Summary:

- Boeing faces major leadership changes and restructuring after years of fallout from scandals and ongoing airplane malfunctions.

- CEO Dave Calhoun will step down at the end of 2024, but investors still face 9 months with him as CEO before the new CEO can fully start the turnaround.

- BA stock has been stagnant for 4 years, and the company’s future turnaround may take several more years.

nycshooter

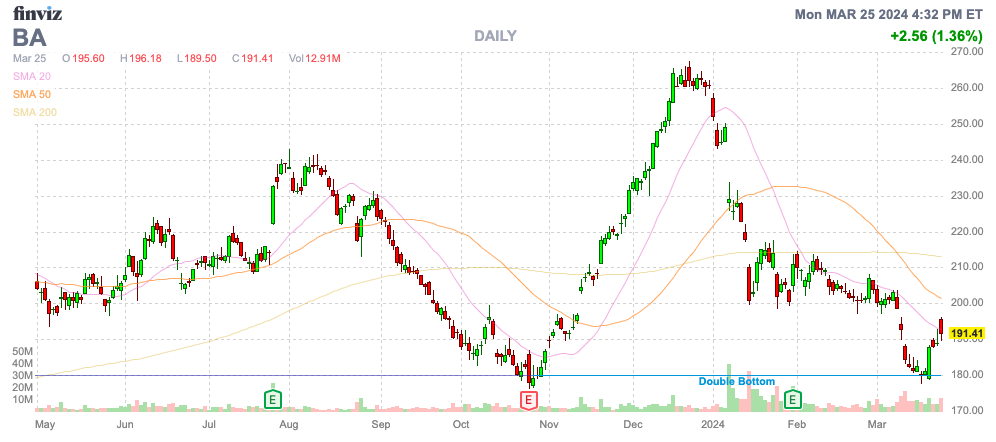

Any company needing drastic leadership changes will likely struggle until new leadership is in place and the business if fully restructured. The Boeing Company (NYSE:BA) faces this exact scenario after years of fallout from a scandal that hasn’t gone away. My investment thesis has long told investors to steer away the airplane manufacturer until operations have improved and now the company is back in the penalty box after a string of airplane malfunctions and major leadership changes that won’t end until the start of 2025.

Source: Finviz

Boeing’s Leadership Changes

Before the market opened on March 25, Boeing announced 3 major leadership changes at the company as follows:

- Dave Calhoun announces intent to step down as CEO at the end of 2024; Calhoun will continue to lead Boeing through year-end

- Independent Board Chair Larry Kellner announces his decision not to stand for re-election at annual meeting; Steve Mollenkopf appointed new chair

- Stan Deal to retire; Stephanie Pope named Commercial Airplanes CEO

The major news, and probably not an unexpected move, is CEO Dave Calhoun stepping down at year end. Mr. Calhoun turns 67 in April and Boeing manufacturing issues haven’t improved under his leadership.

In fact, Calhoun was a member of the Board of Directors during the Max 737 calamity and had become the Chairman of the Board in October 2019 before becoming the CEO in January 2020. His leadership was probably necessary during the traumatic period of the FAA grounding 737 Max planes from flying, but Mr. Calhoun has been the CEO for 4 years now and quality issues continue popping up with Boeing planes.

In the first quarter alone, Newsweek has documented 9 major issues with Boeing planes as follows:

- January 5 – 737 Max operated by Alaska Airlines forced to land after door plug flew off in midair.

- January 13 – 747-8 operated by All Nippon Airways forced to cancel takeoff due to a cracked cockpit window.

- January 18 – 747-8 operated by Atlas Air grounded after failed engine caused fire.

- January 20 – 757 operated by Delta Air Lines lost front nose wheel.

- February 6 – 737 Max 8 aircraft operated by United Airlines had stuck rudder pedals on landing.

- March 7 – 777-200 operated by United Airlines rerouted after takeoff due to a wheel falling off.

- March 11 – 787-9 Dreamliner operated by LATAM Airlines experienced a midflight technical issue resulting in 50 people injured from the aircraft dropping.

- March 13 – 777-300 operated by United Airlines forced to turnaround after a fuel leak discovered on takeoff.

- March 15 – 737-900 operated by United Airlines landed with a missing exterior panel.

The biggest issue with the executive leadership changes is that the top position at the company won’t change over until Mr. Calhoun retires at the end of 2024. Boeing investors still face 9 months with him as CEO and an unknown future CEO starting in 2025. The company has changed the Chairman of the Board with Steve Mollenkopf appointed the new chair after years of leading QUALCOMM (QCOM).

The problem here is that similar situations where CEO changes were recently made haven’t ended well for shareholders, at least over the short term. The problem with firms needing major executive shuffles is that restructurings are needed with lengthy impacts on the business ultimately weighing on the stock.

A similar example is Wells Fargo (WFC). CEO Charlie Scharff was hired in October 2019 to clean up the company from the banking scandal and the stock struggled after the excitement of the initial pop. The company took time to restructure the business due to Covid impacts and the stock is now soaring to recent highs, but the turnaround has taken 5+ years with minimal upside during the period.

Another important example is Disney (DIS) with the rehire of Bog Iger. The CEO originally retired in December 2021 as the Executive Chairman and returned to the media giant in November 2022. After nearly a year on the job, the stock had slumped to below $80 before the recent rebound from a business that traded at nearly $150 before Iger originally left the CEO role.

One could even go back and look at the executive leadership changes at General Electric (GE) where Dave Calhoun previously worked. The stock hasn’t really recovered since the financial crisis starting in 2007 and the hiring of Larry Culp as CEO in late 2018 has taken over 5 years to get the industrial giant back into solid growth mode.

Dead Money

Boeing has already been dead money for 4 years and this leadership change will likely extend the period. The airplane manufacturer has a massive order book leading to huge demand, but all of the manufacturing issues of the last 5 years, along with new leadership and the potential acquisition of Spirit AeroSystems (SPR) will slow down any turnaround in the next year.

The stock has flatlined around $200 for nearly 4 years. The big issue is even figuring out normal EPS levels in order to value Boeing now.

The company earned $16 per share in 2018 before the 737 MAX grounding issues in 2019 hit profits. Boeing had reported 2 decades of consecutive profits, but now the consensus estimates for the next few years are mixed. One can hardly make the case for the stock being a value at $200 if the EPS target hardly tops $10 per share through 2026.

Boeing still has a massive order book of $520 billion with over 5,600 commercial airplanes, but the company can’t steadily produce the aircraft to take advantage of this massive backlog. The airplane manufacturer had just shifted 737 production up to 38 aircraft per month with the goal of reaching 50 aircraft produced per month by 2025/26, but the leadership changes and recent aircraft problems hint at a need to slowdown production.

The stock only has a minimal market cap of $115 billion after delivering $6.0 billion in operating cash flow during a tumultuous 2023. The problem is that operations are likely to remain in flux in the next year via leadership changes and incorporating an acquisition of Spirit AeroSystems. If anything, Boeing seems a lot like Boeing and GE in 2018 and 2019 before a long 4 to 5 year period of no shareholder returns.

Takeaway

The key investor takeaway is that Boeing is making the necessary changes looking for new leadership, likely a few years too late. The problem for investors is that the airplane manufacturer is just entering a restructuring process that might not fully start until 2025 and take a few years to fully turnaround the business.

Investors should continue watching the stock from the sidelines knowing an opportunity will ultimately open up to buy a better Boeing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.