Summary:

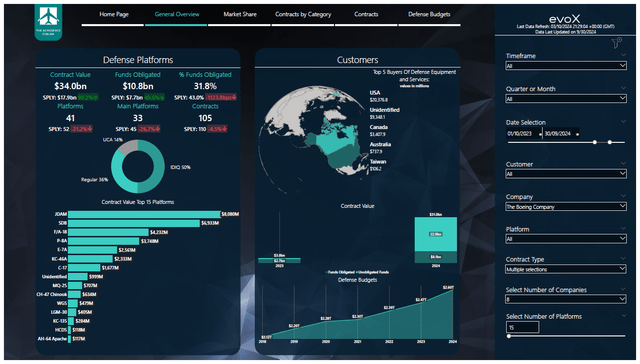

- Boeing’s defense contract value surged to $34 billion, nearly doubling year-over-year, driven by aircraft and bomb programs despite challenges in other areas.

- Excluding indefinite delivery/indefinite quantity contracts, BA’s contract value still increased by 40% year-over-year, highlighting strong demand for profitable legacy programs.

- Boeing’s defense segment faces profitability issues due to fixed-price contracts on next-generation programs, resulting in significant losses and margin fluctuations.

- The Company needs to align engineering with monetary gains and avoid fixed-priced development contracts to improve profitability and leverage its strong backlog.

Wirestock/iStock Editorial via Getty Images

The financial year for the Department of Defense ended on the 30th of September. That provides a good moment to see how much contract value has been secured by the primary defense contractors. In a previous report, I have already done so for Lockheed Martin (LMT) and observed that while defense budgets are expanding measured by dollar value, the contract awards dropped 7.1% which, I believe, is related to the long-term nature of procurement processes.

In this report, I will be focusing on the contract flow for Boeing (NYSE:BA), and given the problems that the company is facing in their commercial and defense business, it might come as a surprise that the company actually nearly doubled its contract value. I will be unpacking the contract announcements to assess where this growth is coming from.

Boeing Defense Contract Value Surges

Boeing secured $34 billion worth of contracts, which include regular contracts but also indefinite-delivery/indefinite-quantity contracts. These so-called IDIQs provide a framework against which task and delivery orders can be placed. IDIQs generally do not get added to the backlog of a company, so what we do see is that a substantial portion of the contract value does not add to the backlog unless an order is placed against the framework. Nevertheless, we see that the potential contract value significantly exceeds the growth rates of global defense budgets, and it does show that part of Boeing’s product portfolio is still in demand.

The IDIQs were driven by the Joint Direct Attack Munition program, which turns unguided or “dumb bombs” into all-weather precision guided munitions. The other program that accounted for more or less the remainder of the framework contracts is the Small Diameter Bomb or SDB. One could say that absent the IDIQs, Boeing might have had a bad year when it comes to securing contracts that actually do add to the backlog, but that is not the case. I filtered out framework contracts from our interactive model developed by The Aerospace Forum and observed that the contract value still reached $16.9 billion, which an increase of almost 40% year-over-year driven by the P-8A, E-7A Wedgetail, F/A-18, KC-46A and C-17.

I do recognize that the company has some troubled programs in the form of the KC-46A, MQ-25, VC-25B and T-7A which are in a loss position, and if we filter those programs out, we still see that there were $13.8 billion worth of contracts marking a 47.1% increase year-on-year. So, the conclusion is that the programs on which Boeing is able to generate profits saw significant year-on-year growth in contract value.

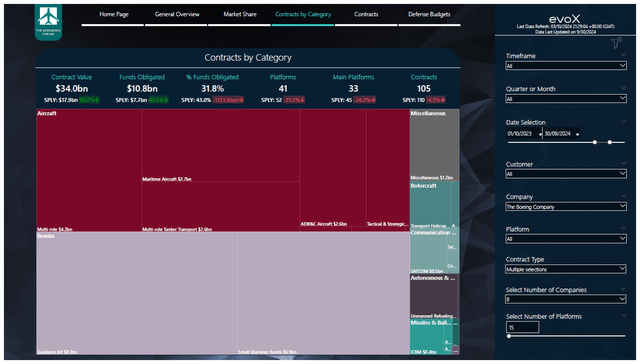

Boeing Contracts Focused On Aircraft and Bombs

Whereas Lockheed has a strongly diversified contract value inflow by category, that is less the case with Boeing, which derived nearly 90% of its contract value from aircraft and bombs. Perhaps that also shows one of the issues with Boeing. The company lost its edge on missile defense as the GMD or Ground-Based Midcourse Defense anti-ballistic missile system for which Boeing was the prime contractor will be replaced by the Next Generation Interceptor which Lockheed Martin and Northrop Grumman (NOC) partnered with RTX are competing while Boeing’s land-based intercontinental ballistic missile system, the Minuteman III, will be replaced by Northrop Grumman’s LGM-35 Sentinel. It shows that Boeing has been missing out on the development of successors to platforms on which it was the prime contractor, and that adds on top of previously missing out on the development of what became the F-35 and the next-generation strategic stealth bomber. What the company is left with is some legacy programs and non-performing programs such as the KC-46A, MQ-25A, T-7A Red Hawk and the VC-25B which is the Presidential Aircraft Replacement program.

What Is The Problem For Boeing Defense?

Boeing’s defense segment has annualized sales of $26 billion, using the latest reported revenues. What makes things somewhat tricky to compare sales with the order inflow and backlog is the fact that some of the Boeing Global Services can be attributed to military platforms. I believe that this is somewhere around $10 billion. That would result in sales attributable to military platforms and satellites of $36 billion. So, with that in mind, $34 billion in contracts is not bad as it indicates a book-to-bill of roughly 1.1x. Boeing also has a $59 billion backlog for Defense, Space & Security, and using the sales distribution between commercial and defense on the backlog would indicate that around $9.75 billion of the Boeing Global Services backlog can be attributed to military platforms for a total backlog of $68.75 billion.

Generally, we are looking for backlog being around 2 times sales, and in Boeing’s case, that is not the case. With a $68.75 billion backlog and $36 billion in sales, we would get to 1.9x sales. If we would solely apply it to the reported backlog for BDS, we would have $59 billion divided by the $26 billion annualized and that would BDS backlog at 2.3x annual sales, which is actually a bit better than Lockheed Martin. Staying with the conservative 1.9x, I would say that the backlog is a bit lower than the 2x that I deem comfortable. However, Boeing’s problem is not the backlog at this point.

The problem is that the company doesn’t have highly profitable future-proof programs. All next-generation programs such as the KC-46A tanker, the unmanned MQ-25 tanker drone, the Presidential Aircraft Replacement and the T-7A Redhawk trainer jet are all in a loss position and those losses are eating away the profits generated by the legacy programs such as the F/A-18, bombs and guidance kits. Boeing can only hope that its losses on the programs taper and demand for the legacy programs remains strong.

Two weeks ago, Ted Colbert, who served as the CEO of Boeing Defense, Space & Security, was pushed out of Boeing. I believe that was driven by the fact that Boeing kept absorbing additional costs on the programs that it has been trying to de-risk for years, and it shows how big the challenge is. As CEO, Colbert was responsible for what happens at BDS, but it is unrealistic to assume that Colbert would be able to fix cost performance on programs for which designs have already been frozen long before he became CEO and fixed-price contracts were agreed on also long before he became CEO.

Conclusion: Boeing Defense Has A Strong Backlog But Performance Lacks

Boeing’s contract value rose significantly year-on-year with or without IDIQs added to the tally. The good news for Boeing is that even without the contract value for the troubled defense programs added, there was significant growth visible. In other words, the performing legacy programs are still seeing solid contract awards. Boeing’s problem in the defense segment is the fact that its fixed-price contracts are resulting in significant losses that result in high fluctuations to the margins and even put the defense segment in a loss-making position.

So, it also goes without mentioning that Boeing needs to align its engineering skill to harvest monetary gains, rather than making engineering a function of monetary targets. That has never been a good idea, and we also see that just agreeing on fixed-price development contracts to win the contracts is not a good idea either. It puts Boeing in a position where it needs to count on profitable after sales spares and services support to make up for the losses incurred on the development and production of its current line up of tankers, tanker drones and trainer jets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.