Summary:

- The Boeing Company’s commercial business is in a sad state, and the turnaround process remains uncertain.

- Corporate culture and management issues are responsible for ongoing problems at Boeing.

- Future EPS estimates may be too high, and continued underperformance could keep the stock price depressed.

Stephen Brashear

I recently outlined The Boeing Company (NYSE:BA) as a likely beneficiary of increasing defense spending and other factors. Unfortunately, Boeing’s commercial business remains a sad state of affairs. While Boeing is in an advantageous position because of the Boeing/Airbus duopoly, it’s unclear how long the turnaround process will take.

Boeing’s management remains at the eye of the storm, and its corporate culture of “profits over safety” is directly responsible for the ongoing issues at the troubled industrial giant. I recently sold my stock in Boeing because the company’s problems could continue affecting profitability, and the outlook remains cloudy for Boeing’s stock.

I’m concerned about the opportunity cost. There could be better stocks to buy and hold than Boeing. Therefore, I am downgrading BA from a buy to hold until we have more clarity regarding its turnaround and brighter skies ahead.

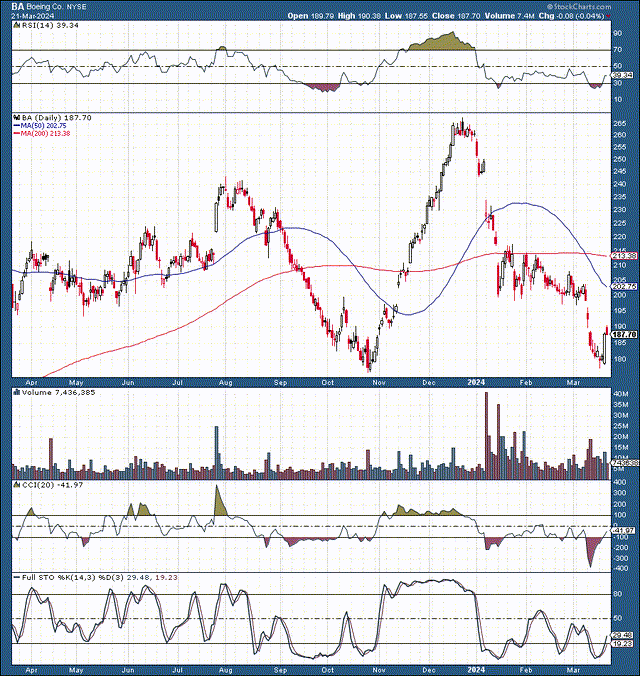

Stock Remains A Rollercoaster Ride

When we thought things were improving, Boeing’s stock fell off a cliff. From its high of around $265 in late 2023, it cratered, losing about one-third of its value, crash-landing at about $180 recently. Despite being technically oversold, the wild rollercoaster ride with BA could continue, which is not something we want. Boeing should be a stable company with a relatively stable stock and a dividend instead of expressing extensive volatility, as we’ve seen recently with BA.

Boeing’s History Of Profits Over Safety

I first covered BA in 2019, when the stock was around $350-400. I called it a sell then, and unfortunately, five years later, not much has changed. Corporate greed and misconduct continue to plague the iconic airplane maker. Around 2018-2019, BA had horrifying back-to-back crashes, illustrating “difficulties” with its 737 Max 8 plane.

Thankfully, we’re not seeing Boeing’s drop from the sky anymore, but its issues seem far from resolved. Recently, a door blew out in midflight on a Boeing Alaska Air flight. While investigators are still trying to figure out exactly why the door plug didn’t stay put, other issues keep piling up.

There was a critical problem on a BA plane, and the Secretary of State Antony Blinken was set to fly on it recently. In another incident, the wheel of a BA Delta flight dropped off the plane shortly after takeoff. Loose bolts and mis-drilled holes are some of the issues associated with the 737 Max “Dreamliner.”

These problems may be the tip of the iceberg and are the product of many years (decades) of cutting corners and safety lapses to maximize profits rather than provide an extra layer of safety for customers flying on its planes.

The Last Words Any Person Flying Wants To Hear

There is “a disconnect” between Boeing’s senior management and its employees regarding “safety culture,” concluded a report released by the Federal Aviation Administration. These may be the last words anyone flying on a Boeing plane wants to hear, but the statement outlines the corporate culture rather clearly.

Boeing management’s primary objective is increasing profits. This is logical, as any company’s responsibility is to return wealth to shareholders. However, in BA’s case, it’s much more complicated. Unfortunately, Boeing maximizes profits at the expense of safety measures it should be implementing to ensure safe flight experiences for its passengers, and this strategy has backfired in a big way.

Boeing’s Management Catastrophe

The recent report described BA’s safety culture as “inadequate” and “confusing.” Several factors cause this dynamic, but the main one remains greed, in my view. Despite horrible stock performance and an awful safety record, BA’s top management receives sky-high compensation worth millions of dollars.

Instead of paying its executives tens of millions of dollars, Boeing should hire more supervisors overlooking safety issues plaguing its planes. The FAA Administrator Mike Whitaker said, “Boeing must commit to real and profound improvements.” Whitaker added:

“Making foundational change will require a sustained effort from Boeing’s leadership, and we will hold them accountable every step of the way.”

What’s happening to Boeing is shameful, and the image of the iconic American brand may get tarnished beyond repair. The most significant problem remains entrenched in the company’s corporate culture, and that’s not an easy issue to resolve. Unfortunately, BA’s management mishaps have affected its bottom line, and the stock remains depressed.

Earnings Continue To Suffer

BA’s earnings have been mostly negative over the last four years. Boeing lost $5.82 in EPS last year. Consensus estimates were for a loss of about $5.34. Thus, we see a miss rate of around 10% for BA. Additionally, EPS revisions have moved lower consistently, suggesting BA could continue underperforming.

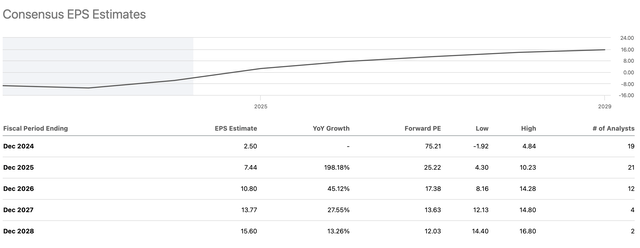

EPS Estimates May Be Too High

EPS estimates (seekingalpha.com )

The consensus estimate is $2.50 this year, a considerable jump to $7.44 in 2025. However, judging by BA’s record and ongoing scandals, BA could miss such optimistic EPS projections and earn around the lower end of the EPS range. Considering BA could earn around $5 in EPS next year instead of the $7.44 estimate, its forward P/E is around 40 here, relatively expensive for a company with a cloudy outlook like BA. Continued underperformance could keep BA’s stock price depressed moving forward.

The Bottom Line

There are many positive factors when considering The Boeing Company as a possible portfolio candidate. BA has a solid defense business and is part of a powerful duopoly in the lucrative commercial airplane space. However, the iconic plane maker suffers due to chronic managerial issues and is plagued by perpetual safety concerns regarding its planes.

Moreover, BA’s profitability continues to suffer, and future estimates may be too optimistic. Therefore, BA’s earnings could continue underperforming, which may negatively affect its stock. Due to BA’s ongoing safety and other issues, I recently sold my BA position and have dropped my buy rating to a hold rating on The Boeing Company’s stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!