Summary:

- Safety issues and the ongoing strike have diminished Boeing’s ability to perform well this year.

- With the 737 MAX production cap still in place by the FAA, it’s hard to imagine how Boeing’s performance will significantly improve anytime soon.

- BA is a Sell for us, even after a major depreciation of its shares.

Jon Tetzlaff

Boeing (NYSE:BA) (NEOE:BA:CA) faces a PR disaster that has already affected its performance and outlook for the rest of the year. As the challenges continue to pile up, it will take a while for the company to execute a proper turnaround. We also believe that not all downsides have been priced in and this is one of the reasons why Boeing’s shares are not a great investment in our opinion.

It’s Getting Worse

Boeing started to face major problems at the start of 2024 when a door in one of its planes operated by Alaska Air Group (ALK) was blown out during the flight. This has led to the temporary grounding of some 737 MAX planes. Since that time, Boeing has paid compensation to Alaska Airlines, while the production of 737 MAX was capped by the FAA to 38 planes per month. But the problems didn’t end there.

A few weeks ago, the FAA issued a safety alert for 737 aircraft operated by foreign airlines as there’s a possibility that some planes are using rubber components that could pose safety risks. Then a few days ago, the FAA also opened a safety review that will last for three months and will show whether Boeing complies with the safety regulations so that its planes could avoid the scenario that occurred at the start of 2024. As such, the production cap of 737 MAX is unlikely to be lifted anytime soon and the company risks further losing its share in the narrow-body market. But that’s also not the end of the story.

In September, close to 33,000 employees of Boeing went on a strike that lasts to this day. This has already affected the production of the company’s flagship 737 MAX planes and the S&P rating agency believes that the strike costs Boeing over $1 billion per month. On Wednesday, the union rejected the latest offer by the company and negotiations are still ongoing.

The safety issues and the strike have already negatively affected Boeing’s performance. The Q3 earnings report, which was also released on Wednesday, showed that the company’s revenues decreased by 1.4% Y/Y to $17.84 billion and missed expectations by $100 million. The bottom-line performance was also poor as non-GAAP EPS was -$10.44, below the expectations by $1.62.

The fact that the company a couple of weeks announced that it might raise as much as $25 billion by issuing more shares or increasing its debt over the coming years clearly shows that the safety issues and the strike had a major negative effect on its operations. There is an indication that the process of raising additional funds is already underway as news came out recently that Boeing has already sold one of its defense subsidiaries to the French arms producer Thales (OTCPK:THLEF)(OTCPK:THLLY).

Since Boeing also faces additional competition from COMAC and Airbus (OTCPK:EADSF)(OTCPK:EADSY), while its major clients become dissatisfied with its performance, we can clearly see that the issues that the company faces are serious.

The Real Value of Boeing

Considering all the issues that Boeing faces, we wanted to figure out what Boeing’s real value is in the current environment. Below we present our valuation model, which will show whether Boeing’s shares have a meaningful upside or downside from the current price.

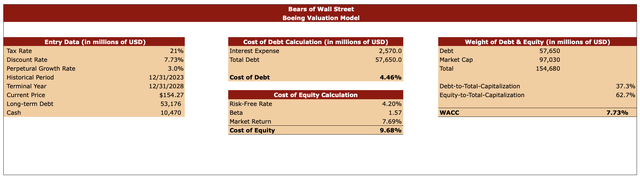

For our valuation model, we used a tax rate of 21%, which is the standard corporate rate in the United States. The perpetual growth rate is 3%, which is the rate that investment bankers use a lot of times as it’s close to the historical GDP and inflation rates. We made this model when Boeing was trading at $154.27 per share and the data for the long-term debt and cash was taken from the latest earnings report.

To calculate Boeing’s cost of debt, we divided its TTM interest expenses by its total debt at the end of Q3. For calculating the cost of equity, we used the risk-free rate of 4.20%, beta of 1.57, and the market return rate of 7.69%. By figuring out the cost of debt and cost of equity, we were able to figure out Boeing’s discount rate, which in our model stands at 7.73%.

Boeing’s Valuation Model (Bears of Wall Street)

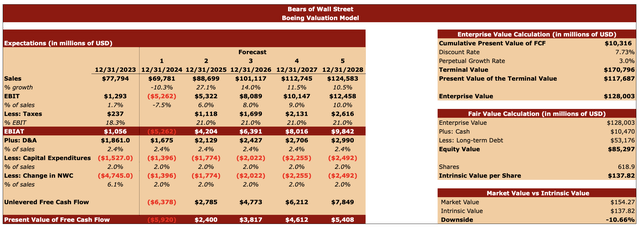

In 2024, we expect the deterioration of Boeing’s sales and negative earnings due to the worsening outlook and a weak performance in the first half of the year. After that, we expect the sales and earnings to improve in 2025 and beyond thanks to various growth opportunities that will be discussed later in this article. Our assumptions for sales and earnings are similar to the overall consensus. All the other metrics are not expected to change significantly in comparison to Boeing’s historical performance.

After completing our forecast table, we managed to figure out Boeing’s present value of FCF, terminal value, present value of terminal value, and enterprise value, which is $128 billion. We then calculated Boeing’s equity value, which in our case is $85.3 billion, and divided it by the number of outstanding shares to find out that the company’s intrinsic value is $137.82 per share. This means that Boeing’s shares are overvalued by ~11% at the time of this writing.

Boeing’s Valuation Model (Bears of Wall Street)

Will There Be A Turnaround?

While we believe that not all of the downside has been priced in, Boeing still has growth opportunities that could undermine our bearish thesis.

In Q3, Boeing booked 49 net orders. In addition, at the end of Q3, the company had $511 billion worth of backlog that included over 5400 commercial planes. That is why things are not catastrophic despite all the recent events. Since Boeing is also one of the biggest companies within the American military-industrial complex, the company could be considered too big to fail and won’t go under anytime soon.

Also, while the union rejected Boeing’s latest offer, it makes sense to believe that some type of deal will be made in the future. Although the company will likely be required to pay higher wages to reach such a deal, the end of the strike will result in the resumption of the production of Boeing’s planes. It would also help the business return to profitability over time.

The macro picture is also on Boeing’s side. The global passenger traffic is increasing and by the end of the decade, the global revenue passenger kilometers is expected to reach 11.4 trillion, 136% of 2019 volume. Considering that it’s unlikely that C919 will be flying over American skies anytime soon, if ever, it’s safe to assume that the Boeing-Airbus duopoly will be intact for years to come.

Final Thoughts

Boeing still has options to execute a recovery, but the road to such a recovery will likely be long and painful. The company won’t perform well this year, since it already showed poor performance in the first three quarters of the year, while the challenges continue to pile up. That is why Boeing is a SELL for us at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.