BA shareholders. Accordingly, SPR’s market cap of $3.78B accounts for less than 3.5% of BA’s market cap.

I reiterated my bullish BA thesis in my previous article in late March 2024. BA has continued to underperform the S&P 500 (SPX, SPY) as the market surged to a new high. However, it’s noteworthy that subsequent negative press coverage hasn’t deterred dip-buyers from returning since BA bottomed in late April. Accordingly, the negative coverage includes increased whistleblower fallout, lowered optimism for Boeing’s Q2 performance, and BA CEO Dave Calhoun’s “contrite tone during the US Senate subcommittee hearing” in mid-June. In addition, BA investors must also weigh potential criminal charges against Boeing, possibly dragging BA into a long-drawn legal process.

Boeing Stock: “Bad News” Mostly Priced In

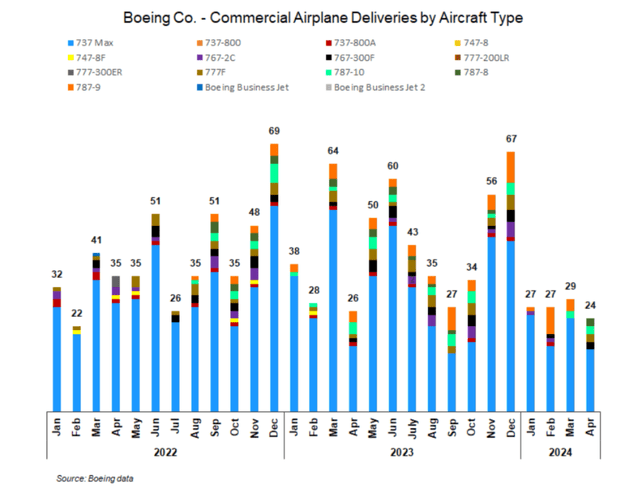

Boeing deliveries metrics (Boeing, Seeking Alpha)

Therefore, it seems like the market has taken all this “bad news” in its stride as investors reassess their confidence in BA’s bullish optimism. There are reasons to be sanguine as we head into the second half of 2024.

Some investors could be caught up in “repeating” what we all already know. Yes, Boeing delivered just 83 commercial aircraft in Q1, a significant drop from last year’s 130 deliveries. The weak momentum continued in April with just 24 deliveries.

CFO Brian West cautioned investors in May 2024 about a potentially tepid Q2, justifying the market’s pessimism. Despite that, BA investors still held their April lows. Therefore, it suggests the market is likely anticipating a potential growth inflection in the second half. Possible?

China has reportedly allowed Boeing to “resume deliveries of widebody jets to China.” It was one of the pain points highlighted by West, suggesting it is expected to “impact quarterly deliveries and cash flow.”

In addition, Boeing’s supplier master schedule suggests a recovery in Boeing’s monthly production rate, reaching 42 per month in September. While this represents a delay from its initial June target, it suggests Boeing’s production travails have likely hit rock bottom.

In addition, Boeing’s attempts to improve its production safety and operational improvements have reduced Boeing’s fuselage defects. Accordingly, Boeing “is seeing a sharp drop in defects on 737 Max fuselages from supplier Spirit AeroSystems.” Therefore, the thesis of a sustained second-half improvement through 2025 is increasingly likely, suggesting that the worst of the “bad news” has been reflected.

BA Stock: Management Needs To Lift Investor Confidence

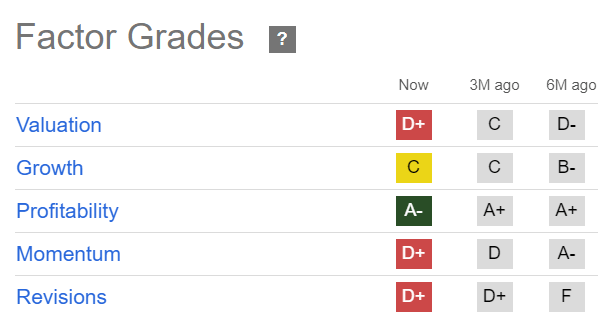

BA Quant Grades (Seeking Alpha)

Seeking Alpha Quant rates BA with three “D” range grades, suggesting caution. BA’s “D+” valuation grade raises the possibility that the market could still be too optimistic, as analysts downgraded Boeing’s estimates to reflect the recent crisis.

Therefore, Boeing management must convince investors that the worst is over as the company looks to restore buyer confidence. I concur that BA’s selling intensity (“D+” momentum grade) could worsen near-term downside. However, I also gleaned that BA remains robustly supported above its long-term uptrend.

Is BA Stock A Buy, Sell, Or Hold?

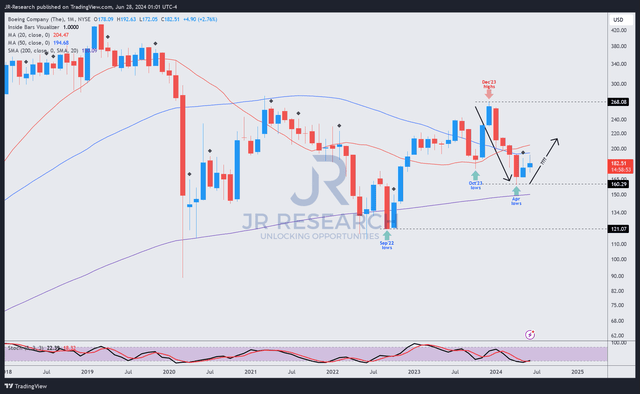

BA price chart (monthly, long-term) (TradingView)

BA’s price action suggests it’s still supported above its 200-month moving average (purple line). Therefore, as long as BA’s September 2022 lows hold robustly, BA’s long-term uptrend should remain intact.

In addition, I also gleaned that BA has attempted to climb above its previous October 2023 lows ($175 level), which preceded the steep rise to form BA’s December 2023 highs.

I assess that a decisive recovery of BA’s $175 level is critical to mounting a renewed attempt to dispel bearish sentiments and help BA resume its long-term recovery.

Notwithstanding my optimism, investors must continue monitoring Boeing’s developments closely. The DOJ could still slap Boeing with criminal charges. Consequently, it could lead to a protracted legal process with potentially significant legal liabilities. It could then discourage buyers from returning with more vigor, potentially slowing BA’s recovery from its current malaise.

Based on my evaluation of The Boeing Company’s risk/reward, I have assessed that a Buy rating is still appropriate. However, buyers must continue to defend the $160 support level, which is pivotal to BA’s long-term uptrend recovery.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!