Summary:

- Boeing is considering selling parts of its space and defense businesses, focusing on non-core assets to improve its balance sheet.

- The most likely divestments include the Commercial Crew Program and the United Launch Alliance joint venture with Lockheed Martin.

- Boeing’s space segment, facing competition and underperformance, presents more divestment opportunities compared to its defense segment.

- The strategic focus should be on investing in core businesses and improving contract management to enhance competitiveness, not just shedding assets.

Elen11

The Boeing Company (NYSE:BA) recently raised $21 billion through a combination of common stock and depositary stock representing a 20% interest in Boeing preferred stock. The capital raise is one of the steps that Boeing has taken to improve its balance sheet. The other step that the company is engaged in is shedding its non-core businesses and assets. In this report, I will be focusing on which businesses Boeing might be looking to sell.

Boeing Has Started Evaluation Process For Selling Space and Defense Businesses

Determining which businesses Boeing might sell and how much the company might receive for selling certain parts of the business is not an easy task for various reasons. The first reason is that Boeing currently does not have a list of non-core assets that it is interested in selling. So, determining how much the company might raise from shedding parts of the business is not as easy as taking a business segment and applying a valuation on that. The second complicating factor is that defense and space programs and businesses are in many cases matters of national security interest, which means that the businesses cannot just be sold to any party which narrows the array of potential candidates and narrows the number of businesses that Boeing could eventually sell. So, it’s not a matter of shedding loss-making businesses or selling a few profitable businesses at a premium. That also leads me to believe that Boeing will mostly be looking to sell space businesses and commercial space in particular.

The third complicating factor is that while Boeing operates its defense and space business through four divisions, down from eight divisions prior to November 2022, it reports its revenues only at the segment level. So, we don’t have any recent data on how each division performs.

A Look At Boeing Defense, Space & Security

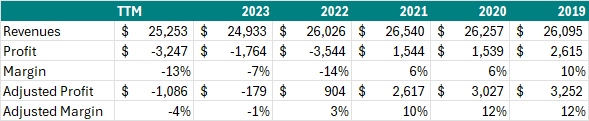

The Aerospace Forum

Looking at the performance of Boeing Defense, Space & Security, we see that the company has not been able to grow sales. In fact, sales have declined from around $26.1 billion in 2019 to around $25.3 billion in the last 12 months. At times, the revenues have increased due to higher volumes but part of the revenue increases that we did see were also driven by higher costs on programs which allowed BDS to report higher revenues as revenues are recognized proportional to costs. Reported margins have fallen from 10% to -13% while adjusted margins fell from 12% to -4%. Boeing is facing significant cost growth on fixed-price development contracts and the most notable programs that are a cost drag on Boeing are the following:

- The KC-46A tanker aircraft.

- The MQ-25A tanker drone.

- The T-7A Red Hawk trainer jet.

- The VC-25B or Presidential Aircraft Replacement, which will serve as the new Air Force One.

- The Commercial Crew Program

To get somewhat of an idea of how the defense and space business perform under normal circumstances relative to each other, we have to go back to 2016 when Boeing still reported revenues and earnings by division. Network & Space Systems accounted for roughly 36% of the sales and 29% of the earnings, meaning that its margins were less than the Boeing Military Aircraft segment. While the revenues and earnings patterns have likely evolved over time, it provides another indicator that the space segment is where Boeing could be looking for opportunities to divest.

Which Boeing Space and Defense Businesses To Sell?

As said, it’s not quite clear which businesses Boeing wants to sell. The plane maker initially sought to raise $25 billion through capital raises and debt issuance. Even though the company reached a $10 billion credit agreement, it still proceeded with a capital raise of $18 billion with options that could increase the raise to $20.5 billion. If the remainder came from divestments, it would put the divestments at $4.5 to $7 billion. However, the capital raise was upsized to $21.1 billion with options that would increase the capital raise to $24.3 billion. So, if the gap between the raised amount and the $25 billion target is any indicator, we would be looking at around $4 billion to be raised through divestments.

Boeing has already sold its Digital Receiver Technology business to Thales for an undisclosed amount. While the transaction value is not made public, it provides somewhat of an indication in which segment Boeing is looking for business transactions.

Boeing Defense, Space & Security operates through four divisions:

- Vertical Lift, which includes the company’s rotary platforms.

- Mobility, Surveillance & Bombers, which include the KC-46A, E-7, VC-25 and Bombers.

- Air Dominance, which includes the F/A-18, F-15, MQ-25 and T-7.

- Space, Intelligence and Weapon Systems, which include satellites, munitions, missiles, weapon system deterrents, space launch, maritime undersea and subsidiaries BI&A, Millennium, Insitu, Liquid Robotics, Spectrolab, Argon and DRT.

DRT was part of the Space, Intelligence, and Weapon Systems division. The subsidiaries are mostly focused on robotics, satellites and ISR (Intelligence, Surveillance, and Reconnaissance). I believe that the DRT acquisition shows that Boeing is primarily looking to sell businesses in the space division. ISR is currently in high demand, and I believe it’s an important part of Boeing’s business. Boeing has exposure to the unmanned undersea vehicle XLUUV for which it received $242.8 million in contracts over the past six years, according to the defense contracts monitor developed by The Aerospace Forum. While undersea solutions do not seem to be Boeing’s domain, I do believe that if we look at the current defense landscape, there’s demand for unmanned operations as well as ISR, which would primarily leave the space businesses to be considered for divestment.

Selling parts of the space operations also does make sense. Demand for space solutions is high and Boeing has not been performing that well while competition is intensifying. Boeing provides support to the ISS, and while the ISS might be decommissioned by the end of the decade, I do believe that this is a part of the space business that Boeing would like to continue operating. The bigger challenges are in the crewed missions and launch business, where Boeing is facing competition from SpaceX.

One business that Boeing may want to sell is the commercial crew program. That program has been loss-making, but the intellectual property and engineering resources could be interesting to parties looking to develop crewed landing vehicles. In November, Blue Origin was selected as the second Artemis lunar lander provider and I do believe that acquiring parts of the crewed space business could be of interest to Blue Origin. When the Commercial Crew program was launched, Blue Origin also bid for the contracts, but it did not get through the down-selection process.

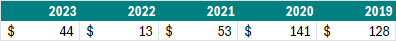

The business for which it does seem more certain that Boeing is willing to sell it is the 50-50 United Launch Alliance joint venture with Lockheed Martin Corporation (LMT). In 2019, Boeing and Lockheed Martin were already exploring selling the business amidst increased competition from SpaceX and a difficult path forward to scaling the business. In 2023, Boeing reported $44 million in equity investment profits primarily from United Launch Alliance which is down from $128 million in 2019. In 2015, Aerojet Rocketdyne offered $2 billion for the launch operations, which would put the value of ULA at roughly 8x earnings. If we were to apply that to the ULA earnings for 2023, the value would not get much higher than $700 million, but we should also keep in mind that at the time ULA had to invest in a new launch vehicle which might not have made acquisition extremely attractive.

The Aerospace Forum

The equity investment earnings, which primarily are related to ULA, show that earnings have been declining. 2022 was a low for ULA, if we exclude this outlier and value the company at 10.8x to 12x earnings, which is where most aerospace companies trade the value of ULA would be $1.98 billion to $2.2 billion. So, a simple calculation indeed confirms the low end of the valuation that Reuters reported in August. That’s without a premium on sale and without considering that there are not that many launch businesses for sale. Typically, I’m looking for a 25% premium, which would value ULA at $2.5 billion to $2.75 billion at a 25% premium and $2.57 billion to $2.85 billion when a 30% premium is applied. Half of that would be for Boeing, indicating proceeds of $1.235 billion to $1.43 billion.

Another area where Boeing could be looking to streamline its business is in the satellite space. In Europe, we have already seen restructuring efforts focused on the satellite business amidst a trend that favors smaller satellites and increased manufacturing costs for satellites. Boeing’s satellite business is largely based on a $3.75 billion acquisition of Spectrolab in 2000 producing large satellites. But that business should be profitable, and with a mix of commercial and government contracts, I don’t think this is a business that Boeing would identify as non-core.

Conclusion: Boeing Divestments Are Not Straightforward

If we go through the product portfolio and businesses that Boeing has, there are opportunities to sell parts of the defense and space business. However, those are likely not so much focused on selling loss-making programs. On defense, Boeing has quite a few loss-making programs. But due to the financial state, I don’t believe there are many takers for the program. And due to the national security interest as well as the balance in the defense industrial base, I don’t think that it will be easy for Boeing to find buyers and gain approval for selling some troubled defense programs.

The opportunities to sell parts of the business are bigger in space. The Commercial Crew program from a financial perspective is worth close to nothing, but the intellectual property and engineering resources that come with it could lay the foundations for parties interested in developing crewed modules. One might look at the Starliner and wonder why would anyone want to have that engineering core develop a module. I believe the reality is that the engineering core in a streamlined environment focused on providing good quality without huge financial pressure can still develop a capable product. Other divestment opportunities are the servicing of the ISS, although I do believe that Boeing is not necessarily interested in selling this part of the business. The bigger divestment opportunity is United Launch Alliance, which has a hard time remaining competitive and in the satellite business there could be some carving out of businesses. So, I don’t expect we’re going to see big parts of the business go. What I do expect is that smaller parts of the business that are hard to scale and function more like supplying businesses to Boeing and other defense and space contractors can be considered part of Boeing’s non-core business.

While we see multiple reports circulating on Boeing looking to sell its space business, the reality is that Boeing is unlikely to shed big chunks of its business apart from the Commercial Crew Program and ULA unless it in a surprise move declares space exploration and the satellite business as non-core businesses completely. Even the Starliner and ULA are not huge when looking at the bigger picture.

The solution for Boeing, in my view, also is not to shed businesses. It seemingly is the easy solution, but to bring in the big cash I don’t think it’s going to be a game changer. Boeing has to decide in which businesses it wants to invest to remain competitive for years to come, and it’s more through the investment lens that I believe the company will and should make the divestment decisions. I fully support the mindset of the current CEO that Boeing should probably do less and do better on the remaining portfolio. However, shedding huge parts of the business is not a solution. Investors for a long time have called for the divestment of the entire defense business, but that is something that is unlikely to help Boeing. What Boeing needs, whether it sells businesses or not, is to change the way it approaches contracts in terms of risks and engineering. That itself already makes the business more competitive than it is today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.