Summary:

- The Boeing Company is facing program mishaps in commercial airplanes and defense portfolio, with a new CEO trying to address issues.

- SpaceX to provide solution for Boeing’s Starliner program setbacks, with crew returning to Earth on Dragon 2 in February 2025.

- Boeing’s Starliner program has cost overruns of $1.8 billion, with doubts on recouping costs through crewed flights and potential future in space transportation market.

6381380/iStock via Getty Images

The Boeing Company (NYSE:BA) is trying to recover from program mishaps that basically include many of its programs in the commercial airplanes and defense portfolio. While Boeing has a new CEO, which I consider to be a good move, the obvious reality is that the CEO will not immediately be able to fix some issues Boeing faces. This is especially when it comes to contracts that have already been entered or products that are already in development. For those programs, it is more about taking it on the chin and moving on, and the Starliner or Commercial Crew program is one of those programs.

Earlier this year, after years of delays, Boeing carried out the first crewed test flight, and it hasn’t gone smoothly. In fact, it has been decided that Elon Musk’s SpaceX will fly the crew of the Boeing capsule back to Earth in February 2025. A painful moment for Boeing, but I think this is also the best decision. In this report, I will be discussing the troubled history of the program, with a focus on cost and what the latest setback means.

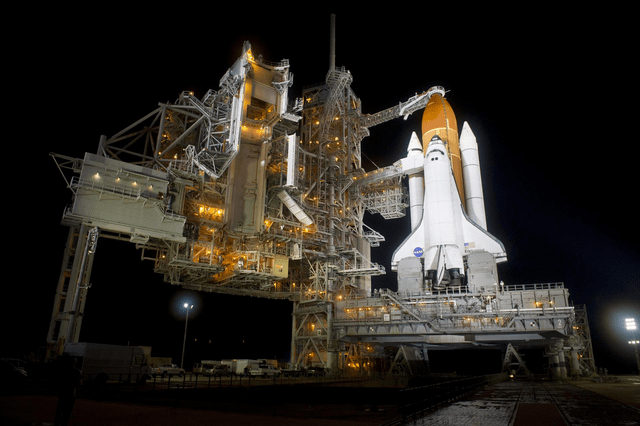

NASA Commercial Crew Program To Develop Successor To Space Shuttle And Soyuz Alternative

In 2011, the Space Shuttle made its last flight without any replacement to transport astronauts between the ISS and Earth. That was in part driven by the cancellation of the Constellation Program, which also aimed to provide transportation between the ISS and Earth. This left NASA dependent on the Russian Soyuz. While the position of Russia today makes it obvious that Russian dependence is likely not desired, 13 years ago, the world looked a bit different. The Commercial Crew Program was not necessarily launched due to adversity, but the goal was to end the reliance on Russia. Besides that, it was simply the case that that due to the absence of an ISS-Earth transportation method coming out of the Constellation Program, it had to come out of a new program. Using the Soyuz capsule was always considered a temporary solution, as the contract for US astronauts to be carried on the Soyuz would eventually end. Furthermore, NASA having its own launch providers on US soil provides more flexibility. The introduction of a second and even third way to transport astronauts would restore the connection in the sense that there was no dependence on just one vehicle for transportation service, which adds to the reliability of the connection. If there was a problem with one way to get to the ISS, there would also be a second way to get there.

In 2014, NASA awarded Boeing a $4.2 billion contract, while SpaceX received a $2.6 billion contract. At the time, it was anticipated that both vehicles would be certified by the end of 2017. However, both companies ran into delays and the fixed price nature of the contracts transfers the risk to the contractor. Government agencies have increasingly been looking to lower costs, and that happens through competition and risk sharing.

Where SpaceX and Boeing diverged was on the development and progress pace was in 2019. That was the year in which Boeing carried out its uncrewed test flight but failed to dock at the ISS due to software issues. These centered on the mission elapsed timer being out of sync and another software error. The issues could have caused even the loss of the capsule if it had not been corrected before re-entry.

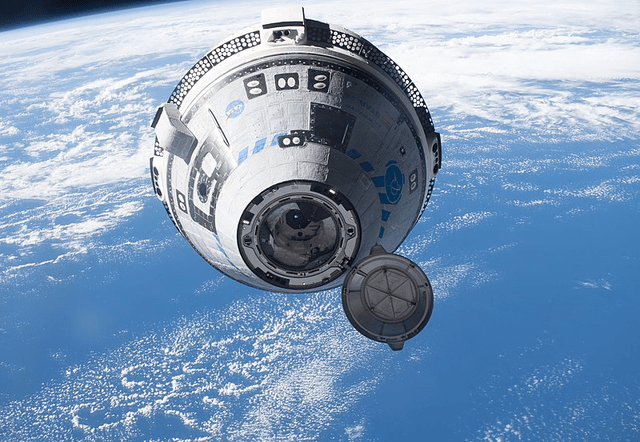

A second test flight was deemed necessary, but the launch was delayed to May 2022 as Boeing worked to issues with the software and thrusters. The crewed test flight was scrubbed twice in 2024 due to issues with an oxygen valve, and later on due to a hardware failure on a computer on the ground. The launch eventually happened on the 5thof June, but was not uneventful, as 5 out of 28 thrusters failed and there was a helium leak. That itself might not have been a reason to assume that the capsule would not be able to return to Earth with the crew on board. However, the fact that simulation tests back on Earth did not provide a conclusive answer as to why the thrusters failed, nor did the proposed and ground simulated fix work in the Starliner. The conclusion was that the thruster malfunction was not understood, and therefore it was deemed too big of a risk to send the crew back to Earth on the capsule.

Boeing Loses Face As Elon Musk And SpaceX Provide The Solution

The plan is now that on a return mission of the SpaceX Dragon 2 in February 2025, the Boeing capsule crew will return to Earth. It is most definitely a loss of face for Boeing, which has significant experience in crewed missions but has not demonstrated it on the Commercial Crew Program. In fact, years ago when the contract was awarded it was the SpaceX solution that was considered the experimental solution and Boeing scored high when it came to past performance. In some way, it is decades of experience that has been put to shame, and from there it is the easy leap to the conclusion that this is yet another indicator of Boeing’s engineering excellence diminishing.

While Boeing had been struggling since 2019, SpaceX completed the Crew Dragon test flight in May 2020 with the first commercial flight in November 2020. By now, the capsule has flown eight missions, more than the initial six that were planned as a minimum, and that is driven by continued delays of the Starliner certification.

Is This The End Of The Boeing Starliner?

While the Starliner is facing issue after issue, neither NASA nor Boeing is talking about halting the program. That, in some sense, could be considered a sign of confidence that Boeing will eventually get it right. At the same time, the risk of further schedule delays resides with Boeing, so NASA has no reason to cancel, and Boeing would likely also not want to cancel the program due to any potential compensations or termination liabilities. In the latest quarterly filing, the company had around $148 million in termination liabilities and $238 million in capitalized pre-contract costs. In the event of termination of the contract, these would likely have to be charged to remove them from the balance sheet.

During September, the capsule will fly to Earth autonomously. This will allow Boeing and NASA to collect data and determine any future steps. However, at this point, it seems certain that additional reach-forward losses will be recorded on the program and that could rise even further if a second crewed flight were required.

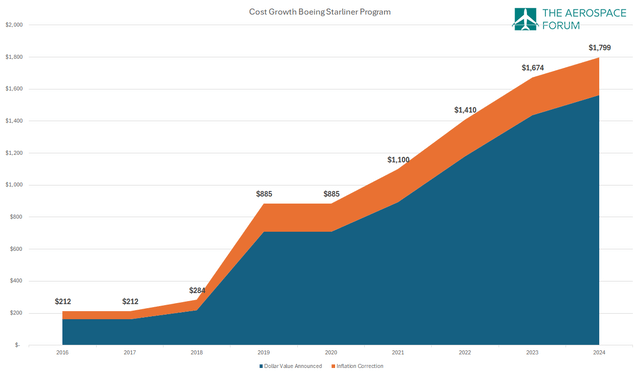

Starliner Program Has Cost Boeing $1.8 Billion

I have collected the Starliner costs overruns and to-date the costs overruns are $1.8 billion, while there definitely is risk for additional cost growth. Boeing has already charged another $125 million against the program, which is included in our calculations. Corrected for inflation, the $4.2 billion plus an additional funding step in 2017 would value the contract at $5.9 billion. The latest milestone funding overview of 2021, suggests that around $2.1 billion (2024-dollars) was funded and another $363.3 million dollars is currently available in potential value. Against the $5.9 billion, that would leave around $3.4 billion that NASA has paid for the development of the program, excluding funding milestones. So, what we see is that on a contract of roughly $5.9 billion, Boeing had cost overruns of $1.8 billion. This shows how engineering decay drove delays and eventually costs and clearly demonstrates why for a company such as Boeing, engineering should be at the heart of its operations.

For a company that should be able to generate $100 billion in annual revenue, the Commercial Crew program is not huge. So, Boeing won’t go belly up from the cost growth, but it is yet another display of the problems at Boeing.

Can Boeing Ever Recoup The Costs?

Whether Boeing will ever recoup the costs remains unknown, but chances are slim to none. To recoup the costs, the Starliner would have to generate its profits from crewed flights. At this point, we don’t even know when the capsule will be accepted for crewed operational flights. However, if we look at the fact that six flights were in prospect, things are not looking great. NASA will likely pay around $90 million (if not more) per seat for Starliner flights once operational. Six flights with 4 astronauts would cost around $2.16 billion. That will not be pure profit for Boeing. If they make a 25% to 30% profit on a single mission, the profit per flight would be around $135 million to $165 million. NASA would need to commission at least 11 to 14 flights, and while that does not seem too many given that SpaceX has 14 flights in planning now, it still does not look great for Boeing. On average, there are two flights per year that NASA commissions. If one goes to Boeing and one goes to SpaceX, that would mean that by 2038 the missions would have been carried out.

Currently, the ISS is slated for retirement by 2030, which means that Boeing might not even be able to carry out the first set of six flights that NASA envisioned. SpaceX has already been contracted to provide the de-orbit vehicle that would end the service life of the ISS, so chances are slim that Boeing will be able to recoup the costs of ISS-Earth missions. Given that there is no replacement station, Boeing can still hope for an extension of the expected service life of the ISS. If not, it will end up with a loss altogether, or it has to hope for launch missions to a future station.

Conclusion: A Painful Moment For Boeing

I believe that with the problems on the Starliner, it is likely that Boeing will see additional cost growth. I don’t think the program is significant to Boeing from a financial perspective, but it is definitely painful for Boeing to see the cost growth and issues continue. At this point, I would say that any doubts about a spot for Boeing in the market for crewed launches into space are justified. Perhaps with the Starliner issues in mind and a possible sale of Boeing’s joint venture to launch payload into space, Boeing’s space adventure might be close to over regarding transportation of payloads and crews into space.

I still rate Boeing a buy despite the current issues, as we are seeing better flows for the Boeing 737 MAX, but do expect some near-term volatility in the stock prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.