Summary:

- Boeing’s CEO and Board Chair are stepping down, signaling a significant change in leadership to assure stakeholders.

- BA investors need the confidence that Boeing is committed to its long-term future over short-term results.

- Despite near-term uncertainties, Boeing’s order book and potential for recovery under new leadership should augur well.

- I explain why buyers have continued to defend BA’s $175 support level robustly, suggesting peak pessimism.

- With much of the bad news baked in, I explain why the current pullback offers a golden buying opportunity.

sanfel

Boeing CEO Steps Down

Investors in The Boeing Company (NYSE:BA) likely found respite recently, as CEO Dave Calhoun announced his decision to step down from his role by the end of 2024. In addition, Board Chair Larry Kellner indicated his intention not to seek re-election. As a result, I gleaned that Boeing has finally gotten its act together to deliver the correct signals to key stakeholders about its intention to change.

Has the market reacted positively to the news concerning the significant management turnover? It’s important to highlight that BA dip buyers returned last week, defending the $175 zone with conviction. Accordingly, the $175 support level also saw robust buying sentiments in October 2023 before BA surged toward its December highs ($267 level). Therefore, losing the $175 zone could spell trouble for Boeing investors, portending a steeper decline and suggesting a significant loss in confidence.

My bullish take on BA in my January 2024 update hasn’t performed well, as BA has underperformed the S&P 500 (SPX) (SPY) significantly since then. With arch-rival Airbus (OTCPK:EADSF) seeing its stock surging toward new highs this month, it’s clear the market has de-rated BA in preference for the European aircraft maker. However, BA has likely reached peak pessimism unless Boeing investors are betting that Calhoun cannot hold Boeing together before the new CEO takes over.

It’s important to consider that Boeing management emphasized that Boeing’s first quarter performance will be abysmal. As a reminder, CFO Brian West articulated in a recent conference that investors should anticipate a cash outflow of between $4B and $4.5B, given the rectifications and delay to its manufacturing process. In addition, Boeing estimated -20% margins for its commercial business in Q1. However, Boeing management anticipates a more robust recovery through 2024, although we should still expect negative margins. Nevertheless, the company believes it can return to “historical margin levels in the ’25, ’26 timeframe.”

However, things could change by the end of this year as Boeing undertakes a significant leadership transition. Its potential acquisition of Spirit AeroSystems will likely drive further funding and integration challenges, although it’s considered essential to bolster customers’ confidence in its manufacturing quality moving ahead. While Boeing management remains confident in its longer-term $10B free cash flow model, I believe the market has likely tempered its expectations.

Can Boeing Still Deliver?

Analysts’ estimates suggest Boeing can still achieve $4.2B in free cash flow this year while pointing to $10.4B in free cash flow for 2026. As a result, Wall Street seems relatively unperturbed about Boeing’s execution risks. However, I urge investors not to throw caution to the wind, as the new CEO will likely be under tremendous pressure to ensure the Alaska Air incident doesn’t happen again.

Despite that, it’s also important to consider that management highlighted that Boeing’s order book for the “787 and 737 are sold firm through 2028, with quoting for 2029 and early 2030s.” In other words, if Boeing could get its act together under the new CEO, Boeing could still deliver and make good on its long-term model. Therefore, I believe Wall Street isn’t delusional, although significant near-term uncertainties are expected to remain till the management changeover.

BA is valued at an FY26 adjusted EBITDA multiple of 13x. EADSF is valued at a slightly higher multiple of 13.5x on a forward basis. Therefore, the de-rating seems apt, as the market likely lowered its expectations of further recovery as investors reassess Boeing’s prospects amid significant uncertainties.

Is BA Stock A Buy, Sell, Or Hold?

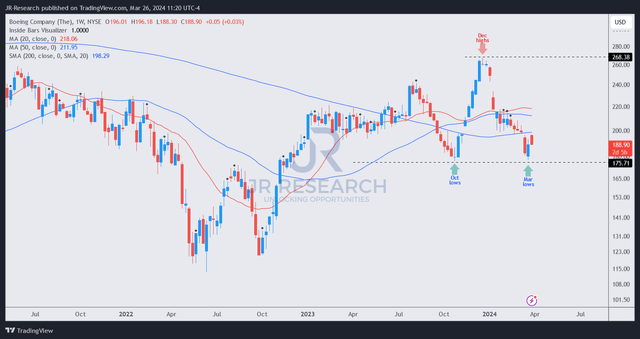

BA price chart (weekly, medium-term) (TradingView)

As seen above, BA investors returned to defend the $175 support level, a pivotal zone that also experienced solid support in October 2023.

A drop below this level could threaten the BA’s ongoing recovery, as it has regained its medium-term uptrend bias. As a result, I expect buyers to defend the $175 zone aggressively, helping BA to consolidate and regain composure.

BA bears could argue that the market hasn’t reacted positively to the news of management changeover by the end of 2024. However, BA bulls will likely suggest that BA’s selling pressure hasn’t worsened. Therefore, the recent de-rating has likely eased substantial expectations for Boeing to outperform in the near term, aligning with West’s recent commentary.

As a result, I gleaned that buyers looking to gain more exposure can consider the recent pessimism to have likely peaked, providing a solid buying opportunity.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!