Summary:

- Boeing reports Q4 and full-year earnings, with stock price increasing by around 5% post-earnings.

- The company faces ongoing challenges, including the recent explosive decompression incident involving a Boeing 737 MAX 9.

- Boeing leadership is on the hot seat after yet another quality escape.

- Boeing’s Global Services segment continues to perform well, while the Defense segment experiences cost growth and the commercial airplane business showed better performance.

Wirestock

Boeing (NYSE:BA) reported four quarter and full year earnings on the 31st of January and the stock price reacted positively gaining around 5% post-earnings. In this report, I will be discussing the fourth quarter and full year results by operating division and address relevant topics discussed in the earnings call.

Bad Boeing News Dominates

Boeing’s leadership went into the earnings call with many stakeholders including airline executives angered as became clear in an interview from NBC News with Alaska Airlines CEO Ben Minicucci:

I’ m more than frustrated and disappointed. I am angry.

Earlier this year, a brand new Boeing 737 MAX 9 suffered an explosive decompression prompting the FAA to ground all Boeing 737 MAX 9 airplanes. The in-air accident was the latest signal that all is still not well at Boeing nearly five years after the second fatal accident with the Boeing 737 MAX. In response to the accident, airlines have started reviewing fleet plans, intensified pre-delivery scrutiny of Boeing jets and the FAA for the time being has forbidden Boeing to increase 737 MAX production rates.

All of this comes at a time when the US jet maker was working on recovery of its manufacturing and design integrity as well as its balance sheet. So, leadership went into the Boeing’s fourth quarter and full year earnings presentation with a lot of negative momentum.

Boeing: A Dive Into The Q3 and Full Year Earnings

The Boeing Company

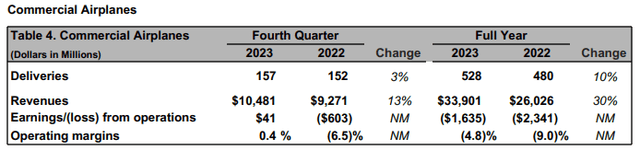

Boeing saw its fourth-quarter deliveries rise 3% and you could say that is not a huge jump in delivery volumes as production is currently higher. So, the higher production rates are not yet reflected in the delivery numbers. There is always some lag in the higher production rates translation to deliveries, but delivering just five units more is not indicative of extremely strong delivery performance compared to the same period last year.

Revenues came in at $10.5 billion, up 13% driven by mix while earnings were $41 million compared to a $603 million loss a year ago. I had expected the delivery value to be in the $10.6 billion to $10.7 billion range, so Boeing missed my expectations on revenues by $185 million. Many Dreamliner operators have agreed on compensation packages with the Arlington-based plane maker which likely has also been granted in the form of additional discount on airplane deliveries.

On earnings level, I had anticipated a $45 million loss compared to the $41 million profit reported. So, Boeing performed significantly better despite missing my revenue estimates. This was driven by 41 million lower research and development costs and $77 million lower abnormal production costs. For the full year, deliveries were up 10% and delivery value was up 30% driven by favorable delivery mix. The operating loss declined from $2.3 billion to $1.6 billion.

The Boeing Company

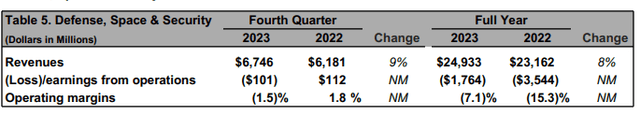

Revenues on the defense segment came in at $6.75 billion, up 9% year-on-year. I tend to model this as a business with $6 billion to $6.15 billion in quarterly sales. Seemingly, Boeing beat my expectations on that end, but it should also be pointed out that the preceding quarter was significantly weaker with revenues around $5.5 billion. So, it is possible that some Q3 revenues had slipped into Q4. While profitable in the fourth quarter last year, the defense, space and security segment swung back to a $101 million loss driven by $139 million in cost growth on fixed-price development contracts. Excluding this cost growth, the segment would be at a break-even level which shows some success in stabilizing the business but also does point at some unfavorable performance and mix effects on the programs excluding the fixed-price development programs.

For the full year, revenues rose 8% to nearly $25 billion and its operating loss declined from $3.5 billion to $1.76 billion. So, the business is still loss making and one can wonder when margins will regrow but we saw significant progress in cutting losses but that was also driven by a significant de-risk attempt last year and perhaps with the previous de-risk attempts in mind it is somewhat disappointing to continue seeing cost growth on a quarterly basis.

The Boeing Company

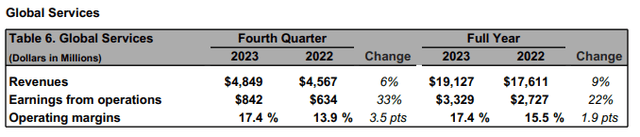

In many ways, Global Services is the star of the show for Boeing. It is the business segment that continues to grow and continues expanding its operating margins. Fourth quarter revenues grew 6% to $4.85 billion on 17.4% margins resulting in 33% higher earnings. Generally, I model the Global Services segment as a $4.75 billion quarterly revenues business with 16% margins. It will be interesting to see whether Boeing can turn this into a $4.75 billion business or more with 17.5% margins going forward. For the full year, the segment saw 9% growth to $19.127 billion in revenues and earnings improved 22% to $3.3 billion.

The Boeing Company

Overall, Boeing reported revenues of $22 billion exceeding analyst estimates by $940 million while earnings per share were -$0.47 beating estimates by $0.32. Looking at Boeing’s performance in Q4, we saw lower cost for Boeing Commercial Airplanes which helped the segment booking a small profit, while the Defense segment continues to experience cost growth and its strong revenues might have been more reflective of a slip from Q3 to Q4 than actually being representative of growth. The services business continues to perform well as demand for air travel is high and that drives flight cycles as well as services and spare parts demand.

Boeing Debt: 2023 Free Cash Flow Was A Watch Item

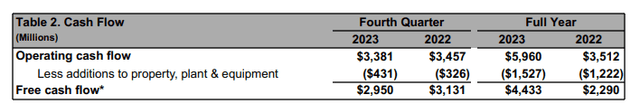

With Boeing trying to execute a multi-year trajectory to reduce debt and clean up its balance sheet, eyes definitely are on the cash flow performance. During the Boeing Investor Day presentation, the company guided for $4.5 billion to $6.5 billion in operating cash flow with $3 billion to $5 billion in free cash flow. That guidance had quite a wide range and in some way was conservative, so it never truly came under pressure but when Boeing’s supplier Spirit AeroSystems (SPR) detected manufacturing issues earlier this year forcing a downward revision on the Boeing 737 delivery target for the year, the cash flow performance became an even closer watch item.

The Boeing Company

Boeing’s fourth quarter cash flow performance certainly was not an eye grabber. In fact, its operating and free cash flow performance declined year-over-year. Perhaps that is also not extremely surprising. Out of the $181 million reduction in free cash flow, $105 million was driven by higher CapEx and the remainder was on operating level. Boeing only delivered 3% more airplanes during the quarter while also experiencing cost growth in the defense business and likely also compensating airlines for delivery delays.

For the full year, operating cash flow came in at nearly $6 billion putting the operating cash flow performance at the higher end of the projected range while $4.4 billion in free cash flow also ended up in the higher end of the guided range marking a $2.1 billion positive swing in cash flow performance for the year.

Sequentially, Boeing’s liquidity improved from $13.4 billion to $16 billion with consolidated debt of $52.3 billion in both periods. This also marked an improvement of $2.6 billion in net debt bringing the net debt to $36.3 billion. So, sequentially consolidated debt remained stable, and one can wonder why Boeing is not accelerating debt repayment. I believe the company aims for a minimum liquidity of $15 billion so there was not a huge space to accelerate debt repayment. Furthermore, Boeing’s debt is fixed rate which shields the company from interest rate fluctuations on existing debt which removes the trigger to accelerate debt repayment. Furthermore, the company also weighs the benefits of debt reduction against short term investments of its cash and with debt being fixed rate its return on investment might be higher than its interest rate savings making it the better path to take.

Liquidity at the start of the year was $17.2 billion with $57 billion in debt putting the net debt at $40 billion. So, liquidity came down a bit, but it was driven by free cash flow being utilized for debt reduction and some continued inefficiencies on some of Boeing’s programs and segments.

Boeing Leadership Focuses On Boeing 737 MAX 9 Debacle

The Boeing Company

The one thing that Boeing executives could not do is put too much emphasis on the financial results and discuss in detail how good or bad they were and rightly so. It is widely considered that the problems at Boeing originate from a financial focused mindset where the focus is on financial numbers rather than engineering and manufacturing strength. In some way, the Boeing stock price had become the focus piece or product rather than commercial airplanes and aerospace products and services.

With that in mind and the lessons learned from Boeing’s awful response to the Boeing 737 MAX crisis, Boeing executives took another approach this time taking full responsibility and promising transparency. While this does seem courteous, it is the only right thing to do so I won’t be applauding Boeing’s CEO David Calhoun for doing what should be common sense and part of integrity.

As a board member of The Boeing Company, Boeing’s board including Calhoun sent the previous CEO to stakeholders to defend Boeing’s interests in a questionable way only for Calhoun to later question Muilenburg’s motives which in all fairness also dented or should have dented Calhoun’s credibility as Boeing’s CEO. In a report, I wrote four(!) years ago I already pointed out that Boeing’s new CEO had a credibility issue and in my view the Boeing 737 MAX 9 debacle only stresses that in the four years that Calhoun is the CEO of The Boeing Company he has been unable to return the focus on engineering and manufacturing quality. In some way, Calhoun is the leader of Boeing, but he fails lead Boeing to greener pastures on the indicators that matter and those are safety, reliability and quality. Without those an engineering company cannot deliver a product. Calhoun carries out a message to the public on the topics of quality, safety and reliability without actually making the positive changes that are needed at Boeing in which case remain just that… words. Too much is going wrong and with the FAA scrutinizing Boeing and the supply chain more heavily, one can only wait for a message of a next manufacturing defect to come out and Boeing’s leadership will turn it into a story of how the company detected the issue and decisively acted. In fact, while this report was awaiting publication, another manufacturing issue on the Boeing 737 MAX was found.

Using yet another failure to show decisiveness is what Calhoun also did during the earnings call:

We’ve been good at taking pauses. I’ve probably taken more pauses in the last three years, and I’ll apologize to all our investors now, than have been taken in 10 years before it. But this is what we do, and it’s how we get better.

The reality is, after four years in which we should have seen a new Boeing with a new mindset, the company has progressed little to prevent quality issues under Calhoun’s leadership and each time he seemingly takes credit for acting decisively when yet another issue surfaces. In my view, complimenting leadership on doing the straightforward thing sets a very low bar because at this point leadership should be asking itself how this continues to happen under the current leadership while that very same leadership carries out a message of being focused on safety and quality. To me it seems this is partially the result of carrying out a message to the public, but not adequately developing the tools, processes and mindset to execute on that message.

In my opinion, if anything, the continued issues that Boeing has faced on its programs including the most recent MAX 9 issues put on display that the current leadership is simply incapable of cultivating a better culture at Boeing. I believe that in some way you can see the current issues faced with the Boeing 737 MAX 9 as the product of Calhoun’s leadership and I believe that the only reason why he is still Boeing’s CEO is because the MAX 9 accident was non-fatal. However, in my view that does not mean that Calhoun should stay. Had the MAX 9 accident happened at cruise altitude, chances are high the outcome would have been very different.

Analysts Focus On Boeing Certification Timelines

While leadership focused on stressing their position on safety, quality and integrity analysts focused on certification timelines for the Boeing 737 MAX 7 and the Boeing 737 MAX 10 which have become less certain. On the topic of the Boeing 737 MAX 7, Calhoun leveraged his meeting with politicians mentioning he met with Senator Duckworth. Boeing had requested that meeting and Calhoun used the content of that meeting to highlight to stakeholders that Duckworth, who is also a decorated pilot, had no safety concerns regarding the MAX 7:

We didn’t have a debate about the safety of the 7 and the 7 in its certification work was moving along at a pretty steady pace.

He also said the senator pointed out that Boeing wanted to introduce the MAX 7 to the public and then come up with an engineering fix months later. Seemingly that sparked something within Calhoun and the company will be delaying the MAX 7 service entry and assign additional engineering resources to develop the engineering fix for the nacelle heating issue on the Boeing 737 MAX.

However, looking beyond the conversation and considering that the MAX 7 is the less popular model in the MAX family while the Boeing 737 MAX 10 is significantly more popular amongst customers, I believe that the MAX 7 is used as a sort of bargaining chip where the MAX 7 certification is being delayed appeasing lawmakers while Boeing tries to keep the Boeing 737 MAX 10 on track as much as possible. In some way, it makes business sense to sacrifice the timeline of a less popular product in favor of the timeline of a more popular one and hoping to keep political interference on Boeing’s production and product plan to a minimum.

Boeing Does Not Provide Financial Guidance For 2024

Given the current circumstances, Boeing leadership did not issue a guidance for 2024 and in some way you could say the uncertainty also does not allow the company to do so. Boeing without doubt has baseline plans that inform supplier master schedules including sensitivity analysis in case some programs such as the MAX experience delays but at this point I believe those scenarios are not firm enough to issue a guidance.

I believe that there are valid reasons for Boeing to not issue a guidance from perspective of usability of said guidance given the high degree of uncertainty embedded, which could aggravate shareholders if Boeing misses guidance. Simultaneously issuing a guidance sends a wrong message to stakeholders, namely that the company continues to focus on financials in a “business as usual” fashion despite a new crisis manifesting itself. During the earnings call leadership also recognized that this is not the right time to issue a guidance and they do not want to get ahead of the regulator.

|

Airplane Family |

Low |

High |

Mid |

2023 |

Increase vs. Low |

Increase vs. High |

Increase vs. Mid |

|

Boeing 737 |

509 |

621 |

565 |

396 |

29% |

57% |

43% |

|

Boeing 767 |

36 |

36 |

36 |

32 |

13% |

13% |

13% |

|

Boeing 777 |

36 |

36 |

36 |

26 |

38% |

38% |

38% |

|

Boeing 787 |

90 |

124 |

107 |

73 |

23% |

70% |

47% |

|

Total |

671 |

817 |

744 |

527 |

27% |

55% |

41% |

I’ve put together a table for each program with low, high and averaged production and delivery assumptions and what we see is that even if Boeing cannot go beyond a production of 38 per month in 2024, there is significant upside compared to Boeing’s commercial airplane deliveries in 2023. Even in the low case scenario, production could increase by as much as 144 units as the jet maker unwinds a majority of its Boeing 737 MAX and Boeing 787 inventory. The high case scenario is not something that I would expect Boeing to achieve, but it would theoretically be possible if Boeing depletes nearly all of its inventory in 2024. The averaged of Mid scenario would increase deliveries by around 40% and would be close to the number of airplanes deliveries from Airbus in 2023. So, that wouldn’t be an unrealistic scenario in my view.

So, what we can conclude is that barring any full and prolonged delivery stops Boeing is set to significantly grow deliveries in 2024, possibly in the 650-750 unit range, and should be able to exceed the delivery growth rate of 10% seen in 2023.

Conclusion: Boeing Remains Troubled But 2024 Offers Upside

I think the conclusion is that 2023 results showed a mix of strengths and weaknesses. Deliveries were not what Boeing and its stakeholders had expected at the start of the year, but its cost execution on abnormal production cost and research and development was strong for the airplane business. The Defense business saw strong fourth quarter revenues, but cost growth persisted while the services businesses is performing exemplary.

Boeing’s net debt did decrease, which is an important thing to keep in mind. What investors should also keep in mind is that even if production does not climb for the MAX program it is very likely that Boeing’s delivery number will significantly rise helped by an unwind of inventory. So, 2024 definitely did not have the start that investors were hoping for, but Boeing’s inventory provides padding to continue growing deliveries at an accelerated rate. My bigger questions are whether the current leadership is the right one to lead this company into the mid-decade and how robust growth in the commercial airplane business can be beyond 2024 because the production rates that Boeing currently targets for the 2025-2026 timeframe would leave little space to increase delivery numbers as there will be no inventory to add to the produced aircraft to from the delivery flow. In other words, production rate increases might merely be offsetting the delivery rate from Boeing’s inventory and then some but not much more.

I believe Boeing’s leadership also knows this and that is why it will be trying to use 2024 to get things in order to secure permission to increase production and aim to safely and incrementally increase production beyond the currently targeted rates for mid-decade. In my opinion, at the end of the day, the earnings call wasn’t so much about earnings but more about viewing management reaction and action on the newest problems that have surfaced at Boeing. While the responses management gave, I am unconvinced that Calhoun can lead Boeing into the right direction. He will be able to increase production, but in my view he has not shown himself able to cultivate and promote the required changes at Boeing including a change in leadership culture by action.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.