Summary:

- Boeing has faced significant challenges, including net losses since 2019, declining orders, and a recent strike that could cost billions.

- The company’s profitability metrics are negative, and its financial fundamentals are weak, with high debt and low cash flow.

- Despite these issues, Boeing’s stock is trading near multi-year lows, suggesting it might be undervalued and a potential recovery story.

- The US government remains a key customer, providing some stability, but significant uncertainties and risks remain, making me neutral on the stock.

nycshooter

Boeing (NYSE:BA) has been recording net losses for several years’ time. It all started back in 2019 when Ethiopian Airlines Flight 302, a Boeing 737 Max 8, crashed after takeoff from Addis Ababa, Ethiopia. Moreover, in 2020, the company reported very low sales revenues. The sales, however, have been rising after 2020, unlike the company’s net profits. One of the recent pieces of news was a strike that, according to analysts’ estimates, could cost the company billions of dollars. At the same time, BA stock is lingering near 52-week lows. So, is it worth buying Boeing’s stock despite the unprecedented challenges facing the corporation now? Although it is my first article on Boeing, I will still try to answer this question.

Boeing’s Strike and Other News

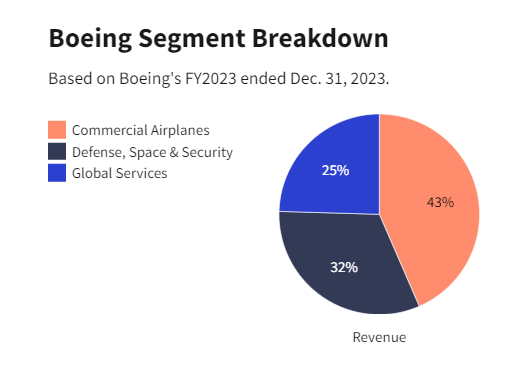

Apart from the recent strike, I will talk more about later in this article, Boeing’s defense unit might continue to negatively impact the company’s earnings in the third quarter. This is because Boeing’s defense division has been struggling with cost rises on fixed-price contracts. The division was also negatively impacted by headlines that NASA decided not to use Boeing’s Starliner space capsule to get two astronauts back from the International Space Station. This is quite serious, indeed, because the US government is the company’s major and most reliable customer. Also, the division itself generates substantial amounts of cash flows. As of 31 December 2023, the defense, space and security division accounted for 32% of Boeing’s sales.

Investopedia

On the positive side, Boeing managed to sell fifty 737 Max 8 jets to China Development Bank‘s financial leasing arm. The company expects to deliver the order between 2028 and 2031. The order is a piece of really good news for the company because it is currently struggling to obtain Chinese orders.

Interestingly, aircraft purchases by Chinese buyers have substantially slowed down since 2018 due to deteriorating US-China relations but are now slowly recovering. In the first seven months of 2024, Boeing and Airbus have delivered 218 and 400 aircraft, compared to 309 and 381, respectively, during the first seven months of 2023. As of July, Boeing was 91 deliveries behind compared to last year’s totals to date, while Airbus is 19 deliveries ahead. As you can see, Boeing’s airplane orders have significantly declined overall despite Airbus, its major competitor, doing better compared to last year.

To make matters even worse, about 30,000 members of the International Association of Machinists and Aerospace Workers have voted against a proposed labor contract and went on strike. The strike halted production of Boeing‘s 737 Max jets, as well as of 777 and 767 wide-body planes. It all depends on how long Boeing’s strike would actually last. Credit-rating companies might downgrade Boeing if the strike lasts longer, say for two months, the way it happened in 2008.

But let me have a closer look at the company’s sales, profits, and other financial fundamentals.

Boeing’s Earnings and Sales Figures

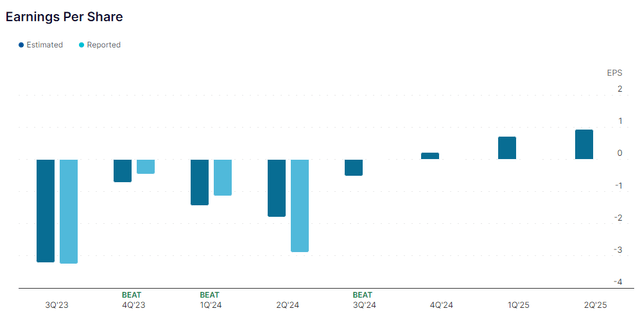

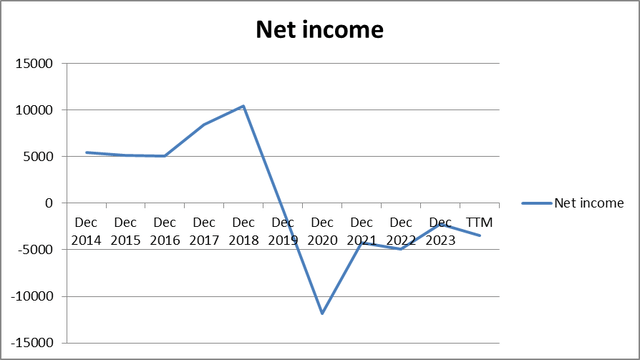

As can be seen from the diagram below, Boeing’s stock is trading near multi-year lows. This has been mostly due to the fact the company’s earnings (‘EPS’) have been negative since 2019. This can also be seen from the graph.

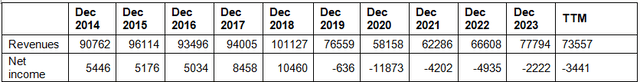

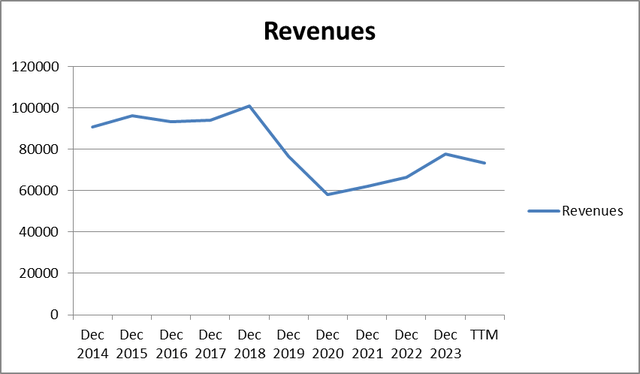

Despite the rather disappointing earnings figures, sales have been performing somewhat better. But still, as can be seen from the yearly sales graph, Boeing’s revenues are struggling to rise from the bottom reached in 2020.

Boeing’s sales and net income history (in $million)

Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

The earnings situation has gotten somewhat better compared to the record net loss observed in 2020. But still, if the trend continues, it seems that it will take the company many years to reach the net income figures recorded in 2018 when the figures were really high.

Prepared by the author based on Seeking Alpha’s data

As can be seen from the graph and table above, Boeing’s net results are still negative despite the positive upward trend.

Boeing’s Financial Fundamentals

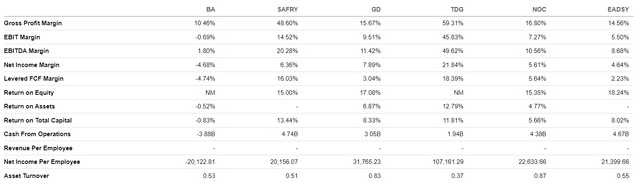

As I have mentioned before, Boeing’s profitability is negative. Despite the fact the company has a positive gross profit margin, its other profitability metrics are negative. Its EBIT margin suggests the company can hardly manage to pay for its costs of revenues and operating expenses. All of the companies whose tickers are mentioned in the table below have much better profitability indicators. Airbus (OTCPK:EADSY) has a gross profit margin which is in line with Boeing but has much better EBITDA and net income margins. Other Boeing rivals, including TransDigm Group Inc. (TDG) and Safran (OTCPK:SAFRY), have much higher gross and net profit margins as well as capital returns.

Boeing’s and its competitors’ profitability indicators

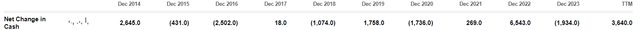

Excerpt from Boeing’s cash flow statement

One of the most unpleasant parts of the Boeing story is its cash flow history. Its 2023 net change in cash was negative at $1,934 million. However, TTM, for the first half of 2024, that is, the company is cash-flow positive because its net change in cash totaled $3,640 million TTM. Notably, in 2022 the company had outlined an annual cash flow target of $10 billion by 2025 or 2026. Also, the company is planning to launch a new aircraft in the next few years, which would require ample amounts of cash expenditures. Despite the net cash flows currently being positive, it is unclear whether Boeing would manage to reach a cash flow target of $10 billion by 2025 or 2026. Wells Fargo (WFC) analysts believe Boeing would not manage to achieve this.

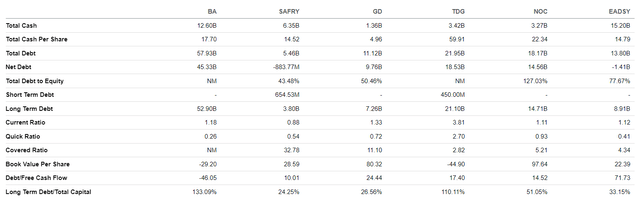

Having high positive net cash flows is particularly important for a company with a high debt load like Boeing. According to Seeking Alpha’s data, TTM the interest expense totaled $2,431 million. The company’s net change in cash TTM was just $3,640 million, just a bit higher than its interest expense. The net profit over the same time period was negative at $3,441 million. So, Boeing’s covered ratio is even negative. Eventually, I think it might get problematic for Boeing to service its debt load. As can be seen from the table below, Boeing has a high net debt compared to its close peer Airbus, which has a negative net debt. Further, as can be seen from the table below, Boeing’s book value per share (book or residual value divided by the number of shares) is negative. This suggests that the company’s assets are lower than its liabilities, which is rare for stable companies. Also worrying are Boeing’s current and quick ratios. These should ideally be higher than 1.5 and 2. In the case of Boeing, these are 1.18 and 0.26 accordingly, which is quite low, indeed.

Balance sheet

Valuations

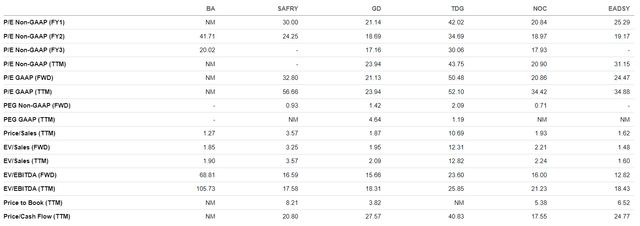

It is quite hard to talk of Boeing’s valuations because of its lack of profitability. Therefore, it is impossible to judge the company by its GAAP P/E ratios. Moreover, its P/B ratio is also negative and so is its P/Cash flow because both the company’s book value and also its free cash flows are negative. The EV/EBITDA ratio is extremely high compared to its peers, which suggests overvaluation. As concerns the company’s P/S ratio, it is the only measure that suggests the company is undervalued compared to peers. But this is quite logical, given years of Boeing’s losses.

We can safely say that all of Boeing’s peers whose tickers are mentioned in the table above enjoy much better valuation ratios due to the fact their profit and book value figures are positive.

At the same time, as I have mentioned above, BA stock is lingering near multi-year lows, which could suggest the market is not optimistic about the company, while the stock is oversold.

Boeing’s 3Q Earnings 2024

BA stock price also depends on the company’s earnings results. The company has announced it will release its quarterly results for the third quarter of 2024 on Wednesday, October 23. President and CEO Kelly Ortberg and Executive VP and CFO Brian West will discuss the recent set of results and Boeing’s outlook during a conference call on the same day.

Here are analysts’ estimates:

Boeing’s consensus EPS is -$0.52. The most optimistic scenario is -$0.11 in earnings per share. More pessimistic analysts expect -$1.16. This means that Boeing is expected to report a net loss. But I would personally be more interested in the management’s press conference and Boeing’s outlook. I would be particularly interested in the steps the management expects to take to decrease its debt level and boost its cash flows. Moreover, I would be interested to see what the management expects its aircraft orders to be this year. Finally, I would also like to hear how the company manages to solve the strike problem and how much it might eventually cost Boeing to solve. So, apart from the actual EPS and sales numbers, the recent developments and also the management’s outlook would be important for investors during this conference.

Downside Risks

The downside factors are very clear, in my view.

First, given Boeing’s rather poor cash flows, it might get harder for the company to service the high debt load, as mentioned in the section above.

Second, there is a risk that Boeing’s factory strikes will cost the company more billions than initially forecasted because these will last longer than expected.

Then, there is a risk defense orders from the government would not be enough to keep the company afloat. As mentioned above, NASA decided not to use the Starliner space capsule. Similar headlines could make BA stock depreciate further.

Finally, there is a recession risk that would make all stocks, including Boeing, go down in value.

Upside Factors

There are two main positive factors, in my opinion. The first is that the worst has already happened to Boeing, it seems. Its stock is, therefore, trading substantially lower than it could. In fact, it is lingering near multi-year lows. The second factor that can easily keep the company afloat is the fact its main customer is the US government, which supports it with defense orders. That is why Boeing seems to be almost “too big to fail” and also very cheap, as if its troubles are likely to persist. However, as time tells, no company is too big to fail. For example, think of what has happened to Lehman Brothers, General Motors, or Chrysler back during the 2008-2009 economic crisis. So, anything is possible.

Conclusion

Overall, from the fundamental viewpoint, Boeing does not seem to be a brilliant company to invest in. However, it could be a wonderful recovery story if the company manages to raise its sales, fix its aircraft defects, and also reach a compromise with its workers to end the strike. But there is too much uncertainty about when this all will happen. On a positive note, I can add that the company’s stock is near multi-year lows, some of its sales are due to the US government, and also that Boeing has a long operational history and seems to be almost “too big to fail”. So, given the rather poor fundamentals but also the fact BA stock is very cheap, I would say I am neutral on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.