Summary:

- Boeing presents a high reward/controlled risk opportunity, making it worth considering small positions now for potential long-term gains, despite recent struggles.

- The stock’s recent performance and production recovery signal a possible comeback, supported by a new union contract and backlog on the 737 MAX.

- Boeing’s valuation grade and chart setup indicate potential upside, making it a compelling contrarian play despite the lack of a dividend.

- I’m buying Boeing shares directly for my portfolio, focusing on potential short-term gains and readiness for a long-term hold if conditions improve.

Jon Tetzlaff

The longer we get into this market cycle, the more that things hit my radar that prompt me to think even more “outside the box” than I usually do. And when a stock like Boeing (NYSE:BA) (NEOE:BA:CA) presents an opportunity for a potential high reward/controlled risk situation, I’m very willing to expand my field of vision. Because some market climates are about “numbers go up,” and this one is quickly approaching that, or already there. But what springs from that is what I’ve seen for four decades as a professional investor: Gradually, situations present themselves that prompt me to say, “worth the risk in small size now because I might just be early on something bigger.” It has been some time, about three years, since a lot of stocks “worked.” It has been Magnificent 7/technology stock/crypto-related market. As a result, a lot of stocks, especially some bigger ones, have been left behind. Oh, they deserved to be. But like that old Bruce Springsteen song goes, “maybe everything one day comes back. He was talking about Atlantic City, which hasn’t really come back, is not my point. It’s the phrase itself, and how stock market history is filled with “comeback” stories. Or, as I like to call them, “long-term contrarian situations.”

I saw this 25 years ago and again 15 years ago, as well as in 2020 to a lesser extent. And while it’s early in the game this time around, I’m starting to compile a long-term contrarian stock list. And some ETFs too. Because the time to do that is right now, when the euphoria is high and people like me feel like idiots for even suggesting that stocks like Boeing are good for more than just a “pop.” But the contrarian in me, and particularly the long-term technician in me, sees a possible path for Boeing stock to go much, much higher. It’s higher risk, given what the company has been through. But that’s what smaller position sizes and tactical buying and selling are for. That is, I might potentially own BA four or five times over the next few years, as this comeback story works itself out… or fails to.

What’s particularly unique about this one (though I expect to find others) is that it has no dividend yield, and yield is a high priority to me. Capital preservation is the highest. But the most important aspect of investment research to me: Avoiding being siloed. Markets change, and man are they changing quickly. They’re changing in what they reward and how. And ultimately, I see a year (next year, the year after or the year after that?) where stocks like Boeing will be the “I wish I had bought some of that” talk of the market.

I’m no fundamental analyst. But more than 30 years of watching, experiencing and exploiting things like market sentiment, price overshoots (up and down) and shifts in what the market cares about make me think this one has a chance.

Boeing: Why I’m buying it directly, and not using an ETF (as in the past)

So with that preamble out of the way, let’s look at the specific case of BA. The stock was the clear leader among the Dow 30 for most of Tuesday, and that has not happened much recently. That was due to the company getting back online following a crippling two-month strike and production challenges. Commercial jet deliveries for November were off more than 75% from last year (only 13 vs. 56). The new union contract should reverse that, but it won’t happen overnight. But let’s be clear, this is not a market that waits for the good news to play out. Case in point: Bitcoin. No confirmed use case for years, but check out that price appreciation. And no, I’m not comparing BA to Bitcoin. But I think it does have the potential to be more than a “rush to buy what’s lagged” situation. That’s the chart read I see currently.

There’s a backlog on the key 737 MAX product, and I suspect there’s also some optimism that the market will include BA among companies that can possibly benefit from lower regulation in the new Trump administration. That’s more of a hunch. But the price action is telling me that, unlike a lot of deceiving contrarian-looking situations I review daily, this one might have more sustained energy behind the move.

Still, FAA supervision of Boeing will be a key risk factor as it re-starts production capacity, corrects supply chain issues, and attempts to shake off the reputational damage the company brought on itself in recent years. There’s also the issue of how to get back to profitability while cutting 17,000 jobs, which the company appears to be in the process of doing.

Since I’m an ETF wonk, and frequently use those vehicles as a back doorway to get access to one or more stocks I want exposure to, one thing I do in cases like this is ask myself, “do I want to own BA or an ETF that allows me to access BA with lots of peer stocks around it.”

Earlier this year, I owned an aerospace ETF as well as two defense stocks, Lockheed Martin (LMT) and RTX Corp. (RTX) as part of my Yield At a Reasonable Price (YARP™) dividend stock approach. But those yields became too low for me to stay interested in owning them for that purpose.

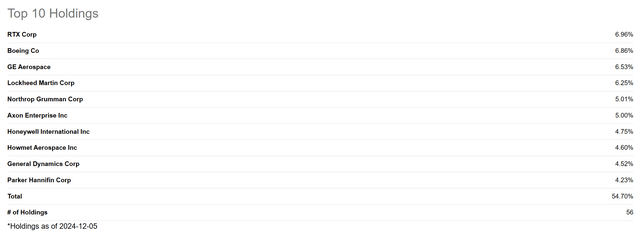

So I reviewed the top 10 holdings of the Invesco Aerospace & Defense Portfolio ETF (PPA), which is one of the larger funds in that focus area, and one I’m owned in the past, for reasons explained above. Boeing is the second-largest holding, but it’s only around 7% of the ETF. So unlike other situations where a leading holding might be a double-digit percentage allocation, owning PPA only helps if I like the stocks around BA in the industry.

Seeking Alpha (PPA ETF top 10 holdings)

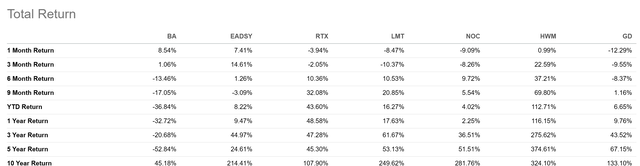

So my next step was to see how much of a laggard BA has been. Is this an industry-wide situation, which would prompt me to lean toward the ETF? Nope. It’s a Boeing-specific issue to me. And since I recently earned a nice profit when exiting two of the stocks on this short list (RTX, LMT), I know that many of the stocks in this group do not look nearly as good to me as BA does, chart-wise.

Seeking Alpha

Again, this is not a dividend situation for me since BA no longer pays a regular dividend. But one of those potential “moments” for the stock down the road is if they do ultimately restore a quarterly payment. That said, there was a time not long ago when I was not even confident the stock would stay in the Dow Industrials. Maybe it won’t. But while I particularly like owning Dow 30 stocks, I don’t overreach to do so. But for BA, it’s no longer such an overreach.

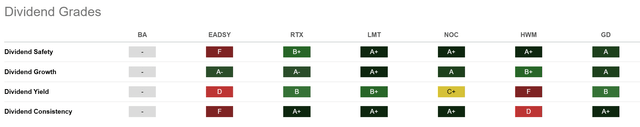

Seeking Alpha

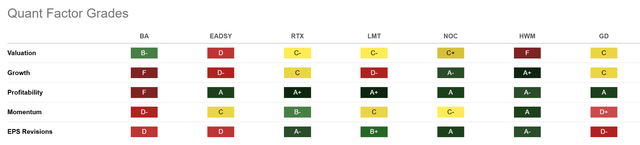

A quick look at the Seeking Alpha Quant Factor Grades for BA and its peers shows me that it deserves what it has gotten in terms of investor treatment. Not that its chief rival Airbus (EASDY) is doing much better. But even the more profitable businesses in this space have only that and a stable dividend going for them. So in my process, that translates to considering them names to watch, not to own currently.

Seeking Alpha

Zeroing in on Boeing, using quant and technical analysis

But Boeing’s valuation grade stands out. B- is not A or A+, but nothing spells “contrarian” to me like a leading business, whose product is not easy to replace for customers, which has fallen on hard times, and for which I can identify a pair of “green shoots,” if you will. One is that valuation grade, which to this non-fundamental analyst, is helpful to see.

I’ll note that the Valuation Grade started 2024 at the lowest grade, F, when the stock was at $260 a share. It’s around $165 now, up from below $140 not long ago. This is all starting to smell like opportunity to me, albeit with plenty of “face-plant” potential if they don’t execute.

BA’s chart: High potential reward vs. modest risk

I don’t see many charts like this these days. So when I do, I drop what I’m doing and do the type of work I summarized here. I’m a chartist first, and I can truly say that whatever success I’ve had the past 38 years, most of that managing “other people’s money” as advisor and fund manager, the vast majority of it is in finding charts that look like this.

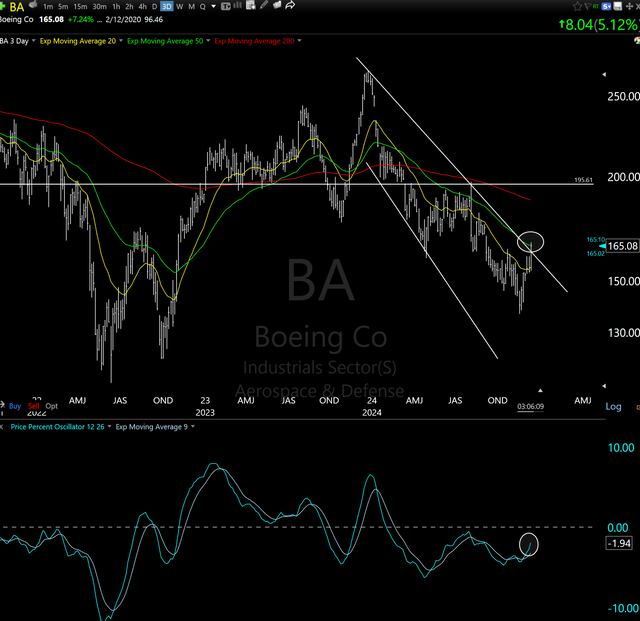

TC2000

It’s a chart of three-day prices, sort of a blend of what I see in the daily and weekly charts. If this one doesn’t work, I can live with it because the setup is just too good. So good that I’ve devoted more than 1,500 words to a stock that’s neither a dividend payer nor a stock with income potential via a single-stock ETF. That top section of the chart shows a breakout in progress, from a very depressed price level. And the bottom shows that momentum has not kicked into overdrive just yet, as that PPO indicator is rising but still below the zero line. So it’s all shaping up.

Actionable item on Boeing

Does this mean BA will move from $165 to $200 or $260, which would be reasonable price targets for a chart like this? I have no idea! I just look at reward and risk, and when the former outweighs the latter, I inch closer. When it’s an iconic stock like Boeing, I do more than that. I buy some shares. Enough to “dabble” for now, a modest weighting in my portfolio, and currently on the trading side of my account structure.

I could easily add it soon to the main YARP portfolio, as that’s a total return objective for me. That means that while dividend stocks and yield ETFs are the main features, I use growth-oriented ETFs and stocks as well as call and put options on major indexes, to create an “all-weather” portfolio.

As for Boeing, I’m on board and ready for takeoff. Let’s see if it’s a rare buy and hold for me, or more of what I did with LMT and RTX. This market is so much more about making 10-20% in three to six months because the old-fashioned three-year/50% or “double my money in five years” has been hijacked (pardon the pun) by today’s market participants. So more than anything, my purchase of Boeing stock is about taking what the market gives me, not trying to force old rules to fit a new, modern investment era.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

By Rob Isbitts and Sungarden Investment Publishing

A community dedicated to navigating modern markets with consistency, discipline and humility

Full Access $1,500/year

Legacy pricing of $975 for first 35 subscribers, a savings of 35%

-

Direct access to Rob and his live YARP portfolio, featuring a trademarked stock selection process he developed as a private portfolio and fund manager, and his decades of technical analysis experience.

-

24/7 access to Sungarden’s investment research deck

-

Bottom-line analysis of stocks, ETFs, and option strategies

-

Trade alerts and rationale, delivered in real-time

-

Proprietary educational content

-

You won’t get: sales pitches, outlandish claims, greed-driven speculation