Summary:

- Boeing has faced a series of negative events and new stories in the past three months, including regulatory issues and safety concerns.

- Despite the challenges, BA remains a major player in the aerospace industry with a strong position and high demand for its products.

- I continue to hold and add to my position in Boeing, believing that many of the issues can be overcome in the long term.

nycshooter

A lot has happened in the three months since I wrote my original article on Boeing (NYSE:BA). And almost all of it has been bad if you’re a Boeing shareholder. The sole exception might be if you’re one of the many that count the resignation of CEO Dave Calhoun at the end of the year as a good thing (I’m in this camp). Back in that article, I encouraged investors to ignore the noise around Boeing and its current issues. But I could never have expected the noise to be as loud as it has been. With all that said, I continue to hold Boeing and have added to my position, and I’ll explain the reasons why in greater detail below.

First – a Note on Bias

Commitment or consistency bias in investing is a very real thing, and one reason that some super investors like Guy Spier don’t talk about their stock holdings. I’m cognizant of the fact that I have made a public opinion and that if I very quickly wavered from that opinion, how would that look? That’s magnified by the fact that this was my first article on Seeking Alpha, as opposed to conversations with friends. But that is not why I continue to hold and have actually added to my position at these levels. I truly believe that many of the items that you read in the news are meaningless if you have a long-term view on the stock and expect to hold it for many years.

But let’s analyze what has gone wrong and what, if anything, can be discarded. Keep in mind that my original thesis is that Boeing is a duopoly and absent another major incident such as the Alaska Air blowout, or worse an actual plane crash, Boeing will ultimately be fine.

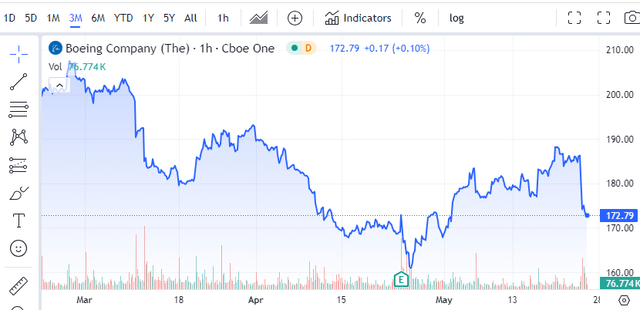

Here’s a chart showing what the stock has done while all this news was being digested by the market:

Boeing: 3 Month Chart (Seeking Alpha)

I’m going to structure this into news items that have occurred in the past three months, categorized by their relevancy to my Boeing long-term view.

The Irrelevant Noise

At least a few times a week, there’s a headline that includes Boeing that really has nothing to do with the company itself. Boeing makes planes which have strict maintenance requirements, but are not going to fly issue free for thirty years. The Alaska Airlines issue was a new plane missing manufacturer installed bolts that was clearly the fault of Boeing and its supplier, Spirit AeroSystems (SPR). A tire falling off a plane that has been in service for over 20 years has nothing to do with the manufacturer, but that doesn’t mean they won’t include Boeing in the headline. I’m also pretty sure when a plane skids off the runway and catches fire, it has less to do with the manufacturer than the pilot, but what do I know?

In my original article, this was the noise I was referring to that should be ignored. Note that Airbus (OTCPK:EADSF) aircraft have been involved in very similar issues such as grounding of aircraft for door alarms, engine issues is Australia, and emergency landings for a hydraulics issue. These fairly common flight occurrences don’t seem to get the same attention when Boeing is not involved.

Mildly Concerning Noise

In this category, I’ll put all the regulatory issues that Boeing is facing with the FAA. At this point, Boeing is firmly in the penalty box and the FAA has every reason in the world to be very critical and deliberate in their review of any Boeing issue and its 90-day quality and safety plan. It also doesn’t help when Boeing can’t produce simple documents related to the Alaska Airlines incident, or when the FAA finds dozens of issues during an audit. I don’t think that Boeing would be the first aviation company to have issues during an FAA audit, but they have put themselves under scrutiny and likely ensured that any such issues uncovered will be made public by the FAA or the media. The FAA does not want any appearance of going easy on Boeing.

At the end of the day, I don’t believe the FAA issues will result in any material impact to the business. But I certainly believe it will slow the return to business as usual and hurt the production rate for many months to come. This all has real consequences in the form of lower cash flows and earnings in future quarters. In my opinion, this moves the $10 billion free cash flow goal at least a year out. A real impact for sure, but not fatal to my thesis.

More Concerning Noise

If my main thesis involves Boeing not having another significant incident or accident, then any new safety issues should be a concern. Much of this seems like noise as well, such as the potential explosion risk on the 777, a model that has been in operation for almost 30 years. The recommended fix is relatively small dollar and the responsibility of the airlines, so really a non-issue for Boeing. The obvious major downside would be if there actually was an incident, so you can’t just rule this out.

There was also an issue with the controls of a 737 MAX aircraft in Newark, that occurred on a relatively newer plane delivered in early 2023 as well as continued issues with the anti-icing system on the 737 MAX and 787. Neither of these issues seem to warrant any significant concern, but if not remedied, could become problematic. This also seems to be another case of a minor problem being highlighted because it’s Boeing.

I’ll also add the whistleblower issues in this category as well. In cases such as the Dreamliner whistleblower, this is a current employee who has a lot to lose, which makes me question whether there’s a bigger issue to be concerned about. It’s also one that will occur as the aircraft ages, and these planes aren’t that old at this point, so it will require monitoring.

Related to this, two former whistleblowers have sadly passed away under somewhat suspicious circumstances, which certainly could be a major concern. I’m not really a conspiracy theorist, and so I’m going to take this at face value and believe the causes of death as reported. Obviously, if Boeing were ever to be found involved in these deaths, that would be devastating to the company.

In my opinion, the potential prosecution by the DOJ is the most serious issue that has arisen in the last three months. While the potential fines and additional oversight would be problematic, the major concern would be the potential to bar Boeing as a government contractor, which would cause incalculable damage to the company. While I have no idea of the likelihood or success of such prosecution, I do believe that eliminating Boeing as a federal contractor would be detrimental to the interest of the United States government, and thus would be very unlikely. But I have to mention it here as it is a possibility, however slim.

Now – The Good News?

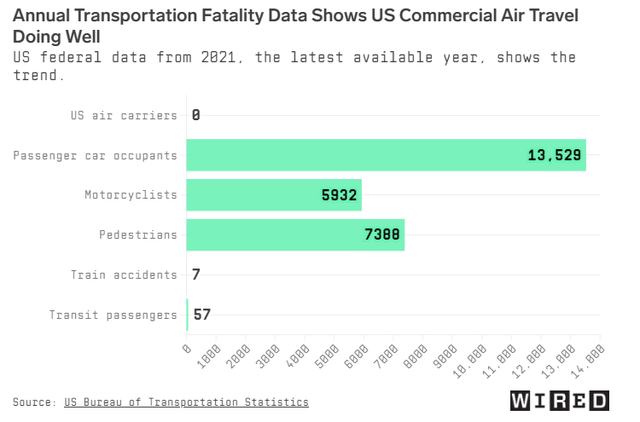

It’s difficult to believe that all that happened in three months. I couldn’t have timed my previous article any worse if I tried. Now that I have laid out a pretty sorry last three months for the world’s largest aerospace company, allow me to refocus on the positives. Despite the news stories depicting horrible flight experiences, air travel is safe.

Aviation in the US was the safest mode of transportation in 2023,”

Says Hassan Shahidi, the president and CEO of the Flight Safety Foundation, a nonprofit research and advocacy group.

If you don’t believe me or Hassan, here’s the fatality data from the last available year, 2021:

US Transportation Fatality Data: 2021 (Wired.com)

All the headlines that you hear regarding mechanical issues on planes don’t mention the 45,000 flights that occur daily in the United States alone. That’s a lot of very successful flights, with very few notable incidents.

Please don’t let this litany of negative news distract you from the fact that there are only two major suppliers of large aircraft with backlogs extending well into the next decade. If you as an investor can weather the challenges for the next several years, it will be very difficult for Boeing not to succeed over the long run, given their position of strength in a high demand industry.

Real Boeing Changes Coming?

Other major changes in the last three months include the announcement of a CEO transition at year-end, along with other management and Board changes. My opinion is that these management changes absolutely had to happen, and I’ll be very interested in whom the replacement CEO is. But I also don’t believe this decision magically changes anything in a culture that has been built up over decades. Additionally, Boeing has confirmed discussions of the potential acquisition of Spirit AeroSystems. These two changes are significant to the long-term direction of the company, but not much is currently known about how they will play out over the rest of the year.

While no successor has been named as CEO, the current Spirit CEO, Patrick Shanahan, could be an intriguing possibility should the acquisition come to fruition, though it would be unusual for an acquiree to take over a much larger enterprise such as Boeing. Shanahan was hired by Spirit in the fall of 2023, well after their many documented issues, and had a long and successful career with Boeing before serving as the Acting Secretary of Defense under President Trump. More importantly for the culture of Boeing, he’s also an engineer and has spent decades in the engineering function at Boeing. Long-term investors would be wise to follow these two developments carefully.

Valuation

Boeing did report Q1 results, which, to no one’s surprise, were poor. My previous valuation assessment was not based on the past or even current financial results, so Q1 earnings didn’t have much of an impact on my assessment of valuation. There were no real changes here, other than the likely delay (management has not officially pushed this out) in getting to that $10 billion free cash flow number that the company originally predicted in the 2025-2026 timeframe. Previously, when the stock was $205, that worked out to a 16x EV/FCF multiple, which seemed reasonable. The lower stock price now obviously makes that multiple even more attractive, but the discount associated with the potential delay in reaching those numbers probably makes this a wash.

Either way, the current valuation based on these expected future cash flows seems reasonable to me. Now the company must execute and make it happen, after ensuring that all the quality issues allow the FAA to give it the green light to move forward.

Conclusion

There probably couldn’t have been a less advantageous time to write an article about ignoring the noise on Boeing, other than the fact that there was a lot of noise to ignore. Despite the many negative articles, I remain steadfast in my belief that this remains an attractive long-term investment at these levels. It will not be pretty and is likely to require some fortitude to stay the course, but I fully believe that a stockholder today will be rewarded several years down the line.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.