Summary:

- The Boeing Company has faced numerous challenges in 2024, impacting its reputation, delivery schedule, and impacting its core customer base.

- The company’s series of mishaps have had some significant consequences for the airline industry as a whole.

- To recover, Boeing needs to take necessary actions to address its issues and regain the trust of customers and stakeholders.

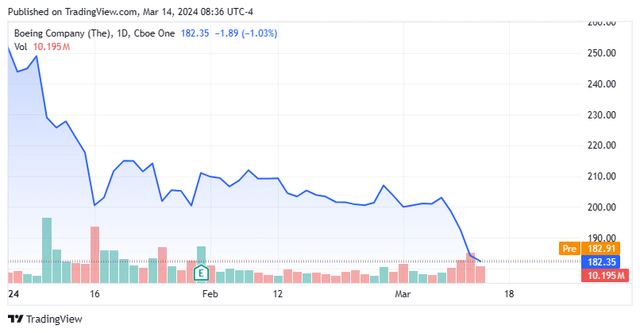

- Until these issues are fully addressed, it is hard to have faith the stock has bottomed despite a 30% sell-off so far in 2024.

- We take a look at the current challenges facing Boeing and its shareholders in the paragraphs below.

Kesu01

It is hard to come up with a well-known American company that has had a tougher start to 2024 than The Boeing Company (NYSE:BA). The manufacturing icon has begun the year with a series of high-profile incidents and mishaps.

This all started with a door coming off mid-flight on an Alaskan Airlines flight on January 5th. This happened on a Boeing 737 Max airplane that had no bolts on the door and was scheduled to undergo a thorough maintenance check. The incident occurred at 16,000 feet and forced an emergency landing. Fortunately, there were no fatalities or serious injuries on the flight, but many of the 177 passengers were traumatized by the event, and it got widespread coverage in the national media.

Since the near-disaster on that Alaskan Airline flight, there have been serious incidents involving other Boeing airliners including its 787 Dreamliner and 777 product lines. The latest incident occurred Wednesday night when a Boeing 777 was forced to make an emergency landing at LAX due to a suspected mechanical issue.

Impacts On The Airline Ecosystem:

Obviously, Boeing’s recent issues impact more than just the company. Major airlines are also affected.

United Airlines Holdings, Inc. (UAL) has just urged the company to put off production of its coming 737 Max-10 version and focus on ramping up production of the 737 Max-9. The Max-10 (a bigger version of the Max-9) was due to be certified by the FAA for flying this year before these latest safety/production incidents. Prior to this push, United had 277 firm orders on the books for the Max 10, along with options to buy 200 more planes. Some of these orders have also been rerouted to Boeing’s primary rival, Airbus SE (OTCPK:EADSY).

A few days prior to United’s communication, Delta Air Lines, Inc. (DAL) which has firm orders for 100 737 Max-10s with options on 30 more, said it doesn’t expect any deliveries for this version of the 737 Max until 2027 now.

Early in March, American Airlines Group Inc. (AAL) did show some long-term faith in the 737 Max-10 by ordering an additional 75 copies of this version of the 737 Max product line. This brought American’s commitment to the Max-10 to 110 firm orders and options for 75 additional planes.

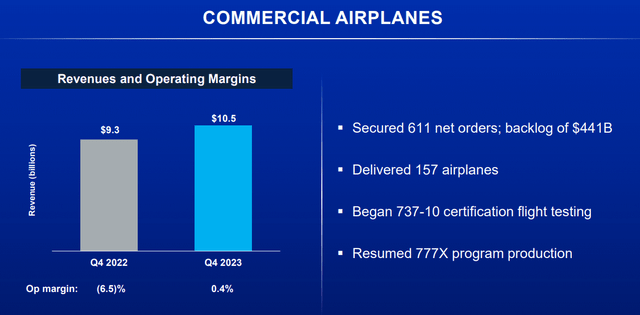

Boeing produces more 737 Max passenger jets than any other plane in its product line. These recent incidents have already caused Boeing to push back a planned production ramp-up by several months. The company was planning to produce 42 737 Max planes a month (up from the current production run of 38 planes a month) in February. This will be pushed back to at least June now, pending further developments. Given plane deliveries are a big-ticket item in the monthly Durable Goods report, this reading will also be impacted in a negative way.

What Needs To Happen To Right The Ship:

I believe the company needs to do three things to put this huge manufacturer back on the right path. First, obviously, management must address the recent quality control and safety issues and also get back into the good graces of government regulators. Given it is an election year, I could see these recent incidents drawing congressional scrutiny. As it is, the FAA late in February gave Boeing 90 days to fix systemic quality-control issues. Some details from a six-week audit by the FAA on Boeing and subcontractor Spirit AeroSystems turned up many issues and are still part of an ongoing investigation. Boeing is currently in talks to acquire its struggling supplier it should be noted.

Boeing also needs to put these issues to bed to avoid reopening a deferred prosecution agreement (more on this in the Conclusion section below) and push through with the certification of its 737 Max-10 airliner.

Second, Boeing needs to make right by some of its core customers like Delta and United Airlines who have been impacted by these recent challenges. This will probably involve rebates, discounts, and other givebacks that obviously will impact Boeing’s bottom line. However, they seem necessary to keep in the good graces of some of its largest customers.

Finally, I think the company needs to bring in some new management. If one goes to any kind of investment chat room or discussion around Boeing, it is populated heavily with current and former Boeing employees. One theme emerges over and over again. And that is Boeing, throughout its proud history, has been led by engineers, but currently it is led by “accountants.” This seems to be part of the company’s recent manufacturing issues and Boeing bringing in some new leaders in key posts would likely improve operational efficiency, improve safety, and be well-received by the investment community. Insiders stepping up to purchase shares in light of the recent decline in the stock would also be encouraging. The last insider purchase of this equity happened in July 2023, however.

Conclusion:

This is not the first time in recent years Boeing has faced considerable ire and controversy from the public, investors, and its core customer base. Two 737 Max airplanes crashed, in Indonesia in October 2018 and in Ethiopia in March 2019 that resulted in 346 deaths. These incidents resulted in the international grounding of all 737 Max airplanes as well as a congressional investigation. The stock of Boeing lost a hundred points from its high of late February 2019 ($440 a share) just before the second 737 Max crash until the stock bottomed in mid-August of that year. A floor the shares held until the COVID-19 breakout and the associated lockdowns.

Percentage-wise, the stock of Boeing has already suffered a greater loss of value than was triggered by those 737 Max crashes some five years ago. These incidents eventually forced Boeing to reach a $2.5 billion settlement with the federal government. In a huge case of bad timing, the deferred-prosecution part of that agreement was due to expire two days before the Alaskan Airlines incident on January 5th.

Fourth Quarter Company Presentation

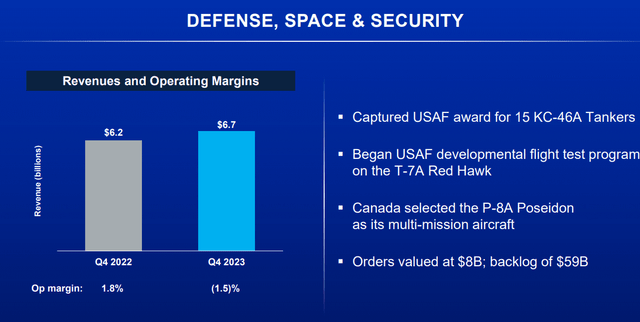

The 30% drop in Boeing stock so far in 2024, could signal there might be some good opportunity for longer-term investors in BA given this is a bigger drop than occurred when the 737 Max was involved in two fatal crashes a half decade ago. Boeing is also one of two major manufacturers with Airbus of large passenger jets in the world, which effectively is a duopoly. In addition, the company has a large defense business (roughly 30% of revenues) that should not be significantly impacted at all by these recent incidents.

Fourth Quarter Company Presentation

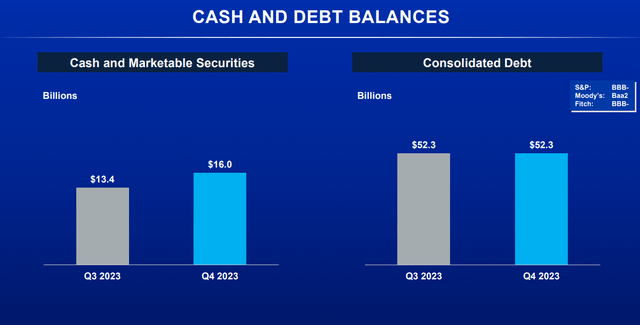

That said, I would like to see production ramp up fully restarted and some progress on the three areas outlined in this article before I start to buy Boeing stock. The company does have a massive order backlog of north of $440 billion, which is a long-term positive. However, given the company’s horrid start to 2024, it just feels like things could very well get worse before they get better, and a true bottom could be some time off. Boeing does have over $15 billion of cash on its balance sheet, so its liquidity is solid.

Fourth Quarter Company Presentation

In addition, the stock is not compelling from an earnings perspective. Boeing lost nearly $6.00 a share in FY2023, and the median analyst firm consensus has the company making just less than $3.00 a share in FY2024 and nearly eight bucks a share in FY2025. Obviously, there is a wide variance in earnings estimates and will likely continue to be so until some more clarity around Boeing’s challenges is forthcoming. Bottom line, there will come a time it will be time to establish a stake in The Boeing Company stock, but we are clearly not at that point yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: I present an update my best small and mid-cap stock ideas that insiders are buying only to subscribers of my exclusive marketplace, The Insiders Forum. Our model portfolio has more than doubled the return of its benchmark, the Russell 2000, since its launch. To join our community and gain access to our market beating returns, just click on our logo below.