Summary:

- Boeing airplane orders increased in July with 72 orders, including 57 single aisle orders valued at $5.2 billion.

- Boeing delivered 43 airplanes in July, including 32 single aisle airplanes and five wide body airplanes, stabilizing deliveries compared to last year.

- Despite challenges, Boeing is showing signs of improvement in order inflow and production rates, shaping up for a promising balance of the year.

Wirestock

Boeing (NYSE:BA) is currently working on a much-needed turnaround. The appointment of a new CEO is one of many steps that’s currently being taken. Kelly Ortberg, like any CEO, has to prove himself worthy of the CEO position of The Boeing Company. It would be unrealistic to expect that with Ortberg now in the CEO role, things will change overnight. However, I do believe without focusing on the financials and granted that the FAA and Boeing remain focused on safety and quality, the airplane orders and deliveries will tell a story about how Boeing is progressing on its core principles. The orders tell a story about confidence in Boeing, while deliveries tell a story about the ability of Boeing to increase production at the quality standard that is required and desired.

So, the monthly order and delivery reports that I provide have become even more important to keep an eye on. In this report, I will be discussing the orders and deliveries for July.

Boeing Airplane Orders Jump As MAX Momentum Increases

The Aerospace Forum

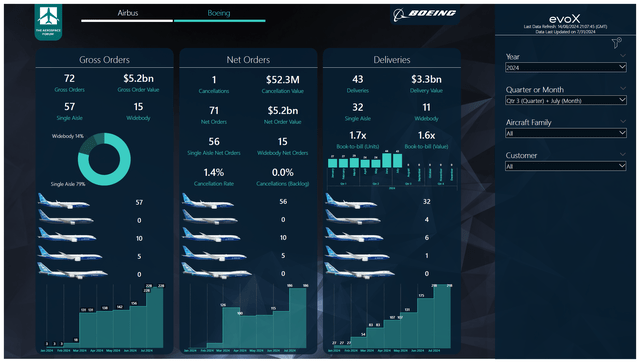

In July, airplane orders increased sequentially from 14 orders to 72 airplane orders. Orders consisted of five freighter airplanes, 10 wide body jets and 57 single aisle orders valued at $5.2 billion:

- Aviation Capital Group ordered 35 Boeing 737 MAX airplanes.

- Japan Airlines (OTCPK:JAPSY) finalized an order for 10 Boeing 787-9 airplanes announced at the Farnborough International Airshow.

- Macquarie AirFinance finalized an order for 20 Boeing 737 MAX airplanes announced at the Farnborough International Airshow.

- An unidentified customer ordered two Boeing 737 MAX airplanes.

During the month, the following changes were made to the order book:

- Aerolineas Argentinas cancelled an order for one Boeing 737 MAX.

- British Airways selected GE (GE) turbofans for six Boeing 787-10 airplanes on order with Boeing.

- Xiamen Airlines was identified as the customer for three Boeing 737 MAX airplanes.

- Air China was identified as the customer for one Boeing 737 MAX.

- China Eastern Airlines was identified as the customer for one Boeing 737 MAX.

In July, we saw airplane orders for the Boeing 737 MAX tick up with a total of 57 orders, including 55 orders from lessors. I believe that this is a sign of confidence in Boeing’s product, as lessors tend to order airplanes with good value retention and high demand. It was not the best order month for Boeing this year, but July was the strongest order month since March.

With 72 gross orders and one cancellation, the net order tally for the month was 71 units with a net order value of $5.2 billion. In the same month last year, Boeing booked 52 gross orders and no cancellations, bringing its net orders to 52 aircraft valued at $6.8 billion. What we see is that the order inflow was higher this year, but the value of the orders was lower, pointing to a less favorable mix. We also note that not all tentative orders announced at the Farnborough Airshow have materialized.

Year-to-date, Boeing has gathered 228 gross orders and 42 cancellations, bringing the net orders to 186 valued at $16.8 billion. In the same period last year, the company logged 579 gross orders and 112 cancellations, bringing the net order tally to 415 valued at $41.2 billion. So, we see a significant decline in airplane orders, and given the lower production that Boeing has on the Boeing 737 MAX program, leading to uncertain delivery schedules, it’s not odd to see a sharp decline in order activity.

During the month, the ASC 606 adjustments tally, which records orders for which a purchase agreement exists, but additional criteria are not met, decreased by one unit. This was driven by an order for one Boeing 737 MAX from Aerolineas Argentinas being cancelled and leading to a removal from the tally. Overall, the tally of orders for which a purchase agreement exists, but additional conditions are not met decreased from 679 to 678, meaning that more than 11% of the order book is currently doubtful. However, once the additional requirements are met, we could also see the tally reduce. So, while ASC 606 adjustments could be seen as a prelude to a cancellation, that’s not necessarily the case. Especially over the past year, we saw the tally reduce without the order being cancelled, meaning that the additional set of requirements to count the order to the backlog was met.

Boeing Airplane Deliveries Stabilize

The Boeing Company

In July, Boeing delivered a total of 43 airplanes consisting of 32 single aisle airplanes, five freighters and five wide body airplanes valued at $3.3 billion:

- Boeing delivered 32 Boeing 737 airplanes, consisting of 31 Boeing 737 MAX airplanes and one P-8A Poseidon.

- Boeing delivered two Boeing 767-2C, which is the base airplane for the KC-46A tanker, and two Boeing 767-300F airplanes.

- Boeing delivered one Boeing 777F airplane.

- Boeing delivered six Boeing 787s, including two Boeing 787-9 airplanes and four Boeing 787-10s.

Boeing is producing significantly below the targeted rates on the Boeing 737 MAX and Boeing 787 programs. However, we do see that Boeing is delivering 737 MAX airplanes in excess of the production rate of around 25 airplanes a month and that indicates that the company is burning off its inventory, which I consider to be a good sign. The same holds for the Boeing 787 program. So, the production output is nowhere near where it should be, but we have seen Boeing 737 MAX production increase and a reduction in inventory, providing Boeing with stable month-over-month deliveries. Normally, June is a month with higher deliveries to end the quarter, and so we cannot necessarily derive from that a sustainable production of delivery volume is achieved, but the July numbers look encouraging.

In the same period last year, Boeing delivered 43 airplanes valued at $3.2 billion. So, deliveries are actually not only stable sequentially but also year-on-year, and that’s not a bad thing. To date, Boeing has delivered 218 airplanes with a value of $16 billion compared to 309 deliveries valued at $21.8 billion a year ago, indicating a decline of 29% in units and 27% in terms of value, pointing to a better delivery mix.

The book to bill ratio for July was 1.7x in terms of units and 1.6x in terms of value, while for the seven months of the year it is 1.0x and 1.2x, mostly reflecting Boeing not producing in line with its production plans.

Conclusion: Boeing Could Shape Up For A Promising Balance Of The Year

Things are not going to change overnight at Boeing, but we do see that things are changing. Unfortunately, those changes that Boeing should have made five years ago after the second MAX crash. So, Boeing in some way has not progressed as the company should for years under the leadership of Calhoun. It will take a long time before Boeing will produce MAX airplanes, as the company had planned for years ago. However, we do see positives in the order inflow which still supports the MAX, and by the end of the year Boeing production rates could increase further, and we are already seeing some recovery in the delivery profile. So, Boeing is not out of the woods yet, but we are seeing improvements.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.