Summary:

- Boeing faces significant challenges, including a machinist strike, debt load over $45 billion, and delays in key projects like the 777X and 767.

- The company’s financial struggles are exacerbated by past buybacks, COVID-19 impacts, and defense program cost overruns, risking its investment-grade credit rating.

- Boeing’s market position remains strong, but resolving the union dispute and fixing its culture are crucial for long-term recovery and investment potential.

- Despite risks, Boeing’s impressive asset portfolio and leadership’s commitment to recovery could make it a valuable long-term investment opportunity.

nycshooter

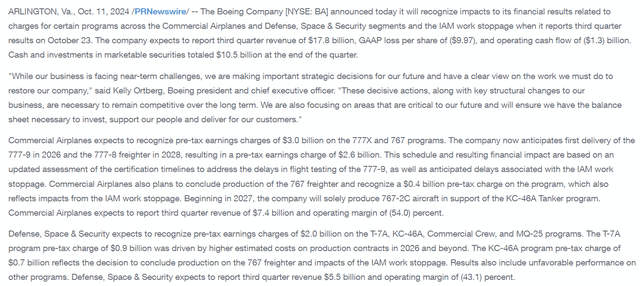

Boeing (NYSE:BA) (NEOE:BA:CA) recently announced surprise pre-3Q earnings in the midst of one of the largest strikes in its history. The company is in the midst of a strike costing it more than $1 billion per month, though strikes would argue the financial position is the company’s own fault after spending $10s of billions on buybacks.

In our last article, we discussed how the company’s brand was dying, something the company needs to repair. As we’ll see throughout this article, Boeing needs to focus on what drives it, its employees, to recover.

Boeing’s Struggles

Boeing’s struggles started with the two plane crashes with MCAS. It ultimately came down to the company skimping out on the proper redundancy and pilot training to save money. That was followed by COVID-19 which was a black swan event for the company and then the company’s Alaska Airlines door plug blowout, which showed an inability to maintain manufacturing quality.

Now the company’s machinists are on strike, and a resolution isn’t close. Boeing withdrew its last offer, after being too far apart from the union. The union wants a 40% raise + pensions, and Boeing is offering a 30% raise. What happens remains to be seen, however, this remains a massive cost for the company.

The company’s striking employees argue that the company has spent too much on buybacks to not afford to support it. The company recently filed a bad faith complaint with the NLRB. We expect the resolution here to be closer to the union’s 40% request, which will represent a substantial additional long run cost for Boeing.

The company has announced a planned acquisition of Spirit AeroSystems for almost $9 billion. Whether that pans out remains to be seen, however, the company is working to put itself back together. The spread on the deal recently expanded with uncertainty.

Boeing’s Financial Future

Boeing’s financial position is tough due to the company’s debt load of more than $45 billion. The company is at risk of losing its investment grade credit rating.

The company’s preliminary results include revenue of almost $18 billion, with an operating cash flow loss of $1.3 billion. The company has the cash and marketable securities to continue handling the cost, but not forever. At the same time, along with the 17k layoffs, the company is delaying its 777X until 2026 and halting 767 once it finishes the final deliveries.

On top of these several billion dollars’ worth of charges, the company is also taking a hit on a number of defense programs. The defense department has cracked down on infinite cost overruns for projects, and that’s putting pressure on the company. The company is cleaning up its existing pipeline of tough projects, but what happens here remains to be seen.

The company appears to be taking steps in the right decision, but who knows what else is hiding under the hood.

Our View

Boeing is a storied company with an impressive portfolio of assets. The company’s massive layoffs are potentially pertinent but asking a lot from employees and laying them off at the same time is risky. The question here is can the company come to a resolution with its union.

The company sits at a market capitalization of just over $90 billion, with ~$45 billion in net debt. In a more normal environment, such as last year, the company’s strength is clear, with annualized FCF at more than $10 billion. For 2024, it expects to lose more than $10 billion, putting its investment grade credit rating under potential harm.

The company will need years to recover; however, it has an impressive portfolio of assets. Demand for the company’s assets is higher. The company needs to show the ability to continue making intelligent decisions; however, we expect that it’ll make the company a valuable long-term investment opportunity.

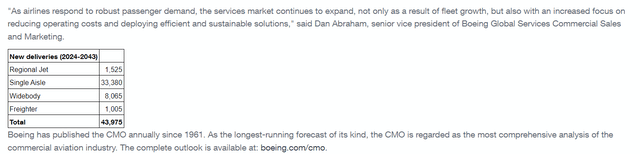

Boeing expects demand through 2043 to be an astounding 44k planes. Boeing trails Airbus with 35% of the single-aisle market, but that still means the potential for more than 10k plane deliveries. For a company that delivered just under 400 plane deliveries in 2023, moving towards 500+ plane deliveries shows its potential.

At the same time, the company has a higher market share in the widebody segment where the company could deliver thousands of 777X widebodies given the new launch and current demand. We expect continued long-term demand along with finally making the right decisions (repurchasing Spirit AeroSystems) could enable the company to succeed.

However, it will also be key to see if the company can resolve the strike in a timely manner to show that management has properly readjusted its portfolio.

Thesis Risk

The largest risk to our thesis is that Boeing needs to fix its culture, and that’s one of the toughest problems that a company can face. Whether the company can successfully do that, in a timeframe that enables it to handle its debt load, will be tough to see. Until then, this is a company worth $100 billion, losing money each day.

Conclusion

Boeing announcing early results resulted in the share price going up, but the company also announced massive layoffs as workers continue to be impacted for prior mistakes. We think it’s incredibly risky given the impacts on morale, it’s tough to convince employees who don’t trust you to go the extra mile in reporting potential problems with your airlines.

Boeing does have an incredibly strong market position in a growing market. It does have a leadership team that’s committed to putting itself back together. However, it remains seen to tell how the company’s resolution of the strike goes, to tell whether or not the company is an interesting investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.